IC Markets Review 2025

IC Markets is a broker offering over 300+ instruments across three live accounts. This broker review covers spreads, leverage rates, trading platforms and more. We also look at the broker’s UK regulatory status and minimum deposit requirements. Find out whether IC Markets is the right broker for you.

About IC Markets

IC Markets is an Australian-based CFD broker. The company was established in 2007 by founder and CEO, Andrew Budzinski, and serves both retail and institutional clients.

The brokerage is a trading name of International Capital Markets Pty Ltd, which is licensed and regulated by the ASIC.

Other entities in the group include IC Markets Europe Ltd, which is regulated by the CySEC and IC Markets Global, which is regulated by the FSA. As a global broker, it has offices in various jurisdictions including in Limassol, Cyprus and the Seychelles.

Unfortunately IC Markets is not regulated by the FCA and does not have offices in the UK. With that said, British traders can still open a live trading account.

Trading Platforms

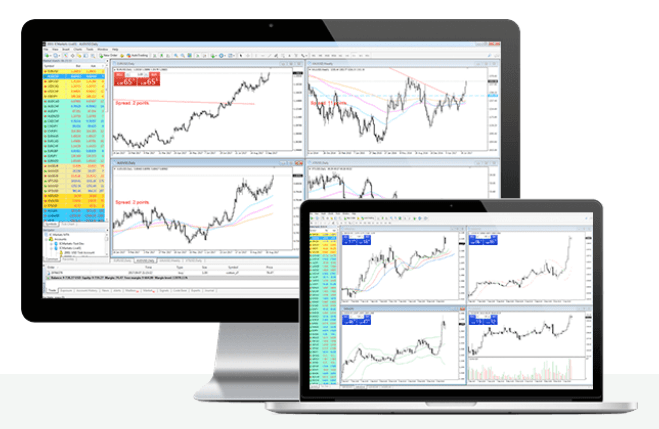

MetaTrader 4

The MT4 platform offers excellent trading conditions and competitive raw pricing. The terminal allows retail clients to trade with institutional-grade prices that compare with some of the world’s leading execution venues. MT4 is a popular choice for high volume traders and those employing scalping systems.

Hedging strategies are also supported and the broker does not impose a ‘first in first out’ rule.

MetaTrader 4

IC Markets offers 20 exclusive advanced trading tools for MT4 including Market Manager, Sentiment Trader, Correlation Matrix, Mini Terminal and more. Alongside interactive charting, several order types and dozens of indicators, clients can place trades as small as one micro lot (0.01) with no maximum lot size requirement.

The MT4 platform is available for desktop download (Mac and Windows), via WebTrader (major browsers), plus mobile apps (iOS, Android and Blackberry).

MetaTrader 5

MT5 is a refined version of its MT4 predecessor. The platform offers advanced charting technology and order management tools along with the broker’s raw pricing from 25 providers. The MT5 servers are located in the Equinix NY4 data centre in New York to provide optimal execution speeds.

MetaTrader 5 promises flexible lot sizing, trading directly from charts, plus the capability to build or buy algorithmic robots via Expert Advisors (EAs).

Finally, IC Markets offers level II pricing on MetaTrader 5 with full market depth for liquidity transparency.

MetaTrader 5

The MT5 platform can be installed on desktop (Mac and Windows), accessed via WebTrader and downloaded as a mobile app.

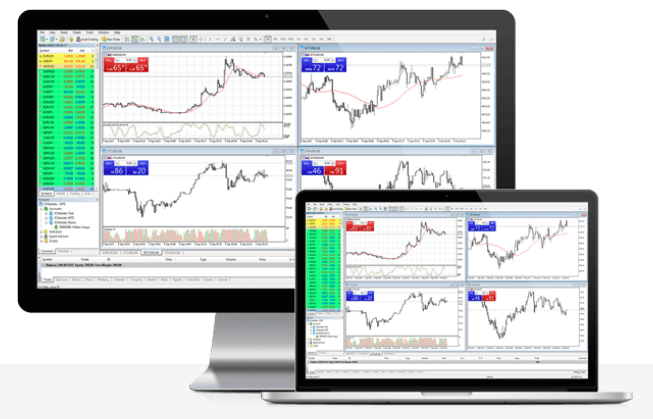

cTrader

cTrader facilitates trading on 64 forex pairs and 16 major equity indices, amongst others. Offering an alternative feel to the MetaTrader terminals, the trading solution has a lot to offer. Aside from live forex and CFD quotes, users benefit from multiple order types, detachable charts, real-time reports and one-click trading.

cTrader is a powerful retail investing platform that will meet the needs of beginners and experienced investors.

cTrader

cTrader is available on Mac, cTrader Web, iOS (iPhone and iPad) and Android app.

Assets

IC Markets offers trading on over 300+ CFD instruments:

- Forex – 60+ major, minor and exotic currency pairs including GBP/USD, EUR/USD and SGD/JPY

- Commodities – 19 energy, agriculture and metals including Brent crude oil, cocoa and gold

- Stocks – 200 stocks across major exchanges including the FTSE, Nasdaq, NYSE and ASX

- Cryptos – 10 popular altcoins including Bitcoin, Ethereum and Ripple

- Indices – 23 indices including the FTSE100, US30 and AUS200

- Bonds – 6 international bonds

- Futures – 4 global futures

Note the FCA does not permit UK retail traders to invest in crypto derivatives. The broker also does not offer binary options.

Trading Fees

IC Markets offers variable and tight spreads across its trading platforms:

- Raw Spread (MT4 & MT5) – Spreads from 0.0 pips and $6 commission per lot round turn

- Raw Spread (cTrader) – Spreads from 0.0 pips and $7 commission per lot round turn

- Standard – Spreads from 1.0 pip and zero commission

Average forex spreads on the EUR/USD pair are 0.1 pips on the Raw Spread account and 1.1 pips on the Standard account. Typical gold spreads average around 1.0 pip. To see accurate quotes and live prices, open the broker’s trading platforms.

Leverage Review

IC Markets offers significantly higher leverage than is usually available to UK traders under FCA regulation.

Users can trade with leverage up to 1:500 depending on the regulator (ASIC and CySec limit leverage to 1:30).

See the broker’s website for details on margin call levels and requirements.

Mobile Trading

IC Markets does not offer a proprietary mobile app. However, clients can trade using the MT4, MT5 and cTrader applications. The apps provide easy access to live trading accounts anytime and anywhere.

The MetaTrader apps offer significant flexibility with one-click trading, customisable layouts, 30+ technical indicators, advanced charts and more. The cTrader mobile app also provides all the tools needed for effective technical analysis, including common trend indicators, oscillators, volatility measures and line drawings.

Mobile trading

The MT4, MT5 and cTrader mobile apps are available on iOS (including iPad) and Android devices (including Windows). They can be downloaded from Google Play or the Apple App Store.

Deposits & Withdrawals

IC Markets offers 15+ funding options and GBP payments, reducing currency conversion charges. Processing times vary between options:

- Credit & debit cards i.e. Visa and Mastercard – Instant

- Neteller & Neteller VIP – Instant

- Broker to broker – 2 to 5 days

- Wire transfer – 2 to 5 days

- RapidPay – Instant

- Klarna – Instant

- PayPal – Instant

- Skrill – Instant

To withdraw earnings, account owners need to submit a withdrawal request from the secure client area. Withdrawals cannot exceed the amount deposited. Typical processing times for debit and credit card withdrawals are 3 to 5 business days.

IC Markets does not charge any additional fees for deposits or withdrawals. With that said, third-party payment solutions may have their own fees.

Demo Account

IC Markets offers a demo account for both new and existing clients. Once created, you can access the IC Markets demo server instantly. The demo simulator mirrors the live trading environment with the same tools and market data available. Users benefit from unlimited virtual funds, though it’s worth noting that practice accounts expire after 30 days of inactivity.

Regulation Review

IC Markets is not regulated in the UK. Instead, the broker is authorised is other financial hubs.

IC Markets AU under International Capital Markets Pty Ltd holds an Australian Financial Services Licence (AFSL) and is regulated by the Australian Securities and Investments Commission (ASIC) under company number 335692.

IC Markets EU Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under registration number 356877. Lastly, IC Markets Global, trading under Raw Trading Ltd, is regulated by the Financial Services Authority of Seychelles (FSA) under company number 8419879-2.

So whilst UK traders may be disappointed by the lack of FCA oversight, IC Markets is still regulated in multiple jurisdictions indicating that the company is legitimate and trustworthy.

Additional Features

- Education – The broker provides decent educational tools, which include videos and tutorials, research webinars and an information hub for both new and professional traders.

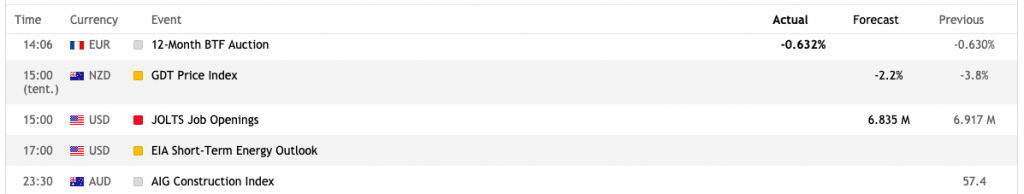

- Resources – Clients can access multiple resources, including market analysis blogs, trading news, forex & pip margin calculators, an economic calendar, plus an FX glossary.

- Social media – IC Markets has a good social media presence on Twitter, Instagram and a decent following on Facebook, where they post regular news and tips on trading trends.

Economic calendar

Other Tools

Clients have access to Multi-Account Manager (MAM/PAMM) software, which is suitable for traders or money managers utilising EAs.

The broker also offers a free VPS hosting service with fast connectivity to IC Markets trading servers. As a result, traders can run EAs without worrying about backup internet or computer hardware.

A FIX API trading solution is also available for traders looking for the lowest latency and control over automated investing strategies. Additionally, auto trading is available via three social platforms; ZuluTrade, Myfxbook’s AutoTrade and Signal Trader, which allow you to copy signals from other investors.

IC Markets Accounts

IC Markets offer three account types to suit traders of different levels. The main variations are the platforms, spreads and commission fees.

- Raw Spread (MetaTrader) – This account is best suited to trading with EAs and scalping strategies

- Raw Spread (cTrader) – This account is best suited to day traders and scalpers

- Standard – This account is suited to discretionary traders

IC Markets offers swap-free Islamic account conditions across each of the above. The broker also accepts joint account applications, though a request will need to be sent to the customer support team.

Another thing to consider is the USD $200 minimum deposit requirement. You may also be subject to slippage when trading stocks, futures, commodities or forex.

To open an account, visit the ‘Open a Live Account’ link, complete the application form and provide ID verification i.e. a government-issued tax document. Once registration has been approved by the accounts team, you will receive your login details and investor password.

IC Markets Pros

When comparing IC Markets vs competitors such as FxPro, Global Prime, and CMC Markets, the broker scores well in several areas:

- ASIC, CySEC and FSA regulation

- Wide range of deposit options

- No concerns around scams

- Forex commission rebates

- Over 300+ instruments

- Zero spread accounts

- AutoChartist on MT4

- Secure stop out levels

- Historical tick data

- Copy trading

- EA lab

IC Markets Cons

Compared to alternatives like Pepperstone, FXCM, IG and eToro, IC Markets has several drawbacks:

- No welcome bonus or discount promotions

- No proprietary platform application

- $200 minimum deposit

- No FCA regulation

- No spread betting

Trading Hours

IC Markets clients can trade 24/7. However, each instrument will have different opening hours. Visit the IC Markets website under ‘Trading Hours’ for a breakdown by timezone.

Note that the broker server time has a GMT offset of GMT + 2 or GMT + 3 when daylight savings is in effect. Also keep in mind that IC Markets’ rollover occurs at 00:00 MetaTrader 4 server time.

Customer Support

If you encounter issues such as no connection errors, withdrawal problems, or general complaints, you can contact the customer support team 24/7 via:

- Email – support@icmarkets.com

- Live chat – Bot available on the website

- Global toll-free numbers – UK +44 800 014 8775

The company’s headquarters address is: Level 4, 50 Carrington Street, Sydney, NSW 2000, Australia.

Client Safety

The broker holds client funds in segregated accounts with tier 1 banks. The company also abides by a privacy policy, which ensures personal information is safe and not sold to third parties. The MetaTrader platforms use encryption technology and dual-factor authentication at the login stage.

IC Markets Verdict

IC Markets is a legitimate broker offering tight spreads with a proven track record. The brokerage offers a selection of leading platforms, a range of assets, copy trading and a suite of learning resources. The only major drawbacks for UK traders are the lack of FCA oversight and negative balance protection. Overall, we are comfortable recommending IC Markets.

FAQ

Is IC Markets A Good Broker?

IC Markets is an established and regulated broker that complies with the strict stipulations set out by several bodies, including the ASIC, CySEC and FSA.

The online forex and CFD provider offers an excellent trading experience with fast executions, trusted platforms and zero pip spreads. As a result, IC Markets receives strong customer reviews and user ratings.

What Is The Live And Demo Server IP Of IC Markets?

IC Markets’ server locations are located in the NY4 and LD5 IBX Equinix data centres in New York and London. MetaTrader platforms run on the New York server while the cTrader platform runs on the London server.

How Much Capital Do I Need To Trade With IC Markets?

All account types on IC Markets require a minimum initial deposit of $200 USD or equivalent. A free demo account is also available with no deposit needed.

Is IC Markets Halal?

IC Markets offers swap-free Islamic trading conditions across all of its account types for Muslim investors.

Top 3 IC Markets Alternatives

These brokers are the most similar to IC Markets:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- FP Markets - Founded in 2005 in Australia, FP Markets is a broker regulated by both ASIC and CySEC. It offers a wide range of tradable assets and provides Standard and Raw accounts suitable for traders of all levels. The platform excels in tools, featuring the MetaTrader suite, user-friendly TradingView, and practical insights from Trading Central and AutoChartist.

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

IC Markets Feature Comparison

| IC Markets | Pepperstone | FP Markets | IG Index | |

|---|---|---|---|---|

| Rating | 4.8 | 4.8 | 4 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $200 | $0 | $40 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | IC Markets Review |

Pepperstone Review |

FP Markets Review |

IG Index Review |

Trading Instruments Comparison

| IC Markets | Pepperstone | FP Markets | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | No | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

IC Markets vs Other Brokers

Compare IC Markets with any other broker by selecting the other broker below.

Popular IC Markets comparisons:

|

|

IC Markets is #5 in our rankings of CFD brokers. |

| Top 3 alternatives to IC Markets |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Demo Account | Yes |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Regulated By | ASIC, CySEC, FSA, CMA |

| Trading Platforms | MT4, MT5, cTrader |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Cards, Klarna, Mastercard, Neteller, PayPal, Rapid Transfer, SafeCharge, Skrill, Swift, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade |

| Signals Service | Signal Start |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Corn, Gold, Natural Gas, Oil, Orange Juice, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | 1.0 |

| CFD GBPUSD Spread | 0.23 |

| CFD Oil Spread | 0.03 |

| CFD Stocks Spread | 0.02 |

| GBPUSD Spread | 0.23 |

| EURUSD Spread | 0.02 |

| GBPEUR Spread | 0.27 |

| Assets | 75 |

| Crypto Coins | ADA, BCH, BNB, BTC, DOG, DOT, DSH, EMC, EOS, ETH, LNK, LTC, NMC, PPC, UNI, XLM, XRP, XTZ |

| Crypto Spreads | BTC 42.036 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |