BDSwiss Review 2024

|

|

BDSwiss is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to BDSwiss |

| BDSwiss Facts & Figures |

|---|

BDSwiss is an award-winning forex and CFD broker founded in 2012. The firm offers 250+ instruments to clients in over 180 countries. With spreads from zero pips and three powerful charting platforms, they offer a rounded trading package for beginners and seasoned investors alike. The broker is regulated by the Mauritius FSC and Seychelles FSA. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Trading App |

The BDSwiss Online Forex Trading app, makes 250+ markets available for online trading on a fast, modern and user friendly platform. More features could be added, and the overall rating by users is a concern, though the service is responsive and reliable. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSC, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | BD Swiss offers CFDs on 250+ instruments through the MT4 and MT5 platforms or an in-house app - all of which deliver a superb trading environment. The proprietary Webtrader, for example, offers over 50 indicators and studies, plus a Trend Analysis tool. |

| Leverage | 1:30 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 1.7 |

| Oil Spread | 0.8 |

| Stocks Spread | 0.1 |

| Forex | BDSwiss continues to offer an above-average selection of 50+ currency pairs with leverage up to 1:400 on major pairs. Typical spreads for EURUSD come in at a competitive 0.3 pips plus a $6 commission which is in line with our award-winner, Pepperstone. |

| GBPUSD Spread | 1.7 |

| EURUSD Spread | 1.2 |

| GBPEUR Spread | 1.3 |

| Assets | 50+ |

| Stocks | Traders can speculate on 120+ stocks from leading companies in the US, UK and five EEA countries. This isn't the widest range compared to the top competitors, although the commission structure is competitive starting from 0.02% for UK shares. |

| Cryptocurrency | BD Swiss traders can access CFDs on 22 different cryptocurrencies paired with USD, while BTC and ETH can also be traded in pairs with GBP and EUR. The 26.57 BTCUSD spread is higher than the cheapest crypto brokers but there are zero commissions. |

| Coins |

|

| Spreads | BTC from 1% |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

BDSwiss is a regulated broker specialising in trading forex, commodities, shares and indices. This review covers the MetaTrader 4 and MetaTrader 5 platforms, the login process, withdrawal options, UK regulation and more. Find out whether to open a BDSwiss trading account today.

About BDSwiss

BDSwiss was founded in Switzerland in 2012 and has grown globally over the last decade. The broker has 1.5 million registered accounts and executes over 56 million trades per year from multiple office locations.

For UK and European traders, BDSwiss has headquarters in Cyprus where it’s regulated by the CySEC. It’s one of the top online brokers for retail trading and promises a raft of high-tech tools and features.

Trading Platforms

BDSwiss offers both the MT4 and MT5 platforms. These terminals are a global name in forex trading and are available to download to desktop devices including Mac and Windows. Login credentials for both MT4 and MT5 are distributed once you’ve opened a live trading account.

MetaTrader 4

Key features of the MT4 platform include:

- Customisable interface

- Instant one-click trading

- Transparent account info

- Automated trading & APIs

- Range of charts and analytics

- Integrated daily news updates

- Multiscreen overlay capabilities

- Forex signals & alerts via Telegram

MetaTrader 4

Note, if BDSwiss traders are unable to download the MT4 platform, access is available via the WebTrader solution.

MetaTrader 5

Designed with experienced traders in mind, the MT5 platform offers more advanced features over its MT4 predecessor:

- 21 timeframes

- Extensive watch lists

- Easy-to-use interface

- Thousands of algorithmic trading bots

- Customisable key performance indicators

- Economic calendar and financial news alerts

- Additional plugins via the MetaTrader Market

MetaTrader 5

Assets

Tradable assets at the BDSwiss group include:

- 150+ stocks and shares CFDs

- 25+ forex pairs (all majors and minors)

- 8 indices including Dax 30 and Dow Jones (US30)

- 7 commodity CFDs including gold and silver (XAUUSD) plus USOIL

Crypto derivatives trading is not available to UK customers so clients cannot invest in the likes of Bitcoin (BTC), Ripple (XRP), and Dogecoin (DOGE). Spread betting and binary options are also not available.

The number of tradable assets available at BDSwiss is low compared to other EU brokers such as eToro, AvaTrade, Iron FX and XM.

Fees & Charges

BDSwiss is transparent about its trading fees and commission charges. Spreads are variable depending on the asset class and account type. Typical forex spreads are 1.5 pips with the Classic account while the Raw account offers zero pip spreads.

BDSwiss charges overnight fees for positions left open into the next day as well as a 10% monthly inactivity fee after 90 days of no activity. BDSwiss also charges a £10 withdrawal fee on transactions less than or equal to £20.

Overall, if you take BDSwiss vs well-known names, such as IC Markets, Trading 212, and XTB, the online broker’s fees are competitive.

Leverage

Complying with relevant legislation, BDSwiss caps retail leverage for UK traders at 1:30. Maximum margin and leverage requirements vary across asset classes:

- Forex – 1:30

- Shares – 1:20

- Indices – 1:20

- Commodities – 1:20

Note, clients may be subject to a margin call if they do not retain enough account equity.

Mobile Trading

BDSwiss offers the MT4 and MT5 mobile apps as well as its proprietary award-winning application. Between the three, clients benefit from a fully interactive mobile trading experience. Instant deposits, powerful tools and built-in support are available across each platform.

The broker’s bespoke app offers:

- Multiple charts

- User-friendly interface

- Timely quotes & updates

- Access to account dashboard

- Direct funding and withdrawal

- Extensive offline trading history and transaction reviews

- Straightforward account sign-up, document upload and KYC verification

Mobile app

Deposits

To deposit or withdraw funds, traders are required to sign in to the BDSwiss dashboard via the client portal. A range of deposit methods are available, in which all fees are absorbed by the broker and processing times are typically instant.

Clients can load their live accounts using Visa, Mastercard, Skrill, iDEAL, Sofort, PayPal, Neteller, Giropay, bank wire transfer and more. BDSwiss does not currently support Bitcoin deposits.

Withdrawals

The withdrawal processing time for all payment methods is just 24 hours. BDSwiss does not have a minimum withdrawal limit or amount. The broker does not charge a fee on amounts over £20.

Details on how to withdraw funds from BDSwiss can be found online though traders simply need to follow the instructions in the payment portal.

Demo Account

The broker offers a free demo account. To open a BDSwiss practice account, users need to submit their name, date of birth, email, and a valid UK phone number. At this stage, BDSwiss does not request KYC documents. Clients can easily upgrade to a live trading account once they’ve explored the company’s platforms and features.

Regulation Review

BDSwiss is a registered trademark of BDSwiss Holding Ltd and is regulated by the Cyprus Securities and Exchange Commission (CySEC). Although BDSwiss is not regulated by the UK’s FCA, traders can proceed with confidence as CySEC is a reliable agency. The broker has to segregate client funds, provide negative balance protection, limit retail leverage and not offer no deposit welcome bonuses.

Additional Features

BDSwiss offers a number of additional features to support its customers. Resources available include an economic calendar, pip calculator and a catalogue of YouTube training videos.

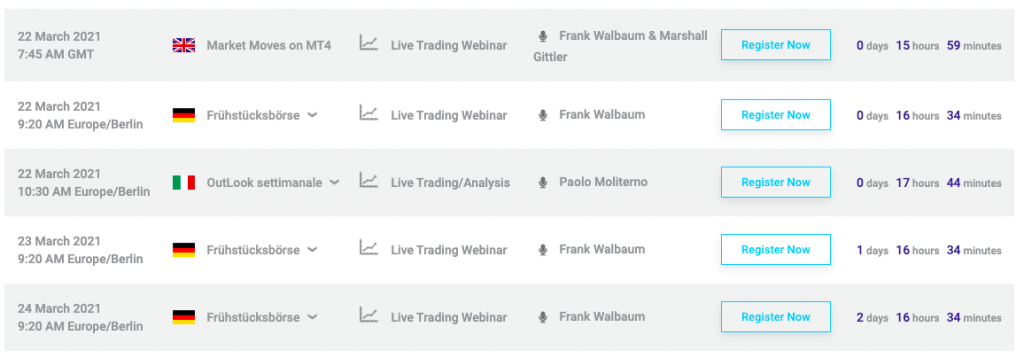

BDSwiss also provides an extensive education centre for its traders. Videos are aimed at traders at different stages of their investing journey with new traders benefiting from a wide range of training resources including basic forex lessons, a comprehensive glossary and online seminars.

Live webinars

BDSwiss Accounts

BDSwiss offers 3 different account types to UK traders. All accounts come with daily market analysis, free live webinars and 24/5 support. The VIP and Raw accounts promise additional features, including a personal account manager and exclusive webinars.

- Classic – $100 minimum deposit, spreads from 1.5 pips and $0 commissions

- VIP – $3,000 minimum deposit, spreads from 1.1 pips and $0 commissions

- Raw – $5,000 minimum deposit, spreads from 0.0 pips and $5 commissions

BDSwiss also offers halal trading on Classic and VIP accounts. All clients must provide KYC documentation to open a live account.

Benefits

There are several good reasons to start trading with BDSwiss:

- Free VPS

- CySEC-regulated broker

- Forex copy trading service

- Strong customer support options

- Thorough background checks and KYC documents

- Multiple mobile trading options including award-winning app

- Extensive range of educational resources for traders of all levels

Drawbacks

There are also downsides to registering for an account with BDSwiss:

- No crypto trading

- Various additional fees

- No joining deposit bonus

- Fewer assets to trade vs other brokers such as eToro, Trading 212 and XTB

Trading Hours

BDSwiss trading hours are 24/5 however certain instruments such as indices like the Dow Jones and Dax 30 are only available during the corresponding stock exchange opening hours. See the broker’s website for operating hours by market.

Customer Support

BDSwiss offers several customer support options for UK traders:

- Email – support@bdswiss.com

- Enquiry form – contact us page

- Online live chat – bot logo on website

- UK telephone helpline number – +44 2036705890

The support team can help if you wish to delete or close an account. They can also help if you get invalid account or trade disabled warnings, or if you need proof of funds.

The BDSwiss live chat function is online 24/5 but is only accessible once users have provided personal details such as name, email and account ID number (if applicable). The broker also offers a comprehensive FAQ section and regularly provides customer updates via Twitter.

Client Safety

The broker makes safety and fraud prevention a priority. During the sign-up process, new customers must provide documents for verification to reduce security and scam risks. All BDSwiss investor accounts are password-protected and a secure forgotten password service is available if access to an account is lost.

Should You Trade With BDSwiss?

BDSwiss offers a comprehensive trading environment for investors of all abilities. The broker combines the industry-leading MT4 and MT5 platforms with its award-winning mobile app to offer extensive features. And whilst not regulated by the UK’s FCA, the company is still trustworthy and licensed by the CySEC. Overall, BDSwiss is an excellent option for retail traders looking to speculate on popular financial markets.

FAQ

Is BDSwiss A Good Broker?

Although some brokers offer a wider range of assets, users can invest with confidence at BDSwiss because it is regulated by the reliable CySEC. UK traders also get access to powerful desktop and mobile trading platforms and can choose between live accounts with varying minimum deposit requirements. As a result, we’re comfortable BDSwiss is a good broker.

Is BDSwiss A Market Maker?

BDSwiss acts as a market maker and follows a non-dealing desk model with most of its accounts while using an ECN system on its Raw account. This means traders benefit from the pros of each model, including transparent fees and rapid executions.

Is BDSwiss A Regulated Broker?

BDSwiss is regulated by the CySEC – a reputable and trustworthy regulator. Licensing conditions include offering traders negative balance protection, leverage up to 1:30 and keeping client capital segregated from business funds. Of course, for UK traders, oversight from the FCA would be an additional benefit.

Is BDSwiss A Legit Broker?

Yes, BDSwiss is a trusted broker with years of experience and an impressive track record. Millions of customers have opened live accounts with BDSwiss and there aren’t many negative reviews and scam concerns. It’s one of the top retail trading brokers operating in the UK market.

Is BDSwiss A Real Site?

The broker has two sites, customers in the UK and Europe can use eu.BDSwiss.com while customers outside of those regions can use BDSwiss.com. Both websites are real and operated by the trading company. It’s always worth checking for the regulator’s logo and company details before opening an account and investing money.

Top 3 BDSwiss Alternatives

These brokers are the most similar to BDSwiss:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

BDSwiss Feature Comparison

| BDSwiss | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.8 | 4.9 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $10 | $100 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC, FSA | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | - | MT4 |

| Leverage | 1:30 | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 69% of retail CFD accounts lose money. |

|||

| Review | BDSwiss Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| BDSwiss | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

BDSwiss vs Other Brokers

Compare BDSwiss with any other broker by selecting the other broker below.

Popular BDSwiss comparisons: