Best Forex Brokers In The UK 2026

Are you looking for the best forex brokers in the UK? We’ve selected the best FCA-regulated platforms with GBP accounts, wide currency pair options, and local support – perfect for British traders ready to trade currencies online.

Top Forex Brokers in the UK

-

Pepperstone provides forex spreads on the EUR/USD averaging just 0.12 pips with their Razor account. This is highly competitive. Their extensive portfolio includes over 100 currency pairs, which exceeds what most rivals offer. Furthermore, Pepperstone stands out by offering three unique currency indices: USDX, EURX, and JPYX, which are rare on other platforms. They have been recognised with our 'Best Forex Broker' award twice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.1 0.4 Total Assets FCA Regulated Platforms 100+ Yes MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower -

XTB offers over 60 currency pairs with competitive spreads, averaging 1 pip on major pairs. The xStation platform is user-friendly, featuring over 30 indicators in its charting package and a variety of order types, supporting diverse trading strategies and risk management.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

FXCC champions its competitive forex trading environment. ECN spreads can drop to an impressive 0.0 pips during busy trading periods. Offering more variety than many competitors, it supports over 70 currency pairs. Furthermore, traders benefit from MT4, renowned for its exceptional charting capabilities, specifically designed for forex trading.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.0 0.2 0.5 Total Assets FCA Regulated Platforms 70+ No MT4, MT5 -

IBKR offers a vast range of over 100 forex pairs, including major, minor, and exotic currencies, outstripping most competitors except CMC Markets. Trading is available across multiple platforms with institutional-grade spreads beginning at 0.1 pips. There are also 20 sophisticated order types, such as brackets, scale, and one-cancels-all (OCA) orders, enhancing trading strategies.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value Total Assets FCA Regulated Platforms 100+ Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

Vantage provides over 55 currency pairs, exceeding the industry norm, giving traders ample opportunities. With a robust liquidity pool, forex spreads start at 0.0 pips on the ECN account, often beating other options. Additionally, there are no commissions, deposit fees, or hidden charges.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.0 0.5 Total Assets FCA Regulated Platforms 55+ Yes ProTrader, MT4, MT5, TradingView, DupliTrade -

IC Markets remains dedicated to offering tight 0.0-pip spreads on major currency pairs like EUR/USD, ensuring outstanding execution with an average speed of 35 milliseconds. Ideal for traders seeking high performance, those dealing in large volumes can also enjoy rebates of up to $2.50 per forex lot.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.23 0.02 0.27 Total Assets FCA Regulated Platforms 75 No MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower -

FOREX.com remains a leading FX broker, providing 80 currency pairs with highly competitive fees. EUR/USD spreads can reach as low as 0.0, with a $7 commission per $100k, making it a standout choice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 1.2 1.4 Total Assets FCA Regulated Platforms 84 Yes WebTrader, Mobile, MT4, MT5, TradingView

Safety Comparison

Compare how safe the Best Forex Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Forex Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Forex Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Forex Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Forex Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Forex Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| FXCC | |||||||||

| Interactive Brokers | |||||||||

| Vantage FX | |||||||||

| IC Markets | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- FXCC has introduced MT5, which in our evaluations, mirrored the trading conditions of MT4 by offering swift execution, improved charting, and market depth tools.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

- There are no deposit fees other than standard cryptocurrency mining charges, which benefits active traders.

Cons

- While the MetaTrader suite excels in technical analysis, its outdated design detracts from the overall trading experience, particularly when contrasted with contemporary platforms such as TradingView.

- FXCC's exclusive MetaTrader platform is a limitation, especially when compared to more versatile options like AvaTrade, which offers five different platforms to cater to various trader needs.

- The variety of currency pairs surpasses most options, but the choice of other assets is limited. Notably, stocks are absent.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- IC Markets provides some of the industry's narrowest spreads, offering 0.0-pip spreads on major currency pairs. This makes it an extremely cost-effective choice for traders.

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

Cons

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Interest is not paid on idle cash, a feature gaining popularity with alternatives such as Interactive Brokers.

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- Funding choices are restricted when compared to top options such as IC Markets. Many popular e-wallets, including UnionPay and POLi, are noticeably absent.

How Did Investing.co.uk Choose The Best Forex Brokers?

We began our review by confirming that every broker in our growing database supports forex trading and accepts UK clients.

Next, we used our custom rating system, which assesses brokers across 200+ data points in eight key areas, including FCA compliance, currency pair variety, fees, and platform performance.

To better serve forex traders in the UK, we gathered detailed data on trading costs for popular pairs like GBP/USD and EUR/GBP. This method helps us deliver recommendations that align with the real needs of UK-based forex traders.

What Is A Forex Broker?

A forex broker is a firm that connects traders and investors to the global currency markets. These brokers enable the buying and selling of currency pairs like GBP/USD, EUR/USD, and more.

These brokers facilitate real-time trading and often offer tools such as leverage, charting software, and advanced order types to help you manage risk and opportunity.

For UK-based traders, forex brokers serve as the primary route to access both major and emerging forex markets.

Forex brokers must be regulated by the Financial Conduct Authority (FCA) to legally operate in the UK. This regulation helps ensure that brokers handle client funds responsibly, maintain operational transparency, and comply with strict financial standards, especially important in leveraged trading environments.

UK traders often benefit from brokers that support GBP accounts, offer tight spreads, and provide intuitive trading platforms. Many also include free demo accounts, educational tools, and responsive UK-based support to help beginners and experienced traders refine their strategies.

Whether trading full-time or just exploring the forex markets, choosing a reliable, FCA-regulated broker is key to trading with confidence and security.

How To Choose A Forex Broker In The UK

Currency Pairs

When choosing a forex broker in the UK, the available range of assets and markets is crucial because it directly impacts your trading flexibility and opportunities.

While forex trading focuses on currency pairs, accessing a broader range of instruments, such as commodities, indices, cryptocurrencies, or stocks, lets you diversify your strategy, hedge your positions, and react more effectively to global events.

A wide asset range gives you more tools to adapt to shifting market conditions and build robust trading strategies.

For example, if GBP/USD consolidates with low volatility, you might trade EUR/USD or gold (XAU/USD) instead, based on stronger price movements.

Or, if you’re trading GBP and notice market sentiment is tied to risk-on or risk-off behaviour, you might want to hedge exposure by trading indices like the FTSE 100 or commodities like oil.

Also, look for brokers offering access to major, minor, and exotic currency pairs.

Major pairs like GBP/USD or EUR/USD typically offer high liquidity and tighter spreads, ideal for intraday trading.

Minor pairs, such as GBP/AUD or EUR/SEK, may present more volatility and trend-driven moves, which can be attractive for swing traders.

Exotic pairs, such as GBP/TRY or USD/ZAR, can offer high-risk, high-reward opportunities, often reacting strongly to geopolitical or emerging market news.

Top pick for markets and assets: CMC Markets tops our list for forex asset and market choice thanks to its extensive offering of over 300 currency pairs – the widest selection in the industry based on our analysis – alongside access to thousands of instruments across indices, commodities, stocks, and cryptocurrencies.

Trading Platforms

In forex trading, your platform isn’t just a place to click ‘buy’ or ‘sell’ – it’s the core of your strategy. Whether analysing price action, managing risk, or placing complex orders, having the right tools can give you a serious edge, especially in the fast-moving currency markets UK traders face daily.

Top UK forex brokers offer precision, speed, and flexibility platforms. Advanced charting, efficient order types, and real-time execution are key. Look for features like RSI, MACD, trendlines, Fibonacci tools, and multi-timeframe charting to help you identify high-probability setups on pairs like GBP/USD or EUR/GBP.

I often start my analysis on a daily chart to catch the broader trend, then drop to the 1-hour chart to find RSI divergence or candlestick reversals.A good forex platform lets me layer these views easily, so I’m ready to act quickly when my signals align.

TradingView stands out for its sleek, web-based interface and robust charting tools. Many brokers, including Pepperstone and City Index, integrate TradingView directly, letting you trade from the charts without switching platforms. It’s ideal if you rely heavily on visual analysis.

cTrader is another top-tier platform known for its clean layout, Level II pricing, and advanced order capabilities. It’s especially popular among UK traders who prefer ECN-style trading environments with fast execution and tight spreads.

Mobile access is equally important. Even if you’re not a scalper, being able to adjust trades, check charts, or react to breaking news from your phone can make a huge difference. All major platforms – cTrader, MetaTrader, TradingView, and broker apps – give you complete control wherever you are.

The right platform can streamline your workflow, sharpen your analysis, and help you stay one step ahead of the market.

Top pick for trading platforms: Pepperstone stands out by offering the most diverse and flexible platform lineup, which includes MT4, MT5, TradingView, and cTrader. Multiple platforms allow you to pick the interface, analytical features, and trade execution style that best suits your forex trading strategy.

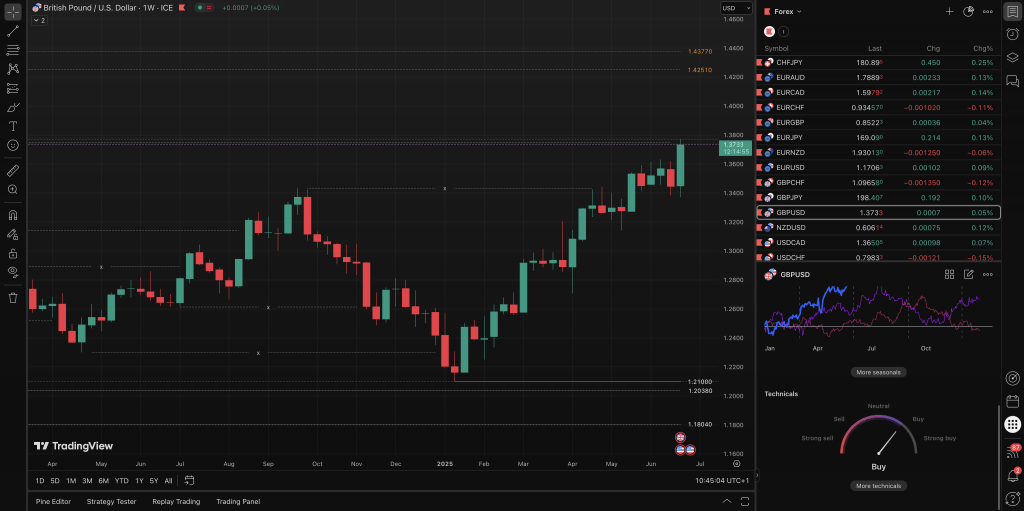

TradingView makes it easy to mark key support and resistance levels on GBP/USD

Forex Trading Fees

Before placing a trade, fully understand fees, spreads, and commissions because these costs directly impact your bottom line.

Every time you place an FX trade, the broker earns money through the spread (the difference between the bid and ask price), a commission, or both. While each fee may seem small, they quickly add up – especially for active traders or those working with tight profit targets.

Always factor trading costs into your risk-to-reward ratio. If your target is 30 pips and the round-trip cost is 3.0 pips, that’s 10% of your profit gone before the trade even plays out. Choosing a low-cost forex broker is a simple but powerful way to gain an edge – especially over the long term.

Spreads are significant in forex because they represent the cost of entering and exiting a position. Tighter spreads mean lower trading costs, which is crucial for strategies like scalping or day trading, where trades are frequent, and profits are often measured in just a few pips.

Major currency pairs like GBP/USD or EUR/USD usually have the tightest spreads, but some brokers mark these up more than others. That’s why comparing average spreads – not just the minimums – is smart.

Some forex brokers we’ve tested operate on a commission-free model with wider spreads, while others offer raw spreads plus a fixed commission per lot traded. For example, a broker might offer 0.1-pip spreads on GBP/USD but charge a £5 round-turn commission per standard lot. This structure can be more cost-effective for high-volume traders than trading with wider spreads alone.

While trading GBP/JPY during the London session, I saw one broker quote a 2.5-pip spread, while another offered a raw spread around 1.0 pip plus a small commission.Over 10 trades, this cost difference was nearly £40 – enough to impact my weekly profits. I boosted my net returns without changing my strategy by switching to the lower-cost forex broker.

It’s also worth checking if the broker charges higher-than-average inactivity fees, withdrawal fees, or overnight financing (swap) rates. The top forex brokers are transparent with their pricing and offer competitive spreads and commissions that align with your trading style and frequency.

Top pick for fees, spreads and commissions: Pepperstone earns high marks for its consistently low spreads on GBP currency pairs during our tests, competitive commission rates, and minimal non-trading fees, making it one of the UK’s most cost-effective forex brokers.

Leverage & Margin

Leverage and margin are key elements that can significantly influence your trading outcomes.

Leverage allows you to open larger positions with less capital, while margin is the portion of your funds required to maintain those positions.

For UK retail traders under FCA regulation, leverage is typically capped at 1:30 for major currency pairs and 1:20 for minors and exotics. These limits reduce the risk of significant losses, but they still provide ample exposure to the market for most traders.

Understanding how leverage and margin work is essential because they directly affect how much risk you’re taking.

I’ve learned that less is often more when it comes to leverage. In one trade on EUR/GBP ahead of a Bank of England announcement, I deliberately used lower leverage to stay within my risk tolerance. When the market moved in my favour, I could take profits comfortably without being overexposed.The lesson? Use leverage wisely to avoid chasing big wins and maintain flexibility and control.

Higher leverage increases both your profit potential and your downside exposure. Conversely, margin determines how many trades you can have open and how much breathing room your account has before facing a margin call.

For example, if you have £1,000 in your trading account and use 1:30 leverage, you can control a position size of up to £30,000 on a major pair like GBP/USD.

However, your losses can accumulate quickly if the market moves against you. That’s why managing your position size and setting stop-losses is as important as identifying a good trade setup.

The best UK forex brokers provide clear margin policies, built-in risk management tools, and safeguards like negative balance protection. Leverage can be a powerful ally when used correctly, but it requires discipline and a strong understanding of risk to avoid turning it into a liability.

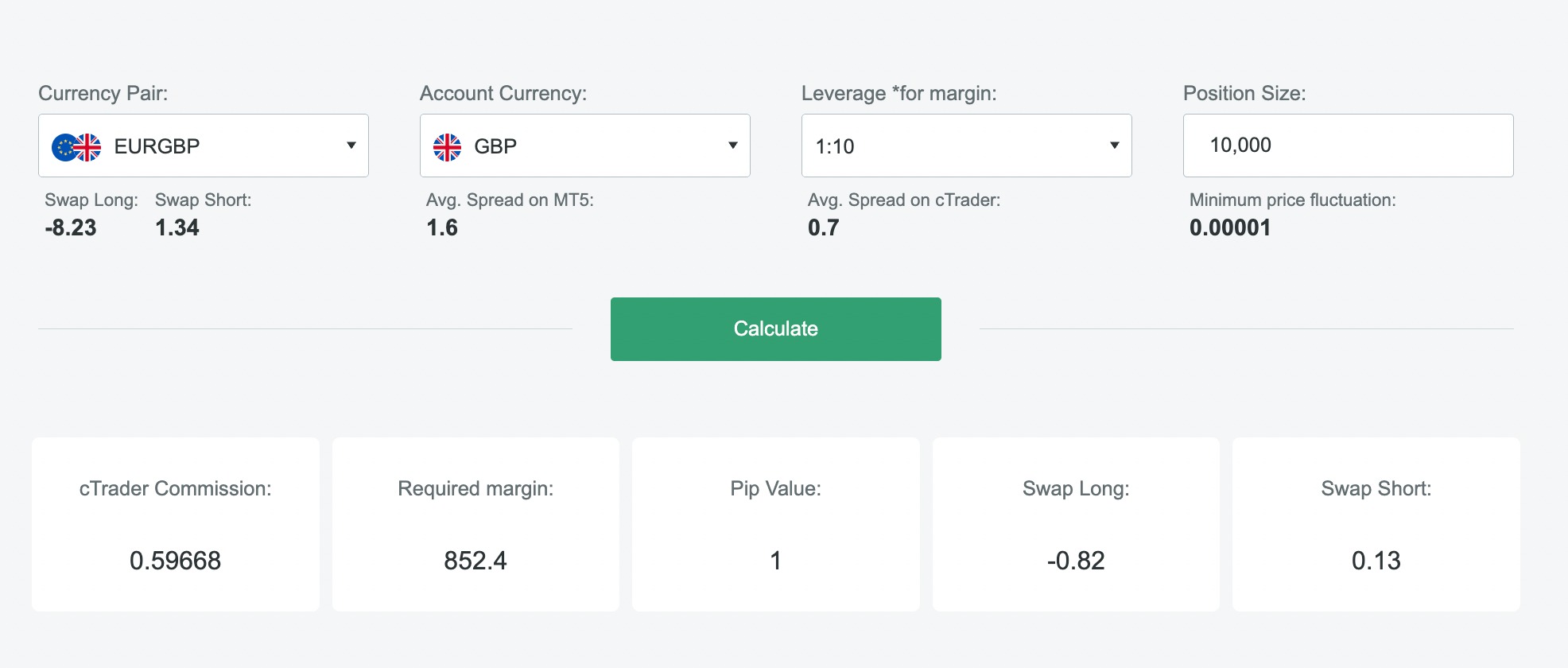

Top pick for leverage and margin: FxPro stands out by offering a really handy trading calculator which helps you understand the leverage available and your required margin on various currency pairs. You can see an example where I planned a EUR/GBP trade below.

FXPro’s forex calculator automatically shows margin, commission and point value

UK Regulation

When selecting a forex broker in the UK, regulatory oversight and platform security are the most important factors. You’re entrusting the broker with executing your currency trades swiftly and accurately and safeguarding your funds, personal data, and trading activity.

For UK traders and investors, choosing a broker authorised and regulated by the FCA is essential. FCA-regulated forex brokers are legally required to uphold high standards, including keeping client funds in segregated accounts, offering negative balance protection, and maintaining operational transparency.

Before opening an account, always verify the broker’s regulatory status on the official FCA register. This step helps shield you from fraudulent or unregulated firms that may seriously risk your capital.

If an FCA-regulated broker goes out of business, eligible UK clients may be covered by the Financial Services Compensation Scheme (FSCS), which can compensate losses up to £85,000 per person. While this protection doesn’t cover forex trading losses, it provides a critical safety net in broker insolvency or misconduct cases.

Cybersecurity is another essential consideration, especially in forex markets where trades can be fast-paced and highly leveraged. Ensure the broker’s platform offers features like two-factor authentication (2FA), encrypted data transfers, and secure login systems to prevent unauthorised access to your account.

Because forex trading often involves real-time decision-making and rapid execution, any breach of security or lapse in regulatory protection can have immediate financial consequences. Choosing a broker that meets UK regulatory standards and invests in strong digital security is a foundational step toward safe and successful forex trading.

Top pick for UK regulation and trust: IG is a top forex broker due to its strong regulatory oversight and long-standing reputation. Regulated by the FCA and having been in the industry for over 50 years, IG has built a solid track record of transparency, reliability, and trust among UK investors, myself included.

Customer Support

Strong customer support shouldn’t be overlooked because trading often involves quick decisions and technical issues that need fast resolution.

Whether it’s a platform glitch, an unexpected market event, or questions about funding your account, reliable and accessible support can prevent costly delays or mistakes.

Forex markets operate 24 hours a day during the week, so brokers offering round-the-clock support in multiple channels – like live chat, phone, and email – are especially valuable.

For UK traders, access to localised support with knowledgeable staff familiar with FCA regulations and UK banking can make a big difference in resolving issues smoothly and quickly.

Before committing to a broker, test their customer service by asking detailed questions about spreads, fees, or platform features. This helps you gauge their responsiveness and expertise – critical factors for confident, uninterrupted trading.

Top pick for customer support: CMC Markets tops our list for its customer support. It provides 24/7 assistance through live chat, phone, and email, as well as in-depth educational webinars and expert market analysis covering UK foreign exchange markets.

Bottom Line

When choosing a forex broker in the UK, focus on FCA regulation for safety and legal protection, competitive fees and tight spreads to reduce trading costs, and a wide range of currency pairs and markets to support diverse strategies.

Ensure the platform offers strong tools and mobile access for efficient execution. Also, look for sensible leverage with clear margin terms and prioritise fast, knowledgeable customer support to handle issues when timing matters.

To find the right forex account your needs, jump to our list of the top forex trading platforms in the UK.