Lightyear Review 2024

|

|

Lightyear is #118 in our rankings of UK brokers. |

| Lightyear Facts & Figures |

|---|

Lightyear is a trading app that offers multi-currency investing with low-commission US, EU and UK stocks, no commission on ETF trades, and the chance to earn high interest on uninvested USD, GBP and EUR. The firm launched in 2015 and UK retail traders will be registered under the Lightyear Financial Ltd entity. This company is authorised and regulated by the Financial Conduct Authority (FCA), license number 955739. Capital at risk |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs |

| Demo Account | No |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| Regulated By | FSA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

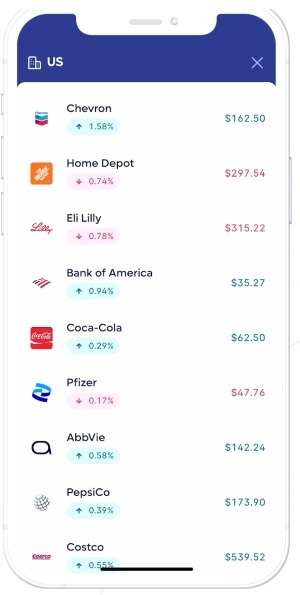

| Stocks | Use Lightyear's simple platform to invest in 3500+ US, UK and EU stocks for low commissions of around $1, as well as ETFs for no fee. The no-frills app is a good fit for beginners and there are no hidden charges. |

Lightyear is a stock and ETF mobile investment platform with low fees. The brokerage provides a no-frills service for traders to invest in 3500+ products. This Lightyear review will unpack minimum investments, app features, financial products, safety ratings, and more. We also explain how to register for an account and start trading.

Lightyear is a popular investing platform with transparent pricing and a beginner-friendly app. Our experts particularly liked that you can earn up to 4.25% interest GBP (as of 24.05.23) on uninvested cash. FCA oversight also gives the firm a high trust score.

Products & Services

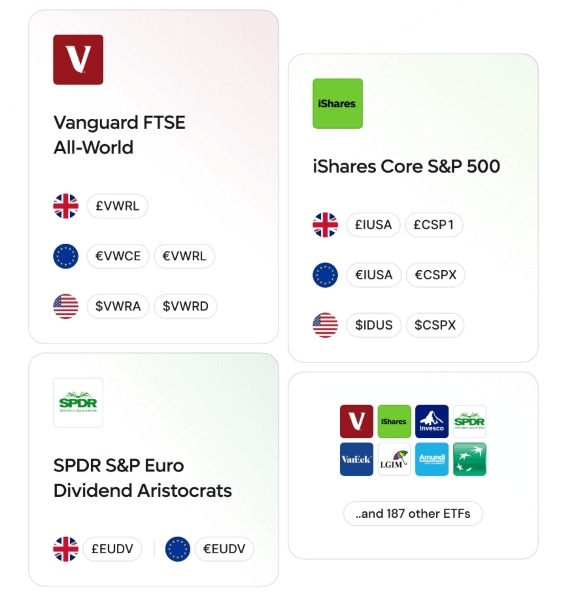

Lightyear offers 3500+ instruments:

- ETFs – Diversify your portfolio with a choice of UK and EU exchange-traded funds including BlackRock iShares.

- Stocks – Trade some of the largest UK, US, and European company shares including Unilever, Tesco, Tesla, and Coca-Cola. Fractional shares are also available for those with less starting capital.

On the downside, the product list is limited compared vs alternatives such as eToro, CMC Markets and Interactive Brokers. And unlike some of its rivals, Lightyear does not offer CFDs, mutual funds, options, or futures.

Dividend payments are available for eligible investments. This includes fractional shares, proportionate to the percentage of an individual share owned.

Fees

Lightyear is transparent when it comes to trading fees, which are generally competitive:

- ETFs – No fee

- UK Shares – £1 per order

- EU Shares – €1 per order

- US Shares – 0.10% ($1 maximum per order)

There is a 0.35% currency conversion fee.

Local tax payments, including UK stamp duty (0.5%), are the customer’s responsibility when purchasing UK stocks.

Interest

A key benefit of trading with Lightyear is that your uninvested funds will earn interest at a competitive rate.

The GBP interest rate was ahead of the competition at 4.25% p/a, as of 24.05.23, which is earned daily and paid into your account monthly.

Accounts

Lightyear offers just one account type for UK traders. This profile provides access to all instruments, with no restrictions based on previous investing experience or projected trading volumes.

When we used Lightyear, we were also pleased to find there is no minimum deposit to open an account.

Yet whilst ideal for beginners, advanced traders may feel let down by the lack of perks or improved trading conditions for higher volumes.

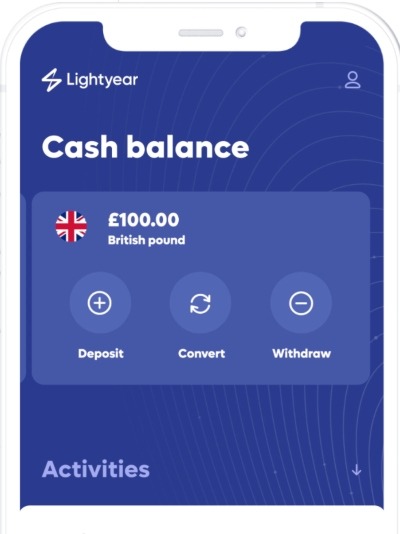

You can deposit, hold, and trade in three base currencies; GBP, USD, or EUR.

How To Open A Lightyear Account

Opening an investment account with Lightyear is very straightforward. The sign-up process took our traders just a few minutes.

- Download the app from the Google Play or Apple App Store

- Enter your mobile number and verify your account with the one-time password (OTP)

- Enter the additional personal details and select ‘Open Account’

- Upload account ID and address verification documents

- Deposit funds and start investing

Deposits

UK traders can deposit funds via debit card, Apple Pay, Google Pay, or bank wire transfer (FPS, CHAPS, or SWIFT).

The broker does not charge any fees for wire transfers, though third-party charges may apply.

It was a shame to see that debit cards will be liable for a 0.5% fee after the first £500 of deposits.

Processing times vary:

- FPS – 0–2 hours

- Debit Card – Instant

- SWIFT – 3–5 business days

- Google Pay/Apple Pay – Instant

- CHAPS – Up to one working day

E-wallet solutions such as PayPal and cryptocurrency are not currently accepted as deposit methods.

Withdrawals

A major drawback of Lightyear withdrawals is that payments are processed via bank wire transfer only, regardless of the payment method used for deposits.

Having said that, processing times are reasonable, with funds typically returned to a registered bank account within 3-5 working days.

The broker does not impose any fees for withdrawals.

How To Make A Withdrawal

- Log in to the Lightyear investment app

- Select the ‘Withdraw’ icon from the applicable trading account

- Follow the on-screen instructions to enter the withdrawal value and submit bank details

- Review the withdrawal request and select ‘Confirm’ to approve the transaction

Note that you will need to upload your bank account details before requesting a withdrawal if you did not use this as your deposit method.

Lightyear App

Lightyear offers mobile-based trading, alongside an easy-to-access web-based platform.

The mobile app is proprietary software, available for free download to iOS and Android (APK) devices. The platform is simple to navigate but offers a decent range of features and chart views.

The app is rated an impressive 4.7/5 on the Apple App Store, and has been recognised as the Best User Experience app at the 2022 AltFi Awards and the Most Innovative Investment Platform at the UK Finance Awards.

We particularly liked the repeat order function, which offers automated investment duplication. This is fully flexible regarding reoccurrences and can be defined by monetary values or share volumes.

Additionally, while using Lightyear, traders benefit from volatility alerts that indicate significant price shifts.

The app’s main features include:

- Portfolio sharing

- Market or limit orders

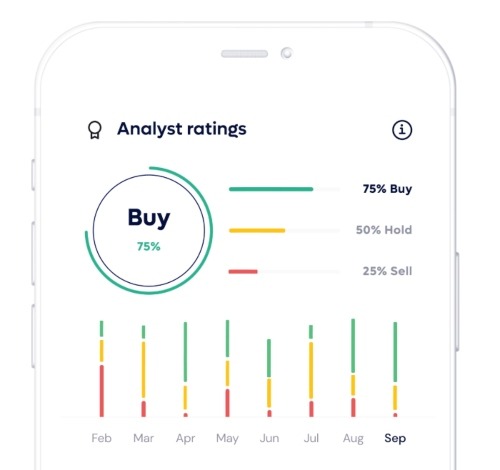

- Analyst insights and price targets

- Real-time profit and loss estimations

- Real-time market data and earnings calls

- Instrument-specific fundamental data and product metrics including dividend yields, market cap, and earnings per share

How To Place A Trade

The easiest way to place a trade on the Lightyear app is by searching for the instrument in the navigation bar.

Alternatively, you can create custom watchlists and visit the instrument page for financial metric data.

Then, simply select ‘Buy’ or ‘Sell’ and enter the order details including volume and order type (limit or market).

Is Lightyear Regulated?

UK retail traders will be registered under Lightyear Financial Ltd, which is an appointed representative of RiskSave who is authorised and regulated under FCA number 775330. Customers’ funds and associated protections are provided through LY EU.

Overall, we are comfortable that Lightyear is legitimate and trustworthy.

Demo Account

Our Lightyear review was disappointed to find there is no demo account. This is disappointing, particularly for beginners.

Having said this, the minimum deposit requirement is very low and there are small investment sizes available so you can get started without having to risk too much money compared to other brokers.

Education & Resources

There is limited educational content or online learning resources available to Lightyear customers. This is a disadvantage for those looking to improve their trading skills.

On a more positive note, the broker does offer some analyst data from a third-party. This includes price targets, buy and sell indicators, plus financial metrics broken down by month.

Ultimately, the Lightyear app is a streamlined investment platform without the extensive learning resources provided by larger brokers in the UK.

Joining Bonus

Lightyear does not offer any bonus rewards for signing up or depositing funds. This is typical for FCA-regulated brokers.

A refer-a-friend promotion, however, is available for UK customers with a £10 value of fractional shares available for successful referrals.

Leverage

Lightyear does not provide any leveraged trading opportunities. This means you cannot trade on margin.

This is a shame as UK stockbrokers are permitted to offer leverage up to 1:5 for individual equities, and this is available from some of Lightyear’s competitors.

Customer Service

Our experts found Lightyear customer support disappointing, with no live chat function or telephone number.

Instead, retail investors are directed to an online help page with FAQs and step-by-step guides. Topics include managing a live account, trading, and payments. Our team found this information useful, but it is no substitute for live helplines which are typically offered by major brokers.

Customers should direct their urgent queries to the Lightyear support email address at support@golightyear.com.

Company Details

Lightyear is a relatively new brand that launched investment services in 2020. Virgin Group announced a $25 million investment in the company in July 2022 as part of a Series A equity round.

The current CEO is co-founder Martin Sokk.

The Lightyear trading platform app is available for UK and EU retail investors only.

Opening Hours

Trading hours vary by product and market opening times. The London Stock Exchange, for instance, is open Monday to Friday, 8am to 4:30pm (GMT).

Orders placed outside of these times will be processed the following working day.

Should You Invest With Lightyear?

Lightyear provides a simple-to-use, low-cost mobile trading platform. However, the brand’s app and product list, which is limited to international stocks and ETFs, are geared toward beginner investors, so the lack of educational resources and customer support was disappointing.

Nonetheless, Lightyear’s fees are transparent and there are some useful insights and market data available to aid with decision-making, so it is a brand worth considering. The low minimum deposit and opportunity to earn interest on uninvested cash is also reason enough to give Lightyear a try.

FAQ

Is Lightyear A Good Investment Platform?

Lightyear provides retail investors with a sleek and easy-to-use trading app plus a web-accessible platform. The solution offers all the functions needed to execute trades easily. This includes custom alerts/notifications, P&L projections, and price target data.

The app and web platform are suitable for beginners, though more experienced investors may feel the terminal is lacking in advanced tools.

Is Lightyear A Safe Broker?

Lightyear is a relatively secure investment platform. Our team are comfortable with the security measures in place and the brand has a good reputation and safety score.

What Can I Trade On The Lightyear App?

Retail investors can trade UK, US, and EU stocks, alongside some popular exchange-traded funds (ETFs). In total, more than 3500 products are available on the investing app and web platform.

Are Lightyear Fees Competitive?

Lightyear offers low-cost trading with no charges to open an account or for inactivity. This includes £1 per order to invest in UK shares, €1 for EU shares and 0.1% up to $1 for US shares. There is also a reasonable 0.35% currency conversion fee.

However, watch out for deposit fees when using debit cards, Apple Pay, and Google Pay after the £500-lifetime limit has been reached.

Does Lightyear Have A Mobile Trading App?

Lightyear offers a mobile investing app, in addition to a web trader terminal. The intuitive application is available for free download to iOS and Android devices. It provides all the basic features needed to trade stocks and ETFs including historical price data, live news streams, and analyst insights.

Article Sources

Compare Lightyear with Other Brokers

These brokers are the most similar to Lightyear:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Lightyear Feature Comparison

| Lightyear | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| Rating | 4.5 | 4.3 | 4.4 | 4 |

| Markets | Stocks | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities |

| Minimum Deposit | $1 | $0 | $0 | $1000 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, FINMA, DFSA, SFC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | - | - | MT4 | MT4, MT5 |

| Leverage | - | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | ||||

| Review | Lightyear Review |

Interactive Brokers Review |

IG Index Review |

Swissquote Review |

Trading Instruments Comparison

| Lightyear | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Lightyear vs Other Brokers

Compare Lightyear with any other broker by selecting the other broker below.

Popular Lightyear comparisons: