S&P 500

With high and regular historic gains, an average daily volume of billions of dollars and containing some of the largest companies in the world, trading the S&P 500 is appealing to investors for many reasons. This guide contains all the information you need to find the best S&P 500 brokers, learn how to trade the stock index and develop an effective strategy. Use our ranking of the top S&P 500 brokers and platforms to get started.

S&P 500 Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30

Safety Comparison

Compare how safe the S&P 500 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the S&P 500 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the S&P 500 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ |

Beginners Comparison

Are the S&P 500 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 |

Advanced Trading Comparison

Do the S&P 500 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the S&P 500.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com | |||||||||

| eToro |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

- eToro secured second place in DayTrading.com's 'Best Crypto Broker' for 2025, offering a vast selection of tokens, dependable service, and competitive fees.

- The trading app provides a top-tier social environment featuring an engaging feed and community chat, which we enjoy using.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The only significant contact option, besides the in-platform live chat, is limited.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

Choosing S&P 500 Brokers

One of the key steps to effective and profitable trading of the S&P 500 index is selecting a good broker. This tutorial breaks down what to look for in the best broker to buy or sell an S&P 500 asset.

Instruments

There are a variety of instruments available for trading at S&P 500 brokers. These include futures, options, binary options and other forms of margin trading. Lucrative day trading and swing trading strategies are possible using leveraged products such as CFDs and e-mini S&P 500 futures contracts.

In addition, S&P 500 mutual funds and tracker funds offer low-cost investing in the index, with investments automatically adjusted to reflect stock weightings and index entries and exits.

Investments in single companies from the S&P 500 are also possible. Traders can find these stocks on exchanges like the NYSE and Nasdaq.

Some firms, such as Interactive Brokers, will also offer several investing vehicles under one roof. These S&P 500 brokers can make trading considerably simpler for investors who wish to test different strategies and approaches.

Fees

It goes without saying that investors will wish to minimise fees and spreads when investing in any market.

Often, S&P 500 brokers will offer different fee structures, with some levying floating spreads for trades and others a percentage commission. In addition, some S&P 500 brokers may levy account management or inactivity charges.

Importantly, the type and price of any charges will depend on the instrument used. However, due to the high trading volume of the index, spreads and charges will typically be low on most instruments.

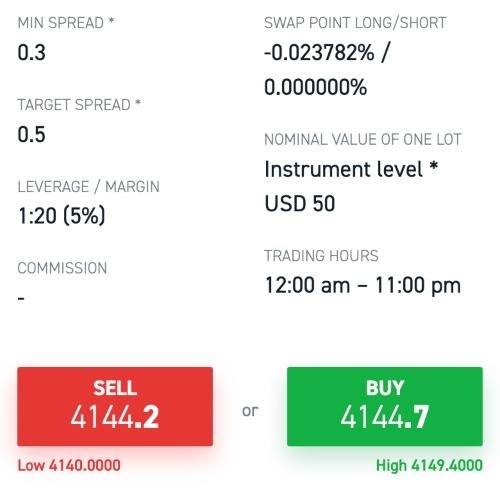

For active traders, Pepperstone offers spreads from 0.4 points on the S&P 500 with up to 1:20 leverage. Alternatively, CMC Markets offers a minimum spread of 0.3 points on the S&P 500.

S&P 500 Investing Conditions – CMC Markets

As S&P 500 mutual funds and ETFs are tracker funds rather than actively managed, fees can be as low as 0.07% for ETFs like the Vanguard UCITS ETF.

In many cases, UK investors will not need to worry about forex fees and trading in US Dollars. This is because many S&P 500 instruments are created by UK financial companies and offered to investors in British Pounds.

Account Types

Many S&P 500 traders will use the index for long-term investing. Many tax-advantaged accounts, such as the SIPP, Stocks & Shares ISA and LISA, are available to UK traders that suit this passive investment style.

However, these accounts will not suit active traders requiring additional market data and advanced live charts to monitor the index.

To find the best broker to buy S&P 500 over the short or long term, ensure that a brokerage supports the account type that suits your investment style.

Platforms & Apps

As with account types, the best platform for the S&P 500 is an individual choice. Some investors favour simplicity, while others require advanced charting and level 2 or 3 data integration, especially when trading derivatives such as options.

For those who regularly invest on the go, prioritising S&P 500 brokers with the best app is sensible. Popular platforms and apps include MetaTrader 4 and MetaTrader 5.

Security & Regulation

Choosing a broker with top-tier regulation from reputable bodies such as the UK Financial Conduct Authority (FCA) can help investors steer clear of scams when online investing.

Additional security measures to look out for include fund insurance, negative balance protection, two-factor authentication and brokers that use segregated accounts for client funds.

What Is The S&P 500?

The S&P 500 is the stock index with the highest market capitalisation and boasts an average daily trading volume above $4 billion. However, the index didn’t always have such wealth behind it.

S&P 500 History

The first form of the S&P 500 was created in 1923 by Standard Statistics Company as a weekly-calculated index of 233 US-based companies. Following a merger with Poor’s Publishing, these firms became Standard & Poor’s – the “S&P” in the S&P 500.

The current 500 company form of the S&P 500 was introduced in March 1957, when Standard and Poor’s launched the S&P 500 Stock Composite Index. From this point, the index has undergone minor tweaks but remains similar to its 1957 inception.

Unlike some other major global indices, inclusion within the S&P 500 is not just based on the trading economics of each equity. A company must pass a committee selection process in addition to meeting minimum market capitalisation requirements, NYSE or NASDAQ listing and minimum volume requirements.

Performance

One of the reasons that investors regard the S&P 500 so highly is its consistent annual returns. Since the index started issuing dividends in 1970, trading the S&P 500 has averaged an impressive total return of over 15% per year.

While the index has a strong dividend history of offering investors competitive returns in the 3-5% range, the S&P 500 is now dominated by growth-oriented equities, which tend to pay little, if any, dividends. As a result, recent dividend yields have been notably smaller, such as the 1.29% paid in 2021 and the 1.71% paid in 2022.

The S&P 500 record trading volume occurred in late 2008, with daily volume reaching over $11 billion.

The S&P 500 all-time high happened on January 3rd 2022 when it reached 4796.56 points.

The S&P 500 all-time low occurred on August 12th 1982, when it closed at 102.42 points.

Investors can view the entire S&P 500 price history through free charts provided by services like TradingView or a broker’s platform.

Why Is It Popular?

The consistency of its price history is one reason the S&P 500 is viewed as one of the most dependable indices. In addition, the long-term returns of the index make it a favourite for UK personal pensions such as SIPPs or LISAs.

Many S&P 500 brokers also offer a range of instruments, including CFDs, options and futures.

Live Price Chart

Top Stocks

The S&P 500 comprises 503 US equities symbols, weighted by the market capitalisation of their publicly traded shares.

Of the entire companies list, over 18% of the index weighting is currently made up of the five biggest stocks in the S&P 500. The share price of these assets will have a significant impact on the performance of the index.

The 5 largest companies in the S&P 500 are currently:

- #1: Apple Inc. (AAPL)

- #2: Microsoft Corporation (MSFT)

- #3: Amazon Inc. (AMZN)

- #4: Alphabet Inc. Class A (GOOGL)

- #5: NVIDIA Corporation (NVDA)

Other notable equities in the S&P top 10 include Tesla (TSLA), Berkshire Hathaway Inc. Class B (BRK.B) and Exxon Mobil Corporation (XOM).

The S&P 500 By Sectors

The S&P 500 is fairly well diversified by industry sectors. This ensures that the index is not overly exposed to individual sector performance.

The primary industry sectors are 27.48% Technology, 14.58% Health Care, 11.18% Consumer Discretionary, 10.9% Communication Services and 9.89% Financials.

Pros Of Investing In The S&P 500

- UK-Based Instruments – Many UK firms have pound-traded S&P 500 vehicles for investors. This means that UK traders can invest in the S&P 500 without forex fees and within UK market hours.

- Consistent Total Returns – With an average annual total return of over 15% per year since 1970, the S&P 500 remains the most consistent index for long-term investing in the stock markets.

- Contains Leading Global Stocks – S&P 500 brokers contain top global equities such as Microsoft (MSFT), Tesla (TSLA) and Apple (AAPL). These high-flying growth stocks provide investors with exposure to some of the largest companies and sectors in the modern world.

- Wide Range Of Instruments – From CFDs to binary options and ETFs to e-mini futures, the S&P 500 is available to trade through a wide range of products at leading brokers.

- Informative Market – The performance and price of the S&P 500 are often used as a barometer of the US market as a whole, whether this is merely to observe and gauge market health or to trade and hedge other investments.

Cons Of Investing In The S&P 500

- Uneven Weightings – While investors may believe that a stock index with 500 companies would be well diversified, when trading with S&P 500 brokers, traders should note that the top 10 stocks make up over 25% of the total index price.

- Low Dividends – Despite historically high dividend yields, the current S&P 500 is primarily made up of growth stocks with small or no dividends. As a result, recent dividend yields sit below the 2% mark.

- Singular Country – The S&P 500 is made up of 503 symbols from 500 companies, which are all from the US. Investors that want regional diversification should choose another index or product.

Strategies

Want to know how to day trade the S&P 500? Or perhaps you are interested in a long-term investment or an options play? Here are five popular S&P 500 strategy ideas:

Long-Term Investing

The idea of investing in a major stock market over a long period is championed by veteran investors Warren Buffet and other finance experts.

While past performance is no indicator of future returns, the historical stability and considerable total returns when investing in the S&P 500 over the last 50 years and beyond suggest that the index is suitable as a long-term investment vehicle at leading brokers.

An advantage of this strategy is its passivity. Whether investing via a mutual fund or ETF, the best brokers to buy the S&P 500 allow investors to set up regular purchases to take advantage of pound cost averaging.

With this strategy, trading at S&P 500 brokers is not about choosing when to buy or sell, nor will investors have to conduct any further technical or fundamental analysis on the index.

There are also many low-cost UK ETFs and mutual funds available at the top online brokers.

Single Stock Picking

As one of the biggest indices in the world in terms of market cap and average daily trading volume, the S&P 500 is a great place to look for single-stock speculation.

Whether you want to buy or sell short, there are ample opportunities for intraday and swing trading of S&P 500 equities, and even chances for investing based on dividend yield for individual companies.

Support & Resistance

Technical analysis can be an effective way of creating S&P 500 signals due to the index’s heavy institutional and automated trading. One way to use this data to create a strategy is to identify key support and resistance levels.

Many technical tools and indicators offered by S&P 500 brokers can identify potential support and resistance levels. These include Fibonacci overlays and moving average indicators like the Ichimoku cloud, Moving Average Convergence/ Divergence Indicator (MACD) and Money Flow Index (MFI).

Using tools such as these helps investors spot trends and a viable trading range for the S&P 500, even without a complete understanding of the index’s trading economics.

Covered Calls

For investors that want to receive stable dividends underlined by a strong and liquid market, trading covered calls on the S&P 500 can be a good option.

A covered call is an options strategy in which an investor holds a long position in an asset and sells call options on that same asset to generate income from the option premiums.

Traders can create these contracts manually through an options broker, or invest in an S&P 500 covered call ETF such as XYLD to automate this process. Dividends are paid monthly with competitive returns that can exceed 10% annually.

Scalping

For investors looking for an options or e-mini s&p 500 futures strategy, scalping can be a lucrative form of online investing available at the best brokers.

Scalping is a high-frequency strategy often involving day trading securities to profit from small price changes and discrepancies between providers. Investors can use an S&P 500 calendar to find periods of potential volatility, such as top 10 stocks’ earnings reports, regional GDP news or announcements from the US federal bank.

Trading Hours

The S&P 500 live opening hours are between 14:30 GMT and 21:00 GMT from Monday to Friday. US-based ETFs and mutual funds will typically follow these times, though UK products based on the S&P 500 may vary.

However, pre-market and after-hours trading is available for some stocks through various S&P 500 brokers. The inclusion of S&P 500 overnight investing takes the full opening hours to 09:00 GMT until 01:00 GMT from Monday to Thursday, and 09:00 to 22:00 GMT on Friday.

These hours differ between markets and products such as futures and CFDs, with indices operating 24/5 and e-mini futures hours trading 11 hours a day from 23:00 GMT until 22:00 GMT Sunday to Friday.

There are no weekend trading markets for the S&P 500.

Bottom Line On S&P 500 Brokers

With a wide range of available instruments, great historical gains and plenty of profitable strategies, the S&P 500 is hugely popular with retail investors.

Choosing the best S&P 500 brokers can be overwhelming due to the number of firms available. However, use this guide to compare S&P 500 platforms to find a suitable provider. Alternatively, choose from our list of top-rated S&P 500 brokers that accept UK traders.

FAQs

Which UK Brokers Offer The S&P 500?

Among the top S&P 500 brokers for UK traders are Pepperstone, CMC Markets, and XTB. These are FCA-regulated firms with tight spreads and low to zero commissions on the S&P 500, plus beginner-friendly platforms and apps, expert market insights, plus reliable customer support in English.

What Are Trading Hours At S&P 500 Brokers?

The stocks traded in the S&P 500 are typically available to trade between 14:30 GMT and 21:00 GMT from Monday to Friday. However, S&P 500 products such as CFDs, futures and binary options may have extended hours of up to 24 hours a day.

When Did S&P 500 Futures Start Trading?

Brokers began to offer futures markets on the S&P 500 in 1982, while e-mini S&P 500 futures were added in 1997.

What Are The Best Stocks In The S&P 500?

Of the 500 companies on the S&P 500, many provide opportunities for growth, short selling, dividends and scalping strategies. Some of the biggest stocks on the index are Tesla (TSLA), Apple (APPL), Johnson & Johnson (JNJ) and Microsoft (MSFT).

What Is The S&P 500 Trading At?

Investors can view current data through live charts on S&P 500 brokers’ platforms or through free resources like TradingView.

The historical high of the S&P 500 was January 3rd 2022 when the index reached 4796.56 points.

What Is The S&P 500 Dividend Yield?

The S&P 500 dividend yield has decreased in recent years as the index has become dominated by growth stocks. Recent S&P 500 dividend yields have come in below 2% per year.

How Should You Compare S&P 500 Brokers?

Key comparison points should include the choice of investing vehicles, leverage and margin rules, spreads and commissions, platforms and apps, regulatory oversight from the FCA, customer support, plus additional tools like copy trading. Demo accounts are also a good way to test S&P 500 brokers.