CharterPrime Review 2024

|

|

CharterPrime is #97 in our rankings of CFD brokers. |

| CharterPrime Facts & Figures |

|---|

Charterprime is an STP/ECN forex and CFD broker established in 2012. Headquartered in Sydney, Australia, the firm offers 50+ forex, commodities and indices on the MetaTrader 4 (MT4) platform. Traders can access 3 account types with variable spreads and leverage up to 1:500. The broker is regulated by the ASIC and is registered offshore in Saint Vincent and the Grenadines. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Commodities, Metals |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Alongside forex and indices, I also found a small selection of metals and energies tradable via CFDs with leverage up to 1:500. The MT4 is an excellent, feature-rich environment for trading CFDs, though I do wish that the broker offered more additional tools and market analysis resources. |

| Leverage | 1:500 (Location Dependent) |

| FTSE Spread | Variable |

| GBPUSD Spread | From 2.0 |

| Oil Spread | Variable |

| Stocks Spread | NA |

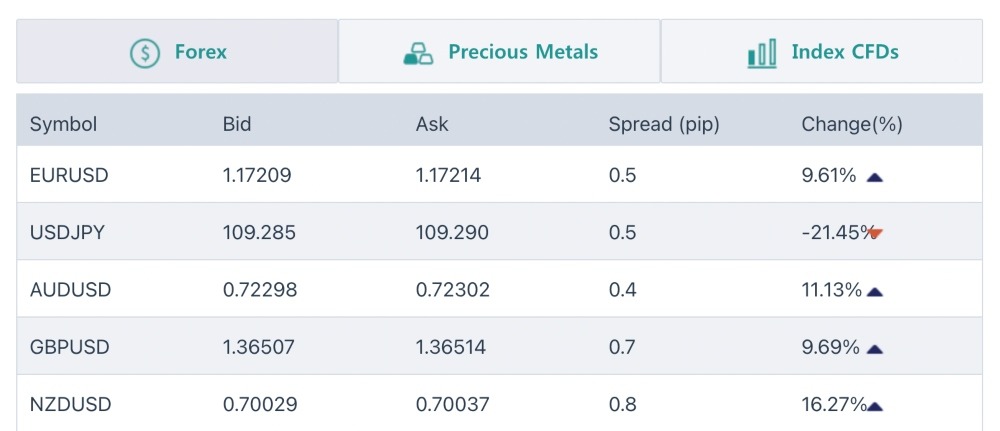

| Forex | I found 45 currency pairs available at Charterprime, which is an OK range but not the biggest I’ve seen. Spreads are the most competitive in the ECN account, averaging around 0.5 pips. It’s good to see that you would only need to deposit $100 to access these prices, though they aren’t the lowest in the market. |

| GBPUSD Spread | From 2.0 |

| EURUSD Spread | From 1.7 |

| GBPEUR Spread | From 1.5 |

| Assets | 45+ |

| Stocks | I think it’s a shame that Charterprime only offers Index CFDs, with no stocks available. That said, the range of 15 indices is higher than some competitors and includes interesting opportunities like the China H-Shares and Dutch 25 Indexes. |

Charterprime is a forex and CFD broker, supporting currency pairs, commodities and indices via the powerful MetaTrader 4 platform. UK clients can access ECN pricing and zero-commission trading via three accounts. This review uncovers the key account features, plus fees, funding options, markets and more. Our experts also conclude whether Charterprime is a good choice for UK traders.

Our Take

- Charterprime is best for scalpers and pro traders with an ECN account and VPS subscription

- The lack of educational resources and market analysis compared to other brokers is disappointing

- The absence of FCA oversight and GBP accounts for UK traders is a major drawback

Market Access

While using Charterprime, we found a rather limited selection of assets compared to other brokers. The brand only supports the trading of 50+ instruments across forex, indices, and a small range of precious metals and energy commodities. With leading brokers offering assets in the hundreds or even thousands, including CMC Markets and IG Index, Charterprime struggles to compete.

We were also disappointed to see no stocks, so investors interested in share dealing will need to look elsewhere.

You can trade:

- Forex: 45 major, minor and exotic currency pairs

- Precious metals: gold, silver and platinum against the USD

- Indices: 15 indices including FTSE, Dow Jones and NASDAQ

- Energies: Brent Crude Oil and US Light Sweet Crude Oil available via spot trades

Account Types

Charterprime offers two accounts which vary by pricing model: Variable and ECN.

The minimum initial deposit for both accounts is £100, which is in line with top brands such as AvaTrade. With that said, this is not as competitive as XTB, for example, which allows you to sign up for free.

Our UK experts were disappointed to see that GBP was not accepted as a base currency for any account, with only USD, EUR and AUD available. This will make managing your trading activity less convenient and increases the chances of conversion fees.

In addition, we weren’t impressed with the overall lack of additional features to make the accounts stand out from competitors.

Variable

Best for casual traders

- Spreads: Floating from 1.7 pips

- Minimum trade: 0.01 lots

- Minimum Deposit: $100

- Leverage: Up to 1:500

- Commission: Zero

ECN

Best for high-volume traders

- Spreads: Raw ECN spreads from 0.0 pips

- Minimum trade: 0.01 lots

- Minimum deposit: $100

- Leverage: Up to 1:500

- Commission: $8/lot

We were happy to see that there is an Islamic swap-free account available for Muslim investors. However, the base currency is USD only for swap-free accounts and commissions are charged at $40 per lot every Wednesday.

How To Open An Account

I thought the registration process was intuitive and only took a few minutes.

- Open the application form

- Complete your personal information, career background and past trading experience

- Verify your email address

- Submit documentation showing proof of identity and address

- Wait for the customer support team to review and accept your application

Charterprime Fees

The Variable account uses a zero-commission pricing model on all trades. The tradeoff is that clients pay via the floating spreads which constantly change according to market volatility. You can expect minimum spreads of 1.7 pips, which doesn’t rival the cheapest brokers in the UK.

When testing the Variable account, I got spreads of 2 pips for EUR/USD and 1.7 pips for EUR/GBP, which are higher than the market average.

The Charterprime ECN account offers raw spreads from 0.0 pips but clients must pay a commission of $8 per standard lot. This is not as competitive as top brokers like Pepperstone ($3.50 per lot). With that said, this account may still suit those with short-term trading strategies.

Aside from the trading fees, there are also withdrawal charges for some payment methods, as well as swap fees, which are interest charges for overnight positions.

Funding Options

Deposits

We like that Charterprime supports several deposit methods. However, we were disappointed to see that none offer instant processing, unlike most other brokers.

Another major drawback is that debit and credit cards are not accepted, which is quite uncommon.

One upside is that there are no deposit fees for most methods:

- Skrill: Processed in 1 day, no fee

- Tether: Processed in 1 day, 1% fee

- Bitcoin: Processed in 1 day, no fee

- Neteller: Processed in 1 day, no fee

- UnionPay: Processed in 1 day, no fee

- Bank Wire Transfer: Processed in 3 – 5 business days, no fee (though you may be charged by your bank)

Note that Bitcoin and Tether deposits are only supported for clients that have their base account set to USD.

How To Make A Deposit

- Log in and go to the Members Area

- Under ‘Funding’, open the ‘Deposit’ tab

- Select the account to deposit funds to and the desired amount

- Choose your method

- Charterprime will then provide details on where to send the funds

Withdrawals

Charterprime offers the same withdrawal methods as deposits. All methods take at least 3 business days, which is in line with competitors.

On the downside, the minimum withdrawal limit of $100 for all methods, as well as the bank transfer fees, are both high compared to other brokers.

- Skrill: Processed in 3 days, 1% fee

- Tether: Processed in 3 days, no fee

- Bitcoin: Processed in 3 days, no fee

- UnionPay: Processed in 3 days, 0.5% or $5 fee

- Bank Wire Transfer: Processed in 3 – 5 days, $40 fee

- Neteller: Processed in 3 days, 2% fee up to a maximum of $30

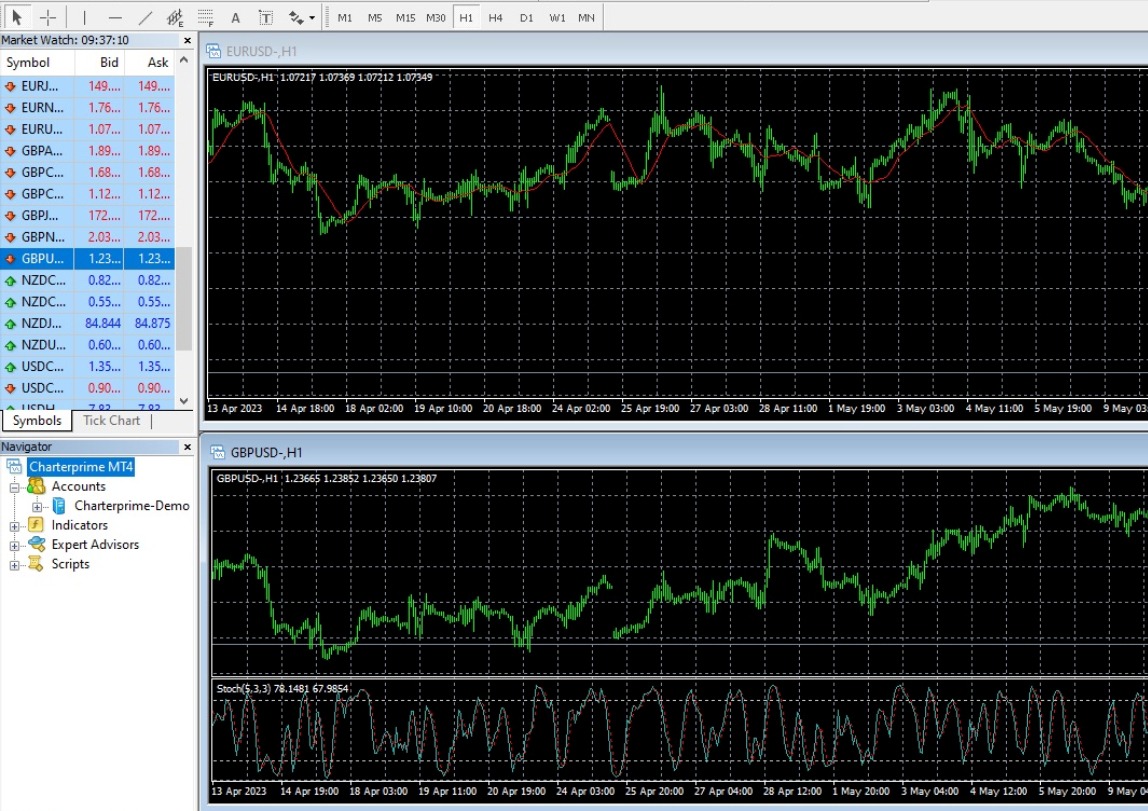

Trading Platform

Charterprime offers a single platform for all clients: MetaTrader 4 (MT4). I would have preferred a wider choice since many brokers also offer a proprietary solution alongside a third-party platform. Thankfully, the MT4 platform is an excellent all-rounder.

Created by software firm, MetaQuotes, MT4 offers a comprehensive suite of technical analysis tools, automated trading functionality and ease of use. Whether you’re a beginner or an experienced trader, the platform should tick most of your boxes.

I particularly rate the selection of 30+ built-in technical indicators, including trend indicators, oscillators, plus volatility and volume indicators. Charts are fully customisable and allow you to switch between 9 timeframes whilst conducting price analysis. Placing a trade is seamless, with one-click trading functionality and a range of order types to choose from.

I like that MT4 also includes an in-house marketplace with thousands of additional indicators and robots (EAs) for those conducting algorithmic strategies.

Charterprime offers MT4 as a downloadable desktop app, compatible with Windows and Mac PCs.

MetaTrader 4

How To Place A Trade

You shouldn’t have any issues placing a trade if you follow these steps:

- In the MT4 platform, click the ‘New Order’ button

- Find and select the desired asset

- Select a trade type from either market execution or a pending order

- Enter the trade volume

- If using stop loss and take profit orders, specify the strike prices

- If you are opening a market execution, click the buy or sell button to submit the order

- If you are opening a pending order, choose from buy limit, buy stop, sell limit or sell stop

- Specify the strike price for the pending order and an expiration time

- Confirm the order request

Mobile App

I was glad to see that the MT4 mobile app is also available.

The app is highly functional and allows me to seamlessly monitor positions and place trades whilst on the go. I was also able to easily access my account and portfolio, as well as all the key features found in the desktop version.

You can find download links for the MT4 app via the broker’s member area for both iOS and Android mobiles.

Leverage

As Charterprime is not licensed by a top-tier authority like the FCA, UK clients can access very high leverage. Rather than the maximum of 1:30 mandated in European jurisdictions, we found leverage limits up to 1:500.

Traders should be warned that increased exposure can lead to significant losses without proper risk management tools in place.

Note that minimum margin requirements vary depending on the market and asset that you are trading. For instance, platinum CFDs have a margin requirement of $10,000 per lot whereas for gold, this limit is only $500 per lot.

Additionally, the leverage for indices depends on the product. For the vast majority, the leverage is 1:100 whereas certain indices such as the Hong Kong 50 are capped at 1:20.

Demo Account

Whilst we liked that Charterprime offers a free demo account, we weren’t thrilled to see that it is limited to only 14 days. This is considerably less than many other forex and CFD brokers such as CMC Markets (with no demo expiry) and Pepperstone (with a 60-day expiry).

Aside from this, we appreciate that Charterprime aims to closely mirror the live trading experience with its demo account. For instance, clients have the choice of opening demos for the Variable, ECN and swap-free account types so they can compare the different pricing models.

Additionally, the demo solution offers flexible leverage up to 1:500 and clients can choose their starting balance up to $5,000,000.

How To Open A Charterprime Demo Account

- Follow the steps above to create a live account

- In the member’s area, click on the ‘MT4’ tab and navigate to the Demo Account section

- Click on ‘Create Account’

- Select the demo account type

- The login details will be sent to your email address

- Download the MT4 app and sign in

- Begin trading

Charterprime Regulation

Our experts were disappointed to see that Charterprime is not licensed by the UK’s Financial Conduct Authority. As a result, UK clients should take care when investing with this broker as they are not protected by the Financial Services Compensation Scheme. This measure allows clients to claim up to £85,000 in compensation if the broker enters insolvency.

Charterprime Limited is registered with St. Vincent and the Grenadines Financial Services Authority (FSA). Unfortunately, this offshore authority does not rigorously regulate forex brokers and therefore your funds may not be protected. On a lighter note, the Aussie entity is regulated by the Australian Securities & Investments Commission (ASIC).

To help with security, Charterprime supports the use of two-factor authentication (2FA). By using the Google Authenticator App, you can help to prevent anyone from accessing your account without your permission. To enable 2FA, go to the settings section in the members’ area.

Extra Tools & Features

Virtual Private Server (VPS)

Charterprime provides a virtual private server for its clients, which facilitates a 24/7 connection to markets with 99.99% uptime.

However, the service comes with two very expensive subscription models, aimed at professional traders only. The Ordinary VPS requires a minimum deposit of $10,000 and that users maintain a balance of at least $5,000 at all times. To pay for this service, there is a monthly $50 charge.

For the VIP VPS, the minimum deposit increases to $30,000 and the minimum maintenance balance is $20,000. If you meet these requirements, there are no additional fees, otherwise, you must pay $100 per month.

I was disappointed that there were few tools for new and intermediate traders, such as copy trading, signals or algo trading features. Such features can be found at top brokers like eToro and FXCM.

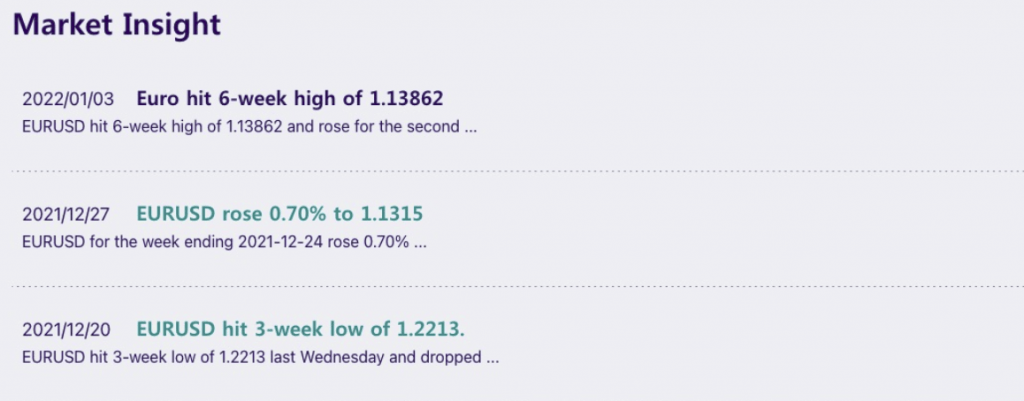

News & Market Insights

We did use the market analysis section where in-house experts provide insights and discuss important recent news. Yet while this service could be helpful, we were disappointed to see that neither the insights nor the news board were regularly updated. For instance, by mid 2023, the five most recent insights were from 2022 and 2021.

Market Insights

Economic Calendar

The broker also offers a free-to-access economic calendar. However it was not populated when we used Charterprime. Again, this is disappointing and further adds to the broker’s substandard services in comparison to most other brands.

Customer Service

Charterprime offers several basic contact methods, but we noticed that, disappointingly, a live chat feature is missing. This is uncommon among leading brokers since many traders expect convenient live chat support.

It’s also frustrating that the response time over email is painfully slow, and you can expect to wait more than a day. If you need urgent assistance, we recommend you speak to the team over the phone.

The customer support team is based in Sydney and, unfortunately for UK traders, is open between 1:00 am and 4:00 pm GMT from Monday until Friday.

- Telephone: +852 8175 6090

- Email: enquiry@charterprime.com

- Social Media: Facebook, Twitter, Instagram and LinkedIn

Promotional Schemes

In the past, Charterprime has hosted exhibitions and trading fairs in countries such as Thailand and the Philippines. These were in-person events where you could meet with other traders to discuss strategies and asset picks.

Unfortunately, there are currently no such promotions upcoming for UK clients. Additionally, there are no financial incentives such as a welcome bonus or no deposit bonus.

Charterprime Company Details

Charterprime Limited was launched in 2012 to provide a high-quality trading experience. Since its inception, the broker has grown and now has offices in Hong Kong and Kingstown, St. Vincent and the Grenadines in addition to the headquarters in Sydney, Australia.

The broker has won several awards in recent years. For instance, it won the Best Broker at the Traders Choice Awards in 2020 and the Best STP/ECN Broker at both the 2017 and 2018 Forex Expo. On the downside, these were years ago and we would like to have seen some more recent achievements.

Trading Hours

Charterprime clients can trade both forex and precious metals markets 24 hours a day, Monday to Friday.

For indices and spot commodities, the opening hours vary depending on the asset. For example, we could trade the FTSE 100 between midnight and 8:00 pm GMT whereas the Dow Jones can be traded from 10:00 pm until 9:00 pm the following day with a 15-minute break at 8:15 pm.

When you log into your account on Charterprime, there is a pop-up showing upcoming changes to typical trading hours. For example, national holidays.

Should You Invest With Charterprime?

We liked that Charterprime aims to support a range of experience levels and strategies with ECN spreads or zero commission accounts. Additionally, the opportunity to use MetaTrader 4 along with support for expert advisors could be attractive for some.

However, we cannot look past the lack of regulation, trading tools and research features, which we would expect from a good all-round broker. For these reasons, UK clients should consider alternatives.

FAQ

Does Charterprime Offer Free Withdrawals?

Charterprime supports withdrawals via bank wire transfer and UnionPay, which cost $40 or 0.5% respectively. You can also use Skrill, which charges a 1% fee or Neteller, which charges 2%. There is also the option of withdrawing via Bitcoin and Tether, both of which are free. For all withdrawal methods, you can expect to wait at least 3 days.

Does Charterprime Offer Accounts For Scalpers?

Charterprime offers an ECN account with tight spreads from 0.0 pips and a trading commission of $8 per lot. This account would be best for scalpers or high-frequency traders. There is also a Variable account, which offers wider floating spreads and no commissions. This will suit newer traders. Finally, there is a Swap Free account with wider spreads and a weekly $40 charge. This is best for Muslim traders.

Is Charterprime Trustworthy?

Charterprime Limited is registered with the Financial Services Authority of St Vincent and the Grenadines, which is not a top-tier financial. As such, UK traders are not protected by the stringent measures offered by the FCA, for example. The lack of UK authorisation also reduces the firm’s safety and trust rating.

What Can I Trade With Charterprime?

Charterprime supports leveraged trading in four asset classes. This includes 45 major, minor and exotic forex pairs, a small selection of precious metals and energy commodities, plus 15 indices including the FTSE 100 and DAX 30. Unfortunately, the breadth of assets is narrow compared to alternatives.

How Can I Speak To Charterprime?

If you require assistance, you can contact the Charterprime support desk over the phone by calling +852 8175 6090. You can also email enquiry@charterprime.com, however, response times are slow. Unfortunately, the broker does not offer a live chat service.

Article Sources

Compare CharterPrime with Other Brokers

These brokers are the most similar to CharterPrime:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

CharterPrime Feature Comparison

| CharterPrime | Pepperstone | FP Markets | INFINOX | |

|---|---|---|---|---|

| Rating | 2.8 | 4.8 | 4 | 3.4 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $100 | $0 | $40 | £1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, SVGFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA | FCA, SCB, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 (Location Dependent) | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 (UK), 1:200 (Global) |

| Visit | ||||

| Review | CharterPrime Review |

Pepperstone Review |

FP Markets Review |

INFINOX Review |

Trading Instruments Comparison

| CharterPrime | Pepperstone | FP Markets | INFINOX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

CharterPrime vs Other Brokers

Compare CharterPrime with any other broker by selecting the other broker below.

Popular CharterPrime comparisons: