Vanguard Review 2024

|

|

Vanguard is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Vanguard |

| Vanguard Facts & Figures |

|---|

Vanguard is a US-headquartered brokerage with 50 million clients globally and $8+ billion in assets under management. The brands offers investing in stocks, mutual funds, bonds, ETFs and options with low fees. The trusted broker is regulated by the SEC, FINRA and FCA. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs |

| Demo Account | No |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| Regulated By | SEC, FINRA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Stocks | Trade thousands of company stocks such as Apple and Tesla, and pay no commission when you buy or sell equities or trade ETFs. UK investors can also access tax-free stocks and shares ISAs. |

Vanguard is a popular investment company with over 30 million customers worldwide. It offers ISAs, pensions and investment accounts to UK customers, who can pick their own funds from Vanguard’s list or take advantage of the brand’s ready-made portfolios and managed accounts. This Vanguard review will lay out the products and services offered by the firm and examine the pros and cons of investing with this company.

Vanguard is a well-known brokerage, offering a range of ISA and pension savings accounts, each of which can be used to access 80+ active funds and ETFs. However, there are no leveraged products and limited short-term trading opportunities. The account opening process is also cumbersome and minimum investments are high on some products. As a result, UK residents should consider leading alternatives, such as Interactive Investor.

Accounts

Vanguard offers five account types:

- Stocks & Shares ISA: Invest up to £20,000 per year in Vanguard’s products and any gains will be shielded from capital gains tax.

- Managed ISA: Enjoy the same tax-efficient benefits as a Stocks & Shares ISA but hand over control of your investments to Vanguard’s experts after creating an investment plan and choosing one of five investment portfolios.

- Junior ISA: Parents or legal guardians can set up an ISA for their child and invest up to £9,000 a year, either in Vanguard’s ready-made portfolios or in their own pick of assets. The account will convert to a regular Stocks & Shares ISA when the child turns 18.

- Personal Pension: Vanguard’s self-invested personal pension (SIPP) account offers the company’s choice of funds or ready-made portfolios with the added benefit of tax relief on contributions and a 25% bonus paid by the government. Investors can contribute a maximum of £60,000 per year to their SIPP.

- General Account: Invest an unlimited amount in Vanguard’s funds with this account, though forgo the other accounts’ tax benefits.

Markets & Funds

While using the firm, our experts found that Vanguard’s clients are limited to investing in funds and ETFs.

With more than 80 different assets available, including 75 index and 11 active funds, there is a good selection to choose from that covers a range of sectors and geographical regions.

Importantly, Vanguard is geared more toward hands-off investors. It has a lot to offer in this department, with an array of ready-made portfolios known as LifeStrategy Funds and Target Retirement Funds. These allow clients to simply set a timeframe and goal for investing and specify their risk appetite, leaving all the legwork to the company’s professionals.

LifeStrategy Funds

The LifeStrategy Funds are premade portfolios built by combining several different index-tracking products.

LifeStrategy fund comprises a mix of between 6,000 and 20,000 shares and bonds, providing varying risk levels and potential returns. These are diversified and designed for those looking to build a portfolio without looking through hundreds or thousands of different assets.

There are five LifeStrategy funds available with Vanguard, each with a different split between shares and bonds:

- LifeStrategy 20% Equity Fund – 20% shares / 80% bonds

- LifeStrategy 40% Equity Fund – 40% shares / 60% bonds

- LifeStrategy 60% Equity Fund – 60% shares / 40% bonds

- LifeStrategy 80% Equity Fund – 80% shares / 20% bonds

- LifeStrategy 100% Equity Fund – 100% shares / 0% bonds

As more stocks are introduced into the portfolio, the risk also increases. Riskier funds are more volatile but come with higher profit potential. They are typically best for those with longer-term goals.

Target Retirement Funds

Target Retirement Funds are premade portfolios designed for building a long-term retirement pot. The funds are made up of a combination of shares and bonds, much like the LifeStrategy funds. However, the retirement products differ in that the composition of the fund changes as it matures.

In the early stages, the fund has a greater weighting in shares. However, as the retirement date approaches, the composition shifts in favour of bonds. This allows for higher growth potential early on and then capital preservation in the later stages.

The funds are split into five-year intervals, with each displayed year (2030, 2035 etc) being the target retirement year. Investors can choose the most appropriate fund for them by selecting the closest retirement year within five years of their own targeted retirement.

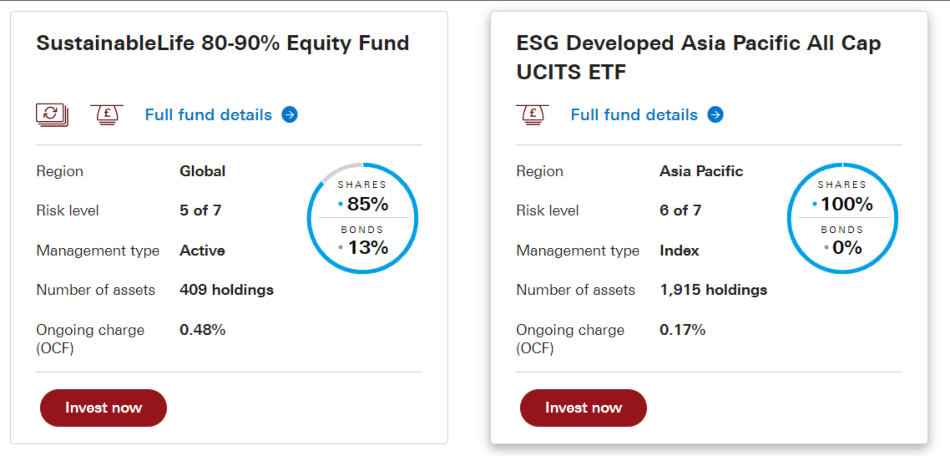

Index & Active Funds

Vanguard also offers 11 active and 75 high and low-dividend yield index funds that investors can choose from to build their own portfolios.

Active funds involve fund managers deciding the assets to invest in. This means that the contents of the fund are reviewed and changed in order to reach the target returns. These typically comprise fewer holdings, usually landing within a few hundred constituent assets. Some of these include the Active U.K. Equity Fund, Emerging Markets Bond Fund and the Global Equity Income Fund.

Index funds are designed to track the performance of financial markets, either overall, by sector and asset type, or by geographical region. These could comprise hundreds or even thousands of holdings and are usually weighted to accurately mirror index performance.

Popular index funds include the Vanguard FTSE 100 Index Unit Trust, Global Bond Index Fund and the U.K. Investment Grade Bond Mutual Index Fund.

ETFs

Vanguard offers 29 Exchange-Traded Funds (ETFs). These are assets that track a specified basket of securities, usually with an overarching theme.

For example, Vanguard offers the FTSE 100 UCITS ETF, S&P 500 UCITS ETF, Global Aggregate Bond UCITS ETF and EUR Eurozone Government Bond UCITS ETF. These four products alone provide broad exposure to the US, UK and European stock markets, as well as global bond markets.

Investors looking to speculate on specific sectors or markets may find ETFs attractive.

ESG Funds

Environmental, Social and Governance funds aim to only include companies and markets that meet certain ethical criteria. Vanguard offers 17 ESG funds, divided into two types:

- Index Fund – These exclude firms that violate certain ESG criteria

- Active Fund – These are actively managed from a pool of companies that fit the ESG criteria

ESG Funds

Vanguard Fees

Vanguard is known for its low fees and charges when compared to competitors. Investors will have to pay fund management costs and an account fee.

When we used Vanguard, the account fee came out at 0.15% per year and with a cap at £375 for accounts with over £250,000. Fund management costs are made up of ongoing costs, fund transaction costs and one-off charges.

- Ongoing costs are between 0.22% and 0.24% for ready-made portfolios and between 0.06% and 0.78% for individual funds.

- Fund transaction costs sit between 0.02% and 0.09% for ready-made portfolios and 0.01%–0.89% for individual funds.

- Additional ETF costs include one-off charges of 0.03%–0.45%. The optional quote and deal service for ETFs costs £7.50 per trade.

Payment Methods

Our experts found that Vanguard allows lump sum payments by debit card or regular payments through a direct debit. These usually settle within one business day and the upper deposit limit is £100,000. Direct debits placed from business accounts, credit cards, cheques and standing orders are not accepted by the firm.

This is a very limited selection of deposit methods but this is fairly typical among ISA and asset management firms.

Company Background

Vanguard is an asset management and investment company founded by Jack Bogle in 1975. It opened its UK office in 2009 and now has over 800 employees.

Vanguard UK is owned by the Vanguard Group, based in Pennsylvania, United States. Worldwide, the firm has attracted over 30 million investors and has been chosen as a recommended provider by Which? In 2020, 2021 and 2022.

UK investors can be assured that the firm is regulated by the Financial Conduct Authority, providing a moderated environment for investment and saving.

UK Regulation

Vanguard is regulated by the Financial Conduct Authority in the UK under registration number 527839. As such, Vanguard is covered by the Financial Services Compensation Scheme (FSCS), meaning investors could be entitled to up to £85,000 if the firm is unable to meet its obligations.

The firm also ensures there is a segregation of capital, meaning investors’ money is held separately from the firm’s.

Customer Services

Vanguard has an FAQ section that covers most of the more popular questions. However, the broker also provides a range of additional contact methods, including a 24/7 chatbot, secure message line, customer service phone number and email address. These can be found on the Help and Support tab on the broker’s website.

Vanguard Contact Numbers:

- From The UK: 0800 587 0460

- From Abroad: +44 (0)20 3753 5087

These lines are available from Monday to Friday, 09:00 to 17:00 UK time (GMT/BST).

Additional Features

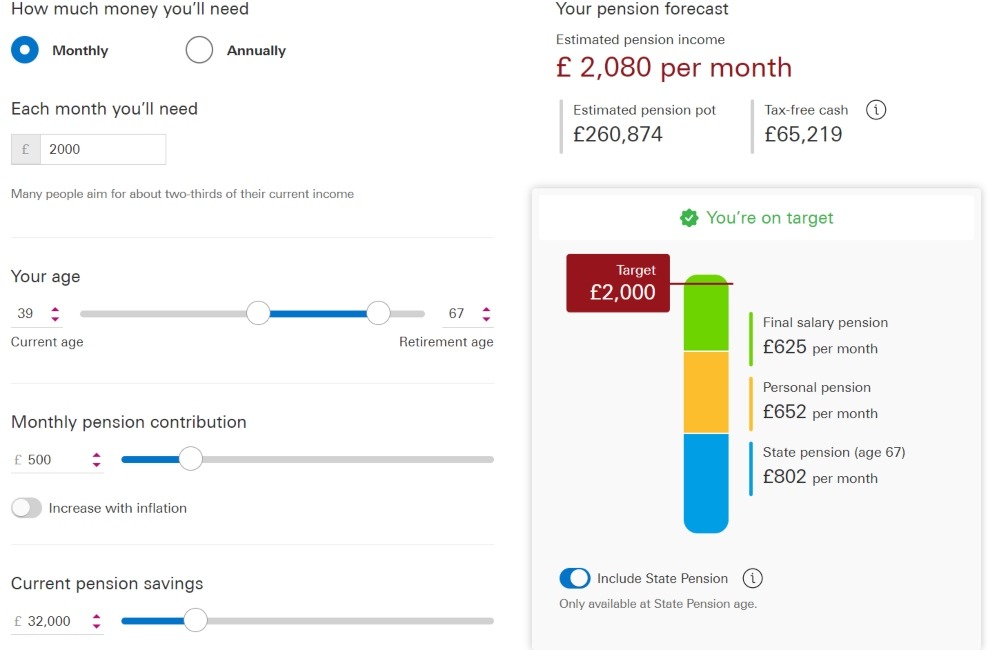

Those without much experience in the investing space can make use of several extra features and services that Vanguard offers. These include a pension calculator with an intuitive interface.

Moreover, the broker’s website contains a helpful education section that covers background information on topics that include accounts, pensions, taxes and savings planning.

Vanguard Pension Calculator

Trading Hours

ETFs are traded twice a day using Vanguard’s bulk dealing service. However, investors can use the quote and deal service (£7.50 per order) to trade the assets in real-time between 08:30 and 16:30 GMT/BST.

Mutual funds have varied cut-off times, which can be found for each product on the fund list.

Should You Invest With Vanguard?

Vanguard offers a cheap, easy way to get into saving and investing through stocks & shares ISAs and savings accounts. The firm offers over 80 funds, ranging from active ESG funds to pre-made portfolios. Alternative services are provided through the firm’s pensions offering, ISA accounts and the general account.

Vanguard also presents a simplified way to invest through its ready-made portfolios, which could customers that want to build their wealth without spending too much time researching investments. Vanguard’s popularity in the UK and worldwide is founded on its low costs, ease of use, varied asset choice and top-tier regulation.

However, the benefits of derivatives trading and short-term trading opportunities, cannot be found here. As a result, see our list of alternatives.

Article Sources

Vanguard UK Asset Management FCA License

FAQ

What ISAs Does Vanguard Offer?

Vanguard offers three different ISA accounts. These are the standard Stock & Shares ISA, Managed ISA and Junior ISA.

The Stocks & Shares ISA allows customers to invest up to £20,000 in any of the firm’s 80+ funds in a single tax year.

The Managed ISA leaves the asset selection to an expert manager, not allowing the investor to choose which funds to invest in.

The Junior ISA can be set up by parents and guardians for a child, with a limit of £9,000 each tax year. These accounts will transition to a stocks & shares account when the child turns 18, at which point account access will also be transferred.

Does Vanguard Offer ETFs?

Vanguard UK offers 29 exchange-traded funds (ETFs) to invest in. These include ESG funds like ESG Developed Europe All Cap UCITS ETF. Popular exchanges are also represented, like the S&P 500 UCITS ETF and FTSE 100 UCITS ETF.

Does Vanguard UK Offer Active Funds?

Vanguard UK offers 11 active funds, including share-dominated and bond-dominated funds. These include the Sterling Short-Term Money Market Fund, the SustainableLife 40–50% Equity Fund and the Active U.K. Equity Fund.

Does Vanguard Have Withdrawal Fees?

Vanguard UK does not charge any deposit or withdrawal fees when transferring money in or out of your account, whatever its type.

What Payment Methods Does Vanguard UK Accept?

To deposit money into a Vanguard UK account, you will need to use your debit card or set up a direct debit. Credit cards, cheques and other methods are not supported.

What Leverage Does Vanguard Offer?

Vanguard investment products are all spot instruments and equities, so there is no option for margin trading. Those looking for leveraged trading will need to find another broker that offers derivatives products.

Top 3 Vanguard Alternatives

These brokers are the most similar to Vanguard:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Vanguard Feature Comparison

| Vanguard | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 4.4 | 4 |

| Markets | Stocks | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities |

| Minimum Deposit | $1 | $0 | $0 | $1000 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, FINMA, DFSA, SFC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | - | - | MT4 | MT4, MT5 |

| Leverage | - | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Vanguard Review |

Interactive Brokers Review |

IG Index Review |

Swissquote Review |

Trading Instruments Comparison

| Vanguard | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Vanguard vs Other Brokers

Compare Vanguard with any other broker by selecting the other broker below.

Popular Vanguard comparisons: