Best MoneyGram Brokers 2026

MoneyGram is a popular and long-running transfer company that allows users to send and receive money internationally, both online and from in-store locations. This guide will cover how UK investors can use MoneyGram to fund their online trading accounts and provide a rundown of fees and transaction times. It will also go over the pros and cons of this payment method for trading and lists the best brokers that accept MoneyGram deposits.

MoneyGram Brokers

Safety Comparison

Compare how safe the Best MoneyGram Brokers 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|

Payments Comparison

Compare which popular payment methods the Best MoneyGram Brokers 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|

Mobile Trading Comparison

How good are the Best MoneyGram Brokers 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|

Beginners Comparison

Are the Best MoneyGram Brokers 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|

Advanced Trading Comparison

Do the Best MoneyGram Brokers 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best MoneyGram Brokers 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|

How MoneyGram Works

MoneyGram International is a financial services company that was founded in 1940 as Travelers Express. In 1998, the company was acquired by Viad Corp and renamed MoneyGram Payment Systems, Inc. In 2004, it became a standalone public company and was renamed MoneyGram International, Inc. and 10 years later became the world’s second-largest service for transferring money. It now has a network of agents that operate in more than 200 countries, making it convenient for traders to transfer funds to MoneyGram brokers internationally or domestically in the UK.

The solution offers a variety of services, including online money transfers and in-person cash transfers, making it a popular choice for traders who need to transfer capital quickly and securely into their trading accounts. Moreover, thanks to the popularity of this established transfer system, there are a number of highly rated UK brokers that accept MoneyGram deposits.

Trading Times

The time it takes for deposits to be made depends on a variety of factors. These include the location of the broker, the payment method used, and the brokerage itself. In general, online or app-based transfers tend to be faster than in-person transfers.

Here are some typical estimates for how long it can take for a MoneyGram trading deposit to be completed in the UK:

- Online or app-based transfers: These can be completed in a few minutes once the sender has initiated the transfer and paid for it.

- In-person cash transfers: These are like online payments – once the payment has been initiated and paid for, it can be completed in a few minutes.

- Bank account transfers: These can take longer as they may need to be processed through the banks involved, so the exact time frame will depend on the policies of the banks.

Additionally, when you initiate a transfer through MoneyGram, whether you are making a deposit into your trading account or the broker is transferring your profits to you, the sender will be provided with a reference number or confirmation code. You can use this number to track the progress of your payment and get updates on its status.

Go to the MoneyGram website or app and enter the reference number or confirmation code. Alternatively, you can contact customer service or visit an official location and provide the reference number or confirmation code to an agent if you do not wish to use the online tracking service. If you are requesting a withdrawal, you can ask MoneyGram brokers to provide you with the reference number so you can track the transaction.

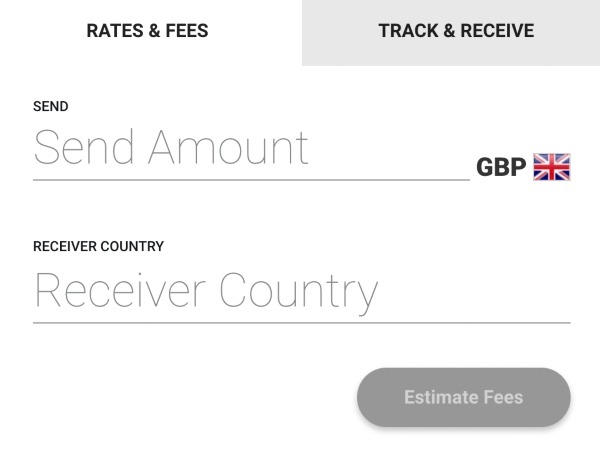

Payment Fees

The fees for making a MoneyGram transaction depend on the location you are sending the money from, the location where the broker is based, the amount of money being sent, and the method you are using to pay for the transfer. Payments within the UK are cheaper than international payments. Additionally, payments made for cash pickup will cost from £1.99-£3.99, but payments to a bank are free for transfers up to £1,000. MoneyGram brokers do not typically accept cash-pickup transfers.

You can calculate the fees for your specific transaction on the MoneyGram website. You may also be subject to currency conversion fees if the broker receiving the money is not based in the UK or does not accept GBP as a base currency. MoneyGram also adds a margin rate for payments requiring currency conversions. This is a fee on top of the mid-market exchange rate. The margin depends on the country the broker is based in. For example, if you wish to deposit to a MoneyGram broker in New Zealand, the margin will be 3.1%.

Brokers that accept MoneyGram deposits may also implement their own fees for payments. However, the most popular MoneyGram brokers in the UK do not charge any transfer fees.

Security

MoneyGram is licensed to operate in the United Kingdom, the United States, Canada, Australia, and many others. In the UK, the company is authorised and regulated by the Financial Conduct Authority (FCA). The FCA is the UK’s financial regulatory body and is responsible for overseeing the financial services industry in the country. MoneyGram’s FCA license number is 900599.

The payment provider uses various security measures including encryption of sensitive data, secure servers, high-tech online logins, and compliance with industry security standards such as the Payment Card Industry Data Security Standard (PCI DSS). These are to protect the information of its customers and to ensure the safety of its financial transactions, so traders’ funds and transactions are safe. MoneyGram also has fraud prevention systems in place to detect and prevent unauthorised activity and a team of security agents who work to monitor and protect against potential security threats.

One danger for online traders is scam MoneyGram brokers, who attempt to lure in investors to either enter their sensitive personal information or directly make deposits. Fortunately, the payment provider allows you to request a refund if you have deposited into the account of a scam firm. This can be requested by contacting customer service and providing supporting documentation as proof of fraud.

If there has been any suspicious activity on your trading account, MoneyGram has various channels for UK customers to contact customer support, including a phone number, an online request form, as well as a live chat function on their website. If you think fraud or a hack has taken place, you may also need to contact your MoneyGram broker.

Traders can follow extra security measures to ensure their personal information is protected to the greatest degree possible. These include creating strong passwords, two-step verification and not sharing personal or financial information with unknown parties.

Note, for any issues with your trading deposits or withdrawals, you can also contact your broker’s customer support team. The best trading firms offer customer service via email and telephone numbers.

Pros Of MoneyGram For UK Traders

There are several potential advantages to brokers that accept MoneyGram deposits:

- Speed: MoneyGram is a fast and convenient way to send money, and it can be a useful option for funding a brokerage account if you need to transfer capital quickly.

- Availability: MoneyGram has more than 8,000 partners in the UK, so it is easy to find a location where you can send or receive money, whether you’re in London or Aberdeen.

- Flexibility: The brand allows you to send money online or in person at an agent location, giving you the flexibility to choose the method that works best for you.

- Security: MoneyGram uses various security measures to protect your personal and financial information and prevent fraud.

- Ease of use: The deposit solution is easy to use and does not require you to open a new account or link your bank account. You can simply visit an agent location, provide your identification and the recipient’s information, and send the money.

Cons Of MoneyGram For UK Traders

There are a few potential disadvantages to using MoneyGram to fund your trading account:

- Sending limits: The payment provider may have maximum limits on the amount of capital that you can send in a single transfer or within a certain period, for example, £7,600 per transaction in the UK. This could make it difficult to fund your brokerage account with a large amount of trading funds.

- Availability amongst brokers: There are not that many brokers that accept MoneyGram deposits vs alternative payment methods.

How To Make Trading Deposits & Withdrawals Using MoneyGram

To make a payment you will first need to log in to MoneyGram brokers. To make sure brokers accept MoneyGram deposits, look for the firm’s red and black logo. Navigate the brokers’ client portal to make a deposit and press the option to pay via MoneyGram.

The brokerage will provide you with the necessary information for the transaction, including the name and location, as well as any specific instructions or requirements. Following this, there are three ways to make a deposit to MoneyGram brokers:

In-Store

You can send money to brokers that accept MoneyGram deposits from an in-store location if you aren’t well-versed in online payments.

- Go to a MoneyGram location and initiate a money transfer using the information provided by your trading platform. You will need to provide your own name plus contact information, as well as the amount of money you want to transfer.

- Pay for the transfer using the desired payment method, such as cash, debit or credit card, or a bank account transfer.

- Once the transfer has been completed, your trading platform will receive the funds and will credit them to your account.

It’s important to carefully follow the instructions provided by your trading platform to ensure that your deposit is successful. If you have any questions, you should contact your trading platform or MoneyGram for assistance.

Online

You can also make payments into your trading account via MoneyGram Online (visit the MoneyGram website) or through the mobile app.

- Make a MoneyGram account and sign in

- Select the “Send Money” option and enter the name and location provided by your broker

- Choose the amount of money you want to send and the desired currency

- Select your payment method – bank account transfer, debit or credit card, or PayPal account

- Review and confirm the details of your money transfer

- Enter your contact and billing information, as well as any additional information required

- Pay for the transfer using your chosen payment method

After you have completed the money transfer, MoneyGram brokers will be notified and will need to accept the payment to receive the funds.

Should Traders Use MoneyGram?

Using a MoneyGram order to fund your trading account can be a fast and convenient option, with wide availability of agents worldwide and within the UK, so the service has a wide reach. Although the payment solution is not accepted by that many UK brokers, its £7,600 limit per transaction and fee-free bank-to-bank transfers make it a good choice for traders.

Head to our list of the top brokers that accept MoneyGram deposits to start trading.

FAQs

Can I Use MoneyGram To Fund My Trading Account?

MoneyGram is a global transfer company that allows traders to deposit and withdraw funds quickly and securely from their trading accounts. The most popular way to do so is through online or an app-based transfer. Our experts have ranked the best MoneyGram brokers.

Are There Fees For Using MoneyGram To Fund My Trading Account?

Yes, MoneyGram charges fees for its transfer services. The exact amount of the fee will depend on the amount of money being sent, the destination country of MoneyGram brokers, and the method of payment (credit or debit card, cash, or bank transfer). Fortunately, a free fee calculator is available on the official website.

Is MoneyGram Safe To Use For Online Trading?

MoneyGram is a safe and trusted financial service. It uses encryption of personal and financial information, high-tech servers and firewalls, and secure sockets layer (SSL) technology to protect online transactions. MoneyGram also has anti-fraud systems in place to detect and prevent unauthorised activity. In addition, the company is regulated by the FCA in the UK.

How Do I Use MoneyGram To Fund My Trading Account?

To use MoneyGram to fund your trading account, you will need to visit an agent location, go online, or complete the app download to send the capital to your broker. You will need to provide your identification and the recipient’s information, as well as the amount of money you want to send. Brokers that accept MoneyGram deposits will then receive the funds and apply them to your trading account.

Can I Request A Refund From MoneyGram If I Fund My Trading Account In Error?

You may be able to request a refund from MoneyGram if you fund your trading account in error. If the transfer has not yet been picked up by the broker, you may be able to cancel the transfer and request a refund by contacting MoneyGram customer service and providing the reference number for the transfer. If the money transfer has already been taken by the broker, it may not be possible to cancel the transfer and request a refund. In this case, you may be able to request a refund if you have been the victim of fraud. You will need to contact customer services and provide proof of fraud.