CapitalXtend Review 2024

|

|

CapitalXtend is #97 in our rankings of CFD brokers. |

| CapitalXtend Facts & Figures |

|---|

CapitalXTend is an offshore brokerage offering CFD trading on 300+ instruments with leverage up to 1:1000 via the MetaTrader 4 and MetaTrader 5 platforms. Both commission-free and raw spread account types are available with ECN pricing that will suit active trading styles. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Metals, Energies, Shares, Indices, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | Financial Commission |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on 300+ forex pairs, stocks, indices, commodities and cryptos with dynamic leverage ranging from 1:25 for 100+ lots to 1:1000 for 1–5 lots. High-volume traders may prefer access to more leverage on their trades, but we think this model provides more than enough leverage for most retail traders. |

| Leverage | 1:1000 |

| FTSE Spread | From 3 (Standard Account) |

| GBPUSD Spread | From 3 (Standard Account) |

| Oil Spread | From 3 (Standard Account) |

| Stocks Spread | From 3 (Standard Account) |

| Forex | Trade 10 major, 26 minor and 67 exotic pairs. This excellent range of forex pairs is a big advantage for dedicated forex traders, who will also benefit from deep liquidity, ECN spreads from 0.2 and the powerful and flexible MT4 and MT5 platforms. |

| GBPUSD Spread | From 3 (Standard Account) |

| EURUSD Spread | From 3 (Standard Account) |

| GBPEUR Spread | From 3 (Standard Account) |

| Assets | 100+ |

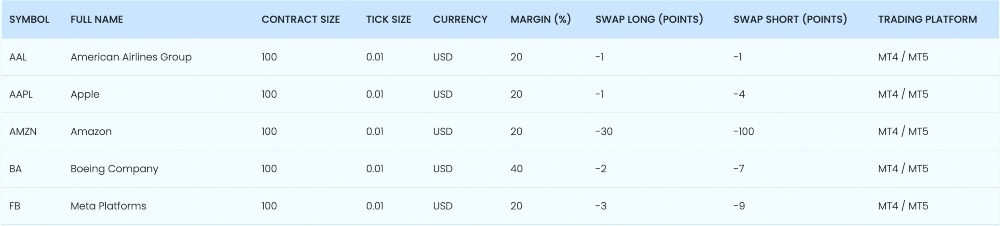

| Stocks | Trade CFDs on 87 global company shares, including Amazon, Meta and Coca-Cola, or speculate on broad market movements with 13 index CFDs covering the US, UK, Europe and Asia-Pacific. On the negative side, the breadth of stocks is fairly average and direct share dealing is not available. |

| Cryptocurrency | Trade leading cryptos against the USD and EUR. However the choice of digital currencies does not match rivals and there is limited research and analysis from in-house experts. |

| Coins |

|

| Spreads | 0.5% Commission |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

CapitalXtend is an offshore broker that provides access to the global financial markets. Founded in 2005, the brokerage is popular thanks to its support for the reliable MT4 and MT5 platforms, competitive spreads, and comprehensive suite of tools for trading CFDs, forex, stocks, commodities, and cryptocurrencies. In this review, we take a closer look at CapitalXtend, its key features, plus the pros and cons for UK traders.

Our Verdict

We gave CapitalXtend a low trust score given its weak regulatory oversight, with no authorisation from the UK Financial Conduct Authority (FCA). And while the firm offers a low minimum deposit and copy trading for beginners, fees on the Standard account are too high compared to leading brokers.

Market Access

Our team found that CapitalXtend offers some good options to forex and crypto traders, with a wide selection from both asset classes. However, the other assets do not stand up so well, and with just 80 company stocks to trade, CapitalXtend falls behind alternatives like eToro and CMC Markets.

Popular instruments include:

- Indices: 13 indices including US 500, US 30, UK 100 and France 40

- Crypto: A range of cryptocurrency pairs including Bitcoin vs USD, Ethereum vs Euro and Litecoin vs Gold

- Stocks: Shares are available for over 80 US and European stocks including Apple, Coca-cola, Volkswagen, Shell and Nestle

- Forex: Over 100 to choose from including majors, crosses and exotics

- Commodities: 13 different spot metal pairs including silver, gold, platinum and copper which are offered against AUD, CHF, EUR, and USD. Crude oil and natural gas can also be traded against USD

Spreads & Fees

The fees associated with CapitalXtend vary according to the account type, but are only competitive with the premium tiers.

Unfortunately, we found that spreads on the Standard account are relatively high starting from 3 pips. The ECN account is more competitive with spreads from 1.6 pips while the Pro-ECN solution offers tighter spreads from 0.2 pips plus a $3 commission. The Platinum account offers the lowest fees with spreads from 0.2 pips, however with a $25,000 deposit requirement, it will phase out most retail traders.

Ultimately the Pro-ECN account probably offers the best balance between low fees and an accessible starting deposit with a $500 minimum investment.

Note that swap fees will apply for CFD positions held overnight.

Accounts

CapitalXtend offers four different account types which we feel cater well to a range of traders. However, our primary issue is that the Standard account that many beginners will start with isn’t particularly competitive. Also, only MetaTrader 4 is available on the Standard profile.

We have broken down the key features of each account:

Standard

- Platform: MT4

- Minimum Deposit: $100

- Commission: None

- Order execution: Market

- Stop out: 20%

- Spread: From 3

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAU/USD and 3 decimals for XAG/USD

- Leverage: Up to 1:1000

ECN

- Platform: MT4 & MT5

- Minimum Deposit: $200

- Commission: None

- Order execution: Market

- Stop out: 50%

- Spread: From 1.6

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAU/USD and 3 decimals for XAG/USD

- Leverage: Up to 1:1000

Pro-ECN

- Platform: MT4 & MT5

- Minimum Deposit: $500

- Commission: $3 fixed per side

- Order execution: Market

- Stop out: 50%

- Spread: From 0.2

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAU/USD and 3 decimals for XAG/USD

- Leverage: Up to 1:1000

Platinum

- Platform: MT4

- Minimum Deposit: $25,000

- Commission: None

- Order execution: Market

- Stop out: 50%

- Spread: From 0.2

- Pricing: 5 decimals for FX (3 on JPY pairs), Spot Metals: 2 decimals for XAU/USD and 3 decimals for XAG/USD

- Leverage: Up to 1:500

Payment Methods

Our experts were disappointed to see that deposits at CapitalXtend can only be made in USD, which is a drawback for UK traders. However, we were pleased to see a good range of funding methods, including bank transfer, crypto and e-wallets. Deposits are also usually processed within 24 hours.

Again, withdrawals can only be made in USD and the fees and processing times depend on the method you use. For example, Mastercard withdrawals come with no fee and take under 24 hours, while Paylivre has a commission of 1.8%. It is also worth noting that bank transfers take the longest at up to 72 hours.

Trading Platforms

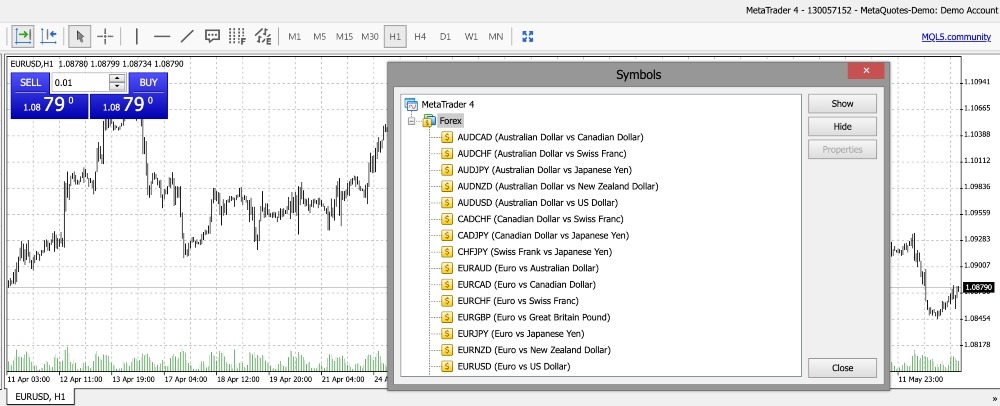

CapitalXtend offers both MetaTrader 4 and MetaTrader 5, which our team consider industry-leading, particularly when it comes to automated trading. We do feel, though, that some newer traders might prefer a more streamlined and user-friendly platform similar to the proprietary platforms offered by rivals like eToro.

- MetaTrader 4 (MT4): This is a popular platform used by traders around the world. MT4 provides traders with access to real-time pricing, advanced charting tools, technical indicators, and automated trading capabilities through the use of expert advisors (EAs). MT4 is the best pick for newer traders.

- MetaTrader 5 (MT5): This is the newer version of the MetaTrader suite and offers enhanced features compared to MT4. MT5 provides traders with advanced charting tools, more technical indicators, and a multi-asset trading platform that supports forex, CFDs, stocks, and futures. MT5 is the best pick for experienced traders.

MetaTrader 4

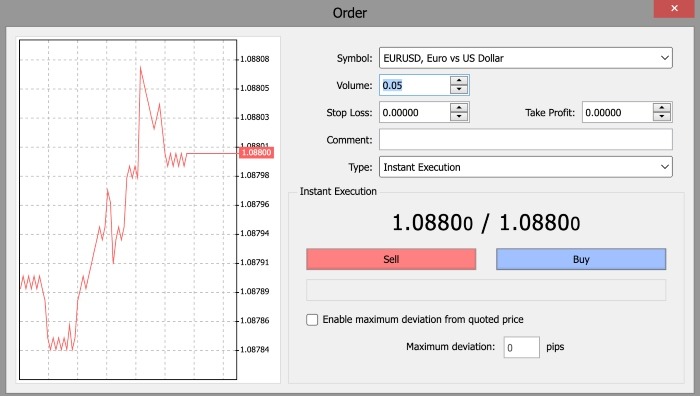

How To Place A Trade

I found it easy to open an order on the MetaTrader platform:

- Log in to your CapitalXtend trading account using your login credentials

- Choose the financial instrument you want to trade, such as a currency pair, commodity, or stock. You can do this by navigating to the trading platform’s ‘Market Watch’ section or by searching for the instrument using the platform’s search function

- Open the order ticket by either double-clicking on the selected instrument or right-clicking and selecting ‘New Order’ from the context menu

- On the order ticket, specify the order type (e.g., market or pending), trade size, stop loss, take profit, and any other relevant details.

- Click the ‘Buy’ or ‘Sell’ button to place the trade. If your trade is successful, it will appear in the ‘Trade’ tab of the platform

CapitalXtend App

We are sure that traders who need to access their terminals on the move will be satisfied with the MT4 and MT5 mobile apps, which consistently rank highly due to their charting capabilities and easy-to-use interface.

Importantly, both solutions are stable and perform well on Apple and Android devices. They can be downloaded for free from the relevant app store.

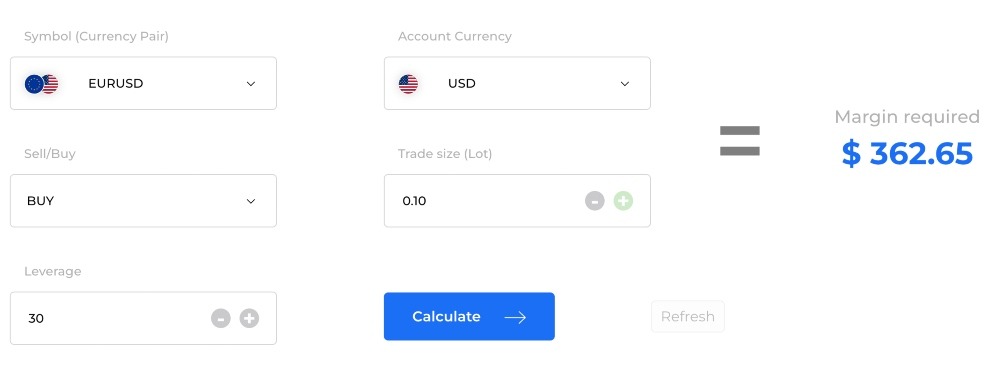

Leverage

As an offshore broker, CapitalXtend does not adhere to the FCA’s rules stating that UK brokers cannot offer more than 1:30 leverage. As a result, the broker offers leverage up to 1:1000, depending on the account type and the asset being traded.

While this is a significant amount of leverage that can greatly boost profits, bear in mind that it will also magnify losses. Inexperienced traders should think carefully before making trades with such high leverage, and we always advise traders to practice risk management.

Demo Account

We were pleased to see CapitalXtend offer traders access to all of their account types as demo solutions. This makes it possible to get a full sense of the broker’s products without risking any capital. We also found that it is a good way to find a trading account that best meets your needs.

UK Regulation

Our experts were not impressed with CapitalXtend’s regulatory status, with no authorisation from the UK’s Financial Conduct Authority (FCA). This ultimately makes the broker less secure for British traders, who will not get the same access to compensation schemes and recourse channels should the firm behave unfairly.

The brand is a Kazakh-founded broker with registration in its home country as well as St Vincent and the Grenadines LLC and a certificate from the Financial Commission. However, these are not particularly well-regarded financial authorities so I wouldn’t be sold on these registrations.

Bonuses

When we used CapitalXtend, we found a 30% deposit bonus where traders can get up to $300 on their initial deposit. To claim it, traders must open an account, opt-in for the bonus in the ‘promotions’ tab in MyCapital, and fund their account with at least $100. However, we were disappointed to find that the bonus cannot be withdrawn during or after the promotion.

There is also a cashback reward where traders can earn up to $3 in cashback per lot. Through this, traders can receive up to $5000 in withdrawable cashback. Essentially, the more you trade, the more cashback you will earn. But again, we urge traders to treat these bonuses with care, as a high volume of trades is needed to receive anything substantial.

Extra Tools & Features

Social Trading

We were happy to see CapitalXtend offers copy trading, which allows users to mirror the strategy of experienced traders, allowing for portfolio diversification as well as providing a learning feature for newer traders.

I like that I can easily select the trader I want to copy from the leaderboard and follow their strategy. From there, I can set the amount I want to invest in and subscribe to a Master Account which automatically copies the trader’s activity. I also appreciate the option to copy simultaneously from several masters and the ease at which I can subscribe and unsubscribe from each one.

PAMM

Percentage Allocation Management Module (PAMM) trading with CapitalXtend gives you a fund that is entirely managed by an experienced trader. It is a kind of pooled money trading managed by a professional who will trade on your behalf.

Yet whilst we like the low fees, there is limited information on the traders who will manage the funds, which makes it hard to verify the legitimacy and efficacy of their trading systems.

Economic Calendar

I found CapitalXtend’s economic calendar a useful feature that helped me plan trades ahead of time. It essentially provides a view of important upcoming dates. I also like that I can filter events by country and impact, making it easier to identify suitable opportunities.

Forex Calculator

We also rated the CapitalXtend forex calculator, which helps traders understand their forex trading better by giving them a way to work out the required margin, profit/loss, and the target closing price. And although the name suggests otherwise, the calculator works on shares, commodities and indices too.

Customer Service

We were impressed to find that CapitalXtend has 24/7 customer support available via email, phone, plus live chat.

We found the live chat to be particularly good, with near-instant responses. However, while the agents could give advice on a range of issues, from market insights to troubleshooting, the style of advice and language was highly informal and sometimes incorrect advice was given and then corrected. This is a notable drawback, especially for beginners that need reliable support.

The email address for the support desk is support@capitalxtend.com. The phone number for the help desk is +357 25056441.

Company Background

CapitalXtend was founded in 2005 in Kazakhstan and operates globally. The brokerage is also based in St Vincent and the Grenadines.

The brand operates five global offices and provides trading services in seven languages, with more than 30,000 active clients.

Security

Although CapitalXtend does not offer the standard of regulation that we typically like to see, traders are provided the security that comes with using the MT4 and MT5 platforms. Two-factor authentication can also be added which is a positive, but the lack of sufficient regulation for this broker still makes it risky to use in comparison to a brand regulated by the FCA.

Trading Hours

The trading hours for CapitalXtend vary depending on the instrument being traded. The forex market, for example, opens at 9 PM (GMT) on Sunday and closes at 9 PM (GMT) on Friday, with currency pairs available for trading between 12 AM to 23:59. US shares are available to trade between 1:30 PM and 8 PM (GMT). Cryptocurrencies can be traded 24 hours a day, with no market closure.

Should You Trade With CapitalXtend?

We feel that, while this broker has some plus points, traders should exercise caution when trading with an offshore brand like CapitalXtend and carefully evaluate the risks involved before opening an account. While the firm has implemented some security measures and operates a transparent trading environment, the absence of regulation exposes UK traders to higher risks. The fees and trading conditions with the starter accounts are also less competitive than many alternatives.

FAQ

Is CapitalXtend Regulated In The UK?

CapitalXtend is not regulated by the UK’s Financial Conduct Authority (FCA) or any other well-regarded regulatory body. This is a major drawback for UK investors who will not receive the same level of account and fund security.

Does CapitalXtend Offer Good Market Access?

CapitalXtend offers a reasonable range of trading instruments, particularly in terms of forex and cryptos. Traders can access over 100 currency pairs, including major, minor, and exotic pairs, as well as popular commodities like gold, silver, and oil. The broker also provides access to stocks from major exchanges. With that said, the list of tradable assets is smaller than at leading brokers.

Does CapitalXtend Offer Reliable Trading Platforms?

CapitalXtend offers the popular MetaTrader 4 and MetaTrader 5 platforms. These are available for desktop and mobile devices, allowing traders to access the markets from anywhere at any time. They are both reliable, stable and suitable for beginners through to experienced traders.

How Can I Fund My CapitalXtend Account?

CapitalXtend supports a variety of deposit and withdrawal options, including credit/debit cards, bank transfers, and electronic payment methods. Deposits are processed instantly, while withdrawals may take up to five business days to process, depending on the chosen payment method.

Does CapitalXtend Offer Good Customer Support?

CapitalXtend provides customer support via phone, email, and live chat. The brokerage also offers a comprehensive FAQ section on its website and a range of educational resources, including trading guides, webinars, and market analysis. With that said, the quality of the customer service is somewhat lacking with representatives not able to help with some queries.

Article Sources

CapitalXtend Saint Vincent & the Grenadines Registration

Compare CapitalXtend with Other Brokers

These brokers are the most similar to CapitalXtend:

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- FXPrimus - FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

CapitalXtend Feature Comparison

| CapitalXtend | Admiral Markets | FXPrimus | FP Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 3.5 | 4 | 4 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $100 | $15 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | Financial Commission | FCA, CySEC, ASIC, JSC | CYSEC, MIFID, ICF, FCA, BaFin, VFSC | ASIC, CySEC, FSA |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (EU), 1:500 (Global) | 1:1000 | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | CapitalXtend Review |

Admiral Markets Review |

FXPrimus Review |

FP Markets Review |

Trading Instruments Comparison

| CapitalXtend | Admiral Markets | FXPrimus | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

CapitalXtend vs Other Brokers

Compare CapitalXtend with any other broker by selecting the other broker below.

Popular CapitalXtend comparisons: