TradeDirect365 Review 2024

|

|

TradeDirect365 is #97 in our rankings of CFD brokers. |

| TradeDirect365 Facts & Figures |

|---|

Founded by professional trader Davin Clarke in 2014, TradeDirect365 is registered in Australia to provide retail traders with half a thousand CFD products at competitive fees and leverage up to 1:30. The firm is regulated by the ASIC, which is a top-tier regulator and offers fee-free and fast deposit methods. A beginner-friendly web platform is available alongside the popular MT4. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Stocks, Indices, Forex, Commodities, Cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Trading App |

TradeDirect365 offers the CloudTrader app. The beginner-friendly application is available on Apple and Android devices and offers one-click trading, customizable charts, and basic account management. |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, SCB |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | No |

| Commodities |

|

| CFDs | Our team was impressed with the range and depth of CFD products available, with more than 500 instruments available on both MT4 and the firm's proprietary CloudTrader. You can go long or short on forex, stocks, indices, commodities and cryptos. |

| Leverage | 1:200 |

| FTSE Spread | 0.4 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 3.0 |

| Stocks Spread | 0.14% (Aus) |

| Forex | TradeDirect365 offers 30 forex pairs with fixed spreads from 0.6 pips on the AUD/USD and EUR/USD. Retail investors can trade forex with 1:30 leverage and pro traders with 1:200 leverage. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 0.6 |

| Assets | 30+ |

| Stocks | TradeDirect365 offers access to 400 Australian, 200 UK & US and 100 European company stocks, including Amazon, Deutsche Bank and CommBank. This is a much wider selection than can be found at most competitor brokers. |

| Cryptocurrency | DeFi enthusiasts can trade 10 different tokens at TradeDirect365, including Bitcoin and Ethereum. These instruments are available with both of the firm's supported platforms at competitive prices. You can trade crypto 24/7. |

| Coins |

|

| Spreads | From 1 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

TradeDirect365 is an online CFD broker offering a useful single-currency trading account and fixed bid-ask spreads. The broker began life in Australia but has gone on to open a UK-based, FCA-regulated branch. In this review, I share my experience using TradeDirect365, from the instruments offered to the reliability of the trading platforms and customer support team. I also unpack the different account types and the broker’s fee structure.

Our Verdict

I am comfortable that TradeDirect365 is a legitimate broker with a license from the UK’s Financial Conduct Authority. I particularly liked that there was a GBP trading account, making it easy to manage trades and finances. I would recommend the CloudTrade account for spread betting and fixed spreads, while the MetaTrader 4 account is best for CFD trading with variable spreads.

To improve its rating further, I would like to see TradeDirect365 bolster its education and market research. I received little in terms of extra tools and expert insights to support trading activities. Adding copy trading functionality would also boost its rating for me.

Overall though, TD365 is a safe pick for UK traders, particularly if you want spread betting with price transparency.

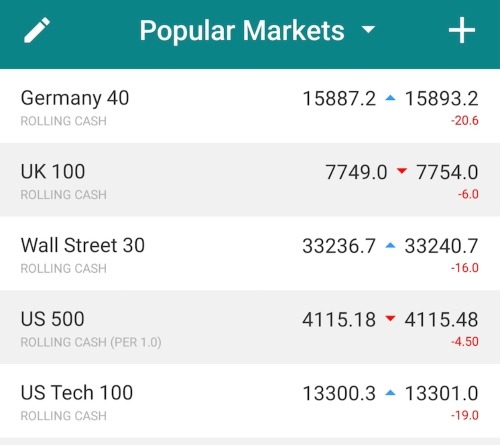

Markets

Covering everything from stocks to forex, TradeDirect365 offers a variety of tradable instruments via CFDs and spread betting. However, I do think some asset classes lack depth, with just 30 forex pairs.

Available instruments include:

- Shares: Stock CFDs from UK, US and European markets, including popular assets like Sainsbury, Shell and Disney

- Commodities: Energy and metal CFDs, including crude oil, gold, silver and aluminium

- Bonds: 3 different bonds are available to trade, Bobls, Bunds and Gilts

- Forex: 30 forex pairs, including popular pairs like GBP/USD, EUR/NZD and USD/JPY

- Indices: Over 30 index products can be traded, including UK 100, Germany 40, and differentials

- Cryptocurrencies: Speculate on popular tokens like Bitcoin with spread bets

Fees

I liked that TradeDirect365’s easy-to-follow pricing structure aims to reduce hidden fees and non-trading charges, with zero-commission trading, no inactivity fees, and no maintenance, platform or similar charges.

Instead, the broker has its fees loaded in its spreads, with fixed spreads on its CloudTrade platform, and variable spreads on the MT4 platform.

I found that fixed spreads can be an attractive option for beginners as the information allows you to better plan trades, helping you determine your profit targets with price certainty. For example, the spread on the Euro Stoxx 50 index is 0.4 pips, and this will be always the case during the trading day.

On the downside, active short-term traders may get lower fees with the variable spread option. I found spreads tend to be lower during periods of high liquidity and are on par with many alternatives.

Account Types

I appreciated the easy-to-understand account options at TradeDirect365. Which account is best will ultimately depend on whether you want to trade spreads bets or CFDs, the platform you prefer, and whether you want fixed or variable spreads.

The CloudTrade account gives traders access to spread betting and fixed spreads, 23 indices, 33 forex pairs, 11 commodities, cryptos, and US, UK and European stocks. This account is also web-based and can be accessed through a mobile app, with support accessible 24/5 and a free demo account available.

The MetaTrader 4 account gives traders access to CFDs with variable spreads, 12 indices, 26 forex pairs, and 4 commodities, but no stocks. This platform also offers 24/5 support. I was frustrated to find that, unlike many other MetaTrader 4 brokers, TradeDirect365 does not offer a free MT4 demo trading account.

Muslim traders may also feel let down by the lack of an Islamic profile.

Single Currency

A useful feature that I rated about TradeDirect365 is its single-currency trading. This allows clients to make all trades in their base currency without conversion fees, regardless of which markets are being traded on.

Currency conversion fees can impact profit margins when trading high volumes on foreign markets so I was impressed that TradeDirect365 has circumvented this by allowing trades directly in the account’s base currency, saving costs over time.

Payment Methods

I think the limited number of payment options is a shame, considering that many competitors offer a more diverse list than the debit/credit cards, Skrill and bank wire transfers accepted by TradeDirect365.

I was also disappointed by the lack of information about payment methods available on the TradeDirect365 client portals, though the minimum and maximum levels are:

- Debit/Credit (Visa/MasterCard) – Min £1 – Max £30,000

- Skrill – Min £1 – Max £100,000

- Wire Transfer

The £1 minimum deposit was a big bonus for me, as it allows beginners and those with less capital to try the broker without risking large sums.

Trading Platforms

TradeDirect365 offers two different trading platforms, CloudTrade and MetaTrader 4, both of which I rated highly.

The CloudTrade platform is a proprietary, online platform available on web browsers, or for mobile trading (iOS and Android). This is best for beginners and casual investors owing to the simple interface.

MetaTrader 4, on the other hand, is one of the most popular trading solutions, providing traders with a host of tools and features. This is a good option for active traders and those using automated strategies.

CloudTrade

The CloudTrade platform is a web-based platform with a sleek, intuitive design that I found easy to use and accessible for all traders. The platform is designed to provide all the tools most traders will use, including a range of technical tools like Bollinger Bands and Moving Averages.

The bonus of this platform is that it can also be used to trade the full range of instruments available from TradeDirect365, including spread bets on cryptos.

The CloudTrade platform can be accessed from the TradeDirect 365 client portal.

MetaTrader 4

MetaTrader 4 is one of the most popular trading platforms. The software features a range of tools to help traders perform technical analysis and implement trading strategies. My favourite features include:

- 30 technical indicators

- 31 graphical objects

- 9 timeframes

- 4 pending order types

- Plug-ins through the MQL4 programming language

- Automated trading through Expert Advisors

- A mobile app

MetaTrader 4

Yet given that MetaTrader 4 is the platform of choice for so many traders, I felt it is a big shame that TradeDirect365 gives access to fewer tradable assets on this platform. I was also disappointed to see that the broker does not offer a free MT4 demo account, unlike many of its competitors.

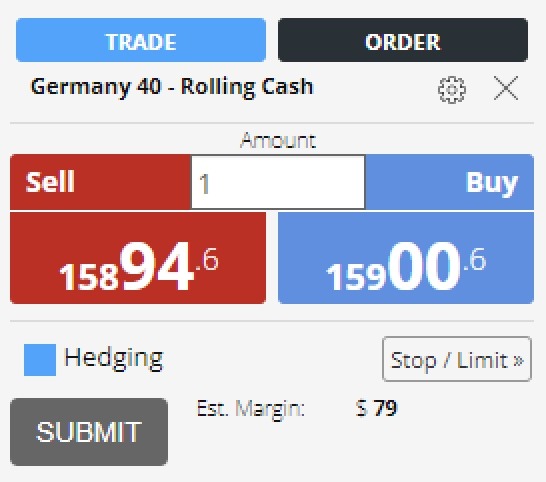

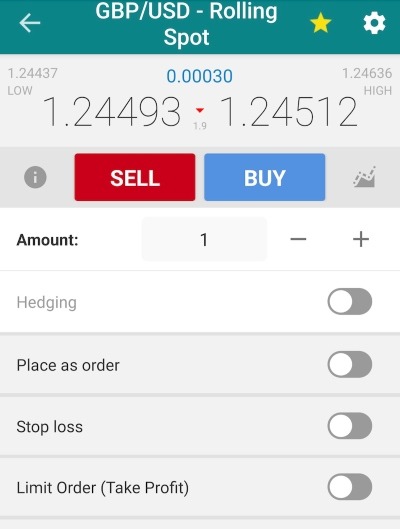

How To Place A Trade

I found it straightforward to sign in and place a trade:

- Log into the trading platform (CloudTrade or MetaTrader 4)

- Choose which asset you would like to trade, e.g. GBP/USD

- Click the “Trade” or “New Order” buttons to open the order window

- Set the parameters of your trade (amount, stop losses, take profits, buy/sell, etc.)

- Click the “Submit” or “Sell/Buy by Market” buttons to place your trade

TradeDirect365 App

Both the CloudTrade and MT4 platforms have mobile solutions available on iOS and Android devices, which is fairly standard at leading brokers.

While using TradeDirect365, I found that the apps offer much of the same functionality as their respective desktop platforms, allowing traders to monitor charts, perform analysis and place orders on the go. Importantly, the applications are stable with minimal slippage and lag.

Leverage

The UK TradeDirect365 entity allows up to 1:30 leverage, which is the maximum allowed by the FCA.

Leverage essentially allows you to trade a larger amount while only providing some percentage of the total value. For instance, if I put down £100 I can trade with up to £3000.

Yet whilst leverage is useful for boosting potential returns losses are also amplified. As such, risk management is required.

Demo Account

I was pleased to see a demo account on the CloudTrade platform, though I wish the broker followed the lead of many competitors to also support MT4 demo profiles.

The CloudTrade demo account can be made either through the client portal after making an account, or from the main website without making an account. This will take you directly to the CloudTrade platform with $10,000.00 in virtual funds. I recommend this as a good way to get familiar with the CloudTrade platform and test trading strategies before risking real cash.

How To Open A Demo Account

- Go to the TradeDirect365 UK website

- Click the “Try Demo Account” button

- This will open a new tab directly into the demo account without the need of opening up your own account

Alternatively:

- Login to the client portal

- Click on the “Add a new demo account” option

- Choose your currency and click “Create a new demo account”

- This will open a demo account that you can access whenever you want from the mobile or browser platforms

UK Regulation

I was reassured to see that TradeDirect365 is regulated by three different financial agencies, the UK Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC) and the Securities Commission of Bahamas (SCB).

Each service has its own website, and I advise UK traders to seek out the FCA-regulated branch because of its stricter rules and safety measures for British traders.

The FCA-regulated service is registered under Trade Nation Financial UK Ltd with reference number 525164. Being FCA-regulated is a major positive for TradeDirect365 as it means that they follow some of the strictest regulations in the world, protecting traders from financial foul play.

This includes traders being covered by the Financial Services Compensation Scheme, whereby you can receive up to £85,000 in compensation if the broker is unable to keep up its financial commitments. Furthermore, I like that negative balance protection and separation of funds ensure that the client does not lose more than they deposit and that their funds are kept separate from the firm’s funds.

TradeDirect365 Bonuses

TradeDirect365 does not offer any kind of bonuses to traders, which is standard for UK-based brokerages due to FCA regulations. This is in place to stop individuals from being enticed into online trading by misleading advertisements and promotions. As a result, the lack of promotions and deals isn’t a big negative for me.

Extra Tools & Features

I was disappointed by the extra tools and features offered by TradeDirect365, with just six video guides to cater to beginner traders including very basic topics such as how to place trades or build watchlists on the platform.

The only other tools provided are the dividend projections, giving me an insight into potential dividend payouts in the future. I thought this was useful for stock investors but it will be of limited use for other traders.

Helpful extras that many leading firms provide include economic calendars, calculators and news updates. A growing list of brokers are also offering copy trading services. For me, these missing features are the real drawbacks of TD365.

Customer Service

TradeDirect365 has multiple support avenues available, including an online live chat, email support, and a contact phone number, but I found the customer support process to be a mixed bag when I tested it. Although the website listed the live chat function as being active, I tried twice during working hours to send a query, but I received no response. A support assistant did get back to me by email within two hours, however.

The customer support team is available 24/5. They can be contacted from 22:00 Sunday to 22:00 Friday, UK time (GMT/BST).

- Phone number: +44 203 180 5566

- Email: support@td365.com

An FAQ is also available on the website covering a few basic questions, but these did not include some important topics I look out for, including help with withdrawal problems.

Company History & Overview

TradeDirect365 was originally founded by a professional trader in 2014 who wanted to provide a platform with low fees. They also wanted transparent trading costs, thus providing a broker that offers fixed spreads.

The firm started out in Australia before expanding to the Bahamas and the UK. TradeDirect365 has two offices, the head office in The Bahamas and a UK office in London.

Trading Hours

The trading hours are dependent on the underlying asset you would like to trade. Assets like cryptocurrencies are available to trade 7 days a week, but others like the UK 100 are only tradable while their respective markets are open.

Should You Invest With TradeDirect365?

TradeDirect365 is an FCA-regulated, CFD broker that offers single-currency accounts, eliminating costly conversion rates – an enticing benefit. I also rated the transparency of the fixed spreads. However, the broker does have a limited number of exotic assets and a stripped-back MT4 trading experience, as well as a threadbare selection of extra tools and a short list of accepted payment methods.

Overall, TD365 is best for traders looking for straightforward pricing and spread betting opportunities. However, seasoned traders may feel let down by the relatively narrow range of CFD instruments and market research.

FAQ

Is TradeDirect365 Trustworthy?

TradeDirect365 has three different entities, each regulated by a different body. The UK-based, FCA-regulated service is the most attractive option for UK-based traders because of its strict regulations protecting traders. It is also a good indicator that the broker is legitimate and trustworthy.

Does TradeDirect365 Offer Good Trading Platforms?

TradeDirect365 offers two reliable trading platforms: CloudTrade and MetaTrader 4. The CloudTrade platform is a bespoke trading platform with a sleek, intuitive design, tailor-made for TradeDirect365’s spread betting assets. MT4 is one of the world’s most popular trading platforms, with a wide range of analysis tools and customisability. I found that it is particularly good for automated trading.

Does TradeDirect365 Have A Low Minimum Deposit?

Yes, all three deposit methods (debit/credit card, Skrill and bank wire transfer) have a minimum deposit of £1. This will appeal to newer traders and those on a budget. The maximum deposits are £30,000 for debit/credit cards and £100,000 for Skrill.

Does TradeDirect365 Have A Free Demo Account?

Yes, you can open a free demo account with TradeDirect365 on the CloudTrade platform. Opening a demo account can be done directly from the website homepage or through the client portal. Unfortunately, I was less impressed to find that the broker does not offer a demo account for the MetaTrader 4 platform. This is something that is usually provided by the top MT4 brokers.

Does TradeDirect365 Have A GBP Account?

Seven different base currencies are available, and all can be used for single-currency trading. These include British Pounds, making the broker accessible for UK traders.

Article Sources

Compare TradeDirect365 with Other Brokers

These brokers are the most similar to TradeDirect365:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

TradeDirect365 Feature Comparison

| TradeDirect365 | IG Index | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 3 | 4.4 | 4.8 | 4.8 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $0 | $0 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:200 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | ||||

| Review | TradeDirect365 Review |

IG Index Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| TradeDirect365 | IG Index | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

TradeDirect365 vs Other Brokers

Compare TradeDirect365 with any other broker by selecting the other broker below.

Popular TradeDirect365 comparisons: