IQ Option Review 2024

|

|

IQ Option is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to IQ Option |

| IQ Option Facts & Figures |

|---|

IQ Option is a trusted broker with multi-asset trading on its user-friendly proprietary platform. The broker provides trading on forex, stocks, cryptos, indices, commodities and ETFs with competitive fees and a good suite of extra features and educational content. You can also open an account with just $10. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFD, Forex, Crypto, Stocks, Digital Options |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS, Android and Windows |

| Trading App |

IQ Option provide a superbly easy to use mobile app. Offering forex trading, plus some bespoke trading instruments of their own, IQ deliver a slick, secure platform for shorter term trades. Recent upgrades have also synchronised the look and feel of both the web trader and mobile platform, making switching between the two, seamless. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.001 Lots |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | IQ Option deals primarily in CFDs, which are available on stocks, forex, cryptocurrencies and several other markets. The leverage available is in line with EU restrictions, to a maximum of 1:30 on major forex pairs but with less available on more volatile assets. Trades are commission-free with floating spreads and clients can use the award-winning platform. |

| Leverage | 1:500 |

| GBPUSD Spread | 1 |

| Oil Spread | 2.3 |

| Stocks Spread | 2 |

| Forex | IQ Option offers CFD trading on 24 forex assets, including major pairs and some minors. EU traders can access a maximum of 1:30 leverage in line with local regulations. The broker offers commission-free trades but spreads are on the high side so the brand does not excel in this area. |

| GBPUSD Spread | 5 pips |

| EURUSD Spread | 14 pips |

| GBPEUR Spread | 15 pips |

| Assets | 60+ |

| Stocks | 200+ stocks are available to IQ Option traders via CFDs, meaning that the underlying equities will not be physically owned. Instead, traders can speculate on price movements with up to 1:5 leverage. IQ Option also offers useful stock collections, from the largest US companies to AI stocks and Warren Buffet's favorites. |

| Cryptocurrency | IQ Option is a leading crypto broker. They offer multipliers and a huge range of digital currency markets, including Bitcoin, Ethereum, and Cardano. Leverage of up to 1:2 is available with a variable spread and no commission. Newer traders will also rate the intuitive trading software. |

| Coins |

|

| Spreads | BTC 7%, ETH 12% (Var) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

IQ Option are one of the most popular brokers trading at present – find out why here. They are rapidly expanding their offering, from binary options, to forex, CFDs and crypto currency trading. We explore the market leading, bespoke platform, and explain how you can get the most from your trading account:

- How to use the platform

- The benefits of the mobile app

- Option Types and Asset lists

- Payout information

- Which additional features to make use of

This material is not intended for viewers from EEA countries. Binary Options are not promoted or sold to retail EEA traders.

Overview

IQ Option are relatively new to the sector, having formed in 2013. Despite this the firm have grown rapidly. This growth is due to offering low minimum deposits (open an account with just $10) – making trading accessible to large numbers of traders – and ensuring they offer a superb trading platform. This has ensured clients are happy, and continue to trade for months and years after they join.

IQ have also have started to collect some of the more prestigious awards in the sector too – including ‘Most reliable binary options broker‘ in 2014, from MasterForex-V. The brand continues to grow and innovate and traders can access a demo account without the need for a deposit. The account is available as soon as you register.

Originally a binary options broker, IQ have expanded to offer forex trading and classic options which mirror cfds. They also now offer direct access to crypto currencies, such as bitcoin, ethereum and DASH.

Bonus

There is no IQ Option bonus offer or bonus code at present.

Trading Platform

In 2016, IQ Option rolled out a new platform. The much anticipated v4.0 platform. It is an excellent platform, and sets the gold standard for binary options brokers.

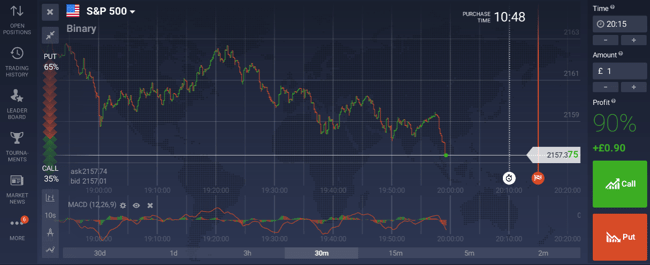

One important strength is the platforms flexibility. Traders can arrange trading windows however they need to. They can focus on one asset, or trade a whole range of them at once. Whatever suits the trader best. Our screenshot illustrates one ‘main’ window. When multiple windows are shown, all the assets can be traded simultaneously:

The price graph is shown across the main part of the trading platform. Along the left hand side of the trading area are the menu options to move to different areas of the website. Users can collapse that menu if required. Alongside the navigational menu are some powerful technical analysis features – more on these in the charts below.

Charts

Charting options include tools to amend the time frame of the chart, as well as the plot type (using bar charts instead of candlesticks etc). The technical analysis features are very useful – traders can add Moving Averages, Bollinger bands, Relative Strength Index or any of the other 7 analysis tools available.

They are added immediately to the chart. Traders can then refine their trades as they need. The drawing buttons allow traders to add freehand objects to the charts – so they can add trend lines or resistance and support levels.

Above the new analysis options is the trader sentiment bar. This shows the way other traders are trading a particular asset. There are then options to minimise or close the current asset trading window.

Choose An Asset

To select an asset, traders can use the drop down arrow at the top of the platform. This will open a new window. From here, the trader can choose which type of option to use and then select the category of asset. Categories include Forex, Indices, Commodities and Stocks. Final the specific asset can be clicked. Once selected, the price graph will update for the chosen market. Cryptocurrency has also been recently added, allowing direct trading of bitcoin and other alt coin options.

There are also ‘tabs’ along the top of the trading area. From these, traders can quickly move to assets or markets that they have traded previously. Open positions will also appear as a new tab in this area, this makes switching very easy.

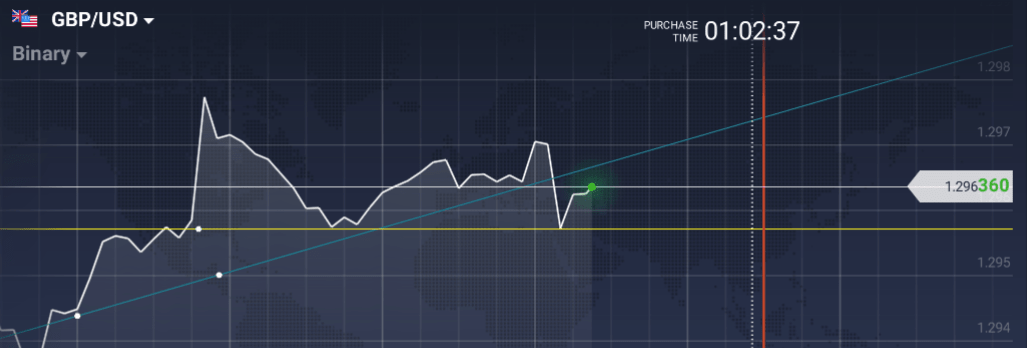

The price graph presents all the current trading information. The graph itself illustrates the recent price movement. In addition, there are vertical lines showing the purchase deadline (the time by which a trade must be confirmed) and the expiration time.

Expiry And Trade Size

There is a ‘Time‘ drop down menu to the right of the graph. Using this, the expiry time can be amended – if changed, the purchase deadline and expiration time will move on the price graph. This gives a visual marker for the timings. The -/+ buttons will move the expiry time to the next time slot.

Listed on the right hand side are the other key figures for the trade. The trade amount is just below the expiry time – the minimum trade at IQ Option is just $1. The payout for that specific asset is then displayed. This confirms the percentage returned in the event of a successful trade.

The Profit indicator shows exactly what figure will be returned if the trade wins. The figure includes the original investment amount.

Finally, at the bottom, are the trading buttons. They are clearly marked, including arrows to indicate the trade direction as well. Where that is not clear enough, if each button is hovered over, an arrow will appear on the price graph, showing which way the price will need to move in order for the trade to finish in profit.

Single Click Trading

The trading buttons at IQ Option are ‘single click‘ which maximises the opportunity for traders to get the price they want. There is no confirmation window or approval delay. Once placed, a trade will be available in the ‘Open positions‘ window. On the price graph at the strike price, a line will also be added, showing the open trade. Once the expiry time is reached, a window will appear confirming if the trade was successful or not, and confirm the profit / loss.

It is a visually exciting, smooth trading environment. It has enough configurability to satisfy almost every trader. While the looks amazing, the addition of excellent charting and technical analysis tools has raised the bar for the brand. It has taken an excellent platform, and turned it into the industry benchmark. Other brokers may offer more trading choice – but none will offer a better trading platform (in our opinion).

Assets

The firm add to their list of assets on a regular basis. In addition, they have also expanded their choice of expiry times – particularly from the binary options lists. End of day, end of week and end of month are now also available. This is a big step for a broker that offered purely short term trades previously.

- Binary Options – The basic binary option. Will the asset rise in value, or fall? The expiry times on offer with these has grown. Now traders can select from 15 minutes up to end of day, week or even month.

- Turbo – Exactly like a traditional binary option, but with short expiry times. Turbo options are usually available in one minute levels, from 1 minute, up to 5 minutes.

- Forex – Traditional foreign exchange trading, offering leverage, stops and per pip profits.

- CFDs – Long term positions can be taken on a contracts for difference basis. This includes assets such as bitcoin.

IQ Option will add assets as their users demand it. One example was Nintendo being added during the ‘Pokemon Go!’ media storm. The broker was quick to add Nintendo to their list of assets. This reflects a desire to deliver the products their clients demand. The asset lists at IQ are now very comprehensive.

Mobile App

The IQ Option mobile trading app is updated on a regular basis. The app is well maintained and developments given priority. IQ do value their mobile offering and take pride in its quality. Mobile trading can sometimes be an after-thought at some brokers, but not at IQ.

The mobile platform maintains the simplicity of the trading area on the website. It retains the split second charting that makes trading binaries viable. The layout is incredibly clear, and can be tailored to suit the needs of individual traders.

In addition to the trading functions, users can also maintain account details, including the ability to request withdrawals from the mobile app. The team developed their mobile offering in-house and the attention to detail is evident.

The app has been written to take advantage of the relevant operating system. So the separate iOS, android and windows versions, all use features unique to those platforms. The firm have certainly delivered an excellent mobile trading service

Download the App for iPhone or Android

Payout

Payouts at this broker are a clear strength. Payouts tend to get larger where the broker is better able to balance trading. This requires a large, active user base – and IQ have that. The most traded assets see payouts of around 85%, with some assets reaching 100%. (Amount will be credited to account in case of successful investment). As ever, the payouts will vary based on expiry times and the asset selected.

Forex and CFD trades obviously work differently to binary trades. Payouts here will depend on price movement of the underlying market. Forex trades do offer per pip profits though, and cfds can be left open long term. Allowing more traditional investing.

Withdrawal and Deposit Options

Deposits can be made via credit card (all major cards accepted) as well as wire transfer and online payment services such as Skrill and Neteller. The minimum deposit is just $10. This initial deposit will decide which account type a trader moves into:

A substantial deposit (the exact figure varies) will move a trader into the VIP account type – this offers a range of improved benefits, including improved returns on certain markets, access to an account manager and VIP training materials.

Withdrawals

Withdrawals are on occasion subject to certain verification processes, including proof of identity. In order to avoid any dispute, it is always better to clarify these requirements before needing to make a withdrawal. All the verification can then be put in place well before monies are requested.

Withdrawals are available via the same methods as deposit – namely credit and debit cards, and wire transfer. Traders will be subject to a 2% withdrawal fee starting from the 2nd withdrawal per month. They are generally processed in 1-3 days.

Other Features

The brand offers their clients a range of other features and benefits:

- Technical Analysis Tools – On the trading platform, there are some technical analysis tools incorporated into the user options. These include trend line tools and moving average and Bollinger band indicators.

- Range of Educational material – IQ Option deliver a suite of education training videos as well as one to one support on occasion. VIP account holders gain access to further material.

- Tournaments – The firm run a range of regular tournaments that traders can buy into. These often provide cash prizes and allow traders to compete against one another to see who performs ‘best’ over a given period.

Image Of Technical Drawings: (Trend Or Support Lines)

FAQ

Does the platform require a software download?

Traders have the option to use the web based trading platform – or download an install. Both versions work in exactly the same way, but the firm suggest the downloaded software improves speed. The website is certainly not slow, so it really comes down to personal choice as to whether you download the software, or use the web platform.

How do they provide liquidity?

IQ Option have grown rapidly since forming. They now boast over 50 million registered users. That offers them a huge amount of risk management, and trader reassurance that the trading platform provides a large amount of volume and liquidity.

IQ are also open about working with liquidity providers. So if they find themselves exposed to market risks beyond what they are comfortable with, they will offset some of that risk with an external partner. Full details of this arrangement are available at their website.

How do they make money?

The firm make money by balancing trader sentiment (buyers and sellers) and taking counter party risk on each trade. Where there is a significant imbalance in trades, IQ Option will reduce their exposure by offsetting risk with a market maker.

Top 3 IQ Option Alternatives

These brokers are the most similar to IQ Option:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

IQ Option Feature Comparison

| IQ Option | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 4 | 4.9 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $10 | $100 | $0 | $0 |

| Minimum Trade | 0.001 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | 1:500 | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 69% of retail CFD accounts lose money. |

|||

| Review | IQ Option Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| IQ Option | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | Yes | No | No |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

IQ Option vs Other Brokers

Compare IQ Option with any other broker by selecting the other broker below.

Popular IQ Option comparisons: