Mitto Markets Review 2024

|

|

Mitto Markets is #97 in our rankings of CFD brokers. |

| Mitto Markets Facts & Figures |

|---|

Mitto Markets offers multi-asset trading across a range of competitive instruments. |

| Instruments | Forex, CFDs, futures, options, mutual funds |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Access financial markets with flexible CFDs. |

| Leverage | 1:30 |

| FTSE Spread | Floating |

| GBPUSD Spread | Floating |

| Oil Spread | Floating |

| Stocks Spread | Floating |

| Forex | Trade on the forex market with 1:30 leverage. |

| GBPUSD Spread | Floating |

| EURUSD Spread | Floating |

| GBPEUR Spread | Floating |

| Assets | 75+ |

| Stocks | Trade in 135 stock products. |

Mitto Markets is a UK-based online trading broker. Standard and ECN trading conditions are available on MetaTrader 4 and the Trader WorkStation platform. Our broker review covers customer ratings, payment options, safety warnings and UK promos. Find out whether to open a Mitto Markets trading account.

About Mitto Markets

Mitto Markets, a registered trading name of Kapwealth Limited, was founded in 2020. The broker offers retail trading services from its headquarters in London, UK. The company is authorised by the Financial Conduct Authority (FCA) and provides a no-frills trading experience with a decent breadth of products to suit varying skill levels.

Trading Platforms

The broker offers two trading platforms; MetaTrader 4 (MT4) and Trader WorkStation (TWS). Both platforms are available as a free download to desktop devices or via major web browsers. Trades can also be placed over the phone through the Mitto Markets helpline.

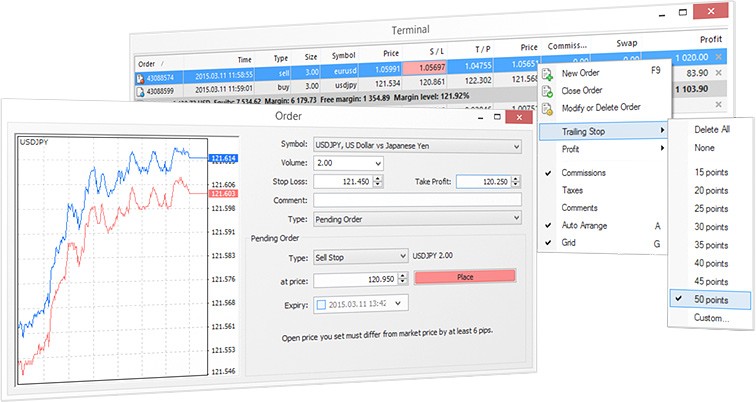

MT4

MetaTrader 4 is a best-in-class platform that allows users to invest in forex and commodities. The easy-to-use trading terminal comes with dozens of drawing tools, hundreds of built-in and customisable technical indicators, multiple time frame charting options, plus instant order execution. The platform supports various strategies and hosts an integrated economic calendar and live news stream.

MetaTrader 4

Trader WorkStation

TWS is a multi-asset platform supporting trading in equities, forex, CFDs, funds, futures, and options. The specialised user interface offers a multi-window view with customisable features. Tools such as OptionTrader are also offered. TWS is a good choice for clients seeking a more tailored trading experience and full access to the broker’s selection of instruments.

Trader WorkStation

Assets

Mitto Markets offers clients global trading opportunities across the following products:

- Forex – Take positions on 75+ currency and commodity pairs

- Equities – Trade shares in 135 global companies and household names

- CFDs – Buy and sell in popular financial markets with leveraged derivatives

- Funds – Access 30,000+ mutual funds including from Allianz, BlackRock, and Fidelity

- Futures & options – Speculate on the future price of commodities and other products

Share dealing is available under ISA and SIPP accounts only. A portfolio management service is also available upon request, offering three specialised profiles.

Note, spread betting and crypto trading are not offered.

Spreads & Commission

Spreads and fees vary by platform and account. The minimum charge on the Trader WorkStation ranges from £3 – £5 per trade depending on the asset class. ECN accounts on the MT4 platform are subject to a commission of £3 per lot but benefit from raw floating spreads. Standard MT4 accounts charge no trading commission with spreads from 1.3 pips.

Leverage Review

UK traders should note that leverage at Mitto Markets is capped in line with European trading rules. For example, forex pairs are offered at 1:30 and commodities up to 1:5. Use risk management tools such as guaranteed stop losses to limit your risk exposure. Leverage can also be manually adjusted from both platforms.

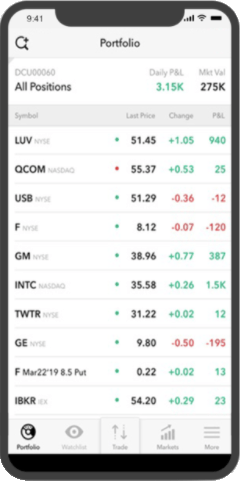

Mobile Trading

Both platforms offer a mobile application, compatible with iOS and Android devices. The MT4 app provides all the key features of the desktop platform. This includes real-time quotes, full trading history and access to analytical functions such as technical indicators, charting tools, and financial news. The MT4 mobile app is popular with UK investors, with countless positive customer reviews and ratings.

The Handy Trader app supports multi-asset investing from mobile and tablet devices. View transaction history, account balances and investment management information while on the go. The application supports real-time market data and charts. Re-routing technology is integrated for prime pricing and optimal executions.

Handy Trader

Deposits & Withdrawals

There is limited information surrounding account deposits and withdrawals. Also, Mitto Markets currently only supports bank wire transfers and credit cards with minimal details around payment fees or processing times. This is a real drawback and may deter future traders.

Demo Account

Mitto Markets offers a demo account on the MT4 platform. This is a safe way to test trading strategies risk-free and to become familiar with the features of the platform. Limited information is provided on the conditions of the demo account, however they usually simulate real-life market conditions with a virtual bankroll.

UK Regulation

Mitto Markets is authorised by the Financial Conduct Authority (FCA), meaning the broker follows established regulatory standards. The FCA is a highly respected body in the UK financial markets. Licensing conditions mean clients benefit from segregated client funds with third-party services alongside access to the Financial Services Compensation Scheme (FSCS) with protection up to £85,000

Live Accounts

Mitto Markets offers one live trading solution; the Standard Investment Account. Clients can trade using either the standard or ECN pricing model, with the latter a good option for scalping. Accounts are available in GBP with no minimum deposit requirement and trading sizes from 0.01 lots.

An online registration form is required for all new account setups and takes an average of 3 minutes to complete. Applications are usually approved the next working day.

ISA and SIPP accounts are also available and portfolio management services can be requested.

Pros

- Demo account

- FCA authorisation

- No minimum deposit

- MT4 & TWS platforms

- Range of tradable assets

- Good customer reviews

Cons

- No crypto trading

- No live chat support

- Limited additional features or education tools

- Limited deposit options and payment fee information

Trading Hours

Mitto Markets follows standard office hours with trading available 24/5, Monday to Friday. With that said, volume and liquidity will vary between markets so defer to the platforms for the best time to trade.

Contact Details

Mitto Markets provides customer support via:

- Query form – Contact page

- Telephone helpline – +44(0)208 159 8985

- Address – C/O Jellyfish Ltd, Mitto Markets, 28th Floor, The Shard, 32 London Bridge Street, London, SE1 9SG

A limited FAQ section is available on the broker’s website and there is no live chat support.

Security

All accounts are password protected. The MT4 platform offers secure logins with industry-standard data privacy. Account setup and personal information are transmitted through encrypted connections.

We’re satisfied the broker is a relatively safe trading provider that follows industry best practices to prevent scams.

Should You Trade With Mitto Markets?

Mitto Markets provides UK traders with a reasonable selection of tools and a strong range of products, with the notable exception of cryptos. The FCA authorisation, free demo account and zero minimum deposit are certainly advantages. However, there is room for improvement. Our review would have liked to see extra payment options, live chat support and more learning resources for beginners.

FAQ

Is Mitto Markets A Scam?

Mitto Markets is authorised by the Financial Conduct Authority (FCA), a highly regarded regulatory body. We are confident the broker is not a scam and does offer a relatively safe trading environment.

What Is The Minimum Deposit To Trade At Mitto Markets?

There is no minimum deposit requirement to open a live account with Mitto Markets. This is a real advantage vs competitors.

Does Mitto Markets Offer Live Chat Support?

Currently, Mitto Markets does not offer live chat support. Available contact options include an online query form and telephone. There is also a modest FAQ section on the broker’s website.

What Trading Platforms Does Mitto Markets Offer?

Mitto Markets offers two platforms; MetaTrader 4 and Trader WorkStation. Both come with access to technical indicators and extensive charting features on easy-to-use interfaces. They also offer instant and pending order types.

Does Mitto Markets Offer Any Promos Or Bonus Incentives?

Due to FCA and ESMA licensing conditions, Mitto Markets does not offer any bonuses or promotions to UK traders. This includes no deposit bonuses.

Compare Mitto Markets with Other Brokers

These brokers are the most similar to Mitto Markets:

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FP Markets - FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Mitto Markets Feature Comparison

| Mitto Markets | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| Rating | - | 4 | 4.4 | 4 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $0 | $1000 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, FINMA, DFSA, SFC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | ASIC, CySEC, ESMA |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | Mitto Markets Review |

Swissquote Review |

IG Index Review |

FP Markets Review |

Trading Instruments Comparison

| Mitto Markets | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

Mitto Markets vs Other Brokers

Compare Mitto Markets with any other broker by selecting the other broker below.

Popular Mitto Markets comparisons: