Capitalcore Review 2025

Founded in 2019 and registered in Saint Vincent and the Grenadines, Capitalcore is a broker offering CFD trading on forex, metals, stocks, indices, and crypto. In 2025, the broker added binary options trading.

This Capitalcore review, conducted by British traders and industry experts, examines its features, reliability, and overall trading experience to determine whether it’s a worthwhile choice for UK traders.

Our Take

- Capitalcore lets you start with as little as $10 or a demo account, making it accessible to test the platform before committing significant funds.

- The broker offers very high leverage up to 1:2000. This may appeal to experienced traders seeking aggressive trading strategies, but also significantly increases risk.

- Capitalcore does not hold an FCA license, so Brits may not get key investor protections like segregated client accounts, negative balance protection, or compensation through FSCS.

- All deposits are converted to USD, meaning you may face currency conversion fees when using GBP to fund your trading account.

- Trading on Capitalcore’s WebTrader platform feels smooth and intuitive, with TradingView-powered charts making analysis effortless – but the lack of MetaTrader support may be a dealbreaker for advanced traders.

- Capitalcore does not offer real-time news feeds or third-party research tools, making it harder to make informed decisions, especially compared to category leaders such as IG.

- I always find Capitalcore’s 24/7 live chat responsive and helpful, but the lack of active social media support is a missed opportunity for engagement.

Is Capitalcore Regulated In The UK?

Capitalcore is not regulated by the Financial Conduct Authority (FCA) in the UK.

The FCA provides robust investor protection and oversight, including features such as segregated client accounts and participation in the Financial Services Compensation Scheme (FSCS), ensuring deposits of up to £85,000 are safeguarded in the event of the broker’s insolvency.

Capitalcore does not have these protections in place, making it a risky choice for UK investors.

Instead, Capitalcore is registered offshore in Saint Vincent and the Grenadines and claims authorization by the International Financial Services Authentication (IFSA). However, we’ve looked into the IFSA and it isn’t a proper regulator – it’s a marketing label, while Saint Vincent and the Grenadines have said they don’t license providers of forex, CFDs and binaries.

Accounts

Live Accounts

Capitalcore provides four account types, allowing trading in currency pairs, stocks, metals, and indices. These accounts support scalping and hedging, catering to different trading strategies.

The Classic account, with a minimum deposit of around £8, may seem attractive to new investors.

However, you should be cautious of the high leverage offered (up to 1:2000), which can lead to substantial losses. This is why FCA-regulated brokers cap leverage at 1:30 to protect consumers.

While the Silver, Gold, and VIP accounts offer additional features like tighter spreads and free VPS, higher minimum deposits (ranging from about £800 to £8,000) creates higher risk.

Demo Account

Unlike many brokers we’ve tested, Capitalcore offers unlimited-duration demo accounts. These are ideal for experimenting with various instruments and leverage settings before committing to real funds.

However, it’s worth remembering that numerous FCA-regulated brokers offer demo accounts with similar features to Capitalcore if you are seeking to practice trading strategies without risking real capital.

For instance, eToro provides a demo account with £100,000 in virtual funds and no time limit, allowing you to test strategies across various asset classes.

Similarly, IG, popular for spread betting in the UK, offers a £10,000 demo account that closely mirrors its live trading environment.

Funding Options

Deposits

Funding methods are very restrictive for UK traders and include only PayPal and crypto (Bitcoin, Ethereum, Dogecoin, Tether, Tron). Over 90% of brokers we’ve tested offer more popular options like bank wire transfers, debit card, and credit card.

Deposit minimums also vary based on the payment method, ranging from $1 to $50.

One notable downside for British traders is the lack of a GBP trading account. Instead, all funds are converted to USD, potentially resulting in conversion fees for deposits and withdrawals.

As a comparison, IC Markets, lets you choose from 10 base currencies, including GBP.

Like some other offshore brokers, Capitalcore offers a 40% deposit bonus, but you should be cautious and consider trading conditions rather than promotional incentives.

Withdrawals

Withdrawal options are the same as the deposit options, but fees and minimum amounts depend on the method used.

For example, PayPal’s minimum withdrawal amount is $1, and fees range from 0% to 5%.

The minimum withdrawal amount for crypto is $20, with fees including the network fee plus an additional 0% to 5% on certain transactions.

From my personal experience using Capitalcore, withdrawals typically take up to 48 hours.

Market Access

Capitalcore offers a limited selection of trading assets. This covers major forex pairs like GBP/USD, precious metals like gold, key stock indices like FTSE 100, US equities, and a handful of cryptocurrency CFDs like Bitcoin.

Disappointingly, it does not provide real UK stocks or ETFs for long-term investing.

Brokers like CMC Markets and eToro offer a much wider range of global markets, including stocks, ETFs, and bonds. eToro also facilitates the purchase of ‘real’ cryptocurrencies.

Crypto trading on Capitalcore is only available through CFDs and binary options, allowing you to speculate on price movements without owning the asset.

In 2025, Capitalcore expanded its offerings by introducing binary trading. Contracts range from 1 minute to 1 hour, and stakes range between $1 and $10,000. While this appeals to short-term traders, binary options trading is highly speculative and carries significant risk.

Additionally, Capitalcore lacks a proprietary copy trading service, which may be a drawback for beginners. Unlike eToro, which offers a leading social trading platform and interest on uninvested cash, Capitalcore does not provide interest on idle funds.

While Capitalcore offers high-risk trading opportunities, those seeking a safer, FCA-regulated broker with better asset variety and investor protections may prefer alternatives like Plus500 and CMC Markets.

Leverage

Capitalcore offers leverage of up to 1:2000, significantly higher than most regulated brokers allow.

For UK retail traders, FCA regulations cap leverage at 1:30 for significant forex pairs and 1:20 for minors and exotics.

Since Capitalcore is not FCA-regulated, it can offer far higher leverage, but this comes with substantial risks.

Higher leverage magnifies potential gains and losses, meaning you can quickly wipe out your capital if the market moves against you.

While Capitalcore’s high leverage may appeal to aggressive traders, you should be cautious as you will be trading without FCA protections and risk excessive losses.

FCA-regulated brokers like IG and FOREX.com offer safer, FCA-compliant trading conditions, especially for beginners.

Pricing

Capitalcore structures its spreads based on account type with average pricing based on our analysis.

Classic and Silver accounts start with 2.5 pips on GBP/USD, for example, while Gold accounts see tighter spreads at 1.0 pips, and VIP accounts go as low as 0.5 pips.

Higher-tier accounts mean lower trading costs, which is ideal for scalpers.

The broker charges zero commissions, but its spreads remain wider than competitors like IC Markets, which is a consideration for active traders.

A rare perk is no swap fees, allowing you to hold positions indefinitely without extra costs.

Deposits are mostly free, but PayPal and crypto withdrawals incur fees. Funds must also be withdrawn using the same method and currency as the deposit.

Unlike XTB and other brokers we’ve tested, Capitalcore doesn’t charge inactivity fees, making it a more flexible option for occasional trading.

Trading Platform

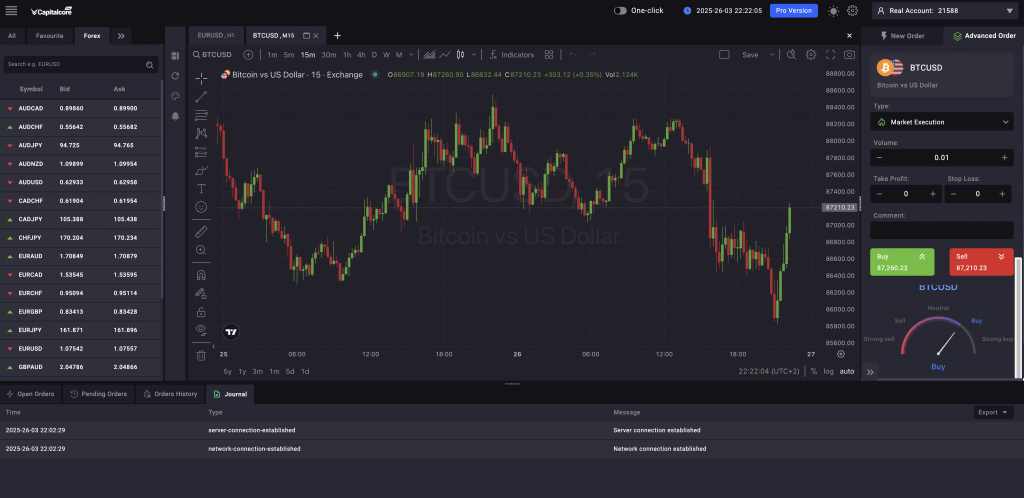

Capitalcore offers two proprietary trading platforms powered by TradingView: WebTrader and Pro Platform.

I’ve used both and they are clearly designed to cater to different trader preferences while maintaining user-friendliness and ease of use, making them suitable for beginners and more advanced traders.

The WebTrader platform provides a sleek and uncluttered interface that facilitates effortless trading on desktop and mobile devices.

It features an impressive library of over 100 technical indicators and drawing tools, 16 chart types (including bars, candles, Heikin Ashi and Renko), and timeframes ranging from 1 minute to 1 month.

To trade binary options, a separate platform lets you place ‘Put’ and ‘Call’ trades with a single click. Testing shows you can trade binaries on forex, metals and digital currencies with returns up to 95%, You can configure your binary trade parameters in under one minute using the right-hand panel.

The Pro Platform removes the WebTrader interface, providing a more ‘vanilla’ TradingView environment. While it doesn’t offer additional tools compared to WebTrader, it caters to traders who prefer a simpler, more straightforward interface without the Capitalcore add-ons.

While these platforms are user-friendly and feature-rich, experienced traders like myself might find them lacking advanced features compared to popular third-party solutions like MetaTrader 5 or cTrader.

The absence of these widely used platforms might be a drawback for some traders accustomed to advanced charting and automation tools.

Extra Tools

Capitalcore focuses purely on order execution, meaning it lacks advanced research tools from brokers like IG, which offer comprehensive market insights.

You won’t find real-time news feeds, detailed economic calendars, or third-party research from providers like Autochartist.

This absence of integrated tools may make tracking market trends and informing trading decisions harder.

However, Capitalcore does provide an updated ‘Market News’ blog with technical and market analysis.

For beginners, there’s a small library of essential forex guides covering topics like ‘What is Forex Trading?’ and ‘Coins vs. Tokens,’ along with a glossary and FAQs.

While useful for newcomers, these resources are still limited compared to brokers like CMC Markets and eToro, which offer in-depth webinars, tutorials, and expert market analysis.

Customer Service

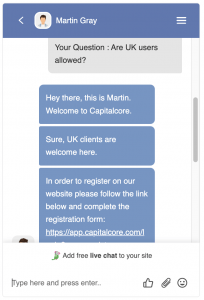

Capitalcore offers 24/7 customer support via live chat, email, a ticket system, and phone (not localised), assisting from registration to withdrawals.

During platform testing, I found live chat responses to be fast and knowledgeable. When an agent couldn’t provide an immediate answer, I received a follow-up email later.

Accessing live chat and support tickets directly from the client dashboard is convenient, though adding phone contact details there would improve accessibility.

One downside is that all social media links on the website are non-functioning, which Capitalcore should fix to maintain a professional image.

Bottom Line

Whether you should trade with Capitalcore depends on your priorities and risk tolerance.

On the positive side, Capitalcore offers a variety of CFDs. It provides high leverage up to 1:2000 and a low $10 minimum deposit for entry-level accounts.

However, there are significant drawbacks for UK traders. Capitalcore is not regulated by the FCA, meaning it lacks key investor protections like segregated accounts and FSCS compensation.

Additionally, the lack of GBP accounts may be a downside for Brits seeking hassle-free account and transaction management.

FAQ

Can You Invest In GBP With Capitalcore?

Capitalcore primarily facilitates trading in USD. All deposits are converted to USD for trading purposes, regardless of the original currency.

However, the broker doesn’t offer a choice of base account currencies, unlike some other brokers, such as IC Markets, which allows accounts in multiple currencies, including GBP.

Is Capitalcore Safe For UK Traders?

Capitalcore is less safe for UK traders. Its lack of regulation by the UK’s FCA or any other significant financial authority exposes you to significant risks.

Also, UK investors using Capitalcore cannot access crucial safeguards like the FSCS or the Financial Ombudsman Service.

Does Capitalcore Offer A Mobile Trading App?

The Capitalcore platform supports mobile trading across various devices, allowing you to trade anytime and anywhere.

The web-based mobile app is part of Capitalcore’s multi-platform strategy, ensuring you can access markets on different operating systems and devices.

On the downside, I quickly discovered it’s not a dedicated app optimised for small screens.

Can You Invest In Cryptocurrency With Capitalcore In The UK?

Due to FCA regulations, UK retail traders are banned from trading crypto CFDs. However, Capitalcore’s lack of regulation means UK traders can speculate on crypto price movements without owning the underlying assets through binaries and CFDs.

FCA-regulated eToro, by comparison, facilitates the buying and selling of ‘real’ digital currencies, including Bitcoin, Ethereum, and Solana.

Article Sources

Top 3 Capitalcore Alternatives

These brokers are the most similar to Capitalcore:

- AZAforex - Founded in 2016, AZAforex operates as an offshore broker enabling trading across more than 235 international financial markets. Traders can engage through binary options, with potential payouts reaching 90%. The broker offers three distinct accounts—Start, Pro, and VIP—each with exclusive features. All account types grant access to the Mobius Trader 7 platform, which has received performance enhancements over time.

- World Forex - World Forex is an offshore broker based in St Vincent and the Grenadines. It provides commission-free trading with a minimum deposit of $1 and leverage up to 1:1000. Digital contracts are available, offering an easy method for novices to speculate on popular financial markets.

- Videforex - Introduced in 2017, Videforex provides trading opportunities across stocks, indices, cryptocurrencies, forex, and commodities through binary options and CFDs. The platform, alongside its mobile app and copy trading features, is intuitive and caters to novice and occasional traders. Additionally, its market analysis tools and trading contests offer valuable avenues for honing trading skills.

Capitalcore Feature Comparison

| Capitalcore | AZAforex | World Forex | Videforex | |

|---|---|---|---|---|

| Rating | 3.9 | 3.4 | 4 | 3.5 |

| Markets | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Minimum Deposit | $10 | $1 | $1 | $250 |

| Minimum Trade | 0.01 Lots (CFD/Forex), $1 (Binaries) | 0.0001 Lots | 0.01 Lots | $0.01 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | GLOFSA | SVGFSA | - |

| Bonus | - | - | - | 20% to 200% Deposit Bonus |

| Education | No | No | No | No |

| Platforms | - | - | MT4, MT5 | - |

| Leverage | 1:2000 | 1:1000 | 1:1000 | 1:500 |

| Visit | ||||

| Review | Capitalcore Review |

AZAforex Review |

World Forex Review |

Videforex Review |

Trading Instruments Comparison

| Capitalcore | AZAforex | World Forex | Videforex | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | Yes | No | No | No |

| Options | No | No | No | No |

| ETFs | No | No | No | No |

| Bonds | No | No | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Capitalcore vs Other Brokers

Compare Capitalcore with any other broker by selecting the other broker below.

|

|

Capitalcore is #3 in our rankings of binary options brokers. |

| Top 3 alternatives to Capitalcore |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Demo Account | Yes |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots (CFD/Forex), $1 (Binaries) |

| Leverage | 1:2000 |

| Mobile Apps | Android, Webtrader |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | PayPal, Perfect Money |

| Copy Trading | No |

| Islamic Account | No |

| Commodities | Gold, Palladium, Platinum, Silver |

| CFD FTSE Spread | 25 |

| CFD GBPUSD Spread | 0.5 |

| CFD Oil Spread | NA |

| CFD Stocks Spread | 1.5 (Apple) |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.5 |

| Assets | 35+ |

| Crypto Coins | BCH, BTC, ETH, LTC, XRP |

| Crypto Spreads | $45 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Expiry Times | 1 minute - 1 hour |

| Payout Percent | 95% |

| Ladder Options | No |

| Boundary Options | No |