FXChoice Review 2024

|

|

FXChoice is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to FXChoice |

| FXChoice Facts & Figures |

|---|

FXChoice is a Belize-based broker established in 2010 and registered with the Financial Services Commission (FSC). The brand offers a wide selection of markets including crypto, plus the familiar MT4 and MT5 platforms. FXChoice stands out for its extra tools and perks, from LearnFx EAs to a VPS and Myfxbook's AutoTrade. New users can also claim a welcome bonus upon sign-up. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Indices, Commodities, Cryptocurrencies, Shares |

| Bonus | 50% Welcome Deposit Bonus |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Trading App |

MT4 and MT5 apps are available to download form the Apple and Google Play stores. Both applications offers one-click trading, advanced charts and graphs, built-in support, plus instant and pending order types. MT4 is best suited to forex beginners while MT5 will meet the needs of experienced FX traders. |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes - MQL5 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | FXChoice offers highly leveraged CFD products on a breadth of financial markets, including shares, indices, commodities and crypto. FXChoice provides more supporting tools than many alternatives, including signals, auto trading, a VPS, and a research center. |

| Leverage | 1:200 |

| FTSE Spread | From $18.53 |

| GBPUSD Spread | From $8 |

| Oil Spread | From $40 |

| Stocks Spread | Variable |

| Forex | Trade 36 forex pairs, including the EUR/USD with spreads from zero pips. FXChoice offers higher leverage on forex than most competitors, alongside 24/5 support and an accessible $10 starting deposit. |

| GBPUSD Spread | From $8 |

| EURUSD Spread | From $5 |

| GBPEUR Spread | From $6.95 |

| Assets | 36 |

| Stocks | Buy or sell 50+ stocks with low margin rates and competitive pricing. Get exposure to US, UK and European exchanges. FXChoice also offers leverage up to 1:200 on equities, more than most competitors. |

| Cryptocurrency | FXChoice offers trading on leading crypto cross pairs with the US Dollar. The selection of digital assets is narrow but spreads are tight starting at 0.15. |

| Coins |

|

| Spreads | 0.11 - 3.0 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | Yes |

FXChoice is an international forex and CFD broker that boasts the popular MetaTrader 4 and MetaTrader 5 trading platforms. The firm offers Classic STP and Pro ECN account types, catering to low-spread and zero-commission investors alike. This 2024 FXChoice broker review explores crucial aspects of the service, such as minimum deposit and withdrawal amounts, demo account support, trading fees, commissions and whether the company is regulated. Is FXChoice a good broker for you? Read on to find out.

About FXChoice

FXChoice was created in 2008 and has been operating worldwide from its headquarters in Belize for over a decade. While this is the only stated location, the company consists of a global team of experienced industry professionals and has won multiple awards for its outstanding support service.

Despite primarily functioning as an STP broker, its forex and CFD markets are also available through a low spread ECN account. Moreover, FXChoice is regulated by the Belize FSC and has strong support for crypto deposits and withdrawals, even offering a bitcoin currency account.

Markets

FXChoice provides a range of speculative markets, including forex and crypto CFDs, though there is no provision for directly investing in equities.

Forex

A total of 36 currency pairs are provided in spot market form. Though major, minor and exotic currency pairs are all represented, including USD/TRY, there are fewer total pairs than some competitors: traders that focus on exotics may want to look elsewhere.

The minimum trade size for forex markets is 0.01 lots and ECN spreads start from 0.0 pips on EUR/USD. However, spreads are variable and typical values are around 0.6 pips for the more liquid markets.

Index CFDs

FXChoice users can use indices to speculate on the overall movement of several regional markets and sectors spanning the United States, the UK, Germany and Japan. Clients can trade CFDs on US index futures like the Dow Jones (US30), S&P 500 and NASDAQ 100 e-mini markets or spot indices in the UK FTSE 100, German DAX 40 or Japanese Nikkei 225. However, as with the forex offerings, frequent index speculators may be disappointed by the limited range of markets provided by FXChoice.

Typical spreads start at 0.9 pips on the DAX and the fee structure for both accounts is the same, with Classi and Pro clients paying higher spreads in exchange for lower commissions.

Stock CFDs

Over 50 shares CFDs are available with FXChoice, including top stocks from the UK, US and two leading European exchanges. Leading tech, energy and pharmaceutical equities provide exposure to global trends, while stocks from France and Germany offer nuanced trading opportunities.

As with indices, both the Classic and Pro account types are subject to STP pricing and execution, with typical spreads starting at around 1.4 pips.

Commodity CFDs

FXChoice offers six commodity instruments, including gold and silver spot markets and both WTI and Brent Crude oil spot and futures assets.

Typical spreads on gold start at 0.3 pips through the Pro ECN account and the Brent oil futures market also starts at 0.3 pips through STP execution.

Crypto CFDs

The fact that FXChoice offers crypto CFDs to UK clients will appeal to many, as FCA regulated brokers cannot sell crypto derivatives to UK residents. The broker supports Bitcoin (BTC), Litecoin (LTC) and Ethereum (ETH) CFDs.

Bitcoin typical spreads start at 4,700 pips, while Ethereum and Litecoin spreads are 630 pips and 38 pips, respectively.

Leverage

FXChoice facilitates leverage rates of up to 1:200 for its forex and precious metals commodities instruments. Index assets support 1:50 margin levels, while fuel commodities and Bitcoin CFDs are available with up to 1:33 leverage. Maximum margin levels stand at 1:10 for Ethereum and Litecoin and clients can trade stock CFDs with up to 1:5 leverage.

Many non-FCA regulated brokers offer leverage rates of 1:500 or greater on selected assets, so FXChoice may not be the best platform for high margin traders.

Account Types

FXChoice provides two main account types: Classic and Pro. These accounts differ in spreads, commissions and available trading platforms.

The Classic account utilises an STP execution method for zero commission trading, while minimum spreads start at 0.5 pips. Leverage of up to 1:200 is supplemented by margin call and stop out levels of 25% and 15%, respectively. This account is only available on the MT4 trading platform and there is an initial minimum deposit of £100.

The Pro account favours the ECN execution method, which offers tighter spreads that start from 0.0 pips in exchange for zero commission fees. As with the Classic account, maximum leverage stands at 1:200, the initial minimum deposit is £100 and margin call and stop out levels are 25% and 15%. However, this account is available on both the MT4 and MT5 trading platforms.

Both accounts allow hedging and offer full expert advisor (EA) support through the MetaTrader platforms.

Islamic Account

FXChoice offers a swap-free Islamic account for traders that cannot pay or receive swap fees due to their religious beliefs. This variant is available for both the Classic and Pro accounts.

Demo Account

A demo account is a great way to practise trading strategies and try new indicators or EAs risk-free. The broker allows clients to open a demo account for paper trading using either Classic or Pro account types.

Trading Platforms

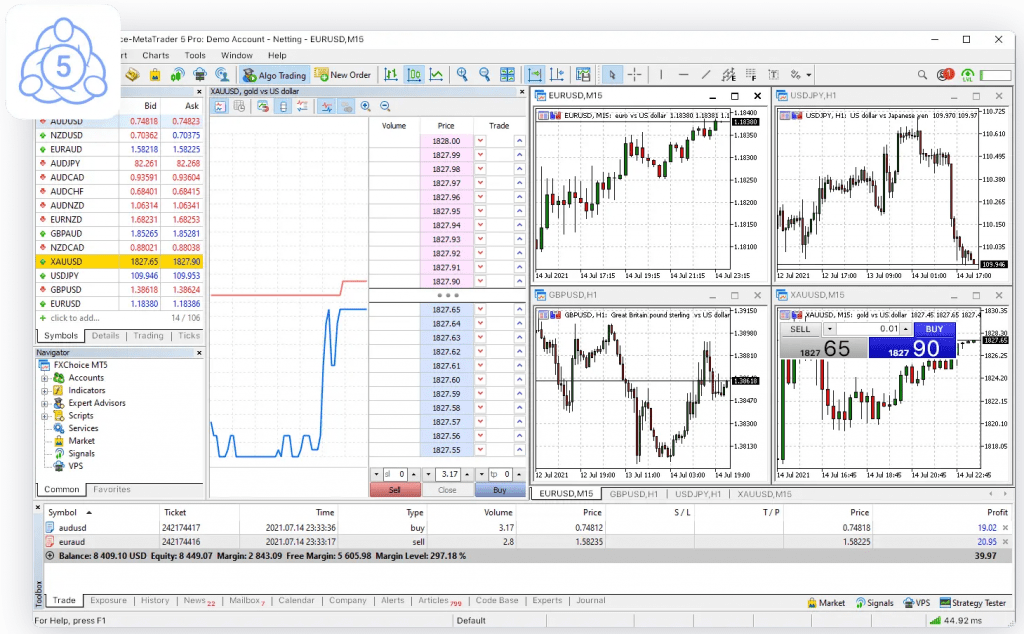

While some brokers will offer proprietary platforms built on the TradingView terminal architecture, two third-party trading platforms are supported by FXChoice. These are the industry regulars MetaTrader 4 and MetaTrader 5 platforms from MetaQuotes.

MetaTrader 4 has been the most popular trading platform in the forex and CFD space for over 15 years, offering investors free access to advanced features such as programmable expert advisors, custom indicators and copy trading support. These attributes combine with solid in-built charting and technical analysis tools in a workload-light program that can run on numerous systems.

MetaTrader 5 builds upon the success of MT4 and adds new instrument and market support, an updated MLQ5 programming language and more standard timeframes and technical analysis tools. As with MT4, custom EAs are available from the populated marketplace and experienced programmers can build their own through the open API.

MetaTrader 5

Both the MT4 and MT5 platforms are available to download on Mac, PC and Linux as independent software or can be accessed on the browser-based WebTrader terminal.

Mobile Apps

Both the MT4 and MT5 platforms have mobile app variants for iPhone (iOS) and Android devices. Application download allows users to enjoy many of the order and charting functions available on the desktop platforms in an on-the-go format.

FXChoice clients should download apps directly from the official app store for their device rather than in a potentially unsafe APK format online.

Fees & Commissions

FXChoice is both an STP and an ECN broker, which means that investors have the opportunity to pay commissions in exchange for raw spreads.

Commissions are slightly higher than some, with clients paying $3.50 per lot per side on eligible markets. However, higher volume traders can see this level reduced to as low as $1.50 per lot per side through the Pips+ loyalty program (more on this later).

Infrequent traders will be pleased to learn that there are no inactivity fees on any account. Swap fees for overnight positions are calculated individually and displayed on the broker’s website.

Payment Fees

Deposit and withdrawal fees can often be a significant factor when choosing a broker.

To this end, FXChoice does not excel in either transparency or fee structure. The only wholly fee-free GBP deposit and withdrawal method for UK clients is ePay, with all other options subject to wallet or network fees.

However, the broker does not state the exact fees for other methods, with clients needing to open an account and receive a quote from their “back-office” account area. While the firm does not charge for Bitcoin withdrawal or other crypto transfers, blockchain networks are often subject to substantial fees.

Payment Methods

There are several deposit and withdrawal options available to fund an FXChoice account.

An area in which the broker excels is its crypto payment options. Nine tokens are accepted as payment methods, including Bitcoin, Ethereum and Ripple (XRP). Bitcoin deposits and the other supported tokens receive a 15% bonus from the broker. Withdrawal times for crypto tokens vary as transactions can take between 1-3 working days to process before the payment is initiated.

Several traditional payment methods and e-payment solutions are also available to UK traders, such as Visa, Mastercard, ePay, Skrill and Neteller. However, clients can only use Skrill, Neteller and ePay to make withdrawals that exceed previous deposits.

After an initial minimum deposit of £100, no further limits are implemented.

Security & Regulation

Prospective clients of any broker often look for strong regulation as a sign of legitimacy and trustworthiness. However, while FXChoice is regulated by the Belize FSC, this is not by a top-tier body like the FCA or ASIC and does not provide such stringent protection to investors.

While its regulation is not as robust as some may like, the broker takes several measures to enhance user security in terms of information and funds. Client funds are held in segregated accounts, while the platform is protected by top-level encryption. Furthermore, MT4 and MT5 login is made through separate details to the main FXChoice account, adding another layer of protection.

Unfortunately, two-factor authentication (2FA) using a service such as Google Authenticator is not supported.

Customer Support

A responsive and experienced help team can help ensure your investing experience goes smoothly. Whether you are struggling with a withdrawal problem, are unsure how to deposit crypto or want to reset your demo account, FXChoice provides several options for answering queries or resolving issues.

The first of these is the dedicated help and FAQ section, where users can access information on the back office area, MetaTrader 4 and 5 platforms, the Pips+ loyalty program and leverage.

If you need personalised support, you can fill out a support ticket to receive an email reply, call the support phone number or contact the live chat via the main website. The award-winning support team aims to reply to email queries within one working day, while the live chat runs 24/5.

- Phone Number: +52 556 826 8868

Educational Content

FXChoice provides a dedicated educational content section called FXEducation, complete with a glossary and guides on trading basics. Beginners can use these resources alongside the free demo account to balance hands-on experience with fundamental knowledge.

Some information on the intricacies of the MT4 and MT5 trading platforms is also provided, though those looking to learn advanced speculation techniques may be better off using a dedicated education platform.

Promotions

Promotions and bonuses are used by many brokers to entice new users to their platforms and to encourage frequent deposits and speculation. FXChoice offers several such schemes, including a welcome bonus for new clients, a fee rebate scheme and a free VPS service.

High value and volume traders can receive rebates and reduced commissions on trades through the FXChoice Pips+ programme. This scheme facilitates both Classic and Pro account holders and has five tiers based on 30-day trading volume or account equity. Rebates reach up to $20 per $1m traded, while commissions are slashed to $1.50 per lot per side at the highest tier.

A free VPS is also offered to clients that maintain a balance of over $3,000 and trade more than five lots per month. A VPS works with expert advisors to take advantage of trading opportunities around the clock. A Europe-based server location and 500 GB monthly bandwidth allowance should fit the needs of most clients.

Deposit Bonuses

FXChoice offers a 15% deposit bonus when clients fund their wallets using crypto tokens. While this seems like a great and repeatable perk, the deposit bonus is delivered in the form of bonus credits that are subject to high wagering requirements. Additionally, the full deposit is locked in and not eligible for withdrawal until the wagering terms are fully met. Therefore, clients may want to carefully consider these stipulations before claiming the bonus for a Bitcoin deposit.

Similarly, new clients are eligible for a 50% welcome bonus on their first deposit. After that, they receive a 25% initial deposit bonus and another 25% bonus on subsequent deposits after account verification is complete. This offer has the same wagering terms as the crypto deposit bonus, so decide if the additional funds are worth the withdrawal restrictions.

Additional Features

As well as its standard brokerage service, FXChoice provides several additional features to enhance clients’ trading experiences. The first of these is copy trading support via ZuluTrade, which allows users to emulate the positions of top traders directly in exchange for a commission on profits.

Experienced traders can sign up for the multi-account management (MAM) service, allowing users to manage funds on behalf of other clients in exchange for a performance-based incentive fee.

While there is no website-based economic calendar, the MT5 platform integrates this service along with MQL5 signals support. The FXChoice website does, however, feature a pip calculator that allows traders to preview their potential profit and loss for a specific position.

Advantages

- Copy trading

- Crypto trading

- Demo accounts

- Crypto deposits

- MT4 & MT5 access

- Educational content

- ECN & STP execution

- Several bonus schemes

Disadvantages

- No equities

- Weak regulation

- Unclear transaction fees

- Limited payment methods

Trading Hours

FXChoice follows standard forex and CFD market hours, supporting new positions and account management 24/5. However, some indices and stock CFDs are limited to local exchange hours. Moreover, while crypto markets run 24/7, the broker’s blockchain-based CFDs are only available during the week.

Account and wallet management, including deposits and withdrawals, is facilitated around the clock, irrespective of your location.

FXChoice Verdict

Overall, FXChoice is a solid broker with key strengths being crypto support, bonus schemes and a range of trade execution options. UK clients can access crypto CFDs and leverage rates higher than FCA regulated alternatives, while fees and spreads are fairly competitive. While this broker review is positive overall, the platform is let down by weak regulation, a limited range of assets and a lack of fee-free fiat deposit and withdrawal methods.

FAQ

Which Trading Platforms Does FXChoice Support?

FXChoice supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are available to download on Windows, Mac, Linux and mobile platforms.

Is FXChoice A Regulated Broker?

FXChoice is regulated by the Belize FSC, which provides legal and financial protection to clients. However, this is limited compared to top tier bodies such as the UK FCA and Australian regulator ASIC.

Does FXChoice Offer Binary Options?

No, FXChoice does not deal in binary options. The broker offers a variety of instruments on forex and CFDs.

Is FXChoice A US Broker?

FXChoice is not a US broker, its headquarters is based in Belize. Moreover, FXChoice is not open to US clients.

Is FXChoice An ECN Broker?

FXChoice offers both ECN and STP execution styles, through its Classic and Pro account types.

Top 3 FXChoice Alternatives

These brokers are the most similar to FXChoice:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 6400+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

FXChoice Feature Comparison

| FXChoice | IG Index | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 4.1 | 4.7 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $100 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, CySEC, KNF, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | 50% Welcome Deposit Bonus | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | - | MT4 |

| Leverage | 1:200 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

69% of retail CFD accounts lose money. |

||

| Review | FXChoice Review |

IG Index Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| FXChoice | IG Index | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

FXChoice vs Other Brokers

Compare FXChoice with any other broker by selecting the other broker below.

Popular FXChoice comparisons: