Bestinvest Review 2024

|

|

Bestinvest is #118 in our rankings of UK brokers. |

| Bestinvest Facts & Figures |

|---|

BestInvest is an FCA-regulated investment platform with thousands of low- or zero-fee US and UK stocks traded via a browser interface or mobile app. Traders can choose between self-directed investment accounts and ISAs or managed accounts. The brand has picked up multiple awards for its trading products. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Stocks, ETFs, Trusts, Funds |

| Demo Account | No |

| Min. Deposit | £0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | £50 |

| Regulated By | FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Ready-Made Portfolios |

| Islamic Account | No |

| Stocks | Trade nearly 1500 US and UK stocks with low or no share dealing fees and earn dividends. Thousands of funds, ETFs and investment trusts are also available to trade. This breadth stacks up well against alternatives. |

Bestinvest is a UK-based investment company offering ISAs, SIPPs, investment accounts, and ready-made portfolios. Established for over 35 years, Bestinvest provides access to a range of financial instruments, including stocks, funds, and ETFs. But is it a good investing app or are there better alternatives? Our team examine the broker in this Bestinvest review, comparing fees, charges, usability, security, and more.

Accounts

Bestinvest offers 5 investment accounts: Stocks and Shares ISA, Junior ISA, SIPP, Junior SIPP, and Investment Account. Our team found each account’s conditions clear and transparent, and I was able to open an account in minutes. This is all good news for beginners looking for an easy investing app to get started with.

Stocks & Shares ISAs

Bestinvest’s flexible Stocks and Shares ISA (Individual Savings Accounts) allows you to create your own portfolio from a range of 1,600 funds, UK shares, trusts and ETFs.

Alternatively, you can choose from a selection of ready-made portfolios, curated and managed by professionals. These are ideal for novice traders or those who don’t have the time to invest.

As per government standards, the annual ISA allowance is £20,000 per year. A Junior ISA is also available for children under the age of 18 and offers the same benefits as the regular ISA. The maximum investment amount per year is £9,000.

SIPPs

Bestinvest’s Self-Invested Personal Pension offers a wider variety of investment assets than typical pensions, including funds and UK shares. SIPPs essentially give you more control and flexibility over your pension savings.

SIPPs are available for UK residents under the age of 75, with an annual allowance of £60,000 per year. This is reduced to £10,000 per year for higher earners.

As with the ISA accounts, any gains in the account are tax-free, though UK tax laws could be subject to change at any time.

You can contribute up to £2,880 per year to a Junior SIPP.

Investment Account

Bestinvest’s Investment Account offers the same conditions as the SIPP and ISA accounts, without the annual limits. This means you can invest in the same range of products without using your annual ISA or pension allowances.

We find the free investment coaching, market insights and analysis tools particularly useful. The downside is that the Investment Account is not tax-efficient like an ISA or SIPP, and clients are responsible for managing their tax liabilities.

Overall, the account is a flexible and cost-effective way for individuals to invest in a range of products.

Bestinvest Portfolios

We were pleased to see that Bestinvest offers an impressive range of 19 ready-made portfolios offered in three categories: Expert, Smart and Direct.

Within each range, there are 7 types of portfolios, depending on the individual investor’s risk appetite. The conservative portfolios focus on non-equity assets such as bonds, whilst adventurous portfolios focus on shares.

Although the range of portfolios is not as high as Interactive Investor, for example, I like that each category is broken down into 7 risk appetites, ideal for beginners who need help deciding where to start.

- Expert – Expert Portfolios invest in funds actively managed by in-house experts who select stocks across a range of asset classes. These are ideal for clients who want a more personalised approach.

- Smart – The Smart range focuses on passive instruments, namely Exchange-Traded Funds (ETFs) which track the performance of an index. Smart portfolios are more cost-efficient than the Expert range, as ETFs are generally low-cost investments.

- Direct – These invest directly into individual shares and bonds, rather than funds. Investors have exposure to approximately 55 assets which are curated by Bestinvest’s expert team and span a range of sectors.

Market Access

There are over 3,000 shares and funds available at Bestinvest. This doesn’t compare to Interactive Investor’s 40,000+, but we are still satisfied that the offering covers a good range of sectors.

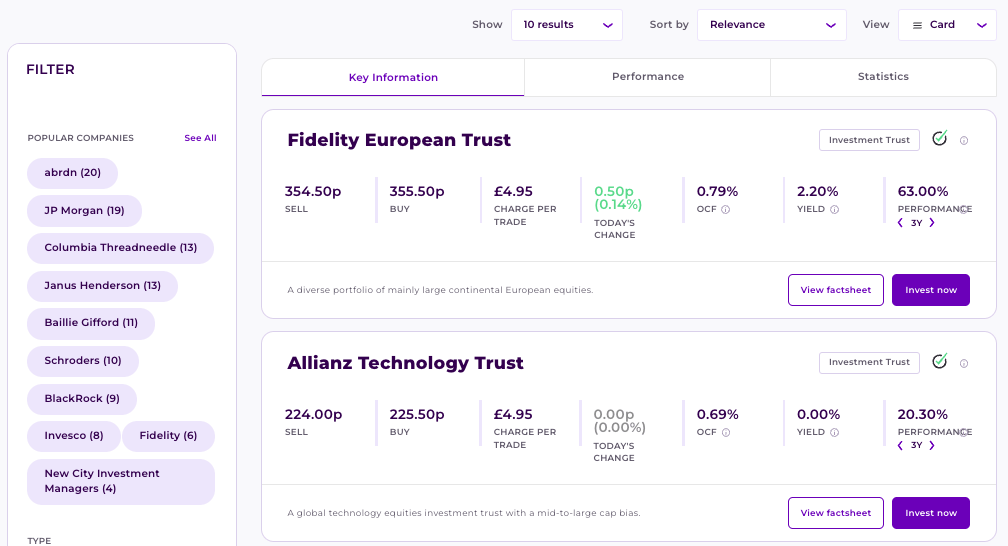

Our team are also impressed by the user-friendly and transparent search function on the Bestinvest website, with a range of available filters to narrow down your search.

- Stocks and Shares – Invest in 1,400+ UK and international stocks through different products, including ISAs, SIPPs, and investment accounts. Examples include Premier African Minerals Ltd and Ergomed Plc.

- Exchange-Traded Funds (ETFs) – Over 300 ETFs which track the performance of a specific index, such as the FTSE 100 or S&P 500. Top performers include the iShares S&P IT Sector UCITS ETF and the Invesco Technology S&P US Select Sector UCITS.

- Investment Trusts – 280+ investment trusts, which are listed on a stock exchange and trade like shares. Trusts can invest in a variety of assets, including equities, fixed-income securities, and property. Companies include BlackRock, JP Morgan and Colombia Threadneedle.

- Bonds – Invest in over 100 government, corporate and high-yield bonds, which can provide regular income and help diversify a portfolio. Popular bonds include the London Sterling Extra Yield Bond A and the Schroder Strategic Bond Z.

- Property Fund – Invest in property funds in a diversified portfolio of commercial and residential property. Property funds, such as the Fidelity Global Property W, can provide regular income and help to diversify a portfolio.

Investment Product Search

Fees & Charges

As expected, investment fees at Bestinvest differ depending on your product.

Notably, the broker’s annual management fees are tiered, rather than fixed. Clients pay a fee based on the value of their portfolio, with lower fees for larger investments. The downside is that investing in larger portfolios may become rather expensive.

Nonetheless, we are pleased to see that Bestinvest does not charge clients to open an account or transfer investments.

Ready-Made Portfolios & US Shares

Annual fees depend on the investment value per account.

- Up to 250,000 – 0.2% (with a minimum of £120 per year if it’s a SIPP)

- £250,000 – £500,000 – 0.2%

- £500,000 – £1,000,000 – 0.1%

- Over £1,000,000 – No charge

Investments

- Up to 250,000 – 0.4% (with a minimum of £120 per year if it’s a SIPP)

- £250,000 – £500,000 – 0.2%

- £500,000 – £1,000,000 – 0.1%

- Over £1,000,000 – No charge

Dealing Fees

It is good to see that Bestinvest does not charge fees for buying and selling funds, since these are already covered in the ongoing service fee. Non-fund investments such as stocks and ETFs cost £4.95 per trade, which we found competitive compared to the likes of Interactive Investor (£5.99 per trade) and AJ Bell (£9.95 per trade).

There is also no account inactivity fee, nor any charges for placing limit orders.

For US shares, there is no online dealing fee and just a 0.95% foreign exchange fee.

Payment Methods

Deposits

Deposits are available via debit card or bank transfer. Debit card deposits can be done directly through your online account by selecting the ‘Add Cash’ button. Bank transfers must be done over the phone.

We were pleased to see that there is no minimum deposit when using a debit card, although investing a lump sum into a fund or setting up a regular monthly investment will require a minimum deposit of £50.

Processing times for deposits via debit card are instant. Bank transfers to ISAs and Investment accounts are typically credited the next working day. SIPPS may take slightly longer. These are all in line with competitors.

Withdrawals

Online withdrawals are typically processed via BACS within 3 to 5 working days. The good news is, there is no charge for online withdrawals through a Bestinvest account. With that said, CHAPS payments must be done over the phone and will incur a £35 charge.

To make a withdrawal, navigate to the ‘Withdraw cash’ tab, choose how much you wish to withdraw and confirm the bank details to pay into.

Bestinvest Platform

My overall experience of using Bestinvest’s web-based platform has been good. The platform’s interface is easy to use for managing my accounts. The platform makes it straightforward to view and track portfolios, make deposits or withdrawals, and set up regular investments.

There is real-time pricing and market data for those who want to buy and sell stocks, shares, funds and other assets. The platform also features research tools including news and market commentary, as well as fundamental and technical analysis tools.

I like that the platform offers a good level of customisability. I can easily personalise my investment view and layout, plus create watchlists and alerts to track my favourite stocks and investments. I can also customise the portfolio view to show the data and metrics that are most important to me.

Overall, our team found that the Bestinvest trading platform is comprehensive and competes well with the likes of Nutmeg.

How To Place A Trade

Making an investment at Bestinvest is relatively quick and easy:

- Log in to your Bestinvest account and navigate to the trading platform

- From the dashboard, select the product you want to invest in

- You can filter your search by sector, geography, or investment style criteria

- Click on the “Buy” or “Sell” button to place a trade

- Enter the number of shares or units you want to buy or sell, the price you want to pay or receive, and any other relevant information

- Review the details and then click “Confirm”

- Once the trade has been placed, you will receive a confirmation message

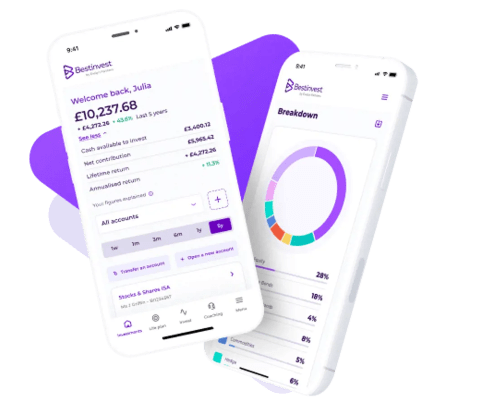

Mobile App

The Bestinvest platform also comes in a mobile app, available on iOS and Android devices. The app is a useful tool for those who want to manage accounts and track portfolios on the go.

We rated that most of the key functions found in the web platform are available within the app, including access to market data, real-time pricing and research tools. You can also open new accounts, buy and sell products, and make deposits.

Again, the customisation options are a plus for me. I also like the smart planning tools, which allow you to set and track investment goals. I was also pleased to see that you can book a free session with an investment coach via the app, which is an excellent addition for beginners.

Overall, the app receives positive reviews, ranking 4.8 out of 5 stars by customers. And when our experts tested the platform, we found the app stands out against app-only competitors such as Moneybox.

Demo Account

We were disappointed to see that like other firms, Bestinvest does not offer a demo account for its platform.

With that said, there is a variety of educational resources for those who need guidance before opening an account. Additionally, clients can open a Bestinvest account with as little as £50 so our team are satisfied that new clients will be well-supported.

UK Regulation

Bestinvest is a reputable and licensed investment firm, authorised by the Financial Conduct Authority (FCA) in the UK. The FCA regulates financial services firms and markets to protect consumers and promote financial stability through a range of protective measures.

Notably, Bestinvest is a member of the Financial Services Compensation Scheme (FSCS), which protects clients in the event of the company’s insolvency.

Clients should be aware that the FCA has previously flagged a ‘clone’ of Bestinvest, where fraudsters have distributed false details to scam UK customers. Bestinvest’s genuine Firm Reference Number (FRN) is 125308. You can check this, along with other subsidiaries of the Evelyn Partners Group on the FCA register.

Bonuses

While using Bestinvest, we were offered cashback amounts from £100 for transferring and investing £1,000 or more into an account. In addition, clients can earn £100 by referring a friend. You can refer up to 5 people per month.

Importantly, always check the terms and conditions of promotions. We also recommend keeping an eye on the website for any future offers.

Research & Education

When using the platform, I was impressed by Bestinvest’s range of investment tools and educational resources.

The standout feature for me is the free investment coaching, where you can speak to a qualified financial planner with no obligation. This includes tailored investment strategies, market analysis, and goal-planning advice such as retirement planning.

I also find the firm’s investment insights comprehensive and easy to navigate and cover various topics. There is a range of research reports, market updates, guides and even podcasts. You can also view analysis and ratings for individual funds to help you identify high-performers.

There is also a unique ‘Spot the Dog’ feature, which is the firm’s definitive guide on funds that have consistently underperformed. The guide indicates which funds to avoid or how to take action if you have already invested in one.

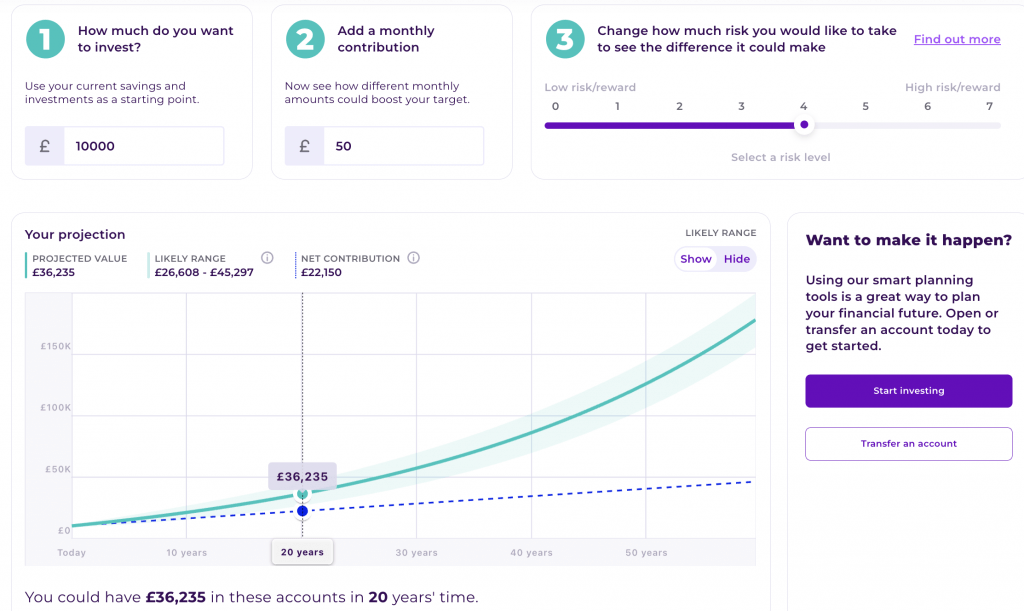

In addition, I was pleased to see a ‘grow my money’ investment calculator on the website, which shows you how and when you can reach a specific investment goal. I particularly liked that the tool presents your projection on an easy-to-digest graph.

Grow My Money Calculator

Customer Service

When we tested Bestinvest’s customer service, our team were happy with the reliability and efficiency of responses. The company offers several channels for support, including telephone, email and live chat.

Bestinvest opening hours are from 7:45 am – 6:00 pm Monday to Friday (except on Thursday when the firm closes at 8:00 pm), and 9:30 am – 1:30 pm on Saturday.

Contact details:

- Telephone number – 020 7189 9999

- Email address – Via an online contact form on the website

- Live chat – Located in the bottom right corner of the website

There is also a comprehensive FAQ section covering topics such as share dealing queries, deposits and withdrawals, and using the life planning tool.

Other customers have also reported positive experiences with Bestinvest’s customer service team, citing their responsiveness, helpfulness, and ability to resolve issues promptly.

Overall, Bestinvest has a solid reputation for customer service. They have won several industry awards for their service, including Best Customer Service at the 2021 Shares Awards.

Bestinvest Background

Bestinvest was founded in the UK in 1986 by John Spiers, and it has since grown to become one of the largest independent investment firms in the UK. The company started as a specialist research house, providing investment analysis and advice to institutional clients.

In 2000, the company expanded its services to include personal investing, and it launched a new platform that allowed individuals to invest in a range of funds and investment products. Bestinvest has continued to expand its offerings over the years, and it now provides a wide range of financial planning services to both individual and institutional clients.

In 2022, Bestinvest was acquired by Evelyn Partners, another leading UK-based investment management company. The combined company now operates under the Evelyn Partners name, but the Bestinvest brand continues to be used for some of the company’s products and services.

Safety

Our team are confident that Bestinvest uses the highest levels of security standards. As expected from a reputable firm, Bestinvest utilises industry-standard Secure Socket Layer (SSL) encryption and multi-factor authentication. For example, when I test the Bestinvest app, I can login using my Face ID as well as my unique login credentials.

In addition, client funds are held in segregated accounts with top-tier banks and custodians, meaning they are not at risk in the event of Bestinvest’s insolvency.

Should You Sign Up With Bestinvest?

Bestinvest offers good long-term investment solutions, with a competitive range of products, accounts and ready-made portfolios. The user-friendly platform, tiered fee structure, and comprehensive educational resources and tools, make Bestinvest a top pick for beginners.

With that said, higher earners may find more competitive pricing elsewhere. There are also no margin trading opportunities and a relatively limited list of stocks compared to alternatives like Interactive Investor.

FAQ

Is Bestinvest A Good Investing App?

Bestinvest is a reputable investment platform with a good range of products and a user-friendly interface. Our team were impressed with the brand’s education resources, suited to all types of investor. The tiered fees are competitive, although investors with larger portfolios may be better off looking at brands with fixed fees.

Is Bestinvest Safe?

Yes, Bestinvest is regulated by the Financial Conduct Authority (FCA), a top-tier regulator in the UK. As such, the firm must comply with strict regulations regarding client money and asset protection. For example, clients have access to a compensation scheme and can be assured that their funds are kept separate from the company’s accounts.

What Fees Are Associated With Using Bestinvest?

Bestinvest charges annual service fees and share dealing fees, depending on the product. For example, you can expect to pay up to 0.2% per year for anything up to £500,000 for ready-made portfolios and US shares. Additionally, trading shares and trusts online costs £4.95 per transaction. Importantly, these charges are competitive vs alternatives.

Does Bestinvest Have A Good App?

Bestinvest offers a free mobile app that allows clients to manage their investments on the go, available on iOS and Android devices. The app allows users to manage accounts, buy and sell shares, and book free consultations with an advisor. You can also follow market news and analysis.

What Is The Customer Service Like At Bestinvest?

Our team are happy with the standard of customer service at Bestinvest. The firm is contactable via phone, email and live chat during normal business hours. They also have a comprehensive Help & Support section on their website, which provides answers to frequently asked questions and other helpful resources.

Article Sources

Compare Bestinvest with Other Brokers

These brokers are the most similar to Bestinvest:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage for experienced traders, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Bestinvest Feature Comparison

| Bestinvest | IG Index | Interactive Brokers | Swissquote | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 4.3 | 4 |

| Markets | Stocks | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | £0 | $0 | $0 | $1000 |

| Minimum Trade | £50 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB | FCA, FINMA, DFSA, SFC |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | No |

| Platforms | - | MT4 | - | MT4, MT5 |

| Leverage | - | 1:30 (Retail), 1:222 (Pro) | 1:50 | 1:30 |

| Visit | ||||

| Review | Bestinvest Review |

IG Index Review |

Interactive Brokers Review |

Swissquote Review |

Trading Instruments Comparison

| Bestinvest | IG Index | Interactive Brokers | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Bestinvest vs Other Brokers

Compare Bestinvest with any other broker by selecting the other broker below.

Popular Bestinvest comparisons: