Plus500 Review 2025

Plus500 is a reputable broker with top-tier regulation and a client base spanning the globe. Offering a proprietary trading platform and thousands of CFDs on underlying assets covering stocks, forex and commodities, the broker is a competitive option.

This 2025 UK review will explain more about trading with Plus500, including fees, account types and more.

Plus500 Headlines

With headquarters in Israel, Plus500 is a platform for online trading that allows users to trade CFDs on over 2,500 instruments using proprietary software. The firm operates in over 50 countries, in 32 languages and is regulated in the United Kingdom, Australia, Cyprus, Israel, New Zealand, South Africa, Singapore and Seychelles.

The number of active users regularly stands close to 500,000. Plus500’s CEO is David Zruia. The firm is quite transparent and you can easily find a list of the board of directors on the website or if you Google Plus500.

Plus500 Ltd, which owns the trademark Plus500, is a publicly traded company (PLC) listed on the London Stock Exchange (LSE) since 2018, meaning that, if you buy shares, you can potentially earn dividends, the company is under the ticker LSE:PLUS.

In 2021, the firm expanded its presence in the US market by acquiring Cunningham Commodities and Cunningham Trading Systems. You can use online brokers and information sites to see Plus500’s history and share price forecasts. It has offices located in the City of London.

Platforms

Plus500 is a market maker which means it acts as the counterpart to any trade you make. With market makers, spreads are usually wider than for an ECN broker as a dealing desk is involved.

The firm offers only one platform to its clients: its own proprietary software. This is available as a WebTrader, on Windows or as an app. You can download the Windows app for Windows 7, 8 and 10 or download the Plus500 mobile app for Android (APK) and Apple (iOS) devices from the Google Play or Apple App Store.

Clients used to popular, industry-standard software such as the MetaTrader 4 or 5 platform may be put off by this limited offering.

However, the sleek, minimal design of the Plus500 interface provides users with an intuitive and functional trading experience.

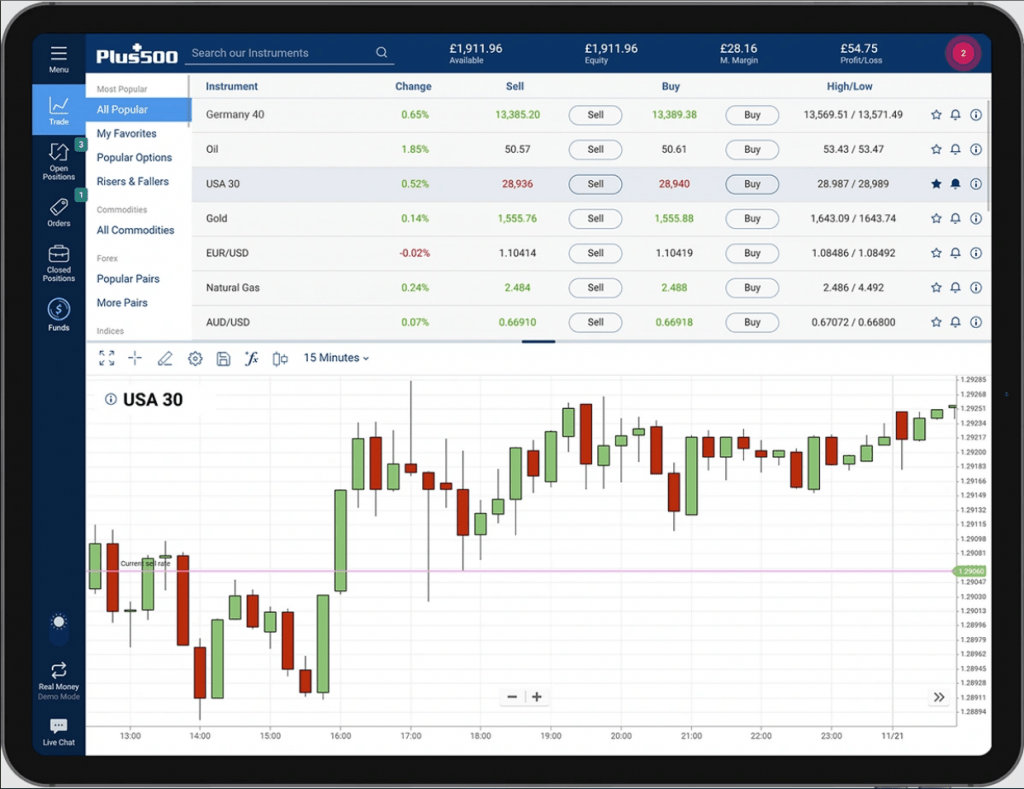

Plus500 Trading Platform

Users can easily access a range of features, including watchlists and chart analysis, as well as placing and monitoring trades. Technical analysis charts offer more than 100 technical indicators that can be applied to a variety of time frames, including tick charts and weekly charts.

The layout of the Plus500 interface feels familiar and easy to get to grips with. With just a few clicks, clients can navigate over 2,000 instruments, use customisable technical analysis charts and place trades.

However, the Plus500 software is a closed system. Users will not be able to incorporate third-party analytical or automation tools.

Plus500 doesn’t offer any of the special features that are typically available at other online forex brokers.

It does not offer ISA accounts nor does it allow for automated trading via expert advisors or other trading algorithms. It does not provide back-testing functionality, nor does it allow clients to manage third-party funds via PAMM or MAM trading platforms.

There are three basic order types on the Plus500 platform:

- Market Order – This is the simplest form of order. A trader requests that their order should be executed at the prevailing market rate.

- Limit Order – This is a pending order where entry is set at a predetermined point. This point may be above or below the prevailing market rate depending on whether it is a buy or sell transaction. Clients can also select the expiration time of limit orders.

- Stop Order – Similar to a limit order, the trader sets the exit at a predetermined point and has the option of selecting the expiration time of the order.

Demo Account

Plus500 offers a fully functional demo account on which you can practice paper trading in real market conditions. There is no limit on how long or how much you can trade on Plus500’s practice account and, once the virtual balance drops below 200 GBP, the original balance will be reinstated.

Assets

Plus500 offers a comprehensive range of CFD instruments, including forex, stock indices, shares, ETFs, options and commodities. In total, there are over 2,000 instruments to choose from.

In 2013, the firm became the first broker to offer a Bitcoin CFD. However, as of January 2021, trading crypto CFDs has been banned in the UK by the FCA.

Markets offered by Plus500 are broken down as such:

- 1,800 Stock CFDs, including US stocks like Tesla (TESLA), Gamestop (GME), AMC and ADVFN, Chinese stocks like Xiaomi and penny stocks

- 33 Stock Index CFDs like IBEX 35, USA 50, France 40, S&P 500, NASDAQ 100, DAX (Germany) 30 and the FTSE 100

- 22 Commodity CFDs like gold (XAU), natural gas and brent oil

- 92 ETF CFDs like the Commodity Index Fund

Plus500 also allows traders to trade on thematic indexes such as the Cannabis Index.

Account Types

Plus500 offers one account type for retail investors, known as a retail account. Clients can also apply for a professional account, which gives them access to higher leverage rates.

To qualify for a professional account, you will need to have carried out sufficient trading activity in the last 12 months, have a financial instrument portfolio of over £500,000 and have relevant experience in the financial services sector.

Fees

Plus500 generates its revenue primarily through spreads. The spread is the difference between the bid and ask price and is typically measured in pips.

For example, when trading EUR/USD, if the buy rate is 1.12078 and the sell rate is 1.12072, the spread is 0.6 pips. The firm offers competitive spreads.

All trading costs are covered within the spread and there are no commission fees.

You may be subject to currency conversion fees if you trade in a currency different from the account’s base, meaning you could pay up to 0.7% of the trade’s realised net profit or loss (P&L).

Moreover, if you opt for a Plus500 guaranteed stop-loss order (GSLO), the result will be an increased spread quote, meaning lesser profits.

Inactivity fees are charged when an account has been idle for three months. These can range up to 10 GBP and are calculated against the remaining available balance in your account. This fee will be charged once a month from that point onwards. You can avoid this fee simply by logging in or you can close your Plus500 account.

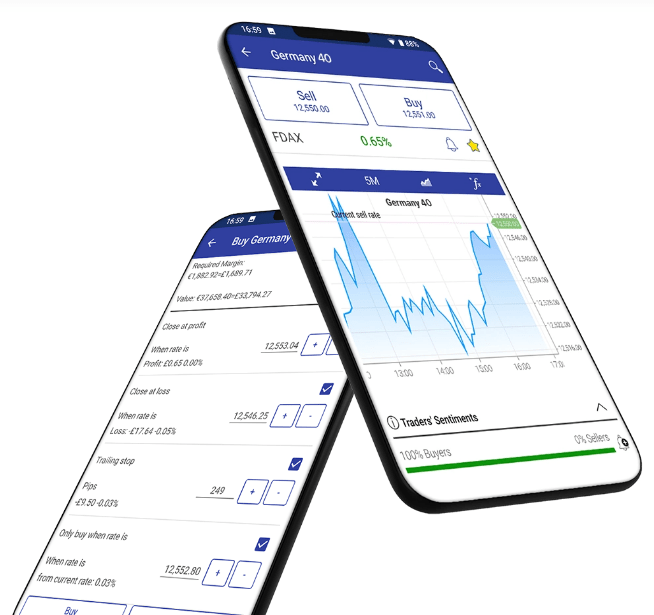

Mobile App

Plus500 has a fully functional mobile app for clients that want to trade on the go. The platform was designed with mobile traders in mind and no features are lacking on the mobile client.

The application is easily available for Android, iPhone and iPad devices. Plus500’s entire instrument catalogue, conditional orders and over 100 technical indicators can all be accessed with just a few taps.

Plus500 Mobile Trading Platform

When carrying out analysis on your mobile device, you may be hindered by the size of your screen. For further detail and clarity during this process, all Plus500 charts can be expanded to full-screen mode. Furthermore, deposits and withdrawals can be carried out with the same ease as the desktop platform.

Leverage

When trading CFDs, you are gaining exposure to the price changes of an underlying asset. You never own anything.

To do this, traders can deposit only a percentage amount of the position size, borrowing the rest of the capital from the broker. This is known as margin trading or leveraged trading.

With Plus500, margins are fixed. This restricts the trader’s ability to reduce the risk associated with position size. Margin levels are as such:

- Stock Indices – 1:20

- Stocks – 1:5

- Forex – 1:30

Investors that qualify for a professional account have the option to increase their maximum leverage from 1:30 to 1:300. Professional accounts incur no additional charges.

How To Start Trading

To help you get started with Plus500 in the UK, we’ve prepared a short guide:

- Click “Start Trading” in the upper right corner of the screen.

- Choose a “Real Money” or “Demo” account.

- If you choose a “Real Money” account, you will need to be verified before you can log in and start trading. This process involves you uploading documents proving your identity, residence and sources of funding. Verification time is usually one day.

- Deposit funds and open a trade.

Security

Plus500 is registered with relevant authorities throughout Europe and the Asia-Pacific region.

This includes the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities & Investments Commission (ASIC). A few locations are forbidden from registering with Plus500, including the US, Canada, Cuba, Iran and Syria.

Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909)

Per FCA regulation in the UK, Plus500 segregates client money from corporate funds to protect customers in case the company becomes insolvent.

The FCA guarantees clients reimbursement of up to £85,000 under the Financial Services Compensation Scheme (FSCS). Note, the sale of CFDs for cryptocurrencies is forbidden in the UK.

The European Securities and Markets Authority (ESMA) requires registered brokers to provide negative balance protection. This ensures clients cannot lose more than they have loaded into their accounts. Furthermore, all clients must uphold a maintenance margin level.

This is the amount of equity a customer needs to maintain to keep a position open. To view the maintenance margin requirement for any instrument, go to the main screen of the platform, select the instrument and click on the “Details” link next to it.

Plus500 also implements security measures to enhance client protection. These include a thorough verification process, two-factor authentication (2FA) and biometric authentication for its mobile app.

Deposits & Withdrawals

One of Plus500’s selling points is that it does not subject client accounts to ancillary fees. There are no charges for normal withdrawals, closing or deleting an account. The minimum to open an account is 100 GBP. Funding options include Visa or Mastercard debit/credit cards, e-wallets (PayPal, Trustly or Skrill) and bank wire transfers.

Plus500 does not charge any additional fees for deposits or withdrawals. To make a deposit, simply click on “Funds Management”, “Deposit” and choose your preferred method. You can access the “Funds Management” screen on the mobile app by clicking the menu button. In the UK, Plus500 has a minimum deposit amount of 100 GBP. For bank transfers, the minimum is 500 GBP.

Users can make a maximum of five free withdrawals per month. After this, Plus500 will charge you 10 GBP per withdrawal. Processing time for withdrawals is usually between 1 – 3 days. E-wallet withdrawals can take between 3 – 7 working days, while bank transfers can take 5 – 7 working days. Credit/debit card withdrawals will be executed according to the issuing bank’s processing time. The minimum withdrawal amounts are:

- Credit/Debit Card – 80 GBP (only if the card was used for a deposit)

- PayPal/Skrill – 40 GBP (only available if used for a deposit)

- Bank Transfer – 80 GBP

- Apple Pay – 75 GBP

Customer Support

Plus500 limit its customer service options to a UK live chat, WhatsApp and email support. Both are available 24/7. You will therefore not find a contact number for Plus 500, even for sales inquiries.

To get in touch with Plus500 you can submit a ticket on their website or ask a question via WhatsApp or live chat. Upon testing, we received prompt, helpful and polite replies on all three channels.

If you need to refer to your conversation with customer service later, there is an option to “share chat”.

Education

Many outdated Plus500 reviews remark on the firm’s lack of educational resources for traders. However, the firm seems to have responded to criticism as there is currently a wealth of additional information available for free on the main site as well as a “Knowledge Base” on Zendesk.

Tools include a comprehensive economic calendar, regulatory news (RNS), a trader’s guide with several “how-to” YouTube tutorials, regularly updated news & market insights with tips and tricks and a downloadable PDF e-book that includes explanations about the instruments offered, platform features and a step-by-step trading guide.

Additionally, the legally required key investor information document (KIID) contains thorough and unbiased simulations of several trading scenarios.

This can clarify how profits and losses are calculated. If you are interested in investing in Plus500, the firm has a terminal of its website dedicated to investor relations, where you can find financial statements, annual and quarterly earnings reports and more.

Trading Hours

Trading hours at Plus500 are relative to the market in which you are trading. Due to market overlaps and time differences, it is possible to trade stocks 24 hours a day, 5 days a week.

Please get to grips with the financial calendar and ensure you know the market open hours and convert them to GMT before you start investing. Knowing the periods of highest liquidity can improve your trading strategy’s success.

Pros Of Plus500

- Access to more than 2,500 trading instruments

- Functional and intuitive platform

- Regulated by the FCA (U.K.)

- Guaranteed stop-loss orders

Cons Of Plus500

- Customer support lacking

- Third-party software cannot be used

- Does not accept clients from the US or Canada

Plus500 Verdict

Plus500 offers CFD trading on an intuitive, sleek platform that lacks some of the advanced functionality of other brokers. The proprietary software is a closed system, which means third-party automation is not possible. However, spreads are kept tight and additional costs are low. Clients in the UK have the extra reassurance of the firm being regulated by the Financial Conduct Authority.

FAQs

Is Plus500 A Real Broker?

Yes, Plus500 is a real and legitimate broker that operates in over 50 countries.

Is Plus500 A Margin Account?

Plus500 offers all clients leverage trading within the FCA’s regulatory limits. The broker offers one account type, which doubles as a margin account for those wishing to gain additional market exposure.

Is Plus500 A Good Broker?

Plus500 is a large and internationally recognised CFD trading platform. It claims to be the largest CFD provider in Germany and Spain and has top-tier regulation around the world.

Is Plus500 A Good Trading Platform?

Plus500 is best suited for intermediate traders looking for an interface for manually executing trades without any advanced technical features. Lack of MT4 access may be a turn-off for more experienced traders accustomed to a certain level of functionality. Costs are kept competitive at the firm but a closed system means API trading and automation are not possible.

How Long Does A Withdrawal Take With Plus500?

In the UK, withdrawals typically take between 1-3 days. E-wallets and bank transfers can take up to seven business days depending on the checks being carried out. Plus500 clients get five free withdrawals per month. After this, each withdrawal incurs a fee of 10 GBP. If you are having problems with withdrawals, contact customer service via live chat or WhatsApp immediately.

What Fees Does Plus500 Charge?

Plus500 generates the majority of its revenue through the spread. Other fees included when trading with this broker include an inactivity fee and an overnight funding fee. Trading with a guaranteed stop-loss order (GSLO) will also increase the spread.

Is Plus500 A Market Maker?

Plus500 is a market maker, which means it takes the opposite position of any trade you make. This allows the firm to offer its own proprietary software without having to worry about liquidity. Although spreads are competitive, ECN brokers will usually have tighter spreads as no dealing desk is involved.

Which Countries Is Plus500 Available In?

Plus500 is a global brand with a trusted logo that is regulated throughout Europe and the Asia-Pacific region. It is available in the UK, Germany, France, New Zealand, Hong Kong and many more locations. Users from the US and Canada are unable to open an account with this firm. Read the Plus500 user agreement to find out if your country is available.

Do I Pay Tax Trading With Plus500?

When investing with Plus500, the trader is responsible for reporting their own tax according to their jurisdiction. In the UK, trading CFDs may be subject to capital gains tax if you breach the tax bracket. Always consult a local tax advisor before investing in CFDs.

Does Plus500 Offer An Islamic Account?

Yes, Plus500 offers users an Islamic, swap-free account for traders of the Muslim faith. This account is halal, not haram.

Does Plus500 Offer Spread Betting Or Binary Options?

No, Plus500 does not offer spread betting or binary options. It only offers contracts for difference (CFDs).

Top 3 Plus500 Alternatives

These brokers are the most similar to Plus500:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Plus500 Feature Comparison

| Plus500 | IG | Swissquote | Pepperstone | |

|---|---|---|---|---|

| Rating | 4.1 | 4.5 | 4 | 4.8 |

| Markets | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $100 | $0 | $1,000 | $0 |

| Minimum Trade | Variable | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | 5% Cashback On Investments | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | Yes | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 79% of retail CFD accounts lose money. |

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

72% of retail investor accounts lose money when trading CFDs |

|

| Review | Plus500 Review |

IG Review |

Swissquote Review |

Pepperstone Review |

Trading Instruments Comparison

| Plus500 | IG | Swissquote | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Plus500 vs Other Brokers

Compare Plus500 with any other broker by selecting the other broker below.

Popular Plus500 comparisons:

|

|

Plus500 is #14 in our rankings of CFD brokers. |

| Top 3 alternatives to Plus500 |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options |

| Demo Account | Yes |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Regulated By | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA |

| Leverage | Yes |

| Mobile Apps | iOS, Android & Windows |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Apple Pay, Credit Card, Debit Card, Mastercard, PayNow, PayPal, Skrill, Trustly, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | No |

| Islamic Account | Yes |

| Commodities | Aluminium, Cattle, Cocoa, Coffee, Copper, Corn, Cotton, Gasoline, Gold, Lean Hogs, Livestock, Oil, Palladium, Platinum, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | Dynamic |

| CFD GBPUSD Spread | Dynamic |

| CFD Oil Spread | Dynamic |

| CFD Stocks Spread | Dynamic |

| GBPUSD Spread | Dynamic |

| EURUSD Spread | Dynamic |

| GBPEUR Spread | Dynamic |

| Assets | 60+ |