Wealth Way Review 2024

|

|

Wealth Way is #97 in our rankings of CFD brokers. |

| Wealth Way Facts & Figures |

|---|

Wealth Way is an offshore broker that offers highly-leveraged trading on global markets. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Futures, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS |

| Payments | |

| Min. Trade | $10 |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade highly leveraged CFDs with STP/ECN execution. |

| Leverage | 1:500 |

| FTSE Spread | From 1.6 pips (Standard Account) |

| GBPUSD Spread | From 1.6 pips (Standard Account) |

| Oil Spread | From 0.03 pips (Standard Account) |

| Stocks Spread | From 1.6 pips (Standard Account) |

| Forex | Trade a wide range of currency pairs with a choice of pricing models. |

| GBPUSD Spread | From 1.6 pips (Standard Account) |

| EURUSD Spread | From 1.6 pips (Standard Account) |

| GBPEUR Spread | From 1.6 pips (Standard Account) |

| Assets | 65 |

| Stocks | Trade US and European stocks and shares with high leverage. |

| Cryptocurrency | Trade major cryptos against the USD and EUR. |

| Coins |

|

| Spreads | From 0.031 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Wealth Way is a global forex and CFD broker that offers plenty of investing and speculative opportunities for UK traders. The firm provides access to thousands of instruments, integration with the MetaTrader 5 (MT5) platform and a wealth of educational resources. This 2024 review will explore more about Wealth Way’s markets, fees, customer support and other services.

Our Take

- There is a competitive range of CFD and futures products across a variety of markets and industries

- Wealth Way incorrectly claims to be regulated by the SVG FSA, demonstrating a lack of legitimacy

- The broker has very high minimum deposit limits that will make it difficult for beginners to access the firm

Market Access

Wealth Way has an excellent range of futures and CFD instruments across several different asset classes, from stocks to cryptocurrencies. Although the crypto offering is fairly limited, our experts found the range of equity products to be particularly impressive compared to other brokers.

The full range of instruments is as follows:

- 20 Futures: Commodities and equity indices

- Stocks consisting of thousands of US and European equities

- 14 Indices: Including the S&P 500, FTSE 100 and Nasdaq 100

- 7 Cryptocurrency Pairs: Including BTC/USD and ETH/EUR

- 62 Forex Pairs: Including EUR/USD, EUR/GBP and GBP/USD

- 13 Commodities consisting of energies, precious metals and agricultural products

Fees

As is the case at most brokers, trading fees with Wealth Way depend on your account type. Although spreads on the ECN, Premium and VIP accounts start from 0.0 pips, these accounts come with a very high minimum deposit, starting from £8,000.

This means that the lowest spreads are outside the reach of low-capital traders and most beginners. We were also disappointed to see that commission on the ECN account is quite high at £8 per lot.

The large minimum deposit limits are also features of the commission-free Mini and Standard accounts, although the Tailor-Made account may provide some more flexibility, subject to the broker’s agreement.

Rollover rates (not applicable on Islamic accounts) are either credited or debited on all positions that are held open after 22:00 GMT. Wealth Way imposes a three-day rollover rate on Wednesday to account for the weekend.

We do not like that dormant accounts are charged £4/month or the full balance of the account if it is under £4. This fee is charged on accounts from the last of 90 calendar days during which there has been no activity, something that many brokers are fine with.

Currency conversion charges may also apply, although this should not be much of an issue for UK traders as GBP is one of the designated base currencies.

Wealth Way Accounts

We were pleased to see that swap-free halal account options are available at Wealth Way, in addition to the main accounts outlined below.

The broker also has a Fix Price Mechanism (FPM) account for Premium or better account holders, which our experts were impressed with, opening up plenty of opportunities. This account fixes the price of assets to help protect against devaluation caused by global inflation and the market’s response. There are risks and drawbacks related to this account, including limited withdrawals and investors potentially not benefiting from a price increase in USD.

Tailor-Made

- Zero commission

- Spreads from 1.4 pips

- 1:500 maximum leverage

- EUR/USD/GBP account currency

- Flexibility over minimum deposit

Mini

- Zero commission

- Spreads from 1.4 pips

- 1:500 maximum leverage

- £8,000 minimum deposit

- EUR/USD/GBP account currency

- Maximum total trade size of 5 lots

Standard

- Zero commission

- Spreads from 1.6 pips

- 1:500 maximum leverage

- £20,000 minimum deposit

- EUR/USD/GBP account currency

- Maximum total trade size of 20 lots

ECN

- Spreads from 0.0 pips

- 1:500 maximum leverage

- £8,000 minimum deposit

- Commissions of £8 per lot

- EUR/USD/GBP account currency

Premium

- Spreads from 0.0 pips

- 1:500 maximum leverage

- Commissions of £4 per lot

- £80,000 minimum deposit

- EUR/USD/GBP account currency

VIP

- Spreads from 0.0 pips

- Commission is £2 per lot

- 1:500 maximum leverage

- £800,000 minimum deposit

- EUR/USD/GBP account currency

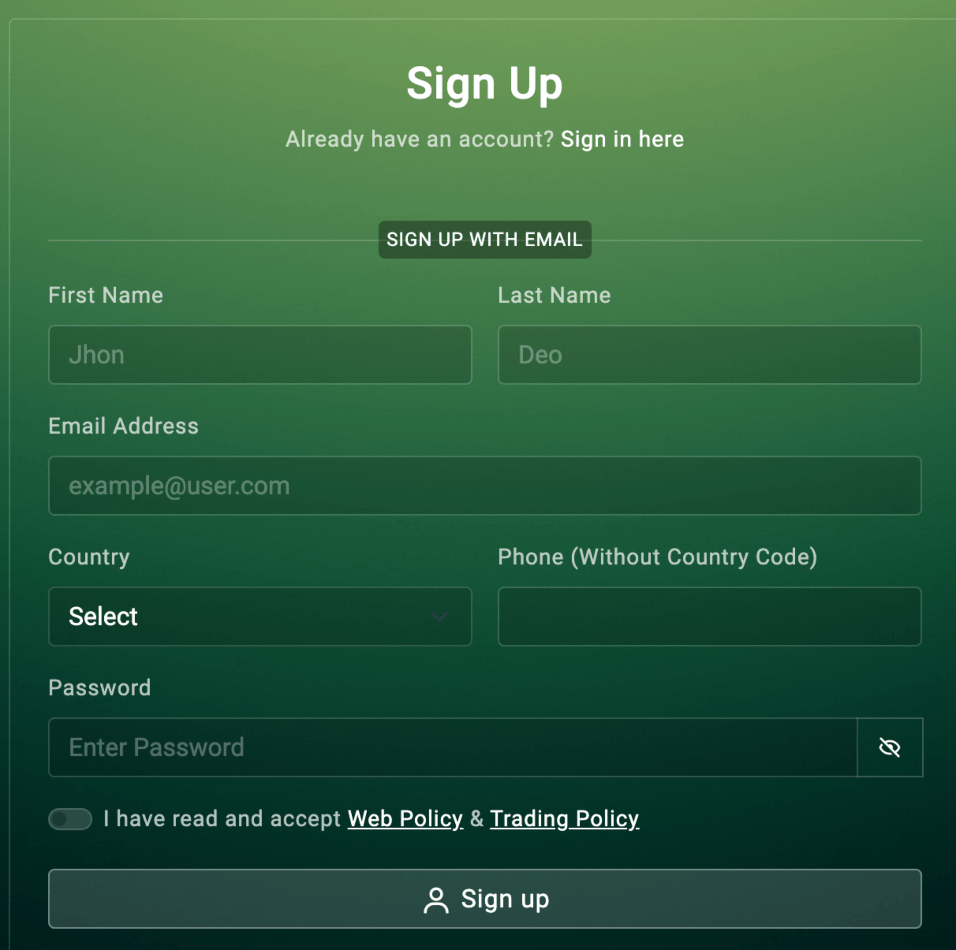

How To Register For An Account

- Click Open Account

- Fill in the form and click Sign Up

- Validate your email address

- Submit ID documents for account validation

Wealth Way Account Registration Form

Funding Methods

Deposits

The minimum deposit for non-initial payments is £8. Although we think this is low compared to many other brokers, each account type at Wealth Way has its own minimum initial deposit, which is sadly significantly higher than this. Some deposit methods may also have a higher minimum amount.

All deposits are instant apart from bank wire transfers, which can take up to five working days. When we used Wealth Way, we were pleased to see that there are no deposit fees (apart from international bank wire transfers under £1,600).

The deposit options at this broker include:

- Debit/credit cards

- Bank wire transfers

- Local bank transfers

- Electronic payment methods, including Skrill and Neteller

How To Deposit

- Login to the Members Area

- Select Add Money under the Deposits tab

- Enter the payment details

- Follow the on-screen instructions

Withdrawals

We found that, like deposits, the minimum withdrawal limit is £8 at Wealth Way. We think this is reasonable, although we were disappointed to see that the firm imposes limits on the number of withdrawals each month from the Tailor-Made and Mini accounts. For the latter, there is a limit of two withdrawals per month, though unlimited withdrawals are allowed on the Standard account.

Withdrawals are processed back to the source of the original deposit apart from any profits, which can be processed back to any available payment method. We were pleased to see that Wealth Way does not impose fees on withdrawals, something that many other brokers do. However, banks may charge their own fees.

Withdrawal requests are completed within 24 working hours, although the overall time for funds to reach accounts varies. E-wallets are usually the same day, whereas bank wire transfers and credit/debit card withdrawals typically take 2-5 business days.

How To Withdraw

- Login to the Members Area

- Select Add under the Withdraw tab

- Enter the required information

- Click Submit For Approval

UK Regulation

Wealth Way Corporation is registered in St. Vincent and the Grenadines and claims to hold a license with the Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA). However, the SVGFSA’s website advises that forex activities are not licensed in St. Vincent and the Grenadines, which may indicate that the broker is unregulated.

We could also find no record of a license on the SVGFSA website, which we find troubling as it potentially shows an intention to mislead clients. This means less robust monitoring of the company, fewer protections for traders and most likely no access to an investor compensation scheme.

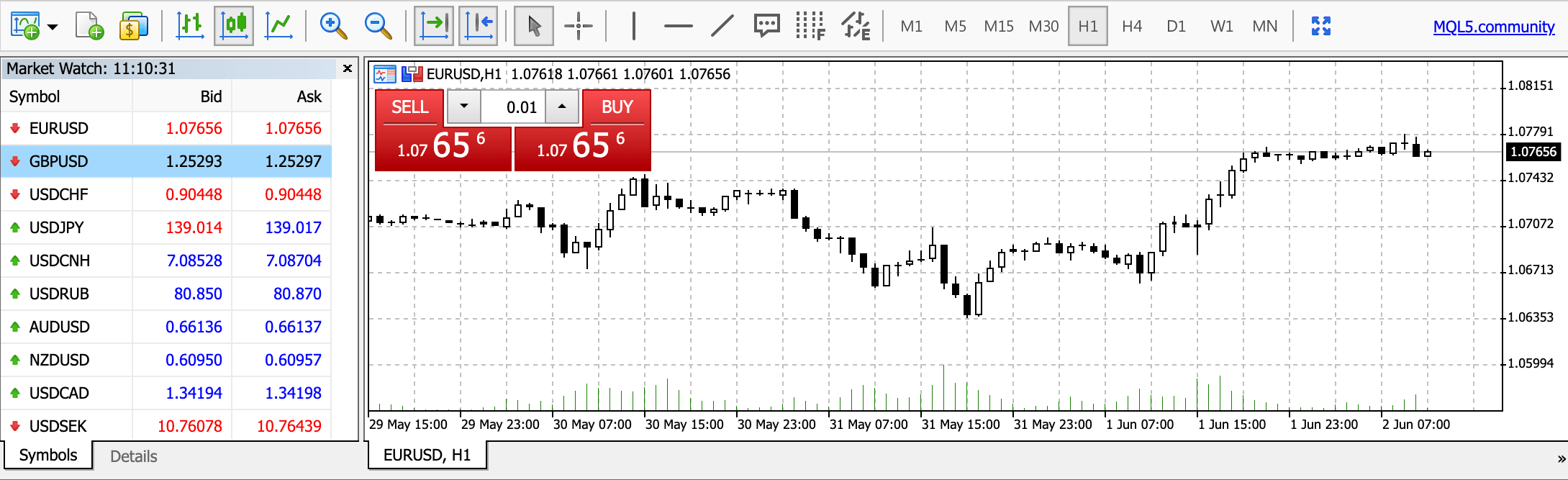

Trading Platform

Only one trading platform is available at Wealth Way: MetaTrader 5. Whilst we prefer to see investors given a choice as to the trading platform they use, our experts find MT5 to be an industry-leading platform with a range of technical and fundamental analysis features.

It is suitable for both beginners and experienced investors, with plenty of intuitive interface features, as well as lots of advanced tools and functionality.

The MT5 desktop version can be downloaded for free from the broker’s website. Alternatively, those not wishing to download software can opt for the web version. The main features of the platform include:

- 21 timeframes

- Algorithmic trading

- 44 analytical objects

- 38 technical indicators

- Unlimited number of charts

- Built-in financial news and economic calendar

MetaTrader 5

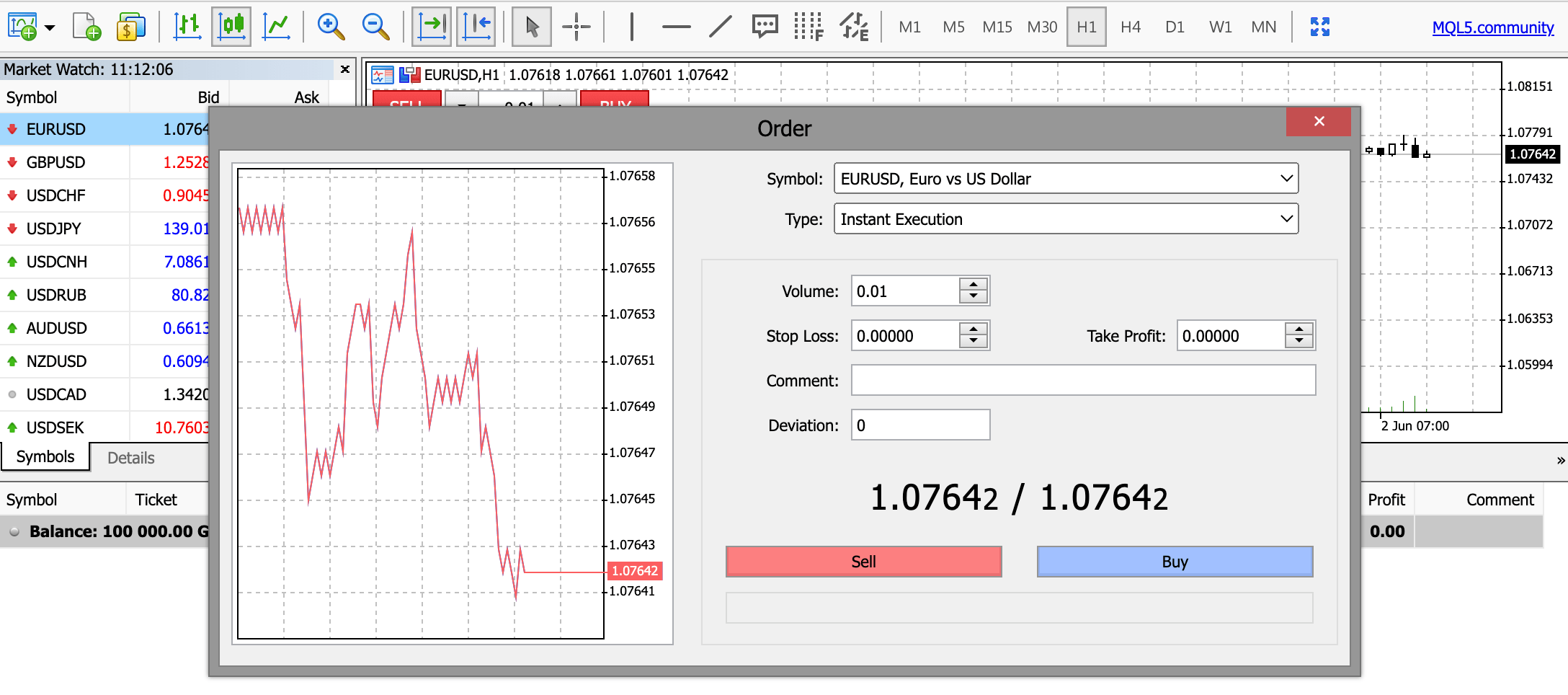

How To Place An Order On MT5

- Right-click on the instrument’s symbol (the list of instruments is on the left)

- Click New Order

- Complete the details including volume and, if necessary, stop loss/take profit

- Press Buy or Sell to complete the order

MetaTrader 5 Order Window

Mobile App

Although we were disappointed to see that Wealth Way does not have a proprietary trading app, the MT5 mobile app is sufficient to be able to trade effectively on the go. The application can be downloaded from both the Apple App Store and Google Play Store.

The mobile app contains many of the same features to use as the desktop version, although it can be more difficult to undertake advanced technical analysis on a smaller screen.

Leverage

As an offshore broker, Wealth Way offers leverage rates of up to 1:500. This is high compared to European-regulated brokers, which are usually limited to 1:30. However, we have found that many other offshore brokers offer rates well into the thousands, making the Wealth Way limits not uncommon.

Margin rates also vary depending on the market being traded. The margin rate for stocks is 20% (1:5 leverage) and 10% for cryptos (1:10 leverage).

Our experts recommend that only experienced traders make use of the higher leverage rates due to the large risks involved.

Demo Account

We found an intuitive and efficient demo account available at Wealth Way with up to £80,000 of virtual funds. This account runs on the MT5 platform, giving traders a realistic experience of how the platform works.

However, investors should be aware that prices on the demo account may not be as accurate as real trading conditions. The demo account is also useful for seasoned traders to test and refine strategies.

Wealth Way Bonus Deals

Wealth Way has a bonus programme that enables investors to trade with increased capital. However, we have sadly found that there are stringent conditions relating to the withdrawal of the bonus amount, including the need to reach 50% growth of the bonus amount and be actively investing for at least three months.

Always check the full terms and conditions before participating in any bonuses.

Extra Tools & Features

We were pleased to see a decent range of additional features and benefits while using Wealth Way. This includes fractional pip pricing (5-digit quotes instead of 4-digit quotes) to provide more accurate price quotes, a personal account manager for all traders, a forex calculator and a VPS service (free to clients who maintain a minimum amount of £4,000 and who trade at least 20 round turn lots or 2,000 micro round turn lots per month). These features are in addition to those mentioned below.

Education

We found Wealth Way to have an impressive education section that our experts believe exceeds many other brokers. Investors can learn how to trade through various teaching methods, including video tutorials, a trading course consisting of four levels and a personal stock market coach.

There is also a comprehensive glossary to get your head around complex trading jargon.

News & Market Analysis

The best traders have excellent tools and insight at their fingertips that they can utilise to effectively analyse the markets. To assist with this, Wealth Way has a news and analysis section, although we have found that this has not been updated since April 2023, despite being updated daily before that.

Our experts were pleased to see access to the Autochartist technical analysis tool that helps predict future market movement. This saves investors time in analysing the market, as do the trading signals and auto-trade mode that are also available. These should not be taken for granted as few brokers provide such features in addition to their designated trading platforms.

We also found that Wealth Way provides an economic calendar, which helps identify upcoming market publications and announcements, although this is now fairly standard amongst brokers.

Company Background

Wealth Way is a relatively new broker, having started in only 2017. Our team discovered that it was established by a group of former professionals in financial services, although no further details could be gleaned regarding the senior management of the firm.

It is headquartered in London. The broker claims to have the vision to make markets accessible to everyone and serve all clients with greater transparency.

Wealth Way Fx is the trade name of Wealth Way Corporation, which is registered in Saint Vincent and the Grenadines.

Customer Service

We were impressed by the 24/7 customer support provided by Wealth Way. A large number of brokers limit their support to 24/5, so we were pleased to see this broker go further.

There is also a good range of contact methods on offer (including a UK phone number):

- Live chat

- Online Contact Form

- Phone – +44 7717 383 818

- Email – operations@wealthwayfx.com

Trading Hours

Wealth Way’s opening hours are Sunday 22:05 GMT – Friday 21:50 GMT, though the trading hours for individual markets within this period vary. Whilst forex is generally 24/5, UK stocks tend to be 08:00-16:30.

Check with the broker what the hours are for your chosen market if in doubt before you begin investing.

Safety

Offshore and unregulated brokers usually come with more risk. However, we liked to see that Wealth Way uses segregated bank accounts to keep client money separate from funds belonging to the firm. We also appreciate that external audits of the company’s financial statements are undertaken regularly and the broker claims to use major banks, although no specific details are provided.

MetaTrader 5 has implemented various security measures of its own to protect users. This includes encryption between the trading platform and servers based on 128-bit keys.

Should You Trade With Wealth Way?

Wealth Way provides an excellent range of instruments, has plenty of educational material and offers a variety of customer support options. It also has generally free deposits and withdrawals. However, our experts feel that Wealth Way’s regulatory status (or lack thereof) is a major cause for concern, as are the high minimum deposit requirements on each account type.

This broker, therefore, may only be suitable for high-capital traders who are prepared to trust an offshore company.

FAQ

Is Wealth Way Legit?

Wealth Way is an offshore broker that claims to have a license with the SVGFSA, although the information on the regulator’s website seems to suggest that they do not. We found this concerning and traders should be extra careful with brokers whose regulatory status is unclear.

Is Wealth Way Good Or Bad?

Wealth Way has many good aspects including its range of instruments, customer support and educational material. However, its high minimum deposit on most accounts and sketchy regulatory oversight are significant drawbacks.

Is Wealth Way Suitable For Beginners?

The high minimum deposit requirements on many account types may make it difficult for beginners to access Wealth Way. However, those with large capital should benefit from the educational resources and demo account.

What Is The Minimum Deposit At Wealth Way?

The minimum amount to deposit is £8, although many account types have significantly higher minimum deposit limits than this (most from £8,000).

Is There A Choice Of Trading Platforms At Wealth Way?

No. The only trading platform integrated with Wealth Way is MetaTrader 5. Fortunately, this is arguably one of the best platforms in the industry.

Article Sources

Compare Wealth Way with Other Brokers

These brokers are the most similar to Wealth Way:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

Wealth Way Feature Comparison

| Wealth Way | Pepperstone | FP Markets | IronFX | |

|---|---|---|---|---|

| Rating | 2.3 | 4.8 | 4 | 3.8 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $10 | $0 | $40 | $100 |

| Minimum Trade | $10 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA | CySEC, FCA, FSCA, BMA / Bermuda |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4 |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) |

| Visit | ||||

| Review | Wealth Way Review |

Pepperstone Review |

FP Markets Review |

IronFX Review |

Trading Instruments Comparison

| Wealth Way | Pepperstone | FP Markets | IronFX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | Yes |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

Wealth Way vs Other Brokers

Compare Wealth Way with any other broker by selecting the other broker below.

Popular Wealth Way comparisons: