Best Stock Brokers In The UK 2026

Choosing a stock broker can feel complicated. There are lots of options, each with its own fees, platforms, and rules. If you pick the wrong one, it can cost you time and money. That’s why we’ve done the legwork to find the best stock brokers in the UK.

Top UK Stock Brokers

-

IBKR offers access to a vast range of equity products from 24 countries. You can invest directly in stocks for capital growth, dividends, or voting rights. Alternatively, engage in trading price movements with CFDs, futures, and over 13,000 ETFs. In 2024, IBKR expanded its European derivatives by including trading on CBOE Europe Derivatives (CEDX).

Stock Exchanges Fractional Shares Leverage Shenzhen Stock Exchange, Toronto Stock Exchange, Euronext, New York Stock Exchange, Korean Stock Exchange, Chicago Mercantile Exchange, London Stock Exchange, IBEX 35, Borsa Italiana, CAC 40 Index France, Nasdaq, Japan Exchange Group, Russell 2000, Nasdaq Nordic & Baltics, Tadawul, Abu Dhabi Securities Exchange, Nairobi Securities Exchange, London Metal Exchange Yes 1:50 Stocks Spread Share Baskets Platforms 0.003 Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

FOREX.com offers a variety of US, EU, and UK stock CFDs with spreads as tight as 1 point. Traders can explore both established brands and new IPOs, enhancing portfolio diversification opportunities. US stocks are available starting at 1.8 cents per share.

Stock Exchanges Fractional Shares Leverage Nasdaq, S&P 500, DAX GER 40 Index, FTSE UK Index, Australian Securities Exchange (ASX), Euronext, Hang Seng, CAC 40 Index France, Borsa Italiana, Japan Exchange Group, IBEX 35, SIX Swiss Exchange, Dow Jones, Hong Kong Stock Exchange No 1:30 Stocks Spread Share Baskets Platforms 0.14 No WebTrader, Mobile, MT4, MT5, TradingView -

Eightcap provides over 590 shares from the US, Australia, and Europe alongside a select range of indices, such as the Dow Jones and FTSE. Their Labs include first-rate educational resources, especially the ‘Navigating Stock Market Volatility’ guide. However, they do not yet offer fractional shares for budget traders, unlike brokers like XTB.

Stock Exchanges Fractional Shares Leverage New York Stock Exchange, CAC 40 Index France, DAX GER 40 Index, London Stock Exchange, Australian Securities Exchange (ASX), Euronext, FTSE UK Index, Japan Exchange Group, Dow Jones, Nasdaq, Hang Seng, Hong Kong Stock Exchange, S&P 500, Russell 2000, Toronto Stock Exchange, SIX Swiss Exchange No 1:30 Stocks Spread Share Baskets Platforms 0.03 (Apple Inc) No MT4, MT5, TradingView -

eToro provides access to countless stocks from Europe, the US, and globally. In 2024, Dubai’s leading stocks will be included, and more than 180 Nordic stocks will be available in 2025. Traders can invest independently or participate in the vibrant social trading community. Long-term investors can explore Smart Portfolios, featuring thematic collections such as Big Tech.

Stock Exchanges Fractional Shares Leverage SIX Swiss Exchange, Euronext, Deutsche Boerse, Japan Exchange Group, Shanghai Stock Exchange, New York Stock Exchange, Hong Kong Stock Exchange, Australian Securities Exchange (ASX), Korean Stock Exchange, London Stock Exchange, FTSE UK Index, S&P 500, DAX GER 40 Index, Dow Jones, CAC 40 Index France, National Stock Exchange Of India, Tokyo Commodity Exchange, IBEX 35, Hang Seng, Russell 2000, Borsa Italiana, Taiwan Stock Exchange, Nasdaq, Nasdaq Nordic & Baltics, Dubai Financial Market, Abu Dhabi Securities Exchange Yes 1:30 Stocks Spread Share Baskets Platforms 0.57 (Apple) Yes eToro Web, CopyTrader, TradingCentral -

IG provides access to over 13,000 shares for trading and investment, surpassing most rivals in the number of listed firms. The broker stands out with its zero commission policy on US shares. Additionally, out-of-hours trading unlocks more than 70 shares, alongside popular ETFs and trusts, even when markets are shut. They have also introduced an AI Index, highlighting opportunities in leading US firms specialising in artificial intelligence and machine learning, like Nvidia.

Stock Exchanges Fractional Shares Leverage SIX Swiss Exchange, Taiwan Stock Exchange, Toronto Stock Exchange, Tadawul, Deutsche Boerse, Japan Exchange Group, Shanghai Stock Exchange, Euronext, Hong Kong Stock Exchange, National Stock Exchange Of India, Australian Securities Exchange (ASX), Bombay Stock Exchange, London Stock Exchange, Dow Jones, S&P 500, IBEX 35, Borsa Italiana, Russell 2000, Korean Stock Exchange, Shenzhen Stock Exchange, Nasdaq Dubai No 1:30 (Retail), 1:222 (Pro) Stocks Spread Share Baskets Platforms 0.02 Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

Traders have the opportunity to speculate on top companies in the US, EU, UK, and Australia, including renowned brands such as Tesla and Apple. The platform supports a variety of trading strategies, whether short, medium, or long-term. Algo traders can utilise Expert Advisors (EAs) for enhanced automation. Moreover, a wide selection of indices and ETFs is available for those interested in diversifying their portfolios.

Stock Exchanges Fractional Shares Leverage DAX GER 40 Index, Dow Jones, London Stock Exchange, Euronext, IBEX 35, CAC 40 Index France, FTSE UK Index, Hang Seng, National Stock Exchange Of India, Bombay Stock Exchange, Nasdaq, Japan Exchange Group, S&P 500, Australian Securities Exchange (ASX) No 1:30 Stocks Spread Share Baskets Platforms 0.01 No ProTrader, MT4, MT5, TradingView, DupliTrade -

Plus500 provides a comprehensive selection of shares through CFDs across UK, US, and European markets. In 2025, this includes new offerings in quantum computing and AI sectors, featuring companies like IonQ, Rigetti, Duolingo, and Carvana. Unique prospects in the ESG and cannabis sectors set Plus500 apart from other platforms. Traders also have access to over 30 indices, with leverage options reaching up to 1:20.

Stock Exchanges Fractional Shares Leverage SIX Swiss Exchange, Euronext, Deutsche Boerse, Australian Securities Exchange (ASX), London Stock Exchange, Borsa Italiana, FTSE UK Index, CAC 40 Index France, DAX GER 40 Index, IBEX 35, Dow Jones, S&P 500, Nasdaq, Hang Seng No Yes Stocks Spread Share Baskets Platforms Dynamic No WebTrader, App

Safety Comparison

Compare how safe the Best Stock Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Stock Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

Mobile Trading Comparison

How good are the Best Stock Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Plus500 | iOS, Android & Windows | ✘ |

Beginners Comparison

Are the Best Stock Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Plus500 | ✔ | $100 | Variable |

Advanced Trading Comparison

Do the Best Stock Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Stock Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| Forex.com | |||||||||

| Eightcap | |||||||||

| eToro | |||||||||

| IG | |||||||||

| Vantage FX | |||||||||

| Plus500 |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

Cons

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- Funding choices are restricted when compared to top options such as IC Markets. Many popular e-wallets, including UnionPay and POLi, are noticeably absent.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- There is an extensive online training academy offering a range of accessible resources, from concise articles to detailed courses.

- In 2025, eToro altered its fee structure by separating crypto trading fees from the spread. A distinct commission is now listed separately, providing traders with increased transparency while maintaining consistent overall costs.

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

Cons

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The only significant contact option, besides the in-platform live chat, is limited.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- The broker provides low-commission trading across varied markets, reducing extra fees and attracting seasoned traders.

- The customer support team consistently delivers reliable support around the clock through email, live chat, and WhatsApp.

- Plus500 has expanded its range of short-term trading instruments by adding VIX options, which feature increased volatility. Additionally, it has extended trading hours for seven stock CFDs.

Cons

- Algorithmic trading and scalping are not available, potentially deterring certain traders.

- Compared to competitors like IG, Plus500 offers limited research and analysis tools.

- The lack of social trading features prevents users from copying trades made by seasoned traders.

How Investing.co.uk Chose The Best Stock Brokers For UK Traders

Our team of experienced stock traders in the UK assessed brokerages by looking at core factors such as stock exchange access, trading fees, execution speed, platform usability, research tools, and investor protection.

Our team combined data-driven analysis with hands-on testing to see how each broker performs in real conditions. We then ranked the shortlisted providers by overall ratings to identify the best stock brokers for retail traders.

What To Look For In A Stockbroker

Regulation & Safety

First, check if the broker is regulated. In the UK, the Financial Conduct Authority (FCA) oversees brokers. FCA regulation means the broker has to follow strict rules to protect customers.

Also, look at the Financial Services Compensation Scheme (FSCS). This protects your money up to £85,000 if the broker fails. It doesn’t cover investment losses, just the broker going under.

Safety is more than just regulation. Check reviews and see if there have been past complaints. A broker with a clean record is usually more reliable.

Fees & Charges

Fees are one of the most significant differences between brokers. Some charge per trade, others have monthly or annual fees.

- Trading fees: Look at the cost per stock trade. Even a small difference matters if you trade often.

- Account fees: Some brokers charge inactivity fees or annual fees.

- Hidden costs: Check for charges on deposits, withdrawals, or currency conversions.

Compare fees carefully. A broker that seems cheap at first might end up costing more if you do a lot of stock trading or want access to equities in different markets.

Range Of Investments

Not all brokers offer the same types of investments. Some focus on UK stocks, others give access to global markets, ETFs, bonds, or funds.

Think about what you want to trade now and in the future. If you only want UK stocks, a simple broker might be fine. But if you plan to trade international stocks or more complex products, check what’s available.

Also, see if they offer fractional shares. This lets you invest smaller amounts in expensive stocks. It’s useful if you’re starting or don’t want to tie up too much money in one company.

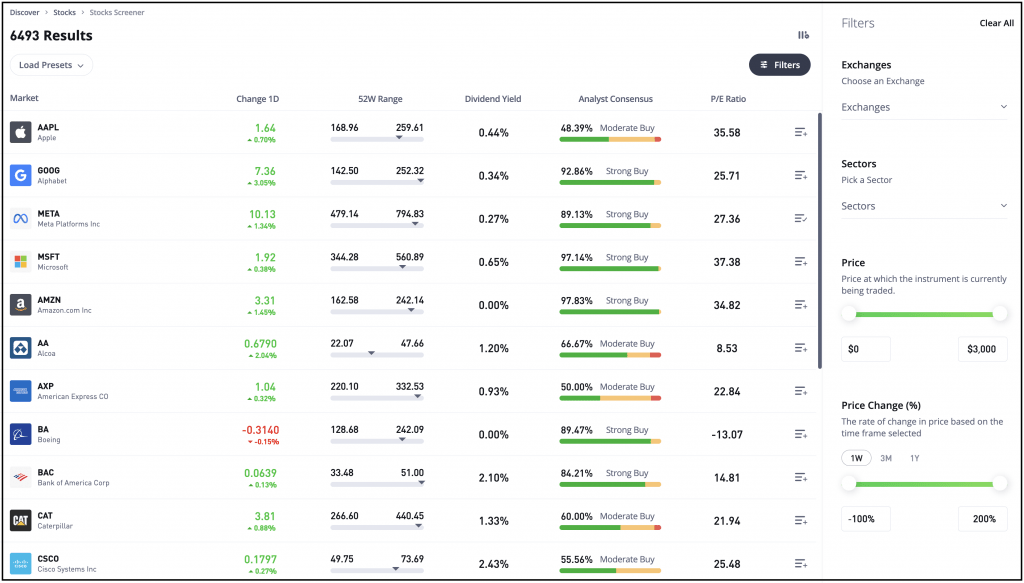

eToro lets you filter stocks by using more than 20 different metrics

Trading Platforms & Tools

A good platform makes trading easier. Look for:

- Ease of use: Can you place trades quickly? Is the interface straightforward?

- Charts and data: Do they provide real-time prices, news, or analysis?

- Mobile access: Can you trade from a phone or tablet without issues?

When I first try a broker’s stock trading platform, I spend more time clicking around than actually trading. I start customising the layout to show only what I need—my watchlist, order buttons, and a simple chart.That small change makes placing trades faster and less stressful, and I now realise I don’t need every feature to trade effectively.

Customer Service

Even experienced traders need help sometimes. Test the broker’s support before signing up.

- Response time: How fast do they answer emails or chats?

- Availability: Do they work weekends or evenings?

- Knowledge: Can they answer your questions clearly?

Good customer service saves frustration. A slow or unhelpful support team can make problems worse.

Account Types & Flexibility

Check what account types the broker offers. In the UK, common options include:

- Standard stock accounts: Simple and flexible.

- ISAs: Tax-free accounts for UK residents.

- SIPPs: Self-invested personal pensions for retirement savings.

Make sure the broker offers the type you need. Also, see if you can move money in and out easily and if you can open multiple accounts under the same login.

Research & Education

Even if you know a lot about investing, research tools can help. Some brokers provide:

- Market news and analysis.

- Stock screeners to find investments that meet your criteria.

- Educational materials for beginners.

Using a broker’s research tools at first felt overwhelming. I focused on a few key metrics and used the guides to gain a deeper understanding of them. It made my decisions clearer and kept me from getting lost in all the charts.

Execution Speed & Reliability

Trade execution matters if you’re buying or selling at precise prices.

- Execution speed: How fast are stock trades confirmed?

- Reliability: Are there frequent outages or delays?

- Slippage: Does the broker sometimes fill orders at a worse price than expected?

For casual investors, small delays aren’t a big deal. But for frequent traders or day traders, speed and reliability are important.

Payment Methods

Look at how you can fund your account and withdraw money. Common options include:

- Bank transfer

- Debit card and credit card

- E-wallets like PayPal and Skrill (less common)

Check if there are fees for deposits or withdrawals. Also, see how long it takes for money to arrive in your account or back in your bank.

Reputation & Reviews

Finally, see what other users say. Look for patterns, not single complaints.

- Consistent complaints about withdrawals or hidden fees are red flags.

- Positive reviews about support and platform reliability are good signs.

Forums and review sites can help, but take extreme opinions with caution. People often post only when they are very happy or very frustrated.

Bottom Line

Choosing the best stock broker in the UK comes down to a few key points. Make sure the broker is FCA regulated and that your money is protected.

Compare fees carefully, and look closely at the types of investments they offer. A broker that fits your trading style is more important than one with fancy features.

Also, test the platform and customer service to see if they are easy to use and responsive. Check how flexible the account options and funding methods are.

Finally, pay attention to other users’ experiences. A clear, reliable broker that meets your needs will save you time and frustration in the long run.