Hang Seng

The Hang Seng Index (HSI) is a major global index consisting of the largest and most liquid companies on the Hong Kong Stock Exchange (HKEX). Traders can speculate on the index using CFDs, ETFs, futures, options, spread betting and individual stocks. This review will explain how to compare Hang Seng brokers, the composition of the index and what to look for when trading it. Moreover, our experts have listed the best UK brokers for investing in the HSI:

Top Hang Seng Index Brokers in the UK

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, CMA, FSA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

IC Trading belongs to the reputable IC Markets group. Designed for dedicated traders, it offers highly competitive spreads, dependable order execution, and sophisticated trading tools. However, it operates from Mauritius, an offshore financial centre, allowing high leverage but within a less regulated environment.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500

Safety Comparison

Compare how safe the Hang Seng are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Hang Seng support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Hang Seng at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IC Markets | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Hang Seng good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| IC Trading | ✔ | $200 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Hang Seng offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Hang Seng.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IC Markets | |||||||||

| IC Trading | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Fusion Markets |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

Cons

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

- Interest is not paid on idle cash, a feature gaining popularity with alternatives such as Interactive Brokers.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

- Trading Central and Autochartist provide valuable technical analysis and actionable ideas. These tools are readily available within the account area or on the cTrader platform.

Cons

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

- Customer support was inadequate during testing, with multiple live chat attempts going unanswered and emails ignored. This raises significant concerns regarding their capacity to manage urgent trading issues.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Global traders can use accounts in various currencies.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- The selection of charting platforms and social trading features is outstanding. Options like MT4, MT5, cTrader, and the newer TradingView meet diverse trader preferences.

- Fusion Markets provides exceptional support, characterised by rapid, friendly, and efficient responses. Unlike other platforms, it doesn't utilise automated chatbots, ensuring traders experience a seamless interaction.

- With an average execution speed of approximately 37 milliseconds, traders can secure optimal prices more effectively, outpacing many competitors in rapidly changing markets.

Cons

- The broker stands out with its extensive selection of currency pairs, surpassing most competitors. However, its alternative investment options are merely average, lacking stock CFDs outside the US.

- Fusion Market falls short compared to competitors like IG in education, offering few guides and live video sessions for enhancing trader skills.

- Traders from outside Australia need to register with loosely regulated international firms that offer limited protection, lacking both safeguards and negative balance protection.

How To Choose Hang Seng Brokers

There are several key areas to compare Hang Seng Brokers in:

- Costs – When trading a tracker ETF through Hang Seng brokers, there may be a commission, spread and/or expense ratio to pay for. The annual expense ratio is the cost of managing the fund, while spreads and commissions are the direct costs of setting up the trade, passed on to the user. ETF expense ratios are often lower than those for mutual funds as there is typically less input required to manage a simple ETF that tracks an index. Some Hang Seng brokers are commission-free, though you should be cautious as this could mean they markup their spreads. Also, keep an eye out for deposit and withdrawal fees, currency conversion charges/exchange rates and account inactivity fees, each of which can eat a chunk of your profits.

- Trading Platforms – Industry-recognised trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5) and TradingView are offered by many of the best brokers with HSI investing support. We recommend selecting those that offer at least one of these platforms as they may help to improve your strategy and profitability. MT5 has 80 built-in indicators, including moving averages, oscillators and momentum indicators. In addition, there is a built-in trading signals service and multiple chart types, such as line, bar, candlestick and Renko.

- Customer Service – The Hang Seng Index tracks a basket of company stocks on an exchange that is typically only open during the week. Therefore, 24/5 customer service is probably sufficient, though some top firms now offer 24/7 customer support. The more variety in customer support contact options, the better. Our traders usually look for a live chat option, email address and phone number.

- Regulation – We recommend choosing Hang Seng brokers that are regulated by a reputable body like the FCA, as is the case with IG and Saxo Bank. A strong regulator ensures better monitoring of the broker’s activities and, therefore, more robust protection for investors. Regulated brokers are also more likely to offer customer protection measures like negative balance protection so you can’t lose more than the capital in your account.

What Is The Hang Seng Index?

History

The index was first introduced more than 50 years ago in 1969 by the Hong Kong-based Hang Seng Bank, although it was calculated retroactively to 1965. It had a base of 100 points and its stocks were listed on the Hong Kong Stock Exchange. Before 1985, the index included only 33 companies, which were heavily concentrated in a few sectors like finance and technology.

After 1985, the HSI was expanded to include 38 stocks and a more diverse range of sectors, such as utilities, telecommunications and retail. It was at this point when more stringent market capitalisation and trading volume requirements were also implemented. Also in this year, four sub-indices were created (with the Finance Sub-Index being the dominant force):

- Hang Seng Finance Sub-Index

- Hang Seng Utilities Sub-Index

- Hang Seng Properties Sub-Index

- Hang Seng Commerce & Industry Sub-Index

Today, there are 76 stock market constituents on the index offered by Hang Seng brokers. The Hang Seng Indexes Company Limited is responsible for maintaining the basket, with headquarters in Hong Kong. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong.

Composition

The HSI is a blue-chip index, meaning it contains the largest and most liquid companies on the Hong Kong Stock Exchange, although a limited number of small-cap and mid-cap stocks can also be included. However, not all these companies are registered in Hong Kong itself.

A significant proportion of the HSI is made up of H-Shares, which are Chinese companies incorporated in Mainland China that are listed on the exchange. The China A/H Premium Index monitors the valuation gap between A-Shares (Mainland Chinese companies trading on the Shanghai and Shenzhen exchanges) and H-Shares.

There are also Red Chips on the index offered by Hang Seng brokers, which are Chinese companies incorporated outside Mainland China (often in Hong Kong) and listed on the HKEX. Some components of the index are local shares, which are Hong Kong-registered companies.

Other Similar Indices

Hang Seng brokers may also offer similar indices linked to the HKEX. The Hang Seng Composite Index is an example of a much broader index, covering all stocks on the HKEX apart from those on the HSI and the Hang Seng China Enterprises Index. The Hang Seng China 50 Index tracks the top 50 China-based constituents in terms of market cap on the Hong Kong, Shanghai and Shenzhen exchanges.

Then there is the Hang Seng 40 index and the Hang Seng 35 index, which are also linked to the HKEX. Futures contracts can be traded on both and their specifications can be found on the relevant exchange’s website.

The Hang Seng Nifty is not an instrument in itself but a combination of the Hang Seng and the Nifty 50 (an index containing the top 50 components of the National Stock Exchange of India).

Other indices linked to the Hong Kong Stock Exchange, some of which can be traded using an index fund like an ETF-HK, include:

- Hang Seng 100 Index

- Hang Seng Top 10 Index

- Hang Seng Utilities Index

- Hang Seng Corporate Sustainability Index

- Hang Seng REIT Index (a type of property index)

- Hang Seng H-Share Index/Hang Seng China Enterprises Index (its constituents include only the Chinese companies on the HKEX)

Opening Hours

Hang Seng brokers are governed by the market opening hours of the Hong Kong Stock Exchange as that is where the index’s stocks are listed. The trading hours are (Hong Kong time zone/GMT+8):

- Pre-Opening Session: 09:00-09:30

- Morning Trading Session: 09:30-12:00

- Extended Morning Session: 12:00-13:00

- Afternoon Investing Session: 13:00-16:00

The pre-market or opening session is a non-trading session, which means orders can only be entered, modified or cancelled. The extended morning session allows Hang Seng brokers to offer continuous investing during lunch.

The Hong Kong Stock Exchange is closed at the weekend and there are also various market holidays throughout the year, so check a trading calendar to see whether the exchange is open today or when you plan to trade. Prices are updated in real-time during the operating hours of the Hang Seng Index, so traders always have access to the latest valuation on their daily or weekly charts.

Trading hours for futures are from 09:15-16:30 HKT.

What Is The Hang Seng Used For?

Diversification

As it currently contains 76 stocks in a wide range of Chinese sectors, including financial services, property, utilities and technology, the Hang Seng Index adds diversification to most investing strategies.

Diversification reduces risk by spreading capital across multiple companies and sectors at the same time. That means that, should one company encounter financial difficulties, you may still net a return based on the performance of the others.

The HSI is more diverse in terms of the number of companies when compared to the Dow Jones and DAX 40 but significantly less diverse than the Shanghai Stock Exchange Composite Index, S&P 500 and FTSE 250.

Chinese Companies

Investing directly in companies from Mainland China like the Shanghai Stock Exchange or the Shenzhen Stock Exchange can be more difficult for foreign investors due to the imposition of various regulations and restrictions. It is often simpler to use Hang Seng Index brokers to access Chinese companies (H-Shares), whether that is via individual stocks, ETFs or derivatives like futures. Given the Chinese economy is currently the second largest in the world, many do not see ignoring this market as an option anymore.

Economic Indicator

The Hang Seng is not a direct indicator of the Chinese economy, although the close economic and political connection between Mainland China and Hong Kong means the index can be affected by changes in policy from the Chinese Government or a change in economic conditions in Mainland China.

It is important to note that the HSI is often influenced by global factors, particularly given the fact that some companies on it like HSBC have their main base outside of Hong Kong and Mainland China.

Trading

As with any index, movement in the value of the HSI creates opportunities for speculation and profit. The Hang Seng has generally been considered a volatile index, often being significantly affected by various economic and political developments. This has become even more apparent after the crackdown on dissent in Hong Kong in 2019.

How The Hang Seng Works

Qualification

New companies are assessed to see whether they meet the criteria to be on the Hang Seng Index. The main criteria are:

- Market Capitalisation – The current minimum market cap for inclusion is 15 billion Hong Kong dollars (HKD), although this threshold can vary over time.

- Trading Volume – This is important to ensure Hang Seng brokers can offer a liquid market where investors can buy and sell shares quickly at their preferred price.

- Financial Performance – This may include looking at a company’s financial stability, growth potential and industry leadership.

Companies must also have been listed for at least 24 months on the Hong Kong Stock Exchange before being considered for inclusion on the Hang Seng Index.

Changes

The Hang Seng Index is not static. Some companies get removed, whilst others are added. The overall size of the index can also vary. There is usually a quarterly review by a committee that considers the above criteria, although changes can be made at any time if deemed necessary. These changes are then updated on the trading platforms used by Hang Seng brokers.

Weighting

The HSI is weighted by free float-adjusted market capitalisation. In other words, the weight of each company depends on the market value of its freely tradeable shares (those not held by controlling shareholders or governments). Larger companies, therefore, influence the index more than smaller ones.

To calculate each weight, the market cap of the company is multiplied by its free float factor. This is then divided by the sum of the market cap of all companies in the index. An 8% weight cap is applied to ensure that the largest companies do not excessively dominate the HSI.

Key Facts

Here are some of the main statistics to keep in mind when investing with Hang Seng brokers:

- In 1974, the index contracted by 60.54%

- In 1972, the index rose by a whopping 147.07%

- In the 2010s, the Hang Seng grew by an average of 3.7% per year

- The Hang Seng Index represents around 58% of the market cap of the HKEX

- The all-time high of the Hang Seng Index was set in January 2018 at 33,223.58 points

- As of February 2023, the index sits at around 20,529.49 points with a 52-week high of 23,046.86 points and a year-to-date increase of 1.83%

Biggest Players

To be featured on the Hang Seng Index, companies generally have to be large blue-chip stocks. That said, some are bigger than others and we have listed some of the largest below, many of which may be offered individually by Hang Seng brokers:

- Tencent Holdings Limited (market cap of HK$3.399tn)

- Alibaba Group Holding Limited (market cap of HK$1.978tn)

- Industrial and Commercial Bank of China Limited (market cap of HK$1.668tn)

- China Construction Bank Corporation (market cap of HK$1.251tn)

- HSBC Holdings PLC (market cap of HK$1.21tn)

Why Trade The Hang Seng Index

Hang Seng brokers provide access to established blue-chip companies, as well as Chinese stocks with large growth potential. As already mentioned, the index is diversified with stocks from multiple industries and provides a mechanism to access the restricted Chinese markets.

It should also be noted that, as one of the world’s major indices, the Hang Seng is a liquid market, meaning traders can buy and sell stocks and derivatives like futures with ease. In addition, charts for previous years have shown it to be relatively volatile compared to a Low Volatility Index, which, despite the fact it can leave traders more exposed, often creates lots of opportunities to profit.

How To Invest In The Hang Seng

There are numerous ways to trade with Hang Seng brokers and speculate on the value of the index, including the following:

- CFDs (derivative for speculating on underlying price difference)

- Direct Investment (buying shares in individual constituent stocks)

- Spread Betting (derivative for speculating on underlying price difference with tax-free profits in UK)

- ETFs (a common instrument for indices like the Hang Seng and China Enterprises Index, as well as commodities like gold)

- Futures Contracts (traders can get live real-time quotes from the Hong Kong Futures Exchange and the Singapore Exchange)

- Options Contracts (Hang Seng options are available on the Hong Kong Futures Exchange and the Chicago Board Options Exchange)

Instruments like options and futures may require more skill and complex live technical analysis using charts and indicators before investing. Some Hang Seng Index brokers will allow clients to short ETFs, CFDs and other instruments in the index markets.

Choosing A Hang Seng Stock

Volume

Stock volume is the number of shares traded per given period. High volume is usually a good sign when choosing stocks at Hang Seng brokers as it makes it easier to buy and sell securities without having a significant impact on the stock price. Volume is also used by many technical analysis traders, such as to identify the strength of a reversal or trend. It can therefore be a good indicator of the market or where the price is heading next.

Volatility

Volatility in the price of stock provides great opportunities to profit. When investing with Hang Seng brokers, a static price has no risk but also no reward. Volatility can be measured in various ways, including standard deviation, beta, average true range (ATR) or implied volatility. The beta coefficient, for example, represents how volatile a stock is compared to a benchmark (such as the HSI). A beta greater than one indicates that the stock is more volatile than the overall market and a beta less than one indicates that it is less volatile.

Intrinsic Value

Those investing in individual Hang Seng stocks should understand the true value of the shares and whether their price reflects that value. Investors should review the company’s earnings statement, cash flow and balance sheet to assess the overall health of the asset.

The P/E and forward P/E ratios can help establish whether a stock’s price is overvalued or undervalued. Make sure to compare ratios with the industry average and those of similar companies. Many investors will also take an interest in a stock’s dividend yield and its history of actually paying the dividend.

A stock offered by Hang Seng brokers is also likely to be impacted by the broader macroeconomic outlook, so account for the performance of the Chinese and global markets. Forex fluctuations can equally heavily influence a company’s international operations. Forecasts and estimates from analysts may provide a useful guide.

Strategies

Traders using technical analysis to invest with Hang Seng brokers can adopt an unlimited number of strategies. The choice of approach may depend on the current condition of the market, such as whether the price is fluctuating within a range or trending. Some take a long-term approach, looking at charts spanning one year, five years, 10 years, 20 years or even 30 years, whilst others focus more on short to medium-term returns, looking at chart periods of six months or less.

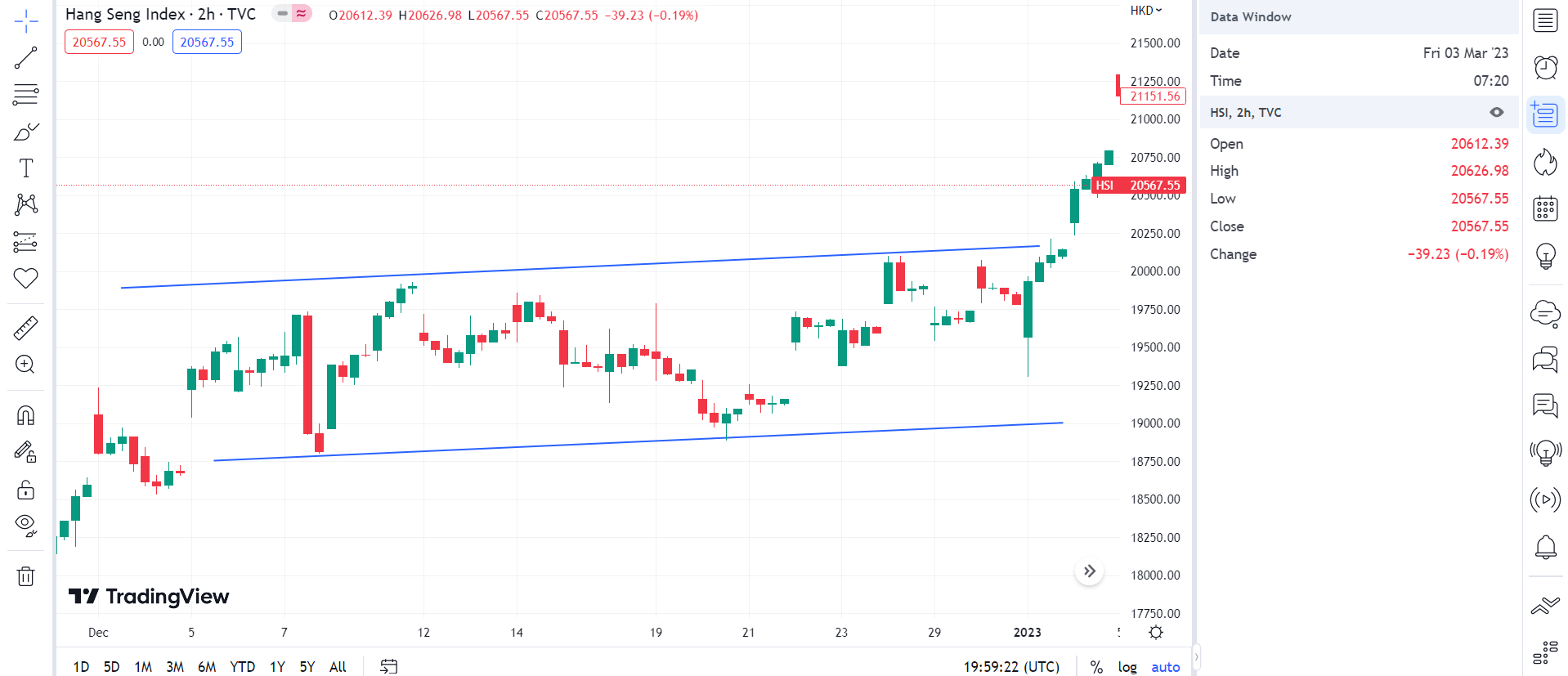

Range Trading

Range trading is suitable when the price fluctuates between a support (lower limit) and resistance (upper limit) band. Range traders look to profit from the oscillatory movement within this range. The first step in the HSI strategy is to plot horizontal lines along the support and resistance levels. These are typically in locations where the price has reached but not passed on at least two separate occasions.

HSI Range Trading Example

Traders could then open a long position when the price reaches the support level and close the position when the price hits the resistance level. Short positions can be used when the price is moving down from the resistance to the support level. There is always a risk of a range breakout, so use a stop loss to mitigate against this.

Momentum

When the price of the Hang Seng Index is not in a horizontal range, it will usually be trending either positively (bullishly) or negatively (bearishly). A 50-day or 200-day moving average can help make a long-term trend clear on your graph as it will average the prices over that period. When the market is bullish, you would take a long position when there is a temporary pullback as this can mean the asset is bought for a relatively cheap price.

However, you must be careful that this is simply a retracement rather than a full trend reversal, which could produce significant losses. That is why it often helps to incorporate elements of fundamental analysis with this technical analysis strategy as company announcements or data from the macroeconomy can help understand what is driving the changes visible on your chart.

Hang Seng Tips

News

When it comes to trading major global indices like the Hang Seng, reading and interpreting the news can be key. Geopolitical instability, interest rate decisions by central banks, trade wars (such as the one between China and the USA) and key macroeconomic indicators can all lead to a rally or sudden drop in the market. US stocks and ETFs can also be an indicator, although the link here is not as clear.

Investors need to stay on top of stock market news and, if possible, predict it. The best way to do this is to actively explore and monitor sources of live stock exchange news, stock quotes and charts for the HSI. Some Hang Seng brokers may feed market news directly onto their websites or platforms to make this easier.

You could also use the Hang Seng Annual Report, which is typically published in the second quarter of each year.

Educational Resources

Many Hang Seng brokers have educational tools and resources available on their websites. These are often tailored to beginners but may also include advanced online material. The best brokers with access to Hang Seng have an array of the following resources:

- Webinars

- Glossaries

- Tutorial videos

- Articles/written guides

Demo Account

A demo account is an excellent way to become familiar with a trading platform, explore a new index or test a new strategy before using real funds. Most reputable HSI brokers offer demo accounts for free, often with no limit on the level of virtual funds or the time the paper trading account can be used for. Demo accounts can also be a useful way of seeing the impact of leverage if using CFDs.

Automated Trading

Trading platforms like MT4 and MT5, which are supported by many Hang Seng brokers, have built-in programming languages that enable traders to create their own bots. Trading bots act within a set of parameters to make decisions on when to open and close positions. Bots can also be refined by backtesting them using historical market data, producing a useful way of investing in the Hang Seng Index without needing to spend a significant amount of time manually looking at charts on a daily or weekly basis.

Those platforms without dedicated scripting languages will often provide an API, which can be used to connect to scripts, algorithms and programmes built using external and open-source languages.

Another way to experience automated investing is by following the positions of copy traders, who tend to be experienced traders that offer insights into their strategies for a small fee. The results of their decisions do vary so make sure to check their yearly returns and stay on top of their performance.

Journal

Refine your investing strategies and learn from any mistakes. This is made easier by keeping a trading journal, which is essentially a diary of the positions you have made using Hang Seng brokers. The journal can even be a simple Excel spreadsheet. Relevant information to include should be:

- Date

- Strategy

- Order success

- Opening/closing value

- Position size (number of lots)

Bottom Line On Hang Seng Index Brokers

The Hang Seng Index is a major global index that provides traders with a diversified group of large-cap companies based in Hong Kong and mainland China. Hang Seng brokers often support a range of speculation vehicles, including CFDs, ETFs and individual stocks. Our experts recommend choosing a reputable broker with low fees, particularly concerning ETFs, which are often a cost-effective and simple way of tracking an index like the Hang Seng. See our top recommended Hang Seng brokers.

FAQs

What Is The Location Of Companies Trading On The Hang Seng Index?

The companies listed on the HSI and offered by Hang Seng brokers are typically registered in Hong Kong, Mainland China or overseas, as is the case with HSBC, which has a London base.

Can I Invest In The Hang Seng Index Using A Regulated UK Broker?

Yes. Many of the best UK brokers provide access to company stocks, futures, options contracts and CFDs on the Hang Seng Index. To pick the one for you, check out our guide or use our expert-curated list of the best HSI brokers.

How Often Are Changes Made To The Hang Seng Index?

Changes to the index are typically made quarterly by a committee, although they can be made at any time. These are then updated on the platforms used by Hang Seng brokers.

What Stocks Do Hang Seng Brokers Offer?

The best brokers that support HSI investing will provide a variety of instruments surrounding the index. These will include tracker funds and ETFs for the HSI sub-indices, alongside equities, CFDs and futures for many of the major constituent companies.

Does The Hang Seng Index Take Into Account The Reinvestment Of Dividends?

No, although there is the Hang Seng Total Return sub-index that does include price changes of constituent stocks and the reinvestment of dividends. However, some Hang Seng brokers may not offer this index.