Capital Street FX Review 2024

|

|

Capital Street FX is #97 in our rankings of CFD brokers. |

| Capital Street FX Facts & Figures |

|---|

Founded in 2008, Capital Street FX is a forex and CFD broker offering 1000+ instruments on the ActTrader platform. The broker offers 4 STP/ECN account types starting from $100 with fixed or variable spreads. Capital Street FX is an offshore broker and is regulated by the Mauritius FSC. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Bonds, ETFs |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSC Mauritius |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Capital Street FX offers over 1000 CFD spanning forex, indices, stocks, cryptocurrencies and commodities, which is a fairly good line-up compared to some other brands. However, I’m concerned that leverage rates are unnecessarily high in the standard retail accounts, reaching up to 1:3500. |

| Leverage | 1:3500 |

| FTSE Spread | From 2.5 Pips (Basic) |

| GBPUSD Spread | From 2.5 Pips (Basic) |

| Oil Spread | From 2.5 Pips (Basic) |

| Stocks Spread | From 2.5 Pips (Basic) |

| Forex | I was pleased to see a decent range of 70+ currency pairs at Capital Street FX. With that said, I’m disappointed that only VIP account holders can access the tightest forex spreads (from 0.1 pips) with a hefty minimum deposit of $10,000. |

| GBPUSD Spread | From 2.5 Pips (Basic) |

| EURUSD Spread | From 2.5 Pips (Basic) |

| GBPEUR Spread | From 2.5 Pips (Basic) |

| Assets | 70+ |

| Currency Indices |

|

| Stocks | My tests uncovered an average range of US, EU and UK shares with commissions from 0.1%. Whilst the range of products is decent, I think dedicated stock traders may feel restricted by the lack of analysis tools and charting features in the ActTrader platform. |

| Cryptocurrency | I found 14 cryptocurrency products at Capital Street FX, including the market leaders Bitcoin, Ethereum, Ripple and Dogecoin. This isn’t the widest range of tokens, though it should be enough for newcomers to explore the market. I’m pleased to see that the broker also offers a risk-free demo account so you can test out your strategies before committing. |

| Coins |

|

| Spreads | From 2.5 Pips (Basic) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Capital Street FX is an online broker that provides access to multiple asset classes. The firm offers over 1,000 CFDs, as well as an advanced trading platform and helpful customer support. This review of Capital Street FX will delve into the broker’s trading tools, typical fees, educational resources and safety ratings. We also share our verdict after using Capital Street FX.

Capital Street FX is an offshore CFD broker with a wide range of instruments but a poor fee structure. Our team noted that some trading costs are fairly high while withdrawals incur a charge. UK traders should also bear in mind that the brokerage isn’t regulated in the UK. In addition, integration with MetaTrader 4 is needed to improve its broker ranking.

Market Access

We rated the selection of assets available at Capital Street FX. In total, there are more than 1000 spanning seven asset classes. With that said, the selection of stocks is focused on the US market.

CFDs are the main trading vehicle, allowing investors to speculate on price movements without owning the underlying asset. The advantage of CFDs is that you can bet on rising and falling prices with leverage.

- 21 ETFs

- 14 Cryptos, including Bitcoin and Ethereum

- 50+ Forex Pairs, including EUR/USD and EUR/GBP

- 80+ Stocks, including blue chips like Apple, Amazon and Tesla

- 21 Index Futures, including the FTSE, Nasdaq and S&P 500

- 5 Bonds, including US Treasury Notes and Japanese Government Bonds

- 17 Commodities, including five energies, five metals and seven agricultural products

Currency options are also available.

Account Types

Capital Street FX offers a good selection of trading accounts, meaning clients of different abilities with various strategies can find a pricing model that works for them.

Importantly, Capital Street FX is a non-dealing desk (NDD) broker. Its accounts all use STP apart from the VIP account, which has ECN execution. The VIP, as a result, has particularly fast execution speeds, although average execution speeds on the other accounts are still quick at just 0.1 seconds.

The Cent and Basic accounts are the most accessible – we recommend beginners start with one of these, particularly as they still provide access to all instruments at zero commission.

Basic

- All instruments

- £100 minimum deposit

- Average spread on EUR/USD of 1.5 pips

- No commission on forex, commodities, stocks and cryptos

Cent

- All instruments

- £50 minimum deposit

- Average spread on EUR/USD of 1.6 pips

- No commission on forex, commodities, stocks and cryptos

Classic

- All instruments

- £200 minimum deposit

- Average spread on EUR/USD of 1.4 pips

- No commission on forex, commodities, stocks and cryptos

Professional

- All instruments

- £1,000 minimum deposit

- Average spread on EUR/USD of 1.0 pips

- No commission on forex, commodities, stocks and cryptos

Zero (With 900% Bonus Only)

- All instruments

- £5,000 minimum deposit

- Average spread on EUR/USD of zero pips

- 0.01% per side on forex, commodities, stocks and cryptos

VIP

- All instruments

- £10,000 minimum deposit

- Average spread on EUR/USD is zero pips

- 0.01% per side commission on forex, commodities, stocks and cryptos

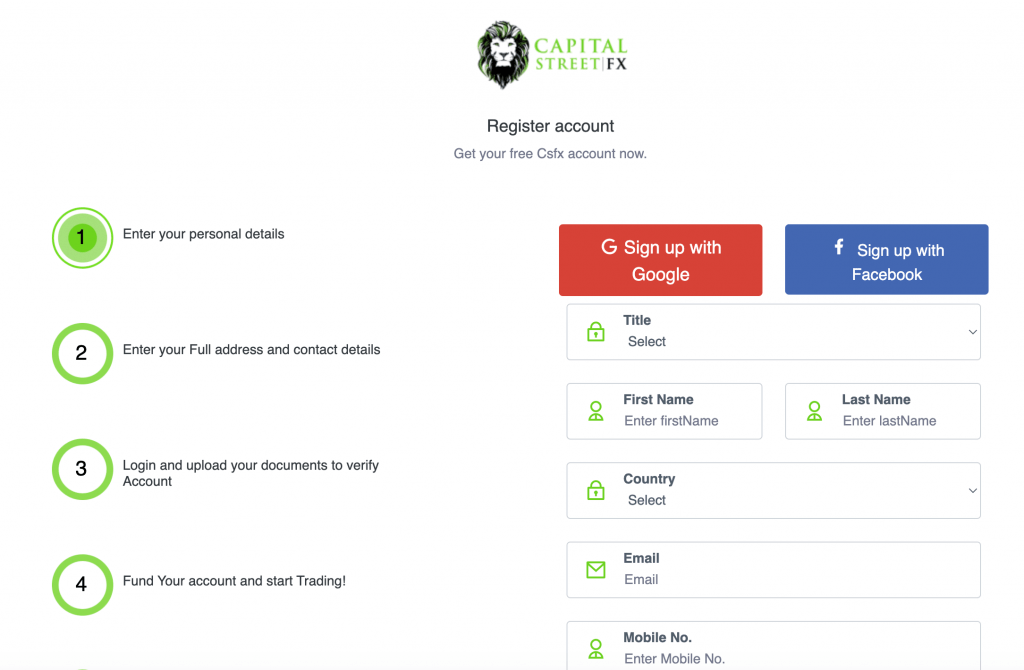

How To Register For A Capital Street FX Account

We found it easy to sign up for a Capital Street FX account with only basic details required. To get started:

- Navigate to the ‘Accounts’ tab at the top of the website and click on ‘Open an Account’

- Enter your personal details

- Input your full address and contact details

- Login to your Capital Street FX account

- Upload documents to verify your profile

- Deposit funds to start trading

Registration Form

Fees

The pricing structure at Capital Street FX could be improved. The confusion partly comes in the multiple trading accounts, which makes it harder to judge what is good value.

Fees essentially depend on the account type. There are usually no spreads on the VIP and the Zero accounts, although there are a few exceptions to this. The Zero, Cent, Classic and Professional account types all have a minimum spread on the EUR/USD, GBP/USD and USD/JPY CFDs of 0.1 pips, while the ECN VIP account boasts spreads starting from 0.0 pips.

Our team found that, on average, the Basic account provides EUR/USD spreads of 1.5 pips, while the Cent account displays 1.6 pips and the Classic account offers 1.4 pips. The Professional account, on the other hand, shows average spreads of 1.0 pips, while the ECN has raw spreads of around 0.1 pips.

These spreads for the non-ECN accounts are a fair bit higher than we would like to see, especially for the Professional account, which has quite a significant minimum deposit.

Fortunately, there is no commission at Capital Street FX on forex, commodities, stocks and cryptos unless investing with a Zero (plus bonus) or VIP account. These accounts have a reasonable commission of 0.1% per side.

Funding Methods

Deposits

When we used Capital Street FX, we were pleased to see that all deposit options are free. Processing times are also instant apart from wire transfers, which take 3-7 business days.

The minimum deposit is just £50, which, although higher than some other brokers, is still reasonable and allows amateur investors to join fairly easily.

Deposit options are extensive and include:

- SEPA

- Advcash

- Apple Pay

- Utrust Pay

- Google Pay

- Binance Pay

- Wire Transfer

- Perfect Money

- Visa/Mastercard

- Eligible cryptocurrencies (including BTC and ETH)

How To Deposit

Making a payment to Capital Street FX is straightforward:

- Log in to your Capital Street FX account

- Go to the Deposit Funds tab

- Choose your preferred payment method

- Follow the on-screen instructions

- Confirm the deposit

Withdrawals

Our team was pleased to see that withdrawals at Capital Street FX are instant, except those processed using Visa or Mastercard payment cards (3-5 business days) and wire transfers (3-7 business days).

On the downside, we were disappointed to find that all withdrawal methods have fees, although these do vary. Most top brokers now offer both free deposits and withdrawals, so this is a major drawback of trading with Capital Street FX.

Withdrawal methods and their associated fees are as follows:

- Advcash – $4 per side

- Perfect Money – 2.5% per side

- Visa/Mastercard – 5.5% per side

- Wire transfer – £50-£70 per transfer

- Eligible cryptos – 2% gateway charges plus blockchain fees

Note that deposit funds can only be withdrawn via the method used to make the deposit. Balance funds (i.e. any profits) must be sent to your bank account via wire transfer.

How To Withdraw

- Log in to the Members’ Area

- Go to the Withdraw Funds tab

- Select the relevant payment method

- Follow the on-screen instructions

Leverage

While using Capital Street FX, we found high leverage is provided, though this depends on whether you are trading with or without bonus funds, what your initial deposit is and what account you have. Accounts under £1,000 will be able to access leverage rates of up to 1:100 without bonus funds. With bonus funds, this increases to 1:1000 on all account types.

The important details can be found below:

- Basic Account – 1:1000 leverage when using up to a 900% bonus. Without a bonus, it is 1:100 on initial deposits up to £1,000 and 1:1000 on deposits of £1000 and above.

- Cent Account – 1:1000 leverage when using up to a 900% bonus. Without a bonus, it is 1:100 on initial deposits up to £1000 and 1:1000 on deposits of £1,000 and above.

- Classic Account – 1:1000 leverage with a bonus of up to 300%. Without a bonus, it is 1:100 on initial deposits up to £1,000 and 1:1000 on initial deposits above that amount.

- Professional Account – 1:1000 leverage with up to a 200% bonus. Without a bonus, it is 1:1000 from a £1,000 initial deposit.

- Zero Account – 1:1000 leverage with a 900% bonus only and from a £5,000 initial deposit.

- VIP Account – 1:100 from a £10,000 initial deposit (no bonus).

Trading Platform

Unfortunately, Capital Street FX only provides one trading platform for technical analysis and account management: ActTrader. The desktop version is free for download and compatible with Windows and Mac, while the web-based version can be used on a range of browsers.

We found that ActTrader caters to investors that want to make simple trades as well as those looking to undertake more rigorous technical analysis. However, we recommend that investors accustomed to MetaTrader 4 and MetaTrader 5 first use a demo account to familiarise themselves with the different layouts of this platform.

Our favourite features on ActTrader include:

- Level II quotes

- Financial news

- One-click trading

- Algorithmic trading

- Multiple order types

- 30 technical indicators

- Range of charts and timeframes

How To Open An Order (Via One-Click Trading)

- Enter the trading platform

- Check that one-click trading is enabled in the Settings menu

- Choose the relevant market

- Right-click on the chart

- Simply select bid or ask

Mobile App

Capital Street FX investors can trade on the go using a dedicated mobile application available on the App Store (Capital Street Mobile ActForex) and Google Play (Capital Street Mobile Trader).

These apps have many of the same features as the desktop version, including the ability to make trades and manage your account settings. We also liked that they are easy to get started with and connect well to the desktop software. This means you open, manage and close positions across multiple devices with ease.

Demo Account

Our experts were pleased to see that Capital Street FX has a free demo account for customers with no time limit.

This is fairly standard now amongst brokers but is an important feature that enables investors to backtest strategies and familiarise themselves with investing in different markets using virtual funds and a simulated environment.

Bonus Offers

As a broker regulated offshore, Capital Street FX can offer generous promotions.

However, before opting for any promotions, investors should carefully review the relevant terms and conditions, including how many lots need to be traded before funds can be withdrawn. We found that fairly strict volume requirements must be met before you can withdraw profits.

The following promotions and bonuses are available:

- Risk-free trade where your deposit is insured

- 150% instant deposit bonus – £100 minimum deposit (new and existing clients)

- 200% instant deposit bonus – £200 minimum deposit (new clients only)

- 650% instant deposit bonus – £1,000 minimum deposit (new clients only)

- 900% instant deposit bonus – £5,000 minimum deposit (new and existing clients)

Is Capital Street FX Regulated?

Unfortunately, we can’t give Capital Street FX a high trust score due to its regulatory status.

The company that owns Capital Street FX (Capital Street Intermarkets Limited) is regulated by the Financial Services Commission of Mauritius. Offshore regulators should generally be treated with more caution as they often do not undertake as robust regulatory scrutiny of brokers as certain European regulators, such as the FCA and CySEC. Investors are also often left without investor compensation schemes should the broker go into insolvency.

Extra Tools & Features

Education

We were pleased to see that Capital Street FX has an excellent education section at both beginner and advanced levels. There are also video tutorials, PDF guides and a glossary so that investors can get their heads around technical trading jargon.

Most brokers have some sort of education section, but we were reassured to see that it has material at different ability levels and in different formats.

Market Analysis

In addition to an economic calendar to identify upcoming market events and announcements, this broker produces daily technical analysis reports and market outlook articles with reviews of the global economic picture. This may include analyses of potential interest rate hikes by the Federal Reserve or another topic of global importance.

We were also pleased to see investing signals and technical analysis videos for traders looking for inspiration. These may require the use of indicators on the ActTrader platform.

How To Install Indicators On The ActTrader Platform

- Go to the Act FX tab

- Select Indicators and Strategies

- Select your desired indicator

- Click on the Apply Indicator icon in the upper-right corner of the pop-up window

Customer Service

The customer service at Capital Street FX is competitive, with online support in more than 20 major languages. We found that technical support is also available 24/7 by email and there is an extensive FAQ section for finding answers to more standard queries.

The following customer support options are available:

- Live chat

- Online contact form

- Phone – +1 (949) 391 1002

- Email – support@capitalstreetfx.com

- Skype &WhatsApp (only in some regions)

- Voice Support (available in more than 10 languages, seven days a week)

Overall, the broker ranked highly for its customer service offering in our review.

Company History & Overview

The Capital Street FX website is owned and operated by Capital Street Intermarkets Limited, which is licensed and regulated offshore by the Financial Services Commission (FSC) of Mauritius.

Established in 2008, the firm now has almost 26,000 active clients from 108 countries. Nearly £100bn is traded every month through the firm.

Ultimately, it is a global company with ten offices around the world and seven companies operating under the Capital Street brand. Its focus is to bring a large variety of investment markets and instruments to fast-developing regions.

Trading Hours

Trading at Capital Street FX begins at 18:00 (GMT-4) on Sunday and stops at 17:20 (GMT-4) on Friday.

However, not all markets will trade 24/5 during this period, although this is generally the case for forex and commodities. Some markets will have breaks, so ensure you check the opening times for the market you are investing in.

Safety

Although Capital Street FX is an offshore-regulated broker, we were satisfied that it has implemented some key measures to help protect client funds and data.

This includes segregated client fund accounts, meeting the regulator’s capital reserve requirements and encryption of client transactions and data. External directors and auditors are also used to ensure compliance with risk management and financial stability edicts.

Should You Trade With Capital Street FX?

Capital Street FX provides a competitive range of CFD products, as well as excellent customer support and strong educational resources. Unfortunately, the lowest spreads are only available to those investors with higher capital, while others are left with much higher fees and limited regulatory assurance.

Overall, Capital Street FX is an offshore broker that provides a range of services and is accessible to traders of varying abilities, although there is no access to a MetaTrader platform and the withdrawal fees for all methods hold the firm back.

FAQ

Is Capital Street FX Legit Or A Scam?

Capital Street FX has been established since 2008 and has a strong global client base. Although it is regulated offshore, its physical presence in many jurisdictions around the world is reassuring. Nonetheless, the lack of FCA authorization means we cannot give it a higher trust score.

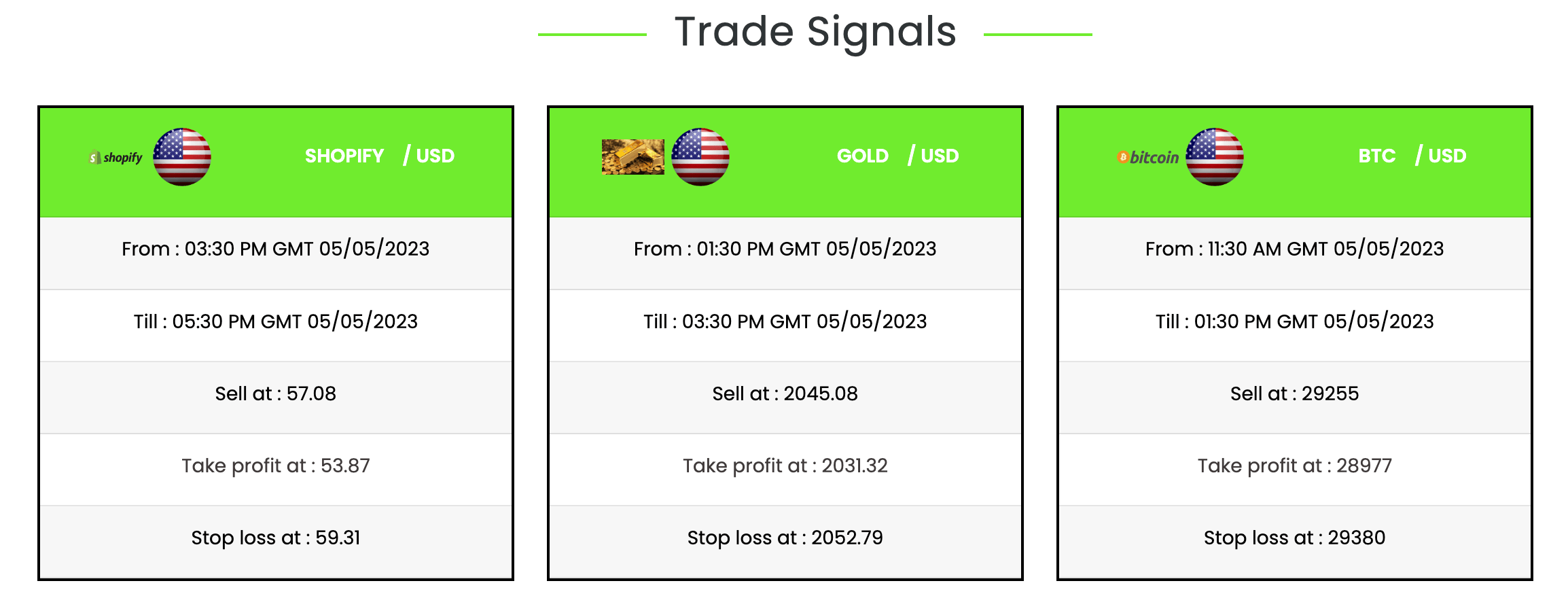

How Do Trading Signals Work On Capital Street FX?

Trading signals at this broker will give a timeframe for a position on a particular asset, what price to sell at and also where to set the take profit and stop loss positions. Our full Capital Street FX review outlines the steps you need to follow to get started with the signals service.

Do I Have A Choice Of Trading Platform At Capital Street FX?

Unfortunately, investors have no choice when it comes to the trading platform – only ActTrader is integrated with this broker. MetaTrader 4 and MetaTrader 5 are not available. This is a major downside vs alternatives.

Do I Need To Download Software To Trade On Capital Street FX?

No. The ActTrader platform has a web-based version that runs on major browsers. No software downloads are required, although there is also a desktop client, which does require a download.

Does Zero Commission Mean I Will Not Pay Any Fees On Capital Street FX?

No. All account types impose fees on investors in some way. If the commission is zero, the fees will be through higher spreads (the difference between the bid and ask prices). Other fees with Capital Street FX include withdrawal charges and overnight fees.

Article Sources

Compare Capital Street FX with Other Brokers

These brokers are the most similar to Capital Street FX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- eToro - eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 76% of retail CFD accounts lose money.

Capital Street FX Feature Comparison

| Capital Street FX | Pepperstone | FP Markets | eToro | |

|---|---|---|---|---|

| Rating | 2.8 | 4.8 | 4 | 4.1 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $0 | $40 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $10 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC Mauritius | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA | FCA, ASIC, CySEC, FSA, FSRA, MFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | ActTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | - |

| Leverage | 1:3500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | ||||

| Review | Capital Street FX Review |

Pepperstone Review |

FP Markets Review |

eToro Review |

Trading Instruments Comparison

| Capital Street FX | Pepperstone | FP Markets | eToro | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | Yes |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Capital Street FX vs Other Brokers

Compare Capital Street FX with any other broker by selecting the other broker below.

Popular Capital Street FX comparisons: