Oval X Review 2024

|

|

Oval X is #97 in our rankings of CFD brokers. |

| Oval X Facts & Figures |

|---|

Oval X are a London based, FCA regulated broker offering tight spreads across a wide range of markets. They offer professional client services for eligible pro clients, and free guaranteed stops on the TraderPro platform. Trade the most popular 250 share CFDs with zero commission. |

| Instruments | CFDs, Forex, Stocks, Cryptos |

|---|---|

| Demo Account | Yes |

| Min. Deposit | £250 |

| Mobile Apps | iOS and Android |

| Payments | |

| Min. Trade | £1 |

| Regulated By | FCA, CySec |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Leverage | 1:30 |

| FTSE Spread | 1 pt |

| GBPUSD Spread | 0.9 |

| Oil Spread | 0.06 pips |

| Stocks Spread | From 0.5% |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 0.9 |

| Assets | 65+ |

| Stocks | Oval X offer stock trading on over 5000+ assets from 20 countries. Spreads are as tight as 0.2% and the firm are FCA regulated. |

| Cryptocurrency | Trade 5 Cryptocurrencies, and BTC against USD, GBP or EUR. Margin is tiered from 50% |

| Coins |

|

| Spreads | BTC Market Spread + 10, ETH Market spread + 8 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Spreadbetting | Oval X offer 5000+ markets with ultra tight spreads for tax free spread betting. The TraderPro platform is delivered on mobile too, and includes price alerts. |

Oval X operates out of its London headquarters, offering professional-level trading services to well-funded, experienced investors and beginner retail traders alike. The firm offers access to a wide range of important markets, from indices and commodities to shares and forex, via CFDs and spread betting instruments. This 2024 broker review will outline everything you need to know about Oval X before deciding to sign up, including facts and figures about the trading setup, available payment methods, login process and the company’s fee structure.

About Oval X

Oval X’s parent company ‘Monecor’ was founded back in 1965 in London and specialised in offering trading services to high-level institutions and individuals with large quantities of capital. In 2002, the company rebranded as Oval X and transitioned into online trading, aimed now at investors of all backgrounds and levels of experience. The company is registered with the FCA, the UK financial services regulator.

Trading Platforms

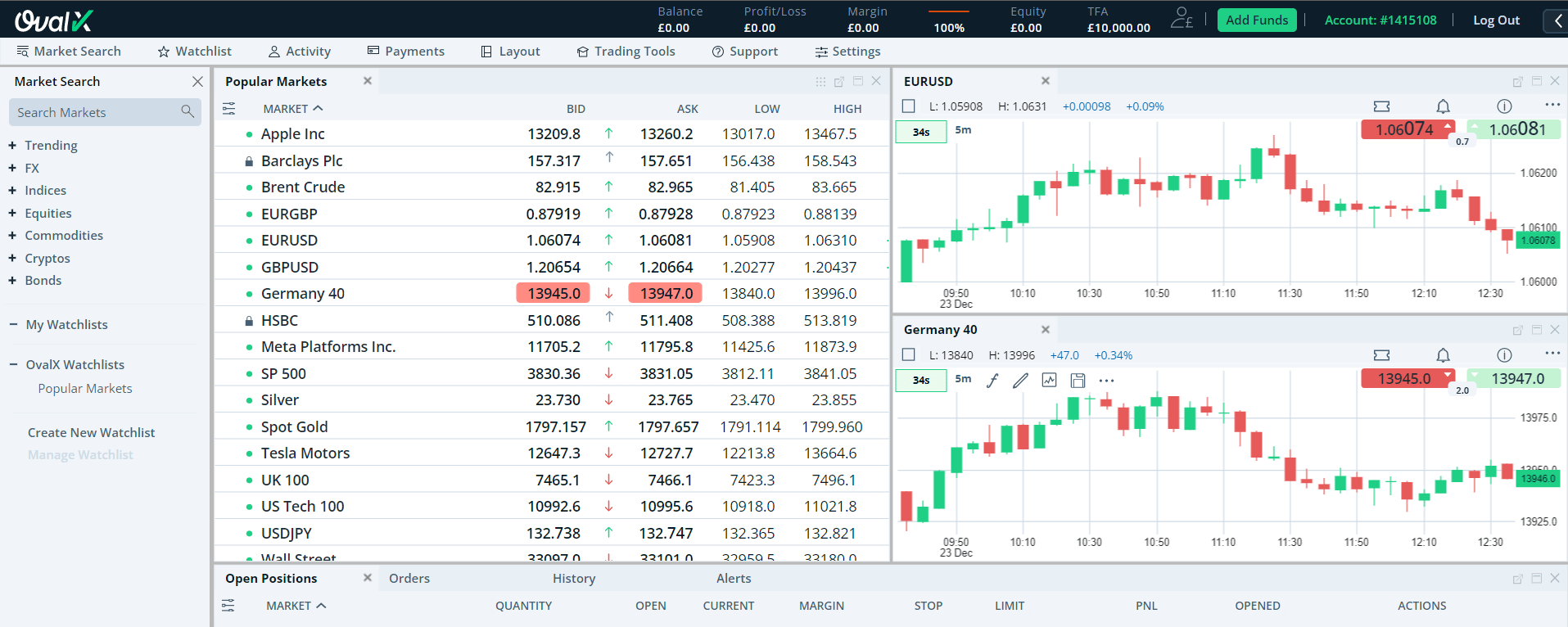

Oval X users are given the choice between two different trading platforms: the firm’s own proprietary solution, the OvalX trading platform, and MT4, one of the most widely used investment platforms in the industry.

While using the platform, we found it to be sleek and customisable, offering users a fast and easily accessible way to access and organise their trades. It is available directly from a web browser, as well as for Apple and Android mobile devices. Key features include:

- Price alerts

- Customisable watchlists

- Specialised charting tools

- Intuitive stop-loss mechanisms

- Wide range of popular indicators

- Up to ten personal workspace layouts

Oval X Platform

Oval X clients can also use the MetaTrader 4 (MT4) platform. This platform is hugely popular with brokers and traders across the world thanks to its advanced functionalities, high level of customisability and intuitive design. Key features include:

- Six order types

- Nine timeframes

- One-click trading

- Historical price data

- 30 built-in indicators

- Multiple screen interfaces

- Daily market news reports

- Advanced price signal tools

- MQL4 automation language

- Online indicator & signals marketplace

Assets & Markets

Oval X offers its users the opportunity to invest in thousands of different CFD instruments spanning a wide range of markets.

- 12 indices

- 60+ forex pairs

- 12 cryptocurrencies

- 23 hard and soft commodities

- 10 interest rate & bond futures

- Thousands of stocks across six major international markets

The firm also boasts spread betting products for those clients that want to expand their portfolios. This form of investing is tax-efficient in the UK that involves staking a specified quantity on the direction of movement of an asset. Both CFDs and spread betting products with this broker are leveraged. Oval X also offers corporate broking and specialised sales trading to institutional clients and high-net-worth individuals.

Spreads & Commission

Clients can access very competitive spreads with this broker, making it an ideal choice for any investor looking to get the most of out their money. These low fee levels can be seen clearly in the company’s forex spreads, which start from only 0.7 pips for the most highly-traded currency pairs, such as the EUR/USD, while GBP/USD starts at just 1 pip. Commodities spreads start at 0.025 points, CFDs start at 0.6 pips and indices start at 1.0 pips, while equities hold commissions as low as 0.08%.

Leverage

Oval X offers leverage for all its retail trading products, from CFDs to spread betting instruments. The maximum leverage rates are the same for both forms and are as follows:

- FX – 1:30

- Indices – 1:5 to 1:10

- Equities – 1:5 to 1:10

- Commodities – 1:10

While investing with leverage can be a great way to take advantage of favourable market conditions, it should be noted that it also increases risks, so should be undertaken with caution.

Mobile Apps

Oval X will suit those who like to invest on the go as both the platforms offered have their own fully functional mobile apps. For both the proprietary platform and MT4, there are mobile applications that can be downloaded for free from both the Apple App and Google Play stores.

When we used each of the mobile platforms, we found them to be optimised for hand-held usage, with uncluttered interfaces, one-click trading and slick navigation. While advanced technical analysis and building investing bots may be more difficult from within the mobile apps, they are kept secure with advanced encryption and touch/face ID logins.

Payment Methods

Oval X offers its users a range of payment and withdrawal options, meaning that, however you manage your funds, you will likely have a convenient deposit method available. The options offered are listed below.

- Skrill

- Giropay

- Neteller

- China UnionPay

- Credit/Debit Cards

- Bank Wire Transfer

Withdrawals are easy and simple. Any money you make can be seen in your account value on the Account Area of the site and withdrawals can be made directly from there. There is no minimum withdrawal, though a small fee is charged for withdrawals under £100, and requests are processed quickly.

Demo Account

While there is only one standard trading account type offered by the firm, there is also a free demo account. Moreover, you can open a demo account for either Oval X TraderPro or MT4. All you need to do is follow the signup procedure on the website and, when you have your login information, you can sign in and trade stocks using virtual money on the markets of your choice.

Oval X Demo

Regulation & Licensing

Oval X has been around as a company for over 60 years and has been registered with the FCA for much of this time under register number 124721. This means that all its activity must comply with the regulations that the FCA dictates, so clients can be assured that they are protected when investing with the firm.

Additional Features

In addition to its investment services, Oval X offers several extra features, available to existing and prospective clients. These include:

- Blogs – Updated three or four times a week, the online blog is available to any member of the public and covers weekly reviews of instruments, such as the FTSE 100 and Brent oil, as well as overall market reviews.

- Webinars – Webinars on a variety of topics, such as advanced technical analysis, trading on the world’s largest markets or simply learning how to trade like a professional are available on the website.

- Market Analysis – Finally, short articles provide analyses of several key markets. These are short reads, only taking around six-to-ten minutes and are perfect for those wanting a quick and snappy update on the latest in financial markets.

Account Types

Oval X offers two primary account types, the Standard Live account and the Pro account.

The standard account is available to anyone with a £100 initial minimum deposit. It offers a large variety of investing tools, as well as access to both trading platforms offered by and the additional features that come with them.

For those signing up to Oval X with a large amount of capital behind them, the Pro account offers a professional-grade service, with more competitive leverage rates and access to types of investments not offered to clients on the Standard Live account. To sign up for the Pro account there are a few stipulations: you must have over £500,000 of liquid assets, excluding your place of residence, and have traded at least 10 times in each of the last four quarters.

Advantages

- MT4 access

- Demo account

- Large asset range

- Educational content

- Long-standing pedigree

- Competitive trading fees

- Professional client services

- Institutional client services

- Range of payment methods

Disadvantages

- No live chat support

- Complicated website

- Limited account options

- Poor customer service reviews

Guide To Getting Started With Oval X

To get started with the firm, you will need to visit the broker’s website and click the Open An Account button. From here, you will need to input various personal details and decide if you want to open a Standard or Pro account. Once this is done, you must select the trading platform you would like to use, either MT4 or Oval X.

Once your account has been confirmed, you can deposit some capital with which to speculate. This can be done via any of the supported methods, whether that be wire transfer, debit card or Skrill.

With some money in your account, you can get started opening positions and trading any of the available assets. Our experts found that you can mitigate your risk by carefully managing the amount you stake on each position and carrying out technical and fundamental analysis before each investment.

Trading Hours

The opening hours for Oval X largely follow the industry standard, with markets being open between the hours of 21:30 GMT on Sundays to 22:00 GMT on Fridays.

It is important to note, however, that these hours may be subject to change on holidays or in response to variations of liquidity, so always check the broker’s website for up-to-date verification.

Customer Support

In an area of relative weakness for the firm, there are not too many options for contacting customer service and customer reviews have told both good and unimpressive accounts of the support offered.

However, this is not to say that Oval X’s customer services are non-existent, as you can contact the company by email, telephone or a Contact Us form on the website. The opening times for customer service requests are 07:30 to 21:00 GMT, Monday through Friday.

- Email: customer.service@ovalx.com

- Telephone: +44(0)2073921494

Security

Oval X claims that the personal security of its users is a priority in how it runs its business. The firm employs a Security Officer for complete oversight of security-related legislation and privacy policies. Additionally, there are several firewalls and encryption protections used to protect all clients.

Should You Sign Up With Oval X?

Oval X is run with a significant amount of experience and the result is a slick, professional service that caters well to complete beginners and experienced professionals. The company offers a proprietary trading tool alongside the industry’s favourite MT4 with which to speculate on thousands of stocks, forex, crypto & commodities via CFDs and spread betting. While the company’s customer service has not had the best reception, the login system is simple and Oval X is licensed and regulated by the FCA, so there will be support and recourse for any significant issues.

FAQ

Where Is Oval X Regulated?

Oval X is regulated under the company name Monecor by the UK-based regulator the FCA.

Does Oval X Offer A Demo Account?

Yes, for investors looking to try out Oval X’s services before they deposit any real money, the broker offers a demo trading account that allows you to get to grips with the platform and make trades with virtual money instead.

What Is The Minimum Deposit On Oval X?

Oval X has a fairly standard minimum deposit of £100.

Is A Good Broker?

Oval X has a weakness in its customer service department but the rest of the services offered are very competitive and draw on a wealth of industry experience to provide a highly professional service to its users. This includes trading fees, execution speed, platforms, additional features and asset range

Is A Trustworthy Broker?

Oval X is regulated by the FCA, so it must abide by the laws and guidelines that exist in the UK to protect clients from nefarious behaviour, such as fraud.

Compare Oval X with Other Brokers

These brokers are the most similar to Oval X:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Oval X Feature Comparison

| Oval X | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 1.8 | 4.9 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | £250 | $100 | $0 | $0 |

| Minimum Trade | £1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySec | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | - | MT4 |

| Leverage | 1:30 | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | ||||

| Review | Oval X Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Oval X | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Oval X vs Other Brokers

Compare Oval X with any other broker by selecting the other broker below.

Popular Oval X comparisons: