Revolut Review 2024

|

|

Revolut is #74 in our rankings of UK brokers. |

| Top 3 alternatives to Revolut |

| Revolut Facts & Figures |

|---|

Revolut is a popular financial app that also offers trading on stocks, metals and digital currencies. The brand has over 25 million users worldwide with a choice of accounts, tools and services to suit different needs and budgets, including online investing and currency exchange. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, Cryptos, Commodities |

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | Linked Account, Bank Wire Transfer, Revolut Transfer, Google Pay, Credit Card, Debit Card, Apple Pay |

| Min. Trade | $1 |

| Regulated By | FCA, Bank of Lithuania |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| Stocks | Buy and own thousands of shares commission-free, including blue chip companies like Apple and Microsoft from the NYSE and NASDAQ exchanges. Fractional shares also allow investments from as little as $1, which will appeal to beginners and those on a budget. |

| Cryptocurrency | Invest in 100+ crypto tokens using 30+ fiat currencies. You can buy, sell and transfer cryptos on the iOS and Android app. We like that traders can also choose to round up leftover cash from card transactions in crypto and use their crypto balance to make card payments. |

| Coins |

|

| Spreads | 2.5% commission for standard profiles |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Revolut is a financial super-app that provides a range of services including online trading, capital transfers, spending, and saving. This 2024 review will explore what Revolut has to offer, how it works and its fees. Find out if our expert traders recommend investing with Revolut.

Company History & Overview

Founded in 2015, Revolut has built a customer base of over 20 million people in more than 200 countries and regions. Its two founder personalities are Nikolay Storonsky and Vlad Yatsenko.

The firm’s registered address and headquarters (HQ) are in London, UK. The objective of this fintech office is to make managing your finances simpler through an integrated spending, saving and investing service.

Our experts found that, officially, the company is an e-money institution and is authorised under the UK Electronic Money Regulations.

In 2021, the firm raised $21m in Series E funding with a valuation of $33 billion.

Mobile Trading Platform

Revolut does have a web platform, although this is mainly for account management (such as to top-up funds), transfers and rewards, rather than investing itself. Most of its speculative functions are located on the mobile app, which has an intuitive design and is easy to navigate.

Beginners should have no difficulty getting used to the mobile app, which can be downloaded from the Apple App Store and Google Play. Whether you want to invest, transfer funds or seek rewards, this can all be done through your mobile device. Face and touch ID can also be activated, making the login process a breeze.

Our UK team reviewed the trading platform and rated the following key features:

- Price alerts

- 24 languages

- Limit and stop-loss orders

- Recurring orders for crypto purchases

- Multiple timeframes from one day to five years

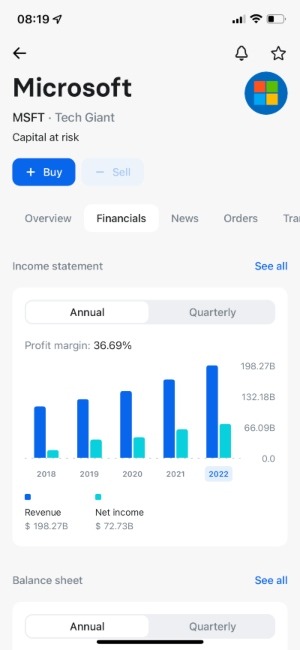

- Income statement, balance sheet and cash flow data

- Some advanced technical analysis and charting tools

Trading App

In summary, our traders found the mobile investing app to rival many of the best trading apps in terms of navigation and ease of use. However, traders looking to conduct in-depth technical analysis may prefer a wider range of charts and technical indicators.

Market Access

While using Revolut, we found the markets offered to be heavily focused on stocks, metals and cryptocurrencies.

ETFs, options and bonds are not available. Although forex (FX) trading is not available in the traditional sense, the company does provide a currency exchange service.

Below is a summary of the assets on offer:

- 1500+ global company shares

- Commodities, gold (XAU) and silver (XAG)

- Cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP)

Revolut also allows fractional trading, making expensive stocks more accessible to low-capital investors and beginners.

Revolut Fees

The firm prides itself on having transparent fees visible in the Revolut app. Commission on stocks is the greater of 0.25% or the specified minimum country-specific fee, which is £1 for the UK. However, all traders receive at least one free trade each month:

- Standard Plan – one free trade a month

- Plus Plan – three free trades a month

- Premium Plan – five free trades a month

- Metal Plan – 10 free trades a month

Revolut has also removed its custody fee, lowering costs for UK stock investors.

Regulatory fees for US stock trading may be applicable, which are usually between $0.01 and $6.49.

Foreign exchange fees depend on the time and are added to the exchange rate. Between 18:00 EST on Sunday and 17:00 EST on Friday, there are no fees for exchanging common currencies but a 1% fee is applied on weekends between 17:00 EST on Friday and 18:00 EST on Sunday. We recommend that those looking to reduce exchange fees focus on liquid assets during normal opening hours.

When exchanging currencies, crypto and precious metals on Revolut, there are exchange fair usage fees on the Standard and Plus plans if you make more than £1,000 of exchanges in a month. This fee is 0.5%.

Crypto and commodity trading fees depend on your chosen account plan. We look at these more closely in the Account Types section below.

Premium and Metal plans are unlimited and fee-free in 30+ currencies (as exotic currency mark-ups apply, and only fee-free on weekends). Weekend markups apply to all plans.

FX payments are on a rolling monthly basis and ATM fair-usage fees apply. See the full breakdown of accounts plus T&Cs for limits, caps and fees.

Payment Methods

Deposits

Depositing money is low-cost for most methods, though credit cards may attract a fee. Third-party fees may also apply for wire transfers. There is no minimum deposit limit but UK traders may be subject to 24-hour maximum deposit or transfer limits for newly added cards.

Investors must first deposit money into their Revolut holding account before funds can be moved to a trading account. Processing times vary – international wire transfers from accounts abroad can take up to five days, though domestic transfers should be faster. Debit and credit cards are usually instant.

The following deposit methods are available:

- Wire Transfer

- Apple/Google Pay

- Credit/Debit Cards: (Mastercard, Visa and Maestro)

Revolut does not accept cash or cheque deposits.

Withdrawals

Investors can withdraw funds to an account in their name. This usually takes one day and there is no charge.

It is also possible to withdraw funds from your account as cash if your Revolut card is accepted by the ATM. UK investors can withdraw at least £200 each month (the withdrawal limit is higher on the paid plans). A 2% fee on UK ATM withdrawals is charged thereafter, though third party providers may also charge their own withdrawal fees.

FX payments and ATM withdrawals are on a rolling monthly basis. Weekend mark-ups and fair-usage fees apply. See the full breakdown of accounts plus T&Cs for limits, caps and fees.

Demo Account

There is no demo account on Revolut. This will be a disappointment to many investors who rely on paper trading accounts to familiarise themselves with platforms and practise their strategies.

Despite this, with no minimum deposit requirement and all investors receiving at least one free stock trade each month, clients can start small without taking significant risks.

Bonuses & Promotions

One of the main benefits of trading using Revolut is that the platform provides so much more than simply investing in popular financial assets. There are plenty of opportunities to earn cashback and discounts on brands with Revolut Rewards. Whether it is up to 30% cashback when eating out or Premium and Metal customers receiving a discount at over 1,000 airport lounges globally, there are many incentives to invest. T&Cs apply. Reward amounts may vary and are subject to availability.

In addition, there is an offer of one-month free membership on the Plus and Premium plans. For new customers only, T&Cs apply. Premium plan subscription fees will apply after the free trial period. You’ll be able to cancel for free at any point before the end of the free trial period. Once activated, you can order a Premium card. If you switch back to your current plan during the free trial period, you’ll be charged for the card and applicable break fees. Read more in our Plus, Premium, and Metal Terms here.

UK Regulation

Revolut is registered as an e-money institution. As such, customer funds are not protected by the Financial Services Compensation Scheme (FSCS) except for funds in the Savings Vault (in annual interest paid daily). That said, client funds are placed in segregated accounts with licensed institutions and protected from creditors in the event of insolvency.

Note that cryptocurrency trading at Revolut is not regulated (apart from for money laundering).

Account Types

Standard Account

- No monthly fee

- 1.5% commodity fees

- 1.99% crypto fees (£0.99 minimum)

- Up to 0.87% annual interest on savings

- One commission-free stock trade each month

- Exchange up to £1,000/month (Monday to Friday) with no fees (fair usage limits apply and weekend mark-ups apply)

- Withdraw up to £200/month fee-free (or up to five withdrawals) from the Revolut ATM network (2% thereafter) (third-party fees and weekend fees may apply)

Plus Account

- £2.99/month

- 1.5% commodity fees

- 1.99% crypto fees (£0.99 minimum)

- Up to 0.95% annual interest on savings

- Three commission-free stock trades each month

- Exchange up to £1,000/month (Monday to Friday) with no fees (fair usage limits apply and weekend mark-ups apply)

- Withdraw up to £200/month fee-free from the Revolut ATM network (2% thereafter) (third-party fees and weekend fees may apply)

Premium Account

- £6.99/month

- 1.49% crypto fees

- 0.5% commodity fees

- Up to 1.65% annual interest on savings

- Five commission-free stock trades each month

- Unlimited foreign exchange with no fees (Monday-Friday) (unlimited and fee-free in 30+ currencies (as exotic mark-ups apply, and only fee-free on weekends))

- Unlimited free domestic transfers and 20% off fees for international transfers

- Withdraw up to £400/month fee-free from the Revolut ATM network (2% thereafter) (third-party fees and weekend fees may apply)

Metal Account

- £12.99/month

- 1.49% crypto fees

- 0.5% commodity fees

- Free reinforced steel metal card*

- Up to 1.95% annual interest on savings

- 10 commission-free stock trades each month

- Unlimited foreign exchange with no fees (Monday-Friday) (unlimited and fee-free in 30+ currencies (as exotic mark-ups apply, and only fee-free on weekends))

- Unlimited free domestic transfers and 40% off fees for international transfers

- Withdraw up to £800/month fee-free from the Revolut ATM network (2% thereafter) (third-party fees and weekend fees may apply)

Fees and limits may apply to offers depending on the plan type, capped amounts, and charges by third parties.

Promotions, FX payments and withdrawals are on a rolling monthly basis and weekend markups apply, plus ATM fair-usage fees. See the full breakdown of accounts plus T&Cs for limits, caps and fees.

*Metal card available on Metal Plan only

How To Trade On Revolut

1. Sign Up For A Revolut Account

Opening an account is quick and easy. This can be done on the mobile app or through the website. In addition to entering some personal details, traders will need to submit a selfie. We would therefore recommend signing up on a mobile or tablet device to make it easier to do so.

Customers will need to choose a four-digit pin, which will be used to sign in in future. When weighing up the different plans, such as Premium vs Metal, consider what you want to use the account for. For example, the higher monthly price of the Metal plan may be justified if you need to make more trades as the Metal plan comes with the highest number of free stock trades.

2. Deposit Funds

You will then need to deposit funds into your Revolut account. As there is no minimum deposit, we recommend beginners start small and become comfortable with the platform before risking higher amounts.

Those wanting to start investing as soon as possible should deposit using a debit or credit card.

3. Open A Trading Account

To begin, Revolut requires some additional information including your National Insurance Number, ID and an overview of your income and wealth, employment status and purpose for opening a trading account. This is part of regulatory KYC requirements.

If you have all the relevant information to hand, this should not take longer than a few minutes but it normally takes up to 48 hours for the online broker to review when you submit the information.

4. Begin Investing

Once your account has been approved by Revolut, you can begin trading from as little as £1. Make use of different order types to automate the process of opening and closing positions. Fundamental data and stats, including market cap, are available on company stocks to help you make more informed decisions on share price movement.

Although advanced technical analysis features are limited, investors can change the timeframe in charts and choose between a line chart or candlesticks.

Leverage

Revolut does not allow investors to trade with leverage. Whilst this may restrict the potential profits (and losses) available, the platform is still accessible to low-capital traders due to its fractional stock trading system.

Additional Tools

Those looking for additional resources to assist them in making investment decisions can access market analysis and news, which may detail recent revenue or other business announcements. There are also short crypto courses followed by a quiz through which you can earn free tokens.

This company also offers a much broader experience than simply investing. Customers can send and receive money globally in over 30 currencies. Transfers are free and instant between Revolut accounts. In addition, the Revolut debit card, which is compatible with Apple Pay and Google Pay, allows users to make purchases in more than 150 currencies.

If you have uninvested funds (including cryptos and commodities) sitting in your account, Revolut offers a Saving Vault that pays out annual interest each day. Group Vaults are also available to share with friends and family as a type of joint savings account.

Other features include:

- Direct debits

- Track your spending habits

- Set limits to help you budget

- Receive your salary a day early

- Manage subscriptions in one place

- Separate your money for paying bills

- Revolut Pro helps freelancers, contractors and sole traders get paid, as well as create and send invoices

- Junior cards & accounts (Ages 6-17. Parent or guardian required to have a Revolut account. T&Cs apply)

Opening Hours

Trading hours on Revolut vary depending on the market in question. The cryptocurrency market is usually 24/7, although the opening hours for stocks will depend on those of the exchange they trade on. The London Stock Exchange (LSE) is open from 08:00 to 16:30 Monday to Friday.

Customer Support

The in-app live chat is the primary method to communicate with Revolut customer service advisors if something is not working on the platform. Customers on the Plus, Premium and Metal plans get 24/7 priority support.

Although there is a UK phone number, this only has pre-recorded material (to help customers block their cards) and does not allow customers to contact staff directly through a helpline. Complaints can be sent via the in-app chat, email or an online contact form.

- Email: formalcomplaints@revolut.com

Those looking for answers to specific questions may also wish to explore the Revolut Community, which is an online discussion forum. The firm also has accounts on Facebook, Twitter, Instagram, LinkedIn and TikTok, in addition to its own YouTube channel with almost 50,000 subscribers.

Client Security

Although investing funds are not FSCS-protected, deposits in Saving Vaults (in annual interest paid daily) are protected for up to £85,000. Revolut stores the majority of crypto funds in cold storage, which is safer and makes them less susceptible to malicious attacks. In addition, private crypto keys do not come into contact with the internet.

Personal account and transaction security are enhanced by fingerprint login, a 3D Secure (3DS) verification system for some e-commerce payments and disposable virtual cards that cannot be used more than once. When customers log in to the website, two-factor authentication (2FA) takes place through the app rather than SMS.

Should You Trade With Revolut?

Revolut is an established fintech company that provides services well beyond the world of investments. While the platform lacks some advanced technical analysis tools, it is intuitive and easy to navigate, plus there are bonus offers of commission-free trades and crypto trading on offer. These factors, plus the low non-trading fees, make Revolut an attractive platform for many investors.

For general information purposes only and does not constitute financial advice. If you have any questions about your personal circumstances please seek professional and independent advice. Revolut is not a financial adviser.

FAQ

Can I Have More Than One Revolut Account?

No. Although it is possible for customers to have more than one card, they cannot have two or more accounts.

Do I Need To Complete A W8-BEN Form On Revolut?

Yes. During the sign-up process, UK residents are required to complete a W8-BEN form to allow them to purchase US stocks.

Are My Funds FSCS-Protected When Trading With Revolut?

Although customer funds are deposited in segregated accounts, money used for trading is not protected by the Financial Services Compensation Scheme. When we used the broker, we found that funds in Saving Vaults (in annual interest paid daily) are, however, protected up to £85,000.

Can I Deposit Funds Into My Revolut Account Using Cash Or Cheques?

No. Revolut only accepts wire transfers, debit/credit cards and Apple Pay/Google Pay as deposit methods.

Can I Speak To Someone Over The Phone If I Have An Issue With The Revolut Platform?

Unfortunately, Revolut only provides a pre-recorded phone line to assist customers in blocking their cards. While using the service, we discovered it is not possible to have a conversation with customer support over the phone.

Top 3 Revolut Alternatives

These brokers are the most similar to Revolut:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Revolut Feature Comparison

| Revolut | IG Index | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.1 | 4.4 | 4.3 | 4.8 |

| Markets | Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | $1 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA, Bank of Lithuania | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4 | - | MT4, MT5, cTrader |

| Leverage | - | 1:30 (Retail), 1:222 (Pro) | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

74-89 % of retail investor accounts lose money when trading CFDs |

||

| Review | Revolut Review |

IG Index Review |

Interactive Brokers Review |

Pepperstone Review |

Trading Instruments Comparison

| Revolut | IG Index | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Revolut vs Other Brokers

Compare Revolut with any other broker by selecting the other broker below.

Popular Revolut comparisons: