Hong Kong Stock Exchange

The Hong Kong Stock Exchange (HKEX) is a major indicator of Asian economic performance and is also used by traders across the world to gain exposure to Hong Kong and Chinese Mainland stocks. Many HKEX brokers offer access to the exchange and it is important UK traders choose the right platform for their strategy. This review will look at how to compare online brokers, what the HKEX is and how to trade it. We have also listed our experts’ recommended brokers for HKEX investing.

Best Hong Kong Stock Exchange Brokers in the UK

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

FXCC, a well-established brokerage since 2010, offers cost-effective online trading. Registered in Nevis and regulated by CySEC, it is distinguished by its ECN conditions and absence of a minimum deposit requirement. The account opening process is efficient, taking under five minutes.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Hong Kong Stock Exchange are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Hong Kong Stock Exchange support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Hong Kong Stock Exchange at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Hong Kong Stock Exchange good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Hong Kong Stock Exchange offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Hong Kong Stock Exchange.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| FXCC | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- FXCC is a trusted and licensed broker under the regulation of CySEC, a leading European authority ensuring excellent safeguarding standards.

- The complimentary education section, featuring the 'Traders Corner' blog, provides a wide array of resources suitable for traders of all experience levels.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

Cons

- While the MetaTrader suite excels in technical analysis, its outdated design detracts from the overall trading experience, particularly when contrasted with contemporary platforms such as TradingView.

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Global traders can use accounts in various currencies.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

Cons

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Choosing HKEX Brokers

There are different factors to consider when choosing between Hong Kong Stock Exchange brokers. Consider the factors below before deciding to ensure you find a secure and suitable firm for your needs:

- Cost – the index or stock trading fee should be a primary consideration for an investor, particularly high-volume traders, as all charges eat into profit margins. The main investing costs to be aware of are spreads and commissions. Pepperstone has spreads from 5.0 points for the HK 50, which is an index linked to the exchange. Other costs to consider include deposit and withdrawal fees, currency conversion fees (for example, from GBP to HKD) and account inactivity fees. Always check the broker’s schedule of trading fees before signing up.

- Trading Platform – the best brokers for the HKEX stock exchange will provide industry-leading trading platforms and analysis systems like MetaTrader 4, MetaTrader 5 or TradingView, available on desktops, browsers and mobile apps. Orion is another recommended example but a less well-known trading tool. These platforms all provide the tools needed to conduct an advanced technical and fundamental analysis of the companies traded on the HKEX or the indices linked to it. MT5, for example, has 38 built-in technical indicators and 44 analytical objects to choose from.

- Customer Service – it is not uncommon for investors to come across technical issues when trading or have general queries for their broker. That is why excellent customer service and contact options are key. Remember that, given the UK time difference, it will often be night during the HKEX’s trading and operating hours in GMT, so customer support should be available 24/5. The best brokers will have 24/7 live chat support, whilst also providing an email address and phone number alternatives.

- Regulation – we recommend choosing a broker that is regulated by a reputable organisation like the FCA, ESMA or ASIC. These regulators provide additional protection to investors and monitor the activities of brokers more closely, ensuring financial fair play and adequate security.

Bear in mind that there are other specific features that some traders may look for, such as whether the broker has an API or whether it allows fractional shares and odd lot investing. Therefore, incorporate any additional investing plans and desired features into your decision-making process.

What Is The HKEX?

History

The Hong Kong Stock Exchange (HKEX) is the main stock market for Hong Kong and also includes Chinese Mainland stocks and some international companies. Its origins can be traced back to the Association of Stock Brokers in Hong Kong in 1891. In 1914, the name of it was changed to the Hong Kong Stock Exchange and, in 1947, the Chinese and foreign trading elements of the exchange merged to create something similar to what we know today.

Growth in the region after the Second World War led to the creation of other stock exchanges in Hong Kong. These were merged in 1980 with the creation of The Stock Exchange of Hong Kong. Then in 1989, the Hong Kong Securities Clearing Company was formed to create a central clearing service. Automated ordering was introduced in 1993.

In 2000, the Hong Kong Futures Exchange and the Hong Kong Securities Clearing Company merged to form Hong Kong Exchanges and Clearing Ltd, which remains the holding company for the HKEX today. The physical trading floor closed in 2017 as the exchange adopted all-electronic trading. There is no need to visit the address of the HKEX building in person – trades can be placed easily through Hong Kong Stock Exchange brokers.

There are several mechanisms used to complete transactions on the exchange, including closing auctions, where a consensus closing price for each security is formed.

Nicolas Aguzin is the current CEO of Hong Kong Exchanges and Clearing Ltd. To improve the competitiveness of the exchange, the cash market fixed investing tariff was removed on 1 January 2023.

Composition

In 2022, the number of listed companies trading on the exchange was around 2,500, compared to 1,200 in 2008. Note that not all these stocks may be available to trade at all online HKEX brokers. This significant growth in the size and status of the exchange has been fuelled by the addition of companies from Mainland China. The Chinese economy has seen rapid growth in recent years and, as the second-largest economy in the world, is now an economic and political superpower.

This is reflected in the increased prominence of the HKEX and the investing indices it is linked to, such as the Hang Seng Index. Large banks and insurance firms from Mainland China make up some key parts of the membership of the exchange, including the Commercial Bank of China and the China Construction Bank. However, the exchange does include other markets, such as fashion (e.g JD.com).

It is important to note that the exchange also includes derivatives and debt securities like bonds, which may be available for investing at Hong Kong Stock Exchange brokers, in addition to company shares.

Regulator

The front-lead regulator of the exchange is the Securities and Futures Commission (SFC), which aims to protect investors, monitor listings and oversee a range of financial activities, amongst other objectives. This is all to ensure the integrity of operational trading procedures. The SFC was established in 1989 and is an independent statutory body. There is a trading levy in place that funds the commission.

Opening Hours

The Hong Kong Stock Exchange (HKEX) is open for 5 hours and 30 minutes on weekdays for its securities (stocks and ETFs) market, as explained in its options and trading rules in Chapter 5. Although these are relatively short opening hours (the London Stock Exchange is open for 8 hours and 30 minutes), this does mean there is often high liquidity for the duration of the session between opening and closing times. High liquidity makes it easier for investors to buy and sell at their preferred share price and can also lead to tighter spreads.

The morning trading session is 09:30-12:00 HKST (GMT+8) and the afternoon session is 13:00-16:00 HKST, which is after the official one-hour break for lunch between 12:00 and 13:00 HKST. Although there are no night-time ETF hours, fortunately for UK investors, there are extended hours for securities and stocks from 09:00-09:30 HKST (pre-market) and 12:00-13:00 HKST (extended morning session) that can be used to access the market when it is technically closed.

The derivatives market, which includes options and futures, has similar investing hours but with a little more variation. Many of the major derivatives markets like the Hang Seng Index Futures usually trade from 09:15-16:30 HKST with a one-hour break for lunch. Some of these derivative products also have after-hours trading sessions.

The Hong Kong Stock Exchange (HKEX) has a halt mechanism in place for the suspension of trading and operating hours as a result of natural events like typhoons that could lead to the announcement of a halt in activity. There are also multiple investing holidays and half-days in the schedule so it is important to check a calendar and plan ahead. Chinese New Year, Christmas Day and New Year’s Day are usually non-trading days, which means Hong Kong Stock Exchange brokers will not be able to offer access to the market. Christmas Eve and the last day of the calendar year – New Year’s Eve – are half-days, so there is a limit on opening hours on these days.

What Is The HKEX Used For?

Chinese And Global Economy

The best HKEX brokers will include stocks from Mainland China in addition to Hong Kong-registered companies. This makes the exchange a good barometer of general Chinese and Asian economic performance, particularly when used alongside the Tokyo, Shanghai and Shenzhen stock exchanges.

Given the importance of Chinese growth to the global economy, the Hong Kong Stock Exchange and the indices linked to it can be a strong indicator of wider economic performance and an increase in the value of the Hang Seng could lead to an increase in the S&P 500, for example. However, the correlation between the HKEX and US equities is not as strong as it once was, partly due to a Chinese regulatory crackdown.

Diversification

Indices offered by Hong Kong Stock Exchange brokers like the Hang Seng Index and the FTSE China 50 Index provide investors with a diversified basket of stocks across different sectors. This is often a safer strategy than investing all your capital in one particular company. The number of companies listed on the Hang Seng Index varies but in February 2023 76 members were on the index. Although this is not as diversified as the S&P 500 or the FTSE 100, it does provide exposure to more companies than the Dow Jones or the DAX 40.

Trading

HKEX brokers are often used by market participants to speculate on indices or individual companies listed on the exchange.

Fundamental analysis may be used where the investor analyses various factors behind the price movement. For example, a trade war between China and the US may lead to a drop in the value of stocks on the HKEX. A strengthening of Chinese economic performance as a result of loosening Covid restrictions, or an increase in the number of jobs, may lead to a rise in their value. The skill of an investor is in predicting these events before they occur to profit from the subsequent movement in price. This is easier said than done.

Other traders prefer technical analysis using indicators and graphs to identify patterns in the market price movement. Prices should update in real-time with Hong Kong Stock Exchange brokers providing live quotes.

The HKEX also has a block trade facility to assist institutional speculators, such as hedge fund businesses – and possibly high net-worth individuals – to take a large position within a certain price range. The block trade may consist of multiple smaller orders – rather than one single unit – and the aggregation of this is the overall trade size.

How The HKEX Works

Indices

The main blue-chip index linked to the Hong Kong Stock Exchange and provided by many HKEX brokers is the Hang Seng Index (HSI). This started in 1969 but was calculated from 1965. The number of companies on the index does vary but stood at 76 members in February 2023.

Its average annual percentage change since 1965 is impressive at approximately 19.2%. This is around double the average returns that can be expected on the S&P 500 (9-10%). However, the figure is skewed by very strong growth in some small periods. In the 2010s, average growth was rather sluggish at 3.7%, only a fraction of that seen during the record periods. This is partly a consequence of the uncertainty over Hong Kong’s future.

Since the mid-1980s, the index has been grouped into four sub-indices: Finance (the largest by some margin), Utilities, Properties and Commerce & Industry.

Other indices linked to the Hong Kong Stock Exchange include:

- Hang Seng China Enterprises Index – the top 50 H Shares on the HKEX

- FTSE China 50 Index – 50 of the largest H Shares, Red Chips and P Chips

- Hang Seng China-Affiliated Corporations Index – the top 50 Red Chips on the HKEX

- Hang Seng Composite – around 500 constituents and 95% of the market cap

- FTSE China A-H 50 Index – the top 50 A Shares and H Shares on the Hong Kong, Shanghai and Shenzhen exchanges

Qualification

To qualify for the Main Board of the HKEX through an IPO, companies must have an operating history of no less than three years. There are three options when it comes to companies meeting the listing requirements and rules: the profit test, the market cap/revenue test and the market cap/revenue/cash flow test. Companies must also meet the criteria for at least one of these.

The profit test for new listings requires a market cap of at least HK$500m and at least HK$80m in shareholder profits in the last three years (HK$35m must have been earned in the most recent year and aggregate profits for the two years before that must be at least HK$45m).

There are also other listing requirements, such as the need for 25% of share capital to be held by the public and the disclosure of various documents.

The exchange hosts a Growth Enterprise Market (GEM) aimed at small and mid-sized issuers that do not meet the eligibility requirements of the Main Board. Many Hong Kong Stock Exchange brokers though will likely focus on stocks on the Main Board.

Separate criteria are in place for companies to be listed on an index. For the Hang Seng index, companies must rank in the top 90th percentile in terms of total market turnover for the past year. In addition, the market value of the company’s ordinary shares must be in the top 10% and the stock must have been listed for at least 24 months. This means that start-ups and certain growth stocks you may find with a quick search are automatically excluded. Market cap, financial performance and representations from the relevant sub-index may also be considered before a decision on the inclusion of a stock on the index.

A committee meets quarterly to decide whether stocks should be added or removed from the Hang Seng Index, with these changes reflected on the platforms of HKEX brokers.

Weighting

The Hang Seng Index is a free-float adjusted market capitalisation-weighted index. This means that companies with a larger market cap will affect the index more than smaller ones when their value changes. However, to avoid particular companies dominating the index, an 8% weight cap is applied. No adjustments are made for cash dividends or warrant bonuses.

HKEX Statistics

Here are some key facts about the Hong Kong Stock Exchange and the Hang Seng Index:

- Stock option trading was introduced in 1995

- HKEX is the fifth largest stock exchange in the world

- The all-time high of the HSI was set in January 2018 at 33,223.58 points

- The Hang Seng Index represents around 58% of the market cap of the exchange

- The combined market cap of the HKEX in January 2023 was around HK$38.9tn

- HKEX is the third largest stock exchange in Asia by aggregate market cap (after Tokyo and Shanghai)

Biggest Players

Some of the largest companies on the exchange that are available to trade with many Hong Kong Stock Exchange brokers are:

- Tencent (HK$3.6tn market cap)

- Industrial and Commercial Bank of China (HK$1.77tn market cap)

- China Construction Bank (HK$1.25tn market cap)

- HSBC (HK$1.15tn market cap)

- AIA Group (HK$982.97bn market cap)

Other stocks on the exchange include Kuaishou Technology (market cap of $HK268.03bn) and NIO (market cap of $HK121.04bn). Popular US companies like Gamestop are not listed in Hong Kong.

Why Trade The HKEX?

In addition to diversification and access to large blue-chip companies, another benefit of HKEX brokers is that traders can access Chinese Mainland stocks. It can be difficult for foreign investors to access stock exchanges in Mainland China directly due to local regulations. Many foreign investors, therefore, use the exchange as a gateway for northbound trading. There are currently 271 H Shares listed on the Main Board and a further 18 on the GEM Board. H Shares are Chinese Mainland stocks listed on exchanges outside the Mainland.

Furthermore, the Hong Kong Stock Exchange also allows investors to trade the following types of stocks:

- Red Chip Shares – Companies incorporated outside of the Chinese Mainland and listed on the HKEX. These can be partially controlled by the Chinese Government but most of their operations are outside China. An example of a Red Chip would be Lenovo, which is incorporated in Hong Kong.

- P Chip Shares – Similar to Red Chips but the companies are privately owned.

How To Invest In The HKEX

It is usually not possible to ‘buy’ an index directly at Hong Kong Stock Exchange brokers. Traders must either invest in an asset like an ETF, futures contract or CFD that tracks the value of the index or in the individual stocks that make up the index. Make sure you are aware of the expense ratios if investing in ETFs. CFDs are often leveraged, which allows for greater exposure, and there are some tax differences as UK traders will usually not have to pay stamp duty on profits. However, margin trading can create enlarged profits and losses.

Wash trading (where the same asset is bought and sold at the same time to manipulate the market), performing a cross trade and insider trading are not permitted and/or are illegal, as is the case generally with the laws and rules of global markets.

Choosing A HKEX Stock

When searching for stocks from HKEX brokers, it is sometimes easier to identify them using a stock code or symbol. However, there are some important factors to look into before attempting to purchase any shares.

Volume

When investing in an asset linked to the HKEX or derivatives like options, daily and current volume is an important consideration. It is essentially the number of shares traded in a given period. In short, the higher the volume, the more significant a price move is in any given direction. If the volume is low and the price moves, that may mean you should attach less significance to the trend. Keep this in mind when deciding whether to invest in a particular stock at a given price. Average daily and monthly trading volumes can vary significantly on the HKEX, which can affect the value and return on your trades.

Volatility

The main measure of volatility is beta. Most traders have different levels of tolerance when it comes to volatility but identifying what the beta is before investing is useful to understand whether you are comfortable with the risk. Beta compares an asset’s return with a corresponding benchmark. So, if the beta is 2, that means the asset moves 200% for every 100% that the benchmark moves. If the beta is below 1, that means the benchmark is more volatile than the asset.

Fundamental Value

It is important to look at the fundamentals of any stock or HKEX index. Some of this data may be found on the website of Hong Kong Stock Exchange brokers, other information may need to be sought from reputable news sources or the HKEX website itself (which also has an Investor Relations webpage, notices and annual reports).

Search for the company’s income statement, balance sheet and cash flow. Read any prospectuses they have released. This can help to determine the intrinsic value of listed companies and whether an asset has strong growth potential. After all, growth is necessary for traders to see a strong return on their investment. Use economic calendars to identify when a company’s earnings announcements are planned for, whether you are investing in northbound or Hong Kong-registered stocks.

It is also important that traders ensure they get value for money when investing. Ratios like the p/e ratio and forward p/e ratio can help determine whether a stock is undervalued or overvalued. It is often good practice to compare these metrics to similar companies in the same industry.

Strategies

Those that favour technical analysis will often look to incorporate one or more statistical investing strategies when using HKEX brokers. Below, we outline two popular strategies that can be utilised for both the HSI and constituent company stocks.

Trend-Following Strategy

This is a mid to long-term strategy that seeks to identify a significant price trend and ride on the back of it. For example, if a negative (bearish) trend were identified, a trader would take a short position on an HKEX index ETF.

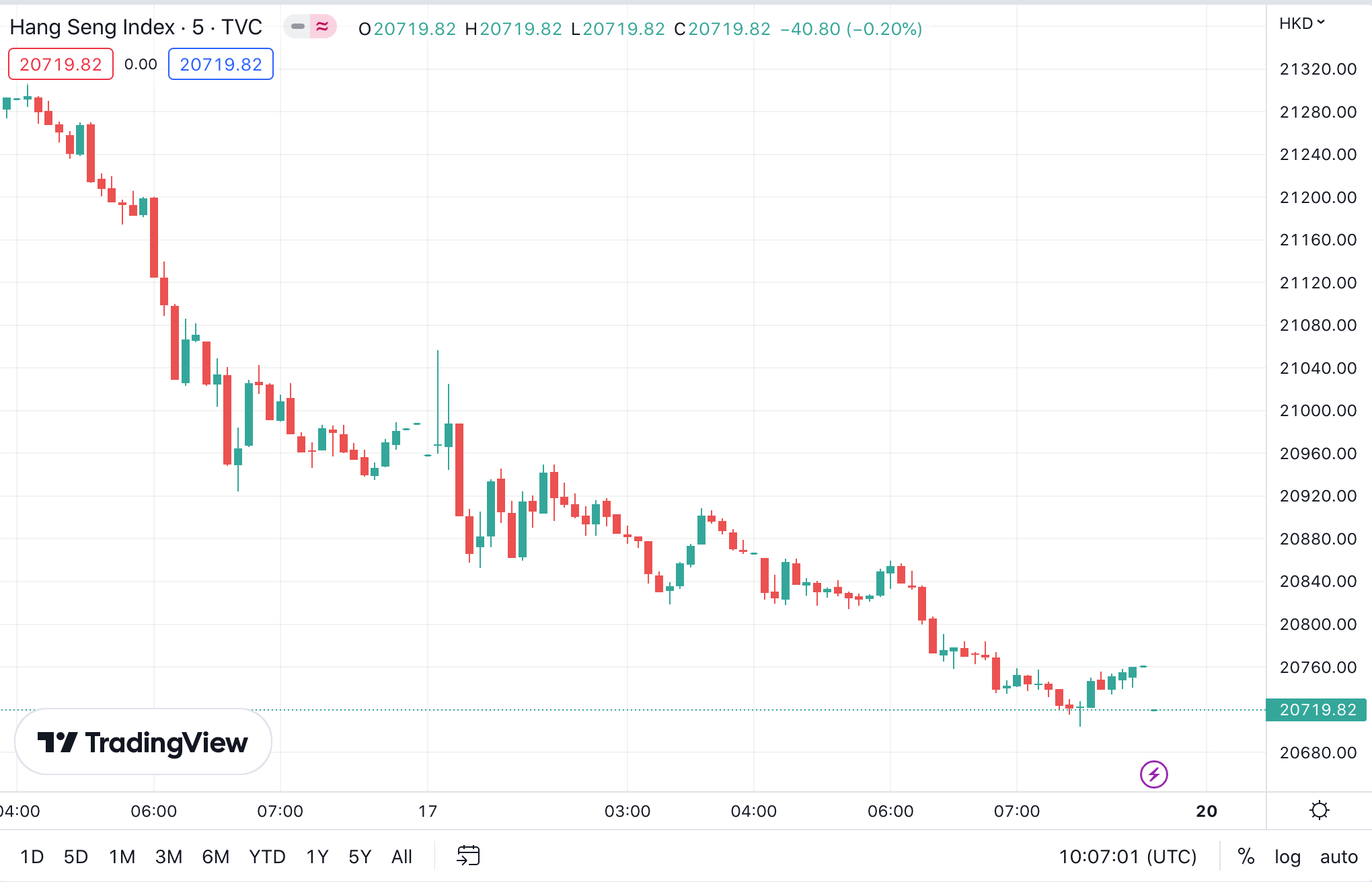

HSI Bearish Trend

Trends can be difficult to identify as a positive (bullish) one does not necessarily mean the price is constantly rising and a negative trend does not mean the price is constantly falling. All trends, whether on the Hang Seng Index or other assets, often have periods where the price stalls or temporarily reverses. A 50-day or 200-day moving average is a good way to help identify a long-term trend as this indicator will average out prices over that period. It is also a lagging indicator, so if the price is above the moving average, it could indicate that an uptrend is about to take shape.

Many also utilise a crossover strategy. This is where two exponential moving averages (EMAs) are plotted, one fast and one slow, and use their intersection to indicate a trend change. For example, one might enter a long position when the fast EMA crosses above the slower one. Similarly, the fast one crossing below the slow one would suggest a downward trend.

Range Trading

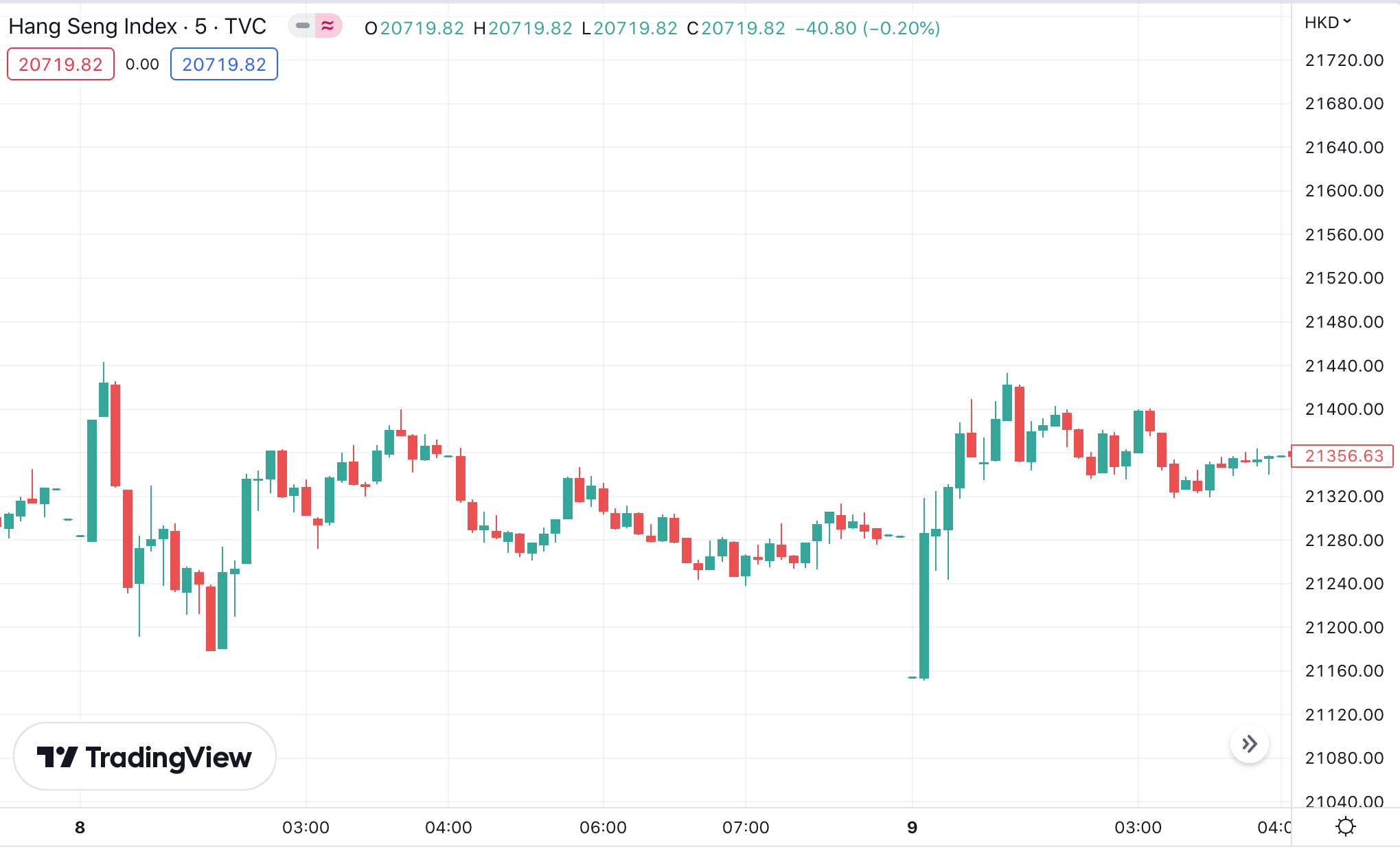

Another technical analysis strategy for investing with Hong Kong Stock Exchange brokers is range trading. This is used when the price is not trending but fluctuating horizontally between a support (low) level and a resistance (high) level. If the price of an HKEX stock or index hits the same level twice or more without extending beyond it, this may indicate a support or resistance level. Traders should plot horizontal lines on their chart that run parallel to show these clearly.

HSI Range Trading

When the price nears a support level, you would then open a long position just before the price enters a new upward phase and then maintain the position until the price returns to the resistance level.

The strategy can be used in conjunction with Bollinger Bands and an RSI indicator, which helps indicate when the market is in oversold or overbought territory. Traders should be wary of range breakouts and use a stop-loss, which most platforms used by Hong Kong Stock Exchange brokers will have, to protect against this risk.

HKEX Tips

Educational Resources

Our experts recommend using the often free educational resources provided by Hong Kong Stock Exchange brokers. The best firms will have webinars, tutorials, trading guides and glossaries, which may cover strategies or economics and could also include relevant market analysis and forecasts.

Demo Accounts

Demo accounts can be used to assist beginners in becoming more comfortable when investing, while experienced traders can use them to test a new strategy or explore new markets. HKEX brokers will usually offer a demo account for free with minimal personal details needed to sign-up.

Automation

Some Hong Kong Stock Exchange brokers like Pepperstone provide access to an automated trading service that lets users build their own bots and backtest their algorithms using historical data and prices. These bots are a form of algorithmic (algo) trading. Copy trading may also be available, with which users can follow the trades of a more experienced investor, usually for a fee.

Journals

It is important to reflect on past trades to understand where mistakes were made and to ensure these are not repeated. A journal can help with this as a useful way to record a daily summary of all your HKEX positions for regular review and reflection. The main details we recommend including are:

- Date

- Success

- Closing position

- Trading strategy

- Opening position

- Position size (i.e number of lots)

Bottom Line On HKEX Brokers

HKEX brokers provide access to a major stock exchange regularly ranking in the top five globally. The Hong Kong Stock Exchange’s rise has been fuelled by the rapid growth in the Chinese economy, presenting plenty of opportunities for traders to invest in growth stocks and indices. HKEX investment is also an excellent way to lawfully bypass regulations and gain exposure to Chinese Mainland stocks, which are otherwise very restricted. Check out our list of the best UK brokers for investing in the Hong Kong Stock Exchange.

FAQ

Can I Only Trade Hong Kong-Registered Companies At HKEX Brokers?

No. One of the main benefits of HKEX brokers is that investors have access to Chinese Mainland stocks and some international companies whose operations are registered elsewhere. Since it is difficult for foreign investors to access exchanges in Mainland China directly, the HKEX provides a useful gateway to UK investors.

Can You Trade Options On The HKEX?

Options contracts are a form of derivative that can be traded on the Hong Kong Stock Exchange. The owner of an options contract is a right holder as they have the rights but not an obligation to exercise the contract at a predetermined price upon its close. Remember that Hong Kong Stock Exchange brokers will usually charge fees for options, just as they would with securities.

How Big Is The Hong Kong Stock Exchange?

The HKEX is the fifth largest stock exchange in the world and the third largest in Asia after the Tokyo and Shanghai stock exchanges. In 2022, it had around 2,500 listings.

Is The Hong Kong Stock Exchange Market Open Today?

Traders can check the HKEX website to see the investing hours and closing days for the market. Generally, for weekdays that are non-holiday days, the times the exchange is open are 09:30-12:00 HKST and 13:00-16:00 HKST. However, there are also extended hours sessions available at certain brokerage firms. Check out the Hong Kong Stock Exchange northbound trading calendar for a complete summary and holiday schedule.

What Are Insider & Parallel Trading On The Hong Kong Stock Exchange?

Illegal insider trading is when an investor is given non-public information with which they then make a trade in parallel to their profit, taking advantage of information not available to others in the market.