AZAforex Review 2025

AZAforex has received attention in the online trading industry, offering flexible account types and powerful mobile and desktop platforms. In this review, we provide an in-depth analysis of the broker’s offerings, covering everything from markets and fees to account types and customer service. We also give our verdict on the broker for UK traders.

Our Take

- AZAforex offers a low deposit of $1, copy trading, binary options, and a demo account, which will appeal to new traders

- The raw spread VIP account and 1:1000 leverage rates are competitive features for experienced traders

- The lack of FCA regulation, poor customer service and limited trading resources are major drawbacks

- The broker offers limited GBP-friendly deposit methods, which is disappointing for British traders who may have to pay currency conversion fees

Market Access

AZAforex offers a decent range of over 130 assets covering key asset classes, as well as cryptocurrencies. We found that the selection of forex pairs, in particular, is competitive, but it would be nice to see some more stocks and indices to compete with the top brands, such as CMC Markets.

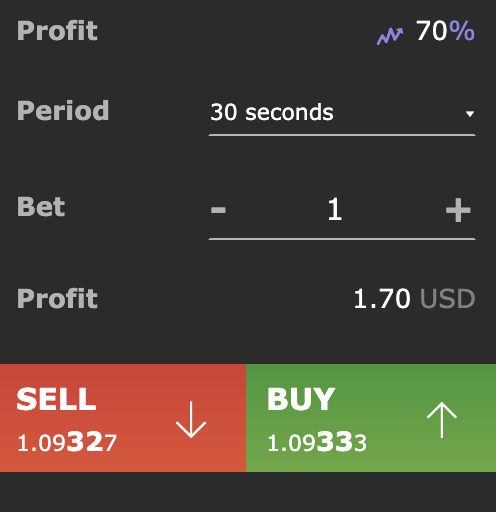

With that said, the broker stands out for its binary options, which allow traders to earn a fixed payout based on a prediction as to whether the price of an asset will rise or fall. These products are particularly popular with short-term traders.

Instruments include:

- Forex: 62 currency pairs on major, crosses and exotic, including EUR/GBP, EUR/AUD and GBP/USD

- CFD Stocks: 33 tradable stocks with CFDs including Apple, Amazon, Barclays and Uber

- Crypto: 10 tradable cryptocurrencies including ADA, BCH, BTXC and ETH

- Binary Options: Bet on 59 binaries with payouts of up to 90%

- Indices: 7 indices including the UK100 and USA500

- Commodities: Gold, oil and energies with EUR and USD

AZAforex Fees

AZAforex claims to offer competitive spreads from 0.1 pips for EUR/USD, however, these tight spreads are only accessible if you have $10,000 to deposit into the broker’s VIP account. Otherwise, retail traders will only access spreads from 1.1 pips for the same pair in the Start account. This is disappointing and doesn’t match up to accessible industry-leading brokers such as IC Markets or XM.

There is a middle ground in the broker’s Pro account, which does benefit from minimum spreads of 0.5 pips, though beginners may still be priced out by the $2,000 initial deposit.

Whilst commission-free trading is available at AZAforex, we did find ECN commissions from 0.003% in the Pro account.

One major downside is the deposit fees on bank transfers, credit/debit cards and some e-wallets, with charges between 5-6% plus a $0.50 transaction fee. AZAforex does claim to cover any fees for deposits over $100 (for e-wallets), $300 (for cards) or $1,000 (for bank transfer) in a single transaction.

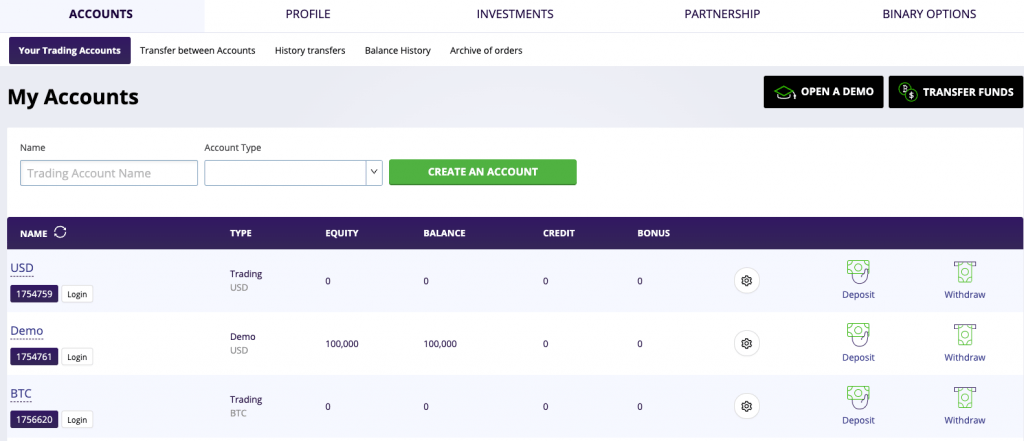

Accounts

AZAforex offers three account types: Start, Pro and VIP.

The Start account is by far the most accessible for novices, with just a $1 minimum deposit. We were impressed with the vast range of base currencies available in each account, including GBP and cryptos.

ECN execution with raw spreads is available in the upper accounts, though minimum deposits reach up to $10,000, which will be disappointing for many newer traders.

All accounts can access PAMM accounts, rebates and loyalty bonuses if you meet certain deposit criteria. Pro and VIP clients can also benefit from advanced analytics and personalised support.

We also rated that swap-free Islamic trading is available in all accounts.

Start

- Execution: Market

- Minimum Deposit: $1

- Currencies with fixed spreads: No

- Trading Platform: Mobius Trader 7 desktop, web, mobile

- Base Cryptocurrencies: BTC, BCH, ETH, DASH, LTC, XMR

- Base Currencies: GBP, USD, EUR, JPY, AUD, CAD, CHF, NZD, UAH, RUB, CNY, ILS, IDR, MYR, THB, VND

Pro

- Execution: Market, ECN

- Minimum Deposit: $2,000

- Currencies with fixed spreads: 13

- Trading Platform: Mobius Trader 7 Desktop, web, mobile

- Base Cryptocurrencies: BTC, BCH, ETH, DASH, LTC, XMR

- Base Currencies: GBP, USD, EUR, JPY, AUD, CAD, CHF, NZD, UAH, RUB, CNY, ILS, IDR, MYR, THB, VND

VIP

- Execution: Market, ECN

- Minimum Deposit: $10,000

- Currencies with fixed spreads: 13

- Trading Platform: Mobius Trader 7 desktop, web, mobile

- Base Cryptocurrencies: BTC, BCH, ETH, DASH, LTC, XMR

- Base Currencies: GBP, USD, EUR, JPY, AUD, CAD, CHF, NZD, UAH, RUB, CNY, ILS, IDR, MYR, THB, VND

How To Open An Account

I was impressed that opening an account with AZAforex took me less than 1 minute:

- Enter your name and contact details

- Choose a password and submit

- Check your emails for confirmation

- Click on the link to login to your ‘Personal Area’ in the confirmation email

- You can then open multiple accounts, deposit/withdraw funds and edit your account details from your dashboard

Payment Methods

Deposits

AZAforex offers multiple payment methods and live accounts can be opened with a minimum deposit of $1, which is highly accessible. However, UK traders will be disappointed that GBP deposits are only available via bank cards, meaning all other options may include foreign exchange fees.

When we used AZAforex, we found the following deposit methods available:

- Crypto, including Bitcoin, Ethereum and Litecoin

- Credit and debit cards including Visa and Mastercard

- E-wallets including Skrill, Neteller and Advcash

Whilst we are pleased to see that AZAforex doesn’t charge fees for crypto deposits, it is disappointing that there’s a 5-6% + $0.50 transaction fee for debit/credit cards and for e-wallets, Perfect Money and Capitalist. This is much higher than most brokers.

The brand aims to process all deposits within the same day, whilst crypto deposits can take 3 to 10 blockchain confirmations depending on the token.

How To Make A Deposit

Funding your AZAfores account is fairly straightforward:

- Login to your personal area and select ‘Deposit Funds’ at the top

- Select your payment method

- Enter the amount you wish to deposit and submit

Some payment methods with AZAforex require verification of the payment card that you are using. If verification is requested then you will be asked to upload proof of ID and address, plus a photo of your credit card. This is applicable for bank wire transfers.

Withdrawals

The same deposit methods are available to withdraw. We appreciate the low $10 minimum withdrawal amounts for bank cards, but we weren’t thrilled to find 3-5% + $10 transaction fees for Visa and Mastercard withdrawals. Again, this is higher than many leading UK brokers.

How To Make A Withdrawal

- Login to your personal area

- Go to the Withdrawals section and select your account number and payment method

- Choose how much you would like to withdraw and the appropriate currency

- Select ‘withdraw’ to process the request

UK Regulation

While AZAforex operates its central office in the UK, it is worth noting that the broker is registered and licensed offshore in the Marshall Islands by the Global Financial Services Authority (GLOFSA). Traders should be cautious of this, as the lack of robust licensing means that client funds may not be protected.

Top-tier agencies such as the UK’s Financial Conduct Authority (FCA), for example, offer measures such as negative balance protection and leverage restrictions to protect traders.

They can also offer compensation schemes, which means that if a broker fails, clients are far less likely to lose all their capital.

Trading Platforms

Mobius Trader 7

AZAforex only offers its proprietary Mobius Trader 7 platform to all clients. Our team were initially sceptical about the single platform offering, though we were impressed with its functionality.

Mobius Trader 7

Mobius 7 is a multi-asset terminal aimed at beginners and experienced traders, offering a suite of technical analysis tools, analytics, education, research, and a community.

We liked the sleek, modern design and user-friendly interface, easily rivalling leading platforms like MetaTrader 4.

Our favourite features include:

- A good range of pre-included technical indicators, including Stochastic Oscillator and Bollinger Bands

- Easily switch to the Options trading interface for quick bet placements

- MCode editor included for writing your own indicators or algorithms

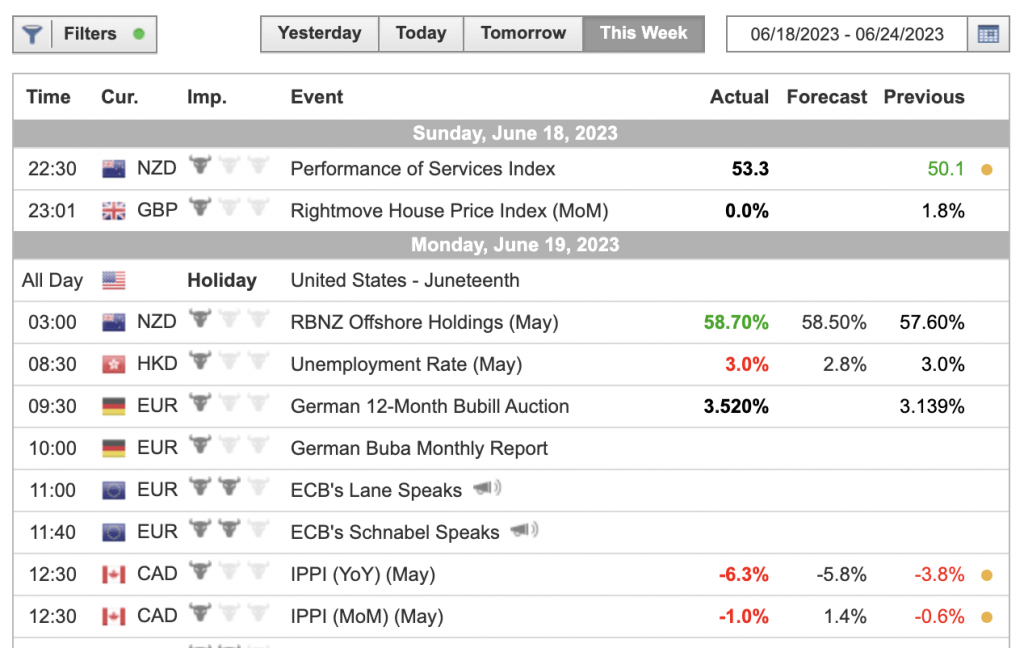

- An economic calendar which can be overlaid directly on the charts

- 9 time frames, from 1 minute to 1 month, plus tick charts

- Integrated copy trading functionality with leaderboards

- Additional indicators available for free in the mStore

- Customisable charts with multiple layouts

Mobius 7 Binary Options Order Window

The broker provides a comprehensive overview of the platform and how it works which we found to be very useful. This includes tutorials on how to operate charts, opening an order, customisation and more.

Mobile App

We were pleased to see that the Mobius 7 trading platform is also available via a mobile app, alongside its desktop counterpart.

The Mobius 7 app is available on both iOS and Android devices and offers many of the same tools founds in the desktop version. We found a full range of orders and time periods, full trading history, 3 types of charts, real-time market data and a newsfeed.

I found the app easy to use and navigate, though not as intuitive as some other proprietary apps.

Leverage

AZAforex offers leverage of up to 1:1000 which is very high considering that the UK’s FCA does not permit brokers to offer leverage above 1:30.

With 1:1000 leverage, a small market move could wipe out your investment. Risks of leverage include losing more than you invested, being forced to close your position, and making emotional decisions.

AZAforex Demo Account

AZAforex offers a demo account so that traders can practice trading without risking any real money. This is a great way to learn about the forex market and develop your strategies before implementing them in live conditions.

If you are thinking about trading forex, I recommend using a demo account first. It is a great way to learn and improve your skills before you start trading with real money.

Bonus Deals

At the time of writing, AZAforex offers a few deposit and loyalty bonuses, though we do advise caution when exploring these.

Deals include a 25% bonus for each deposit in cryptocurrency and a 120% loyalty payout. There is also a rebate programme offering 30% rebates for closed orders of $50 for every $1 million traded each month, as well as passive profit rewards for investing $2,000 or more.

However, we recommend reading the bonus terms and conditions thoroughly before signing up, as we noted several challenging bonus terms.

Extra Tools & Features

Blog

AZAforex offers a range of free trading resources such as a blog with basic insights into how to trade more effectively, though I was disappointed to find that it is not updated regularly.

Overall, the section feels neglected, lacks comprehensive insights and does not match up to leading brands like IG Index.

Trading Analysis

I was also initially pleased to see a trading analysis section containing technical chart insights and forecasts for popular instruments such as Bitcoin and USD/JPY. Frustratingly though, the section is also not updated regularly, despite claiming to be offered ‘daily’.

Economic Calendar

The broker does offer a decent economic calendar. These help forex traders track upcoming economic events and make informed decisions. Key events include interest rate announcements, GDP data releases, and unemployment rate figures.

It is worth exploring this feature if you are trading with AZAforex.

PAMM Accounts

We also found PAMM accounts at AZAforex, which allow you to invest in other experienced traders and earn a passive profit. Alternatively, traders can also become managers and get a cut of the profits earned for investors.

You can find a list of money managers on the broker’s website, including their equity, investments, profit, profitability and commission.

Customer Service

The AZAforex customer support is available 12/5 which, in our opinion, is not accessible enough since the forex market is open for 24 hours per day.

We recommend trading with a broker that offers 24/5 customer service as a minimum, to coincide with the opening times of popular markets.

With that said, AZAforex does have a decent selection of support methods. You can contact the broker from 8:00 am – 8:00 pm UTC via:

- Email: support@AZAForex.com

- Telephone: +447723399001

- Whatsapp: +447723399001

- Telegram: @AZAForex

- Skype: AZAForex.com

AZAforex Company Details

Founded in 2016, AZAforex is an online trading platform that provides access to various financial markets, including forex, commodities, indices, CFD stocks, binary options, and cryptocurrencies.

With over 122,000 clients, the company aims to offer a comprehensive trading experience with competitive fees and a user-friendly, proprietary trading platform.

The broker is registered offshore in the Marshall Islands but has a central office in London. Unfortunately, there is limited information about company background, accreditations or awards on the broker’s website, which is a red flag.

Security

AZAforex offers very limited security measures, which we found concerning.

We did discover that they hold client funds in segregated accounts, however, this only occurs in countries where they are legally obligated to. Whilst this does apply in the UK, we would urge potential clients to be cautious.

Paired with the lack of regulation, we have given the broker a low score for security and safety.

Trading Hours

Forex and CFD trading hours are from 10:05 pm to 9:50 pm GMT, Monday to Friday. Crypto trading hours are 24/7, all year round.

Certain instruments may vary and you can check individual trading hours on the broker’s platform.

Should You Trade With AZAforex?

AZAforex presents a compelling option for traders seeking diverse market opportunities and unrestricted trading. With the proprietary trading terminal, copy trading features and PAMM accounts, the broker has potential.

However, traders should be aware of the broker’s lack of regulatory oversight, poor security features, and sub-par customer service availability. Beginners may want to consider more accessible and regulated alternatives.

FAQ

Can I Trust AZAforex?

AZAforex is registered and licensed offshore in the Marshall Islands by the Global Financial Services Authority (GLOFSA), which is not considered a reputable agency. Brokers operating in these jurisdictions come under very loose supervision, with limited fund protection measures in place.

It is is advisable to exercise caution and conduct thorough research when trading with brokers who are not authorised by top regulatory bodies such as the FCA.

Is AZAforex Good For Beginners?

AZAforex could be a good choice for beginners, with a low minimum deposit of $1. This can be advantageous for traders who want to start with a small investment, although there is also a free demo account to test out the platform first.

With that said, the lack of regulatory oversight is a major drawback for beginners, who will not benefit from negative balance protection or compensation schemes.

Is AZAforex Good For UK Traders?

AZAforex offers high leverage, binary options trading, plus crypto CFDs and deposits, which may be attractive to UK traders. However, funding methods are limited for UK traders who require GBP deposits. British traders will also be disappointed that the broker isn’t authorised by the FCA.

Does AZAforex Offer A Good Trading Platform?

AZAforex utilises the proprietary Mobius Trader 7 platform, which offers some competitive features, including a modest suite of technical analysis tools, customisable charts, an economic calendar, and copy trading functionality. Whilst the platform is not as comprehensive as market leaders like MT4, Mobius Trader 7 could be suitable for those looking for a user-friendly interface and social trading.

What Is The Best Way To Contact AZAforex?

AZAforex provides limited 12/5 customer support via phone, WhatsApp, Telegram, Skype, and email. For active traders, we recommended calling the broker during their office hours if you need quick support (8:00 am to 8:00 pm UTC).

However, it may be worth considering a broker that offers 24/5 customer service to align with the round-the-clock nature of the forex market.

Article Sources

Top 3 AZAforex Alternatives

These brokers are the most similar to AZAforex:

- World Forex - World Forex is an offshore broker based in St Vincent and the Grenadines. It provides commission-free trading with a minimum deposit of $1 and leverage up to 1:1000. Digital contracts are available, offering an easy method for novices to speculate on popular financial markets.

- Grand Capital - Grand Capital is a MetaTrader broker offering welcome bonuses, trading competitions, and an easy-to-use copy trading service. With multiple account options and over 400 assets, it caters to different investors and strategies. New users can set up an account and begin trading quickly.

- Capitalcore - Capitalcore, an offshore broker based in Saint Vincent and the Grenadines, was established in 2019. It offers traders a choice of four accounts—Classic, Silver, Gold, and VIP. As you progress through these tiers, spreads decrease and bonuses increase. The broker stands out for offering high leverage of up to 1:2000 and zero swap fees. However, these benefits are tempered by minimal regulation from the IFSA and limited educational and research resources.

AZAforex Feature Comparison

| AZAforex | World Forex | Grand Capital | Capitalcore | |

|---|---|---|---|---|

| Rating | 3.4 | 4 | 3.9 | 3.9 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Minimum Deposit | $1 | $1 | $10 | $10 |

| Minimum Trade | 0.0001 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | GLOFSA | SVGFSA | FinaCom | IFSA |

| Bonus | - | - | - | - |

| Education | No | No | No | No |

| Platforms | - | MT4, MT5 | MT4, MT5 | - |

| Leverage | 1:1000 | 1:1000 | 1:500 | 1:2000 |

| Visit | ||||

| Review | AZAforex Review |

World Forex Review |

Grand Capital Review |

Capitalcore Review |

Trading Instruments Comparison

| AZAforex | World Forex | Grand Capital | Capitalcore | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | No | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

AZAforex vs Other Brokers

Compare AZAforex with any other broker by selecting the other broker below.

Popular AZAforex comparisons:

|

|

AZAforex is #8 in our rankings of binary options brokers. |

| Top 3 alternatives to AZAforex |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Demo Account | Yes |

| Minimum Deposit | $1 |

| Minimum Trade | 0.0001 Lots |

| Regulated By | GLOFSA |

| Leverage | 1:1000 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ADVcash, Credit Cards, Debit Card, Maestro, Mastercard, Neteller, Perfect Money, Skrill, Visa, Wire Transfer |

| Copy Trading | No |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Copper, Cotton, Gold, Natural Gas, Oil, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | Variable |

| CFD GBPUSD Spread | Variable |

| CFD Oil Spread | Variable |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Assets | 50+ |

| Crypto Coins | BCH, BTC, DASH, ETH, LTC |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Expiry Times | 30 seconds - 1 day |

| Payout Percent | 90 |

| Ladder Options | No |

| Boundary Options | No |