USGFX Review 2024

|

|

USGFX is #97 in our rankings of CFD brokers. |

| USGFX Facts & Figures |

|---|

USGFX is an online broker that has held licenses with the FCA and ASIC. 60+ assets are available with multiple account options. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Commodities, Indices |

| Demo Account | Yes |

| Min. Deposit | £500 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade leveraged CFDs with variable spreads and fast trade executions. |

| Leverage | 1:30 (EU), 1:500 (Global) |

| FTSE Spread | From 0.8 pips |

| GBPUSD Spread | From 0.8 pips |

| Oil Spread | From 0.8 pips |

| Stocks Spread | NA |

| Forex | Major, minor and exotic currency pairs on the MT4 and MT5 platforms. |

| GBPUSD Spread | From 0.8 pips |

| EURUSD Spread | From 0.8 pips |

| GBPEUR Spread | From 0.8 pips |

| Assets | 40+ |

| Stocks | Trade popular global indices on desktop and mobile. |

USGFX is an offshore broker offering forex, indices and commodities trading on the MetaTrader 4 and MetaTrader 5 platforms. Whilst there are some appealing features, the broker’s regulatory status and business history may put some prospective clients off.

This review will flesh out these points and detail the account types, payment methods, trading platforms, and everything a UK investor should know about USGFX in 2024.

Our Take

- USGFX offers attractive tools alongside third-party platforms, including Autochartist and copy trading

- This unregulated broker offers very high leverage up to 1:500 on popular assets like forex

- The pricing is high compared to alternatives, with spreads above 2 pips for the most affordable account

- The asset list on offer is light with less than 100 instruments

- USGFX is no longer authorised by the FCA

Market Access

Our experts felt that the markets on offer with USGFX were a real weak spot, with barely more than 50 total tradeable instruments. The main offering is forex, but with just 40 pairs there is not much variety here, and the absence of stocks deprives traders further.

Since many rivals, such as AvaTrade and XM, offer hundreds or even thousands of instruments, we thought USGFX’s product suite was a big disappointment.

The markets available to trade through USGFX include:

- Forex: More than 40 currency pairs with 7 that include GBP

- Indices: 9 popular indices such as the FTSE and Dow Jones

- Commodities: Spot trading for 2 precious metals and CFDs on 3 energies

Accounts

We weren’t impressed with the accounts at USGFX. The account that is easiest to access has poor trading conditions with very wide minimum spreads and a high minimum deposit requirement. For instance, when compared with CMC Markets where there is no minimum deposit and spreads from 0.3 pips, the USGFX’s ‘Standard’ offering starting from 2.2 pips is not competitive.

Moreover, to access even this ‘Standard’ account type requires a minimum deposit of $10,000, which is extremely high considering competitors like IC Markets offer tighter spreads and only ask for a $200 minimum deposit.

There is a ‘Mini’ account with a much more reasonable $100 minimum from USGFX, but the spreads are even wider on this account.

On a more positive note, I did appreciate that USGFX offers numerous base currencies, including GBP, meaning UK clients can set up and fund an account without needing to pay a currency conversion charge.

Individual, joint and corporate accounts are also permitted in the Standard, VIP and Pro-ECN accounts.

Mini Account

- Minimum spreads from 2.8 pips

- $100 minimum deposit

- Minimum lot size 0.01

- Leverage up to 1:500

Standard Account

- Minimum spreads from 2.2 pips

- $10,000 minimum deposit

- Minimum lot size of 0.01

- Leverage up to 1:500

VIP Account

- Minimum spreads from 1.3 pips

- $50,000 minimum deposit

- Minimum lot size of 0.01

- Leverage up to 1:500

Pro-ECN Account

- Minimum spreads from 1.5 pips

- $50,000 minimum deposit

- Minimum lot size of 0.01

- Maximum leverage 1:100

How To Register A USGFX Account

We found it quick and straightforward to open a USGFX account following these steps:

- Click ‘Open Live Account’ on the USGFX website

- Provide details such as your name, nationality and country of residence

- Select the account type, leverage rate, trading platform, trading server location and base currency

- Submit personal and financial information including source of funds and trading experience

- Complete the initial deposit process by specifying the amount to deposit and your chosen payment method

- Choose whether to participate in an available bonus promo scheme

- Complete the KYC process by submitting the necessary documents showing proof of residence and identity

- Begin trading

USGFX Fees

Our team felt that the trading fees through USGFX are particularly high regarding both commissions and spreads.

CFDs on indices and commodities incur a commission equal to 10 of the contract currency – so, £10 if you are trading the FTSE 100, or $10 for the S&P 500.

While there is no commission charged on forex trading at USGFX, there are very wide spreads, making the broker much more expensive than competitors.

For example, for the Mini and the Standard accounts which require the lowest deposit minimums, the spreads are floating from 2.8 pips and 2.2 pips, respectively. In comparison, the standard account with XTB has spreads floating from 0.9 pips and for Pepperstone, spreads can be as low as 0.75 pips.

You will also need to account for rollover fees on overnight positions if you plan to hold a contract open after 11:00 pm London time. The amount charged depends on the contract size, rollover rate (long vs short), days open and contract value. The rollover is charged at 3x on Thursday evening to account for Saturday and Sunday.

Finally, we were sorry to find that a $5 fee will be charged monthly after six months of account inactivity until the account becomes active again or the balance drops to zero.

Funding Methods

Deposits

I liked the wide range of deposit methods supported, which will accommodate most traders. Also, I appreciated that USGFX does not charge any fees for most deposit methods.

USGFX’s accepted deposit methods and transfer times are:

- Visa and Mastercard credit and debit cards: Can take up to two hours. While USGFX does not impose any fees, you may be charged by your card provider. Credit and debit card deposits must be made in USD, so UK clients may have to pay a currency conversion charge

- Bank wire transfer: Between one and three working days at no cost

- Bitcoin and Tether: 0.5% fee and can take up to 30 minutes

- AstroPay: Instant but costs between 2.4% to 7.5%

- Perfect Money: Free and up to one working day

- FasaPay: Free and instant processing

- Neteller: Free and instant processing

- Skrill: Free and instant processing

How To Deposit Funds To USGFX

- Sign in via the broker’s website

- In the global client area after login, click ‘Deposit Funds’

- Select the account to deposit funds to and specify the amount

- Choose the deposit method

- Fill in your information for funding. For instance, log into your Skrill account or provide credit/debit card details

- Confirm the request and wait for the funds to transfer

Withdrawals

USGFX supports the same methods for both deposits and withdrawals except AstroPay, which cannot be used for withdrawals. Regardless of the method that you choose, the withdrawal time will take between three and five working days to complete. This is in line with most brokers.

We liked that for the majority of methods, there are no fees. This includes credit/debit cards, PerfectMoney, FasaPay, Neteller and Skrill. However, UK clients can only transfer using USD for credit/debit cards and so may have to pay a charge to convert back to GBP. Unfortunately, a very high fee of $40 is charged for using a bank wire transfer.

Trading Platforms

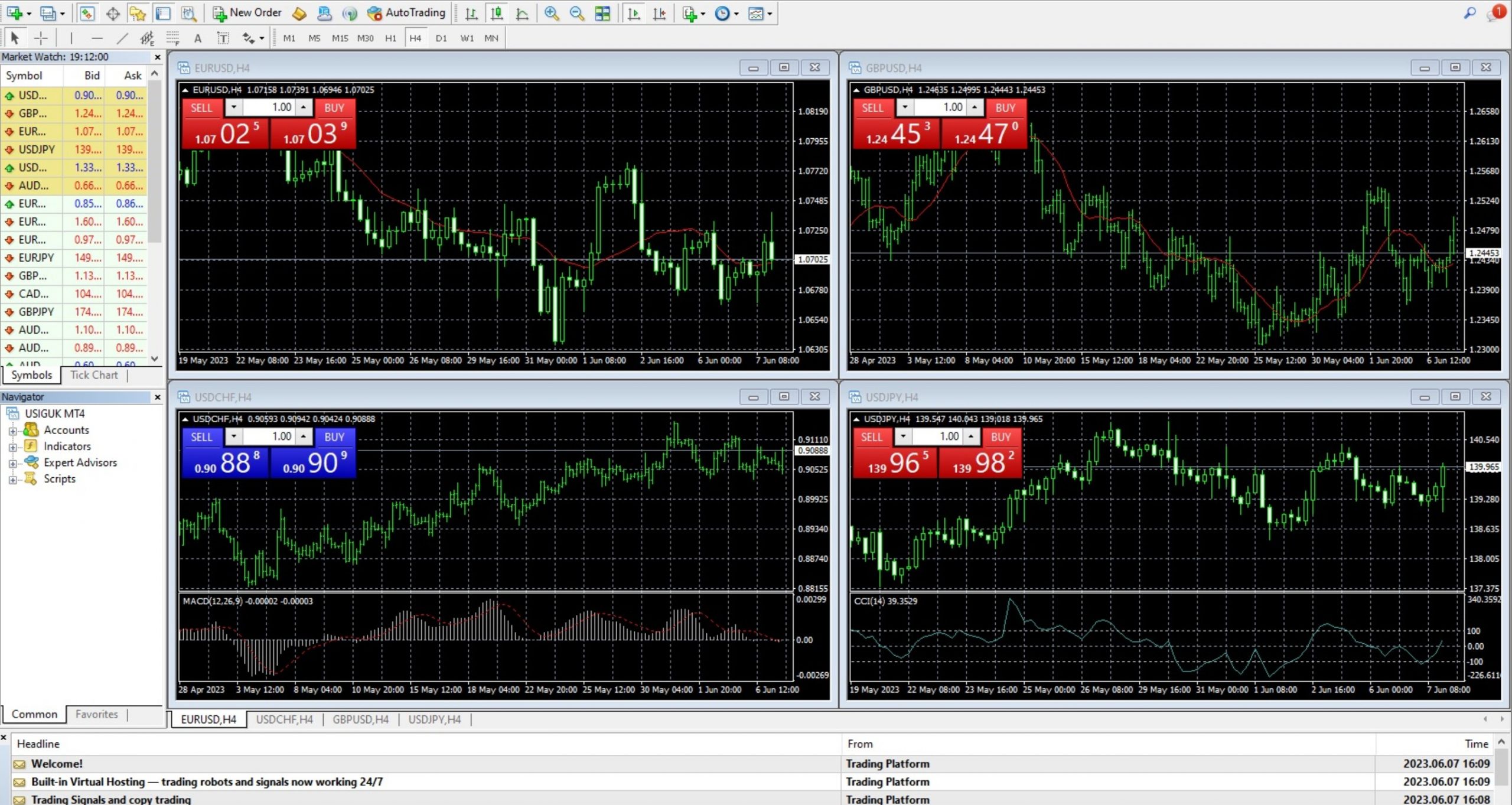

I rated the trading platform offering at USGFX highly as clients can choose between MetaTrader 4 and MetaTrader 5, two world-leading platforms.

We have listed some of the main features of these two platforms which should satisfy both new and experienced traders, with the intuitive UIs and vast range of advanced tools on offer.

With that said, we were quite disappointed that MT4 and MT5 are only available for download onto Windows PCs.

MetaTrader 4

- Expert advisor support

- Windows desktop support only

- An in-house trading signals service

- Customisable workspace with up to 10 charts

- 50+ analytical objects and technical indicators

- Market execution and four pending order types

- Nine time frames with the option to create your own

- Access to a marketplace with thousands of additional indicators you can download

MetaTrader 4

MetaTrader 5

- Unlimited charts

- Strategy backtesting

- An economic calendar

- One-minute quote history

- Windows desktop support only

- Fundamental and news analysis insights

- 80+ analytical objects and technical indicators

- 21 in-built time frames and the option to specify your own

- Two additional pending order types on top of the MT4 offering

MetaTrader 5

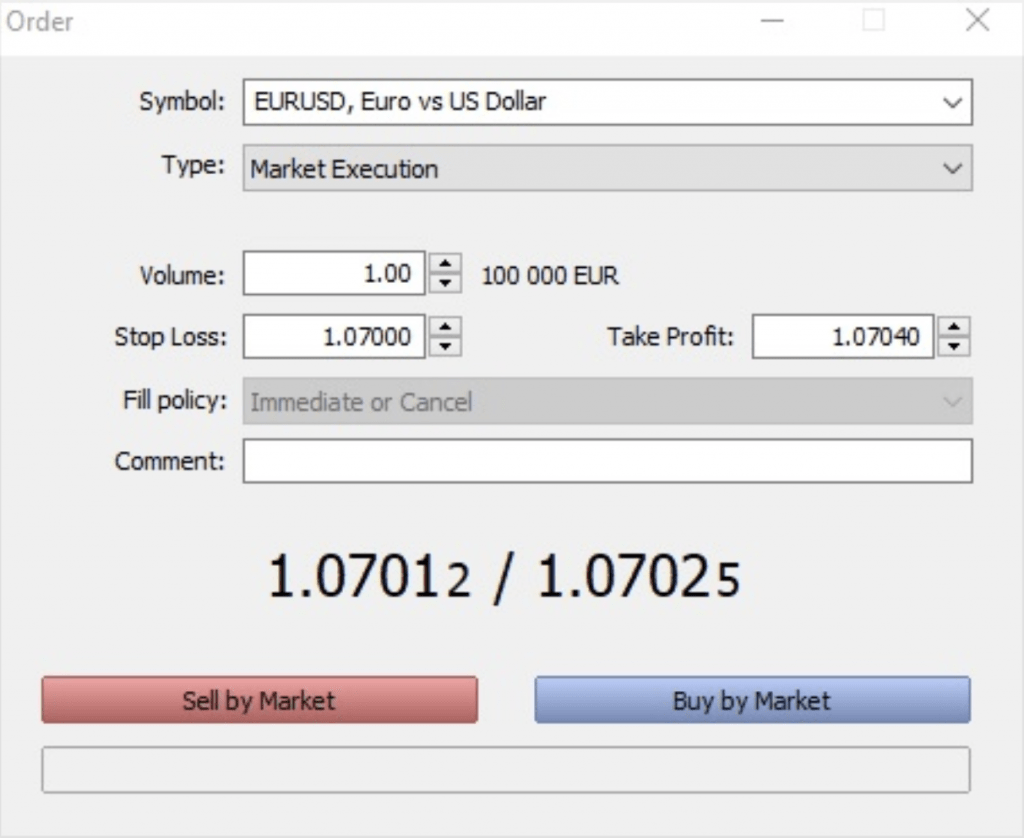

How To Place A Trade

The process to open a trade is straightforward on the MetaTrader software:

- Open the ‘New Order’ tab

- From the drop-down menu, find your desired asset

- Specify the order type from either market execution or pending order

- If you are opening a pending order, choose the type from buy limit, buy stop, sell limit or sell stop

- Input trade information such as trade volume and any take profit or stop loss limits

- If opening a pending order, type in the strike price and, if necessary, the expiration time

- Confirm the order and wait for it to be filled

Mobile App

We would have liked to see a dedicated USGFX app as a convenient way to handle deposits and withdrawals on your mobile, so this was a disappointing omission.

However, traders will be able to monitor markets and open and close trades using the MT4 and MT5 apps, available on both iOS and Android devices via the Apple or Play stores or from the broker’s website.

USGFX Leverage

As USGFX no longer holds a license with the Financial Conduct Authority, it is not restricted by the leverage limits imposed by the MiFID II regulations. As a result, clients can trade with a leverage of up to 1:500, meaning you can open a trade with an exposure of £500 with just £1. This gives clients more autonomy over the leverage they use but comes with the added risk of making even larger losses.

Ultimately, it is the trader’s choice whether they use such high leverage or not. However, we urge inexperienced traders to stick with FCA-regulated brokers, where they will benefit from excellent consumer protections and will be shielded from the risks posed by highly leveraged trading.

Demo Account

I liked that USGFX supports a free demo account with $100,000 of simulated funds for all clients. However, I was disappointed to see that the demo license only lasts 30 days, which deprives clients of a useful way to practise their strategies under real market conditions.

Other brokers, such as CMC Markets, offer paper trading accounts without any time limit.

How To Open A USGFX Demo Account

- On the website’s main page, click on the ‘Open Demo Account’ button

- Fill in the registration form by specifying the desired platform and entering your name and contact details

- USGFX will send you the client login details to your email address

- Using the link in the email, download the specified platform and sign in

- Begin paper trading

Regulation & Security

USGFX previously had a UK subsidiary, but this ceased operations after its license with the Financial Conduct Authority expired. The brand has also been involved in troubling events under its former ASIC-regulated branch in Australia, which collapsed in 2021, losing some $350 million in client funds.

UK-based clients can still register an account with the broker through the offshore branch, which is registered in St. Vincent & The Grenadines. However, British traders should be aware they will get limited legal protections.

Although USGFX is not regulated by the FCA, we were pleased to find that it does impose some measures stipulated by the UK authority such as negative balance protection. This means that the broker will automatically close a losing position to ensure it does not exceed the funds deposited in your account. In doing so, you are prevented from becoming indebted to the broker.

Bonus Deals

USGFX runs several promotion schemes, which allow clients to boost their purchasing power to support their strategy.

The USG Losable Deposit Bonus, for example, pays traders a percentage bonus according to the amount they deposit, from 3% for deposits between $500 and $6,999 to 6% for deposits up to and including $12,999 and 12% for deposits of $25,000 or more.

As with all promos, be sure to check the terms and conditions on the USGFX website to ensure you understand the rules. We also advise traders to be wary of any bonuses offered by unregulated brokers.

Extra Tools & Features

Our experts like that USGFX offers numerous tools and features to help improve the overall trading experience.

Economic Calendar

The broker hosts an economic calendar on the website that shows important upcoming events from countries around the world, including Singapore, the USA and Australia. We thought USGFX’s forecasts on volatility and other key information related to these upcoming events to be a useful tool for traders.

Economic Calendar

Autochartist

USGFX also offers access to the third-party analysis platform, Autochartist, and we are fans of this useful algorithmic tool for technical analysis.

Used right, Autochartist helps clients to establish their own strategy and determine when to open and when to close positions. The platform also comes with features such as trading alerts, performance statistics and daily insight reports.

To sign up, click on the ‘Autochartist’ page under the ‘Market Tools’ tab on the broker’s website. Click on the ‘Start Trading’ button and then fill in the account information. After you apply, a member of the USGFX team will contact you to set up an account.

Copy Trading

We were pleased to find that USGFX runs a copy trading service, allowing less-experienced traders or those without sufficient free time to benefit from experienced traders’ leveraged bets on forex, indices and commodities.

Copy traders can easily view the recent performance of available experts to determine whose trades they wish to mirror. Once you have chosen, you can set up one-click trading so that when the expert makes a trade, you can copy their order with a single click.

Education Centre

The educational content provided by USGFX includes detailed guides that can help beginners get started with forex and CFD trading, though we feel more experienced traders will find little of interest.

All users can download a free ebook covering important topics such as how to complete technical analysis, risk management techniques and why you should use USGFX.

In addition to the ebook, the broker runs regular webinars and seminars discussing how to identify trends as well as establishing support and resistance lines.

Customer Service

Our experts were satisfied with the USGFX customer support, which is reachable 24 hours a day though response times vary. However, our team found that USGFX was generally slow to respond over email and live chat, making the hotline your best option if you need urgent help.

To contact the USGFX support team, you have the following options:

- Live chat on the website

- Email clientsupport@usgfx.global

- Over the phone at +61 291 890 223

Company Details & History

USGFX is a global broker with customers around the world in countries such as the UK, Australia and France, as well as a large customer base in Asian countries including Thailand, Iran and Malaysia.

In the UK it was well-known as the main shirt sponsor for Sheffield United Football Club during the 2019/2020 and 2020/2021 seasons. During this time, the broker held a license with the Financial Conduct Authority under the name Union Standard International Group Limited.

Previously, the broker was based in Australia and was licensed by the country’s regulator, the ASIC. However, in 2021 the Australian subsidiary collapsed and ceased operations.

It was later found to have a shortfall of around $350 million of client funds. Currently, usgfx.com is based in St. Vincent & The Grenadines and the CEO is Soe Hein Min.

Trading Hours

The USGFX opening hours depend on the market you are trading. Forex, for example, can be traded from 10:00 pm on Sunday (GMT) until 10:00 pm the following Friday.

For commodities and indices, the trading hours are asset specific. The FTSE 100 is open from 9:00 am until 11:00 pm Monday to Friday whereas the NASDAQ is open from 1:00 am to 12:00 am, with a 15-minute break starting at 23:15.

When you first load up the website, the broker shows a pop-up of any upcoming holidays or other changes to typical trading hours.

Should You Trade With USGFX?

USGFX is a controversial broker. We liked that the broker offers both MetaTrader 4 and MetaTrader 5 platforms for download and provides a range of useful tools to help your trading.

However, USGFX has very wide spreads and high minimum deposit limits, making it unattractive when compared with other forex and CFD brokers. Moreover, USGFX is not FCA-regulated, meaning UK clients will not be adequately protected, which is important given the firm’s questionable past.

FAQ

Is USGFX Legit?

USGFX is an online broker that offers trading through the MetaTrader 4 and MetaTrader 5 platforms. If you are unsure about whether to register an account with USGFX, you can first sign up for a demo to practise. As this is an unregulated, offshore broker, we recommend carefully testing the broker and reading user reviews before you sign up – and only invest funds that you can afford to lose.

Is USGFX Trustworthy?

USGFX is not regulated by any recognised authority, which we find concerning. In the past, USGFX subsidiaries were regulated by the Australian Securities and Investments Commission and the Financial Conduct Authority in the UK. However, both licenses have since expired and have not been renewed. We typically urge traders to consider regulated firms with a strong track record.

What Should I Do If I Experience Issues With USGFX?

If you have any issues, such as a deposit or withdrawal problem, you can contact the USGFX customer support team. The desk is contactable 24 hours a day midweek and can be reached through live chat on the website, by emailing clientsupport@usgfx.global or by calling +61 291 890 223.

Does USGFX Offer A Good Practise Account?

We were pleased to see that USGFX clients can register for a free paper trading account. Each demo license comes with $100,000 of simulated funds, which allows you to test out both MT4 and MT5 before you register a live account and trade using real capital.

With that said, the time limit of 30 days is quite restricting and not as generous as other brokers.

Is It Easy To Deposit Funds At USGFX?

Yes, USGFX accepts a good range of free and accessible methods for funding live accounts. There are several e-wallet providers including Skrill, Neteller, AstroPay, Perfect Money and FasaPay. In addition, clients can deposit funds using Visa or Mastercard-issued credit and debit cards, bank wire transfers, as well as Bitcoin and Tether deposits.

Article Sources

Compare USGFX with Other Brokers

These brokers are the most similar to USGFX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

USGFX Feature Comparison

| USGFX | Pepperstone | FP Markets | INFINOX | |

|---|---|---|---|---|

| Rating | 2 | 4.8 | 4 | 3.4 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | £500 | $0 | $40 | £1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVGFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA | FCA, SCB, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 (UK), 1:200 (Global) |

| Visit | ||||

| Review | USGFX Review |

Pepperstone Review |

FP Markets Review |

INFINOX Review |

Trading Instruments Comparison

| USGFX | Pepperstone | FP Markets | INFINOX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

USGFX vs Other Brokers

Compare USGFX with any other broker by selecting the other broker below.

Popular USGFX comparisons: