KuCoin Review 2024

|

|

KuCoin is #30 in our rankings of crypto brokers. |

| Top 3 alternatives to KuCoin |

| KuCoin Facts & Figures |

|---|

Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | ETFs, Cryptos, Futures |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes (iOS & Android) |

| Payments | |

| Min. Trade | 0.0001 Lots |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | No |

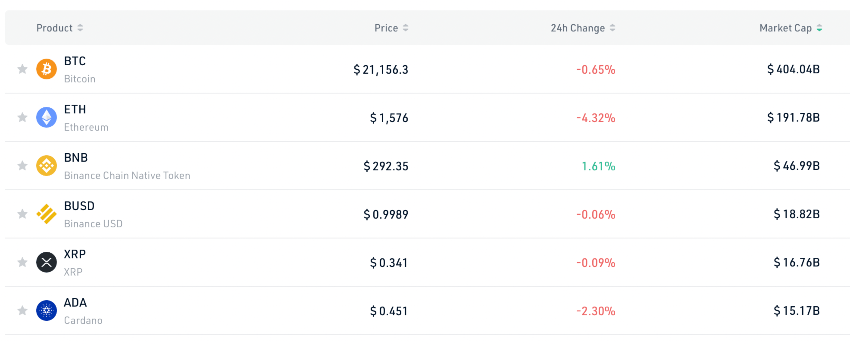

| Cryptocurrency | With well over 1000 crypto assets available, Kucoin offers a great degree of flexibility. It is excellent to see an extensive range of tokens, as this allows traders to search for lesser-known tokens with a high upside. The crypto futures and perpetual swaps are also good additions to the roster, tradeable with 1:10 leverage. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | Yes |

| Crypto Mining | Yes |

| Crypto Staking | No |

| Auto Market Maker | No |

KuCoin is one of the largest online crypto trading platforms, offering a DeFi exchange, OTC service and several other features to global clients. This 2024 exchange review will cover the service through a UK-focussed lens, illuminating GBP minimum deposit requirements, withdrawal fees, the company’s proprietary coin (KCS) and any bonus promos offered. Keep reading for the key findings our experts found when reviewing the KucCoin broker.

About KuCoin

KuCoin is the brainchild of owners Michael Gan and Eric Don, who started building the exchange in 2013 before the platform was publicly launched in late 2017. Current CEO Johnny Lyu has overseen the growth of the exchange to serve over 20 million global investors and process more than £1 trillion in total trading volume.

KuCoin offers several crypto-based services to customers through a proprietary web-based solution, including a secure wallet, exchange platform, yield farming and leveraged token and futures speculation.

The company headquarters is in Seychelles, a popular financial services provider location. However, as with almost all crypto exchanges, the firm is not regulated by any reputable body and lacks the protection measures offered by traditional financial service brokerages.

KuCoin Token

The native governance token of the KuCoin exchange is KCS, a coin that allows holders to earn a daily reward. Owning KCS entitles users to fee discounts and provides exclusive access to the Spotlight new coin listings program.

KuCoin Products

The scope of KuCoin’s operation extends beyond a mere crypto exchange. The platform has multiple offerings, including derivatives investing, an NFT marketplace and yield farming programs.

KuCoin Exchange

KuCoin supports over 1,500 crypto pairs through its sizeable P2P exchange offering, with tokens available in fiat, stablecoin, KCS and major altcoin-based pairs. Investors trade peer-to-peer with other registered clients, though liquidity is good and spreads are tight. The exchange 24-hour volume usually exceeds £600,000,000.

OTC Purchases

KuCoin also allows clients to buy crypto directly via several over-the-counter (OTC) provisions. The platform supports over 70 payment methods and will allow traders to purchase twelve supported tokens using more than 40 fiat currencies, including GBP.

In addition, users can sell their crypto to the platform to receive funds directly into external bank accounts or e-wallets. Again, twelve primary tokens are supported in this service.

Third-party solutions such as Simplex and BTCDirect are also supported, offering competitive exchange rates and a far more comprehensive range of tokens.

Yield Farming

Several staking options are available to KuCoin customers that want to earn interest on their investments.

The first is the lending program, which facilitates the lending of over 100 tokens across the KuCoin network for a set daily interest price. Holders can offer their token for 7, 14 or 28 days, during which time the holding will be locked up and unsellable, which can be a risk.

Investors can also stake their tokens through the platform, with fixed and flexible yield farming programs for both established and upcoming assets. Alternatively, the firm offers access to its mining pool, where clients can receive Bitcoin, Bitcoin Cash and Ethereum directly by mining crypto.

For more speculative traders, the exchange runs frequent lotteries where investors can wager their KCS or USDT tokens to receive an entry into competitions for prizes like AirPods or big USDT jackpots.

KuCoin Wallet

Many crypto enthusiasts require a decentralised wallet in which to store their tokens and NFTs or make quick, secure payments and transfers in the Web3 space. The KuCoin wallet is one such solution, integrating with the exchange, KCC chain and NFT marketplace, making it easy to keep all assets in one place.

KuCard

The KuCoin card allows users to make real-time crypto payments using tokens held in an account. The KuCard works as a Visa debit card and offers cashback in KCS tokens for purchases at selected merchants and member benefits.

The card currently supports payments in USDT, BTC and KCS but the firm plans to add greater coin support soon.

KuCoin Spotlight

KuCoin Spotlight is the hub for token launch programs, with customers able to invest early in upcoming coin releases before they hit the ICO market. The company’s team of experts vets new listings to ensure each project has quantifiable utility and legitimate financial status before issuing alerts.

Some of the firm’s most popular Spotlight listings have gained between 10,000% and 20,000% in value.

NFT Marketplace

While using the broker’s services, our trading professionals were pleased to find a non-fungible token (NFT) marketplace called Windvane, where users can buy, sell and trade NFT art and products. In addition, the Wonderland platform is the firm’s gaming-specific NFT offering that links to several major Web3 games.

For those who want to speculate on the price of a high-value item, the fractional NFT service allows investors to purchase a small percentage of a blue chip token.

Markets

There are over 1,500 markets on KuCoin, including popular tokens such as BTC, ETH, ADA, BNB, XMR, XRP and 1inch. In addition, hundreds of altcoins like XDC, XDB, XYO, ZORT, ZIL, Zilliqa and Qredo are also supported.

While most coins are traded in stablecoin token pairs using coins like USDT, USDC and TUSD, hundreds of BTC and KCS cross pairs are also provided.

Upcoming listings are regularly released onto the exchange and advertised on the website accordingly. In addition, new coin listings are highlighted in a dedicated section of the platform.

Cryptocurrencies

Futures Trading

There are over 100 perpetual futures contracts available on KuCoin. Perpetual futures allow investors to speculate on the future price of a coin or take advantage of spot/futures arbitrage for reliable interest payments.

Traders can take part in “Futures Brawl” games with up to two other investors, pitting clients against each other to predict the future price of a token. The top players on the brawl leaderboard at the end of a trading period share a USDT prize pool worth up to £2,000.

Leveraged Tokens

An alternative to margin trading crypto is to use leveraged tokens, which offer up to 1:3 leverage, either long or short on a token. No collateral or margin requirements are needed to trade leveraged tokens, which track the price movements of a coin rather than the underlying price through an ETF.

Leverage

If the multiplier of leveraged tokens is not as high as traders require, traditional margin trading is also available. KuCoin clients can take advantage of 1:5 leverage when trading cross pairs and 1:10 leverage on isolated margin mode.

Margin is borrowed from other users at the best market rate using the platform’s lending program. As a result, interest varies daily and depends on the borrowed coin.

Account Types

There are five account types provided for KuCoin traders. These are the Main, Trading, Margin, Futures and Financial accounts. Clients can use a single login for all of these variants, though assets are held separately amongst them.

There is no minimum deposit requirement to open an account, with users able to leave their wallets empty when signing up to the platform.

The Main account is used for storing tokens and making deposits and withdrawals to and from the platform. Clients need to transfer funds into this area to withdraw fiat currency and tokens.

Spot trading is done from the Trading account, while KCS fees are also taken from this area. The assets in the Margin account are used for margined borrowing and investing, with debts based on borrowing accumulating in this area.

The Futures account is where all futures contracts are displayed with their current price value and the Financial account is where assets locked up for staking are shown.

Demo Account

In late 2020, KuCoin launched its Trading Simulator 2.0 service in partnership with NewsCrypto. This allows registered clients to trade live market movements on 15 crypto pairs with over £8,000 of paper funds.

While this is not available to non-registered traders, it is a great tool to help new investors learn the markets or experiment with new strategies.

Trading Platforms

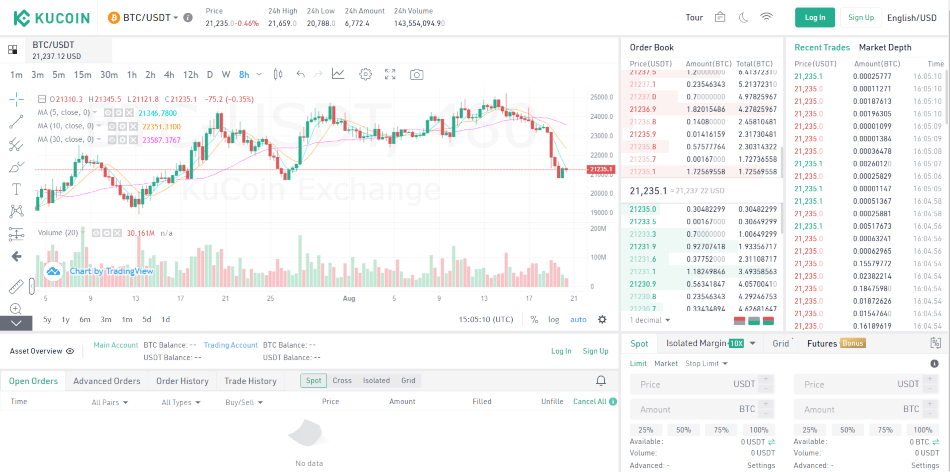

KuCoin offers a proprietary trading platform to trade on its spot, futures and margin markets. This software is entirely web-based, with no option to download a desktop app. However, there is mobile investing through the KuCoin app.

With charting powered by TradingView, clients can utilise twelve time frames, over 100 built-in indicators and comprehensive drawing tools to analyse price movements on any crypto pair.

When we used the terminal, we found seven graphing types provide various views of price history, while three scale variants facilitate advanced technical analysis and price prediction systems. In addition, advanced order types, including the stop limit and stop loss, are available.

KuCoin Platform

Another version of this platform is available for selected instruments through Futures Lite. This variant displays a heavily simplified graph and place order section alongside an easy-to-read long/short ratio indicator.

Trading Bot

The KuCoin Trading Bot is integrated into its platform to assist with portfolio management and automated investing tasks. Working 24 hours a day, seven days a week, traders can take advantage of speedy execution and round-the-clock market monitoring.

API Access

For advanced traders for whom the proprietary platform does not fulfil their needs, KuCoin offers API access to its marketplace. API-based traders can create custom programs to automate investing and take advantage of exclusive perks like interest-free loans and trading fee discounts.

Mobile App

Due to the 24/7 nature of the cryptocurrency markets, having access to your trading account wherever you are is crucial. To this end, the firm offers a highly-rated mobile app available to download on Android and iOS devices.

KuCoin investors can carry out several tasks on the go, including managing open orders, transferring funds between accounts, making deposits and withdrawals or viewing their order history.

KuCoin App

Payment Methods

When adding funds to an account, clients have three options: make a fiat deposit, transfer crypto token from another exchange or wallet or purchase crypto OTC using fiat funds. The platform imposes a 1 USDT minimum deposit or withdrawal requirement.

When buying crypto OTC with GBP, clients can use several supported payment methods, including bank wire transfer, TransferWise, Revolut, PayPal, Visa and Mastercard prepaid, credit and debit cards.

Investors can also make the inverse transaction, selling their tokens in a GBP fiat withdrawal using the same payment methods. This is a fast way to withdraw funds to a bank account, with card and bank transfer withdrawals clearing quickly.

For both deposits and withdrawals, the convenience of this service is at the cost of often unfavourable crypto exchange rates.

Making a GBP deposit to KuCoin is possible via Visa, MasterCard or SEPA bank transfers and traders will receive the fiat funds into their account instantly for card deposits or in 1-2 working days for bank transfers.

Deposit & Withdrawal Fees

In addition to the poor exchange rate offered by the KuCoin OTC service, our experts found there are deposit and withdrawal fees to contend with for some payment methods. For example, card payments and e-wallet transfers are charged up to a 3% fee, though SEPA payments do not have any fees.

Though deposits are fee-free, small charges of up to 0.0005 BTC apply for crypto withdrawals.

Trading Fees

Trading fees are put under the microscope by prospective clients who want to keep as much of their trading profits as possible. KuCoin has a reasonably competitive fee structure for its spot and futures markets, with clients able to bag fee discounts when holding a significant quantity of KCS tokens all the way past zero fees to where the exchange compensates the trader for adding liquidity.

For spot exchange fees, the base fee rate is 0.1% for maker and taker transactions. Twelve VIP levels reduce these values to as low as 0.005% for maker and 0.025% for taker positions. These levels are based either on KCS holdings or 30-day investing volume. A further 20% discount on each rate is available when you pay using KCS tokens.

Futures fees also have twelve VIP levels, with level 0 having fees of 0.02%/0.06% for maker/taker and level 12 reduced to -0.015%/0.03%.

Security & Regulation

Staying safe in the crypto space is a crucial concern for all investors, many of whom are wary due to high-profile hacks and scams. For better or for worse, crypto is almost entirely unregulated and KuCoin is no exception.

There is no fund protection scheme to protect clients in case of company insolvency or hacks, nor is there any regulatory oversight on the platform’s activities.

However, the platform does feature login protection in the form of two-factor authentication (2FA), which customers can set up using a QR code in the account area. This measure uses Google Authenticator to issue one-time verification codes when logging in or making transactions.

Due to the need to complete know-your-customer (KYC) identity verification before investing with futures, customers in the UK may miss out on derivatives trading due to an FCA ban.

Customer Support

The KuCoin help centre has only one option to contact the 24/7 customer service team: submit a support ticket via the ZenDesk platform. It is odd for an online-only platform to be missing a live chat or phone number option, though a Telegram group does exist for the firm.

This said, there are shortcuts to reset trading passwords, 2FA codes and freeze an account, which eliminate the time required to contact support for these often time-sensitive tasks. In addition, Kucoin has an FAQ section well stocked with answers to common queries.

Educational Content

KuCoin has a regularly updated and well-populated blog in which lies all can learn about upcoming crypto events such as the progress of the Ethereum 2.0 project and new coin launches. The firm also operates a YouTube channel with videos targeted at beginner traders and new clients.

However, inexperienced investors should look elsewhere for a more comprehensive and structured crypto education.

Advantages Of KuCoin

- Integrated wallet

- Perpetual futures

- Social trading service

- Competitive exchange fees

- Over 1,500 total token pairs

- 2FA for enhanced login protection

- A host of services to suit every investor

- Free trading bot access and API support

- GBP deposit and OTC crypto purchase support

- Several high-earning staking and yield farming programs

- Negligible minimum deposit and withdrawal requirements

Disadvantages Of KuCoin

- No regulation

- Poor OTC exchange rates

- Little educational content

- Limited online support options

- Significant deposit and withdrawal fees

Promotions

Many emerging tokens use the Kucoin platform to offer promotions that encourage investors to trade or stake their coins for in-kind rewards. Additionally, the firm runs regular promos that bestow gifts upon KCS holders and stakers

A current sign-up joining bonus scheme allows traders to earn coupons worth up to 500 USDT for completing sign-up tasks like KYC verification and trading futures.

Trading Hours

As the crypto markets operate 24/7, it is essential to choose a platform that allows unrestricted access to round-the-clock trading. Happily, KuCoin runs continuously through its web-based platform and mobile app and is backed by 24/7 support.

KuCoin Verdict

This KuCoin review has found the firm to offer investors plenty of features, all under one unified roof. Traders can speculate on more than 1,500 assets in a wide variety of ways, including yield farming, futures speculation and buying NFTs. In addition, crypto newcomers can purchase tokens easily using the OTC service. However, this is at the cost of uncompetitive exchange rates. In addition, the lack of regulation and structured educational content may put some off the platform.

FAQ

Is It Safe To Trade With KuCoin?

KuCoin is a popular and trusted crypto exchange and platform, though the lack of regulation may deter more cautious investors.

Is KuCoin A DEX?

KuCoin is not a decentralised exchange (or DEX) and operates as a centralised exchange (or CEX).

Is KuCoin A Wallet?

KuCoin offers several services to customers, including a secure wallet.

Is KuCoin A Good Exchange?

With over 1,500 token pairs and spot, futures and leveraged tokens to trade, Kucoin will meet the needs of most crypto investors.

Does KuCoin Have A Withdrawal Limit?

KuCoin has a scaling 24-hour withdrawal limit depending on a trader’s VIP tier, with the maximum withdrawal amount starting at 200 BTC or equivalent and reaching up to 3,000 BTC at level 12.

Top 3 KuCoin Alternatives

These brokers are the most similar to KuCoin:

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

KuCoin Feature Comparison

| KuCoin | Swissquote | AvaTrade | IG Index | |

|---|---|---|---|---|

| Rating | 3.6 | 4 | 4.9 | 4.7 |

| Markets | Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities |

| Minimum Deposit | $0 | $1000 | $100 | $0 |

| Minimum Trade | 0.0001 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, DFSA, SFC, AFM | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | - | MT4, MT5 | MT4, MT5 | MT4 |

| Leverage | - | 1:30 | 1:30 (Retail) 1:400 (Pro) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | KuCoin Review |

Swissquote Review |

AvaTrade Review |

IG Index Review |

Trading Instruments Comparison

| KuCoin | Swissquote | AvaTrade | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | No | Yes | Yes |

KuCoin vs Other Brokers

Compare KuCoin with any other broker by selecting the other broker below.

Popular KuCoin comparisons: