Wahed Invest Review 2024

|

|

Wahed Invest is #118 in our rankings of UK brokers. |

| Wahed Invest Facts & Figures |

|---|

Wahed Invest is an ethical investment platform and robo-advisor aimed at Muslim investors. The firm is overseen by the Sharia Review Bureau, offering a range of stocks, ETFs, sukuk and gold. With a reasonable $100 minimum deposit and strong regulatory oversight, the firm has become an accessible option for over 200,000 investors. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, Sukuk, Gold |

| Demo Account | No |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | Variable |

| Regulated By | SEC, SRB |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Robo-advisor |

| Islamic Account | Yes |

| Commodities |

|

| Stocks | Wahed Invest offers a range of global equities, emerging market stocks and Sukuk products, with a low $100 minimum deposit. On the negative side, management fees are a little higher than most competitors, between 0.49%-0.99%. |

Wahed Invest is an online broker aimed at Muslim traders looking to purchase halal portfolios. The broker pools client funds and uses robo-advisors to make investments, making the firm popular with novice investors. This review will uncover how Wahed Invest works, plus their fees, account types and more. Our UK team also reveal their verdict after testing the platform.

Our Take

- Wahed Invest will appeal to Muslim traders looking for halal investments in stocks, sukuk and gold

- The broker is FCA-regulated allowing UK investors to feel secure making investments

- The broker offers six different accounts/portfolios for a variety of financial goals and risk levels

- The educational resources offered by this broker do not compete with the top brokers

Market Access

Wahed Invest pools client funds and allows Investment Managers to make decisions about which halal investments will be made. This means trades are made on the client’s behalf. Once the customer makes a deposit the robo-advisor system manages the portfolio.

I liked that this service makes investing easy and cost-effective for beginners but this system may be frustrating for experienced traders looking to manage their own portfolio.

Instruments available include:

- Stocks in global and emerging markets: iShares MSCI World/EM Islamic ETF Dist (USD) and HSBC Islamic Global Equity Index IC

- Gold: The Royal Mint Physical Gold ETC (USD)

- Sukuk: Franklin Global Sukuk USD W Dis

We appreciated that investors are given a clear way to track investing performance. Clients are sent a report by Wahed Invest every three months with a valuation of investments and a comparison against a benchmark of the Consumer Price Index.

Accounts

We liked that this broker offers six different account/portfolio types which competes with other brokers such as BestInvest.

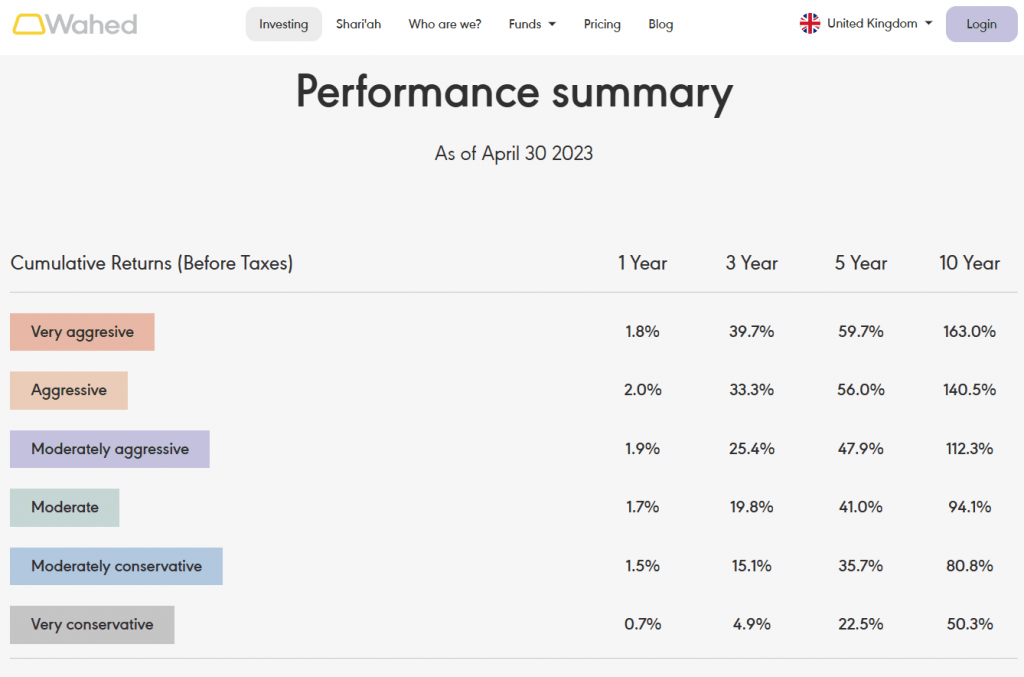

The account types are as follows: Very Aggressive, Aggressive, Moderately Aggressive, Moderate, Moderately Conservative and Very Conservative.

Profiles are recommended to investors after they answer questions about their financial goals, liquidity requirements and time frame. These accounts are made up of different portfolios that provide the highest chance of return depending on the individual investor’s appetite for risk.

We also found that portfolios are managed using financial algorithms derived from the Modern Portfolio Theory. I liked that investors could tailor their accounts depending on their risk appetite as this allows for a variety of investment styles.

Portfolios are as follows:

- Very Aggressive: Stocks only

- Aggressive/Moderately Aggressive/Conservative/Moderately Conservative: A mixture of stocks, sukuk and gold

- Very Conservative: Sukuk only

Suggested cumulative returns on account types vary depending on the account you choose. For example, Very Aggressive portfolios suggest a 1.8% return after 1 year and Very Conservative a return of 0.7% after 1 year.

Wahed Invest Fees

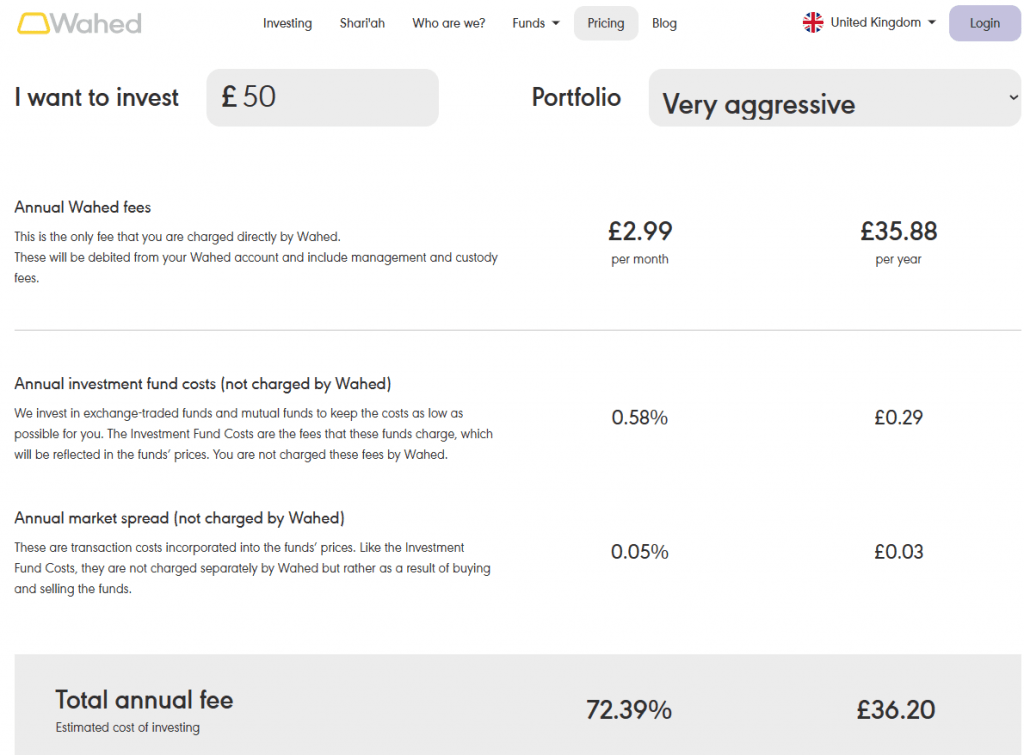

We were pleased to see that Wahed Invest has a relatively low minimum investment of £50 for all account types. This compares well to competitors such as Interactive Investor and makes this broker accessible for investors with a lower budget.

Our team also liked that there are no deposit or withdrawal charges, no fees on an account with a £0 balance and no account closure fees, unlike some competitors.

Annual Wahed Invest fees are £2.99 per month for all account types (or 0.49% per year for accounts with funds over £10,000) which is higher than some competitors.

The annual market spread is 0.05% for all account types. Annual investment fund costs vary depending on which account you choose to open: Very Aggressive has a fee of 0.58%, Aggressive has a 0.62% fee, Moderately Aggressive 0.69%, Moderate 0.76%, Moderately Conservative 0.81%, Very Conservative 0.88% and Physical Gold has a 0.22% fee.

Fortunately, there is a fee calculator on the broker website, which I found useful.

Fee Calculator

How To Open An Account

Clients are required to be over 18 years old, pay tax, have a NI number, and have a UK address and bank account to make an account with this broker.

How To Change Portfolio Type

- Login to your account on the app or broker website

- Go to the Account Details screen

- Click on the My Investment Account icon

- Click on the account type

- Click the Change My Portfolio icon at the bottom of the screen

Note you can only change your portfolio once every six months.

Funding Methods

We were disappointed to find that Wahed Invest only accepts bank transfers as a payment method. No e-wallets are supported by the broker and credit/debit cards are not accepted meaning moving funds is not as simple and accessible as some competitors such as Nutmeg.

GPB is the accepted currency for UK accounts, which means no conversion fees for British traders.

How To Make A Deposit

- Log in to your account via the Login icon on the right-hand-side of the website or the app

- Click the Funding icon

- Click the Add Funds icon

- Enter the amount you want to deposit and select the bank account you wish to withdraw from

Deposits take 1-2 business days to appear in your account, which is longer than many brokers.

How To Make A Withdrawal

- Log in to your account via the Login icon on the right-hand side of the website or via the app

- Click the Withdraw Funds icon

- Enter the amount you wish to withdraw and which account you want the funds sent to

- Confirm the transaction

Withdrawals take up to 10 days, which is also longer than many alternatives.

Note if funds are withdrawn so the investor’s portfolio falls below the value of £50, the account status will be changed to ‘Insufficient Funds’. To continue trading with the portfolio you will need to deposit further funds.

UK Regulation

Our team was pleased to see that this broker is regulated by the Financial Conduct Authority (FCA) with licence number 833225. This robust UK regulation can assure investors that their funds are secure and protected.

The broker is also licensed by the Financial Services Commission of Mauritius, FSRA (Canada) and the Securities & Exchange Commission (US) which can provide investors with further reassurance of the legitimacy of the broker.

We were also pleased to find that Wahed Invest is a member of the UK’s Financial Services Compensation Scheme which provides clients with protection of up to £85,000 if the company goes bankrupt. This should reassure investors that the broker takes the security of their funds seriously and can be trusted.

Shariah Law

Wahed Invest is compliant with Shariah rules meaning investments and returns are halal. Investments are not made in certain industries such as alcohol, gambling, firearms or tobacco.

All investments are also assessed by the broker’s Shariah Supervisory Board (SSB) and the company holds a Shariah certificate ensuring its compliance with Islamic financial ethics.

Wahed Invest Mobile App

We liked the Wahed Invest app which can be used by investors to track their portfolio and manage their funds conveniently.

I found the app easy to use and clear with useful tabs that allow investors to save for specific goals such as a new home.

The app is available on Android or iOS devices and there is a QR code for the app on the broker website.

Leverage

Unfortunately, no leverage on investments is available from this broker.

Bonus Deals

I was pleased to find this broker has a referral bonus which allows investors to invite new users to create an account and both the referrer and referee will receive a £10 bonus in their account.

The new client must join within 30 days of receiving the invite and must keep their account open for at least 30 days for the bonus to apply.

Extra Tools & Features

One of the features of Wahed Invest that we rated was the automatic account rebalancing.

Portfolios are rebalanced if there is a change in risk profile that could significantly impact client goals if funds are moved in or out of a client’s account or if there is a major change in the volatility of a market. Rebalancing is free and allows investors to feel secure that the broker will ensure their portfolio meets their investment goals.

Investors are contacted annually to ensure the portfolio they own is still suitable for their goals which was one of my favourite features of the broker as it demonstrates a client-focused approach.

Our team found the lack of educational resources a little disappointing when compared to competitors such as eToro or Interactive Investor. Wahed Invest does have its own blog, Muslim Money Experts, which offers a range of Islamic finance insights, tips and guides. However, it would be nice to include some more education on the broker’s specific products, such as ETFs and emerging market stocks.

Company Details & History

Launched in 2015 in the USA by CEO and founder Junaid Wahedna, the halal broker now has 300,000+ clients in over 100 countries.

The broker was launched in the UK in 2018 and has 12 offices in countries such as the UK, Malaysia, the USA and UAE.

The company offers clients access to Investment Managers who manage the pooled funds of investors to make halal trades and help clients reach their financial goals.

The company is registered in England and Wales with company number 10829012.

Customer Service

We were a little disappointed by the customer service options for Wahed Invest.

The broker can be contacted by email at uksupport@wahedinvest.com or via their contact number at +448081696662. Their UK office address is 87-89 Baker Street, London, W1U 6RJ.

While these contact details are useful, I would have liked to see an instant message or live chat option on the broker’s website as many competitors such as FlowBank offer this option.

Additionally, the opening hours of the customer service department are not listed meaning traders cannot guarantee they will be able to contact the office.

Security

We were pleased to see that investor funds are held with the custodian, WealthKernel, meaning funds should be at less risk if Wahed Invest went into administration.

The Wahed Invest website uses secure SSL technology and encryption to protect client information. There is also a screening process when making a password for your account which ensures passwords are as secure and unique as possible.

Should You Trade With Wahed Invest?

We found Wahed Invest to have some excellent features, especially for Islamic investors, including a broad range of account/portfolio types to suit different clients, good regulation and investor protection, plus a low minimum investment.

However, we were disappointed by the lack of educational resources and supported payment methods. Additionally, any investors looking for independence with their trading will be frustrated as all trades are made by the Investment Managers.

Overall, we found this to be a good broker for beginners looking to reach financial goals without the pressure of making their own investments.

FAQ

How Does Wahed Invest Work?

Wahed Invest manages client investments through a digital platform, using advanced algorithms to tailor portfolios to client needs. Upon registration, the firm will ask you several questions about your investment goals and time frames to gauge your risk profile and assign you a portfolio. We like how simple the process is, making Wahed Invest a good choice for new investors.

Is Wahed Invest Safe And Legit?

This broker is regulated by the UK’s FCA making it secure and reliable for UK investors. Additionally, the broker is a member of the Financial Services Compensation Scheme which provides investors with protection of up to £85,000 if Wahed Invest goes into administration.

Is Wahed Invest Good For Beginners?

Wahed Invest is suitable for beginners as all trades are made by robo advisors, taking all the responsibility from the investor. Investors can also choose the risk level of their thematic portfolios allowing beginners to minimise the financial risks they take with their funds.

However, the lack of educational resources and a demo account option does mean beginners cannot learn more about trading without risking funds.

Is Wahed Invest Really Halal?

Wahed Invest is a halal broker that is compliant with Shariah rules. All investments are reviewed by the broker’s SSB and the company holds a Shariah certificate. This is an advantage that allows Wahed Invest to compete with alternatives.

Is Wahed Invest Good For UK Investors?

Wahed Invest offers UK investors access to FCA-regulated accounts. The only account currency accepted is GBP, making investing easy for UK residents.

On the downside, the only accepted payment method is bank transfer which does limit the ease and speed of depositing and withdrawing funds for British investors.

Does Wahed Invest Have A Low Minimum Investment?

Yes, Wahed Invest has a minimum investment of £50 for all accounts which is low when compared with other brokers in the market. We are confident that the broker is accessible for most new traders.

What Is Wahed Invest’s Best Portfolio?

The best portfolio for prospective clients at Wahed Invests depends on your risk appetite. The firm makes it simple to choose by classifying 8 risk levels, from Very Aggressive to Very Conservative. If you are a beginner investor, we recommend you opt for one of the more conservative options and monitor your investments in the app. If you feel confident, the broker will allow you to change your portfolio later.

Article Sources

Compare Wahed Invest with Other Brokers

These brokers are the most similar to Wahed Invest:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Wahed Invest Feature Comparison

| Wahed Invest | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3.1 | 4.4 | 4 | 4.3 |

| Markets | Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $0 | $1000 | $0 |

| Minimum Trade | Variable | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | SEC, SRB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | - | MT4 | MT4, MT5 | - |

| Leverage | - | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:50 |

| Visit | ||||

| Review | Wahed Invest Review |

IG Index Review |

Swissquote Review |

Interactive Brokers Review |

Trading Instruments Comparison

| Wahed Invest | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Wahed Invest vs Other Brokers

Compare Wahed Invest with any other broker by selecting the other broker below.

Popular Wahed Invest comparisons: