Cannabis

Cannabis trading offers an attractive opportunity for some investors, given its comparably new status in the agricultural industry. As more cannabis products become legalised for medicinal and recreational purposes, traders are seeking out popular investments via stocks, ETFs and CFDs. This guide will explain the cannabis trading market, from investing vehicles to price drivers. Our UK team have also reviewed and ranked the top cannabis brokers:

Best UK Brokers For Trading Cannabis

-

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

FXCM, a reputable forex and CFD broker founded in 1999, is headquartered in the UK. It has garnered multiple accolades and operates in several regions, including the UK and Australia. Offering more than 400 assets and comprehensive analysis tools without any commission charges, FXCM is a favoured option among traders. The broker is also under the regulation of leading bodies such as the FCA, ASIC, CySEC, FSCA, and BaFin.

Instruments Regulator Platforms Forex, Stock CFDs, Commodities CFDs, Crypto CFDs FCA, CySEC, ASIC, FSCA, BaFin, CIRO Trading Station, MT4, TradingView, Quantower Min. Deposit Min. Trade Leverage $50 Variable 1:400 -

Founded in 1983, City Index is a prestigious broker, now under the Nasdaq-listed StoneX Group. It excels in forex, CFDs, and spread betting. With access to over 13,500 instruments, City Index provides a dynamic Web Trader platform, exceptional educational materials, and round-the-clock support five days a week, ensuring a thorough trading experience.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Cannabis are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| FXCM | ✔ | ✔ | ✘ | ✔ | |

| City Index | ✔ | ✔ | ✔ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Cannabis support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| FXCM | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| City Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Cannabis at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IG | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| FXCM | iOS and Android | ✘ | ||

| City Index | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Cannabis good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IG | ✔ | $0 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| FXCM | ✔ | $50 | Variable | ||

| City Index | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Cannabis offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| FXCM | - | ✘ | 1:400 | ✘ | ✔ | ✘ | ✘ |

| City Index | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 | ✘ | ✔ | ✔ | ✔ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Cannabis.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IG | |||||||||

| eToro | |||||||||

| FXCM | |||||||||

| City Index | |||||||||

| CMC Markets |

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG is amongst the best in terms of its range of instruments, which includes stocks, forex, indices, commodities, and cryptocurrencies, plus added US-listed futures and options as well as an AI Index, providing diversification opportunities.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Leading traders participating in the broker's Popular Investor Programme can earn yearly compensation of up to 1.5% of the copied assets.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- eToro is a globally recognised brand, operating under top-tier international regulations. It boasts a community of over 25 million users.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

Our Take On FXCM

"FXCM remains a leading choice for traders using automated strategies, offering four robust platforms, strategy backtesting, and algorithmic trading via APIs. It is also ideal for active traders, providing discounted spreads and minimal to zero commissions on popular assets."

Pros

- In addition to its four charting platforms, FXCM provides a superior selection of specialist software for seasoned traders, featuring QuantConnect, AgenaTrader, and Sierra Chart.

- FXCM has broadened its trading options by offering stock CFDs via MetaTrader 4.

- FXCM boasts a strong international reputation, holding licences from the FCA, ASIC, CySEC, and FSCA. With two decades of experience, it commands respect in the trading industry.

Cons

- While FXCM primarily caters to seasoned traders, the absence of managed accounts is unfortunate.

- There are no retail account options available for traders, and Cent/Micro account alternatives are also absent.

- The live chat support is often sluggish and inconsistent when compared to leading competitors.

Our Take On City Index

"City Index suits active traders perfectly, offering rapid execution speeds averaging 20ms and a customisable web platform with over 90 technical indicators. Its educational resources are exceptional. For UK traders interested in spread betting on 8,500+ instruments tax-free, City Index is an excellent option."

Pros

- City Index offers access to over 13,500 markets, including forex, indices, shares, commodities, bonds, ETFs, and interest rates. The platform's inclusion of niche markets such as interest rates provides traders with unique opportunities not commonly available on other platforms.

- City Index offers adaptable trading platforms suited to every expertise level. For newcomers, the Web Trader platform is straightforward and user-friendly. For more in-depth analysis and automated features, MetaTrader 4 (MT4) and TradingView are supported, providing a comprehensive trading experience for all traders.

- City Index has significantly improved the trading experience. In 2024, they introduced Performance Analytics, providing insights into trades and discipline. The revamped mobile app now includes integrated market research and swipe-access news.

Cons

- Although many brokers, such as eToro, have broadened their crypto offerings, City Index restricts its clients to crypto CFDs. This limited selection may not meet the needs of traders seeking a wider variety of altcoins.

- City Index does not offer an Islamic account with swap-free conditions, making it less attractive to Muslim traders than brokers such as Eightcap and Pepperstone.

- Unlike brokers like AvaTrade and BlackBull, City Index lacks options for passive trading, such as social copy trading or real ownership of stocks and ETFs. This limitation may reduce its appeal to traders seeking a more hands-off approach.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets has introduced an AI News feature. This leverages AI to highlight and summarise market stories instead of executing trades, suggesting the future direction of broker research tools.

- The CMC web platform offers an exceptional user experience with sophisticated charting tools for trading and customisable options, suitable for both novice and seasoned traders. It supports MT4 but not MT5, and TradingView will be available from 2025.

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

Cons

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

- Although there have been improvements, the online platform still needs further refinement to match the user-friendly trading experience offered by competitors such as IG.

- The CMC Markets app provides a comprehensive trading package; however, its design and user experience lag behind market leaders such as eToro.

How The Legal Cannabis Industry Works

In recent years, licensed companies have been permitted to operate in the cannabis industry. Whilst recreational consumption of cannabis is illegal in many jurisdictions, medicinal usage is widely permitted. For example, in 2018, the UK government allowed cannabis to be used for medical reasons if prescribed by an NHS or private doctor.

In addition, rules around recreational usage have been relaxed in other jurisdictions, including full legalisation in Canada as well as many US states, such as Colorado. As a result, the number of listed companies involved in the cannabis industry has increased. For example, Kanabo Group and Oxford Cannabinoid Technologies are both now registered on the London Stock Exchange.

In the cannabis trading market, companies operate in three main areas: production, retail and biomedical.

- Production & processing: Companies that grow and cultivate cannabis to be shipped and sold as consumer products, such as oils and edibles. One example is Aurora Cannabis, which has been growing cannabis since 2013. A more diversified company is Associated British Foods, which has dedicated cannabis greenhouses in Norfolk, UK, alongside other commodities such as sugar.

- Retail: Following the legalisation of cannabis for recreational consumption, many dispensaries were created with the sole purpose of selling cannabis and related products such as CBD oil. The Chill Brands Group is a prime example of a CBD-product seller.

- Biomedical & research: Companies that investigate the potential medical benefits of using cannabis and develop pharmaceuticals derived from cannabis. For example, cannabis has been used to treat conditions such as epilepsy, migraines, Parkinson’s disease and insomnia. Cellular Goods is a biomedical cannabis company which creates skincare products used to treat pain and reduce inflammation.

Overall, the industry outlook is arguably looking positive. The Global Cannabis Report by Prohibition Partners estimates that the global CBD and cannabis trade could amount to over $101 billion by 2026. With that said, factors such as government regulations and public opinions can heavily impact the market.

Cannabis Price

How To Invest In Cannabis

You cannot trade directly on the price of cannabis as you can with other agricultural commodities such as sugar or soybeans. As a result, the available vehicles for online trading cannabis include shares, indices, exchange-traded funds and share baskets.

- Stocks: You can trade stocks of publicly listed cannabis companies, either directly or via derivatives such as CFDs or futures and options. Share dealing involves buying and owning stocks outright. For example, IG Index is a popular broker offering shares in Cronos Group, Canopy Growth Corporation and more. Derivatives allow you to speculate on bullish and bearish trends.

- Indices: Trade on cannabis-based indices such as the Cannabis Index, which provides a benchmark for the wider cannabis industry. The Cannabis Index derives its value from a basket of 20 listed companies involved in the cannabis business and is available at brokers such as IG Index and City Index.

- ETFs & share baskets: Exchange-traded funds (ETFs) are diversified products that are traded on exchanges and available at leading brokers. One common example is the Cannabis share basket tradable through CMC Markets, which contains 7 licensed medicinal cannabis producers.

5 Popular Cannabis Stocks

At the time of writing, some of the biggest firms in the global cannabis industry include:

- Innovative Industrial (IIPR): Approximate market cap $1.94 billion

- Curaleaf (CURLF): Approximate market cap $1.88 billion

- Green Thumb Industries (GTII): Approximate market cap $1.87 billion

- Tilray (TKRY): Approximate market cap $1.68 billion

- Verano Holdings (VRNOF): Approximate market cap $1.10 billion

What Influences The Price Of Cannabis?

Before you start trading cannabis, you should be aware of certain factors that could impact the performance of your portfolio:

- Regulation: Changes to legislation or trade can affect the entire market. For example, in October 2022 President Biden in the USA pardoned those convicted of possession of cannabis as well as calling for a federal legalisation review into cannabis. Both acts resulted in an immediate boost in the value of many cannabis-based stocks, such as the AdvisorShares Pure US Cannabis ETF.

- Consumption & demand: Consumer trends and sentiment can impact the value of cannabis stocks. For instance, a decline in cannabis demand can lower dispensary revenue and negatively impact a company’s valuation, which may affect its stock price. Between 2018 and 2022, the percentage of recreational users in Canada grew from 22% of the population to 27%, representing a generally positive trend.

- Expansion into new regions: As new countries legalise medicinal and recreational cannabis, new investment opportunities are created. In 2018, Canada legalised recreational cannabis and stocks of related firms in the country saw a boost in valuation. For example, the stock price of Tilray grew by almost 6 times between August and October.

- Company fundamentals: Fundamental analysis is a key element in trading cannabis shares. This includes looking at company performance, news and announcements, industry forecasts and analysing the competitive landscape. Several cannabis companies also operate in other areas, such as growing other soft commodities, which could have an indirect impact on stocks.

Getting Started

Choose A Broker

To find the best cannabis broker for your requirements, consider the following factors:

- Regulation: Our team recommends choosing a broker that holds a valid license with the Financial Conduct Authority, the financial regulatory body in the UK. A broker with FCA regulation ensures that your funds are better protected through various measures. For example, if the broker were to default, you could be entitled to claim up to £85,000 in compensation.

- Fees & charges: Determine the fee structure that is best for your cannabis investing style. This can depend on the instrument you are trading, for example, CFDs via CMC Markets come with a 0.10% commission, which is competitive. Other fees you need to be aware of include deposit and withdrawal charges, overnight swap fees and any inactivity charges.

- Trading platform: Find a broker with a reliable and powerful trading platform which supports technical analysis. Look out for a good range of indicators, patterns and charting options. The best cannabis trading platforms also come with economic calendars and market insights, plus analysis and forecasts from experts or third parties. Examples of some of the best platforms for cannabis stock analysis include MetaTrader 4 and cTrader.

- Payment Methods: Compare the available payment methods that you can use to make deposits into your brokerage account. The top cannabis brokers typically support wire transfers and bank cards, as well as some e-wallets like PayPal or Neteller. E-wallet deposits are typically processed instantly, making them attractive for short-term traders.

Learn How To Trade Cannabis

A key aspect of trading cannabis is studying market trends and stock movements, using news and analysis tools. Leading cannabis brokers will offer access to real-time news feeds and expert industry summaries. In addition, consider using third-party analysis tools such as TradingView to keep on top of stock price movements.

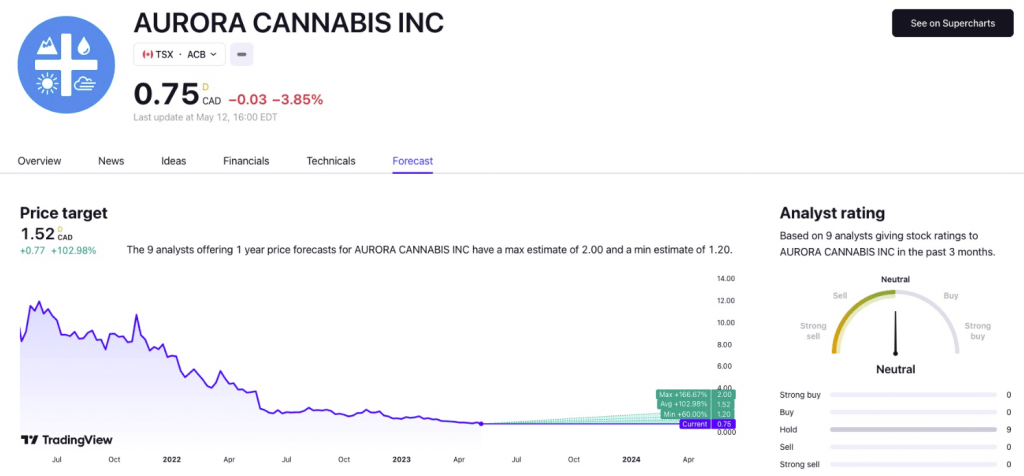

For example, the image below shows a TradingView forecast for the cannabis company Aurora Cannabis Inc.

Aurora Cannabis Inc, TradingView

You should also establish a cannabis trading strategy, which can be used to determine the optimum market conditions for opening or closing a position. A popular example is trend following, which aims to determine whether an asset is undervalued or overvalued and therefore is likely to increase or decrease in price. To do this, you could use technical indicators such as the Stochastic Oscillator.

Finally, we recommend practicing your strategies in a demo account, so that you can familiarise yourself with the platform and practice using technical analysis tools. Most top cannabis brokers, such as IG Index, offer free demo accounts with virtual funds, so you can test trading setups risk-free.

Risk Management

As with all trading, profits are not guaranteed, and cannabis traders can quickly lose money. Implementing a robust risk management system can add a layer of protection to your capital.

For example, ‘take profit’ and ‘stop loss’ orders automatically close your positions under certain market conditions. A take profit secures profit to help prevent you from losing out on a winning position. A stop loss will exit a position once a certain losing margin has been reached to prevent losses from spiralling.

Advantages Of Trading Cannabis

- Cannabis trading offers exposure to a developing industry, where investors could take advantage of short-term volatility

- As cultural views on cannabis shift, more regions may change regulations on cannabis, providing new investment opportunities

- You can diversify your portfolio using CFDs, ETFs, indices or by trading shares in large or emerging cannabis companies

Disadvantages Of Trading Cannabis

- Many cannabis firms are still relatively new, with a short track record, which can make them risky investments

- It is hard to predict future market trends for cannabis since sentiment and government regulations have a large impact

- You cannot trade directly on the value of cannabis. Instead, you often have to trade on companies in the cannabis industry

Bottom Line

The potential for the rapid growth of the industry makes online cannabis trading an exciting investment opportunity. However, as cannabis is not yet tradable as a commodity, you are restricted to trading on cannabis-based companies via stocks and derivatives. In addition, the market is still unpredictable and risky due to jurisdictional laws and changing public sentiment.

Make sure you understand the market well and choose a reputable, regulated cannabis broker which offers all the tools needed.

FAQ

Is It Legal To Trade Cannabis Online?

Yes, it is legal in the UK for clients to start cannabis trading online through company stocks, ETFs and indices. As you are investing in publicly listed and registered firms, it is similar to trading the same vehicles in other commodities.

How Do I Start Cannabis Trading?

We recommend registering with a regulated broker that offers the cannabis assets you wish to gain exposure to. Studying the market considering news and events will allow you to analyse trends in the cannabis industry. Before funding your account, also determine what cannabis trading strategy you want to use and practice your techniques in demo mode.

Is Cannabis A Good Investment?

Cannabis trading can be a good idea for those interested in the long-term outlook of an emerging market. Short-term volatility driven by consumer trends and emerging legislation could also suit a swing trading strategy. With that said, profits are never guaranteed, and volatile markets can also lead to significant losses.