Fusion Markets Review 2025

Fusion Markets is an online broker offering 120+ instruments across two live account types. Our review covers regulation, forex spreads, leverage and the broker’s MT4 and MT5 trading platforms. Find out whether to open an account with Fusion Markets today.

About Fusion Markets

Fusion Markets is a popular forex broker regulated by the Australian Securities & Investments Commission (ASIC). The company is a trading name of Gleneagle Asset Management Limited and was founded in 2017 by a team of industry experts with 50+ years of experience. Fusion Markets is led by CEO, Phil Horner, who also founded the company.

The broker offers low prices and support for clients of all experience levels whilst leveraging the latest technology to ensure a competitive trading environment.

Trading Platforms

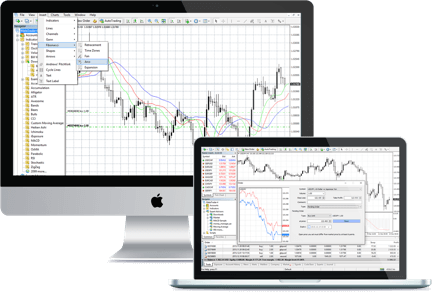

MetaTrader 4

Provided by MetaQuotes and powered by Fusion Markets, the broker offers three variations of the MT4 platform for desktop download, web browser and mobile app. MT4 promises fast executions and direct connection to Fusion Markets’ proprietary client area called Fusion Hub for complete account management.

MT4 has a lot to offer:

- 50+ technical indicators & graphical objects for analysing charts

- Automated trading via expert advisors (EAs)

- Multiple order types & one-click trading

- 9 timeframes and multiple chart types

- Customisable dashboard

MetaTrader 4

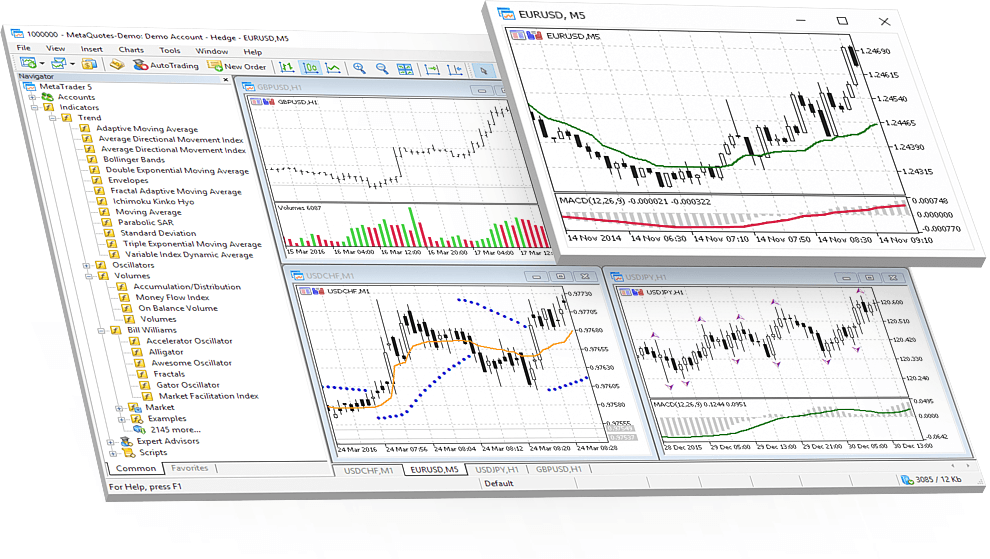

MetaTrader 5

Fusion Markets also offer MT5, an advanced version of MT4 more suited to professional traders. Reviews of MT5 are positive on online forums, praising the extensive features and trading tools, including:

- Expert advisors with MQL5 programming language

- Advanced risk management alerts

- 80+ technical analysis tools

- Faster processing speeds

- 21 timeframes

- Market depth

MetaTrader 5

MT5 is available to download on Windows, Mac, iOS and Android.

Fusion Markets also offers tools that compliment the MT4 and MT5 platforms, such as a Virtual Private Server (VPS). This lets you run a trading platform remotely from a virtual machine at all times, even if your computer is not switched on or if you encounter connectivity issues.

The broker also offers a Multi-Account Manager (MAM/PAMM) for professional clients. This lets you trade across an unlimited number of live accounts. Additionally, Fusion Markets offers an API solution through FIX for institutional clients.

Assets

Fusion Markets have a decent choice of over 120 tradeable instruments:

- Forex – 90+ major, minor and exotic currency pairs, including EUR/USD, USD/CAD, GBP/TRY

- Cryptocurrencies – 5 popular cryptos including Bitcoin, Dash, Ripple and Ethereum

- Indices – CFDs on some of the world’s biggest stock indices, including the FTSE

- Energy – 3 energies, including Brent and crude oil plus natural gas

- Metals – 13 precious metals including gold, silver, zinc, platinum and copper

Fusion Markets is also planning to introduce trading with commodities such as wheat, cocoa, sugar and coffee.

Trading Accounts

Fusion Markets offers two different account types; the Classic and the Zero. The main differences between the accounts are the platforms and payment methods. Neither account has a minimum deposit requirement.

- Classic – This account is designed for newer investors who want a simple trading environment with zero commissions and straightforward spreads.

- Zero – This ECN solution offers tighter spreads and competitive commissions suitable for scalping strategies. The account is best suited to experienced traders.

To register for a live account with Fusion Markets, sign up using the ‘Create an Account’ button on the broker’s website. You will need to provide ID documentation and proof of address. Familiarise yourself with the broker’s terms and conditions before you start trading.

Note, Fusion Markets does not yet offer Islamic swap-free accounts.

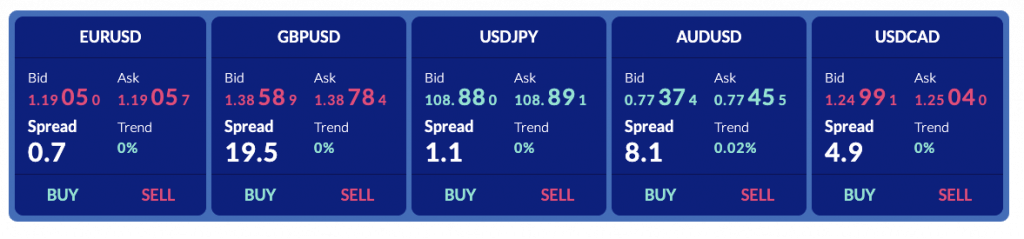

Trading Costs

Fusion Markets is a great choice for UK traders looking for low fees. The broker offers variable spreads from 0.0 pips plus a USD 4.50 commission with the Zero account though the average spread is 0.5 pips. The average spread on the Classic account is 0.9 pips. Fusion Markets also claims its low commission rates are 36% cheaper than the competition.

Forex spreads

Leverage Review

Fusion Markets offers significantly higher leverage than is usually available to UK traders. Flexible leverage up to 1:500 is available. For forex and metals, leverage between 1:20 and 1:500 is available while with CFD trading the limit is 1:100 and for cryptos, it’s 1:2. These leverage levels are much higher than is allowed by the FCA, which comes down to the broker’s Australian regulation.

Account equity also influences the leverage available. The maximum leverage is 1:500 on accounts with up to $50,000 though this drops to 1:50 for accounts with between $250,001 and $500,000.

Demo Account

You can create a demo account within the Fusion Client Hub for free, which gives you full access to trading tools, products and platforms for 30 days. Simply enter basic contact details, provide ID documentation and select the account type, you’ll then receive your demo login information via email.

Additional Features

Fusion Markets also offers an automated social trading platform via Myfxbook. It’s one of the largest forex trading communities that connects emerging traders with experienced investors. Clients can mirror the positions and strategies of successful traders. There are no hidden fees and the broker only displays the top trading systems.

Myfxbook AutoTrade

The broker also offers an easy-to-use trading calculator that lets you work out the required margin, pip values and swaps based on the different instruments. A comprehensive economic calendar is also available on the broker’s website. For further trading ideas and news of promos, Fusion Markets has a strong presence on social media, particularly Facebook.

Despite the above, our review would have liked to have seen more educational tools and resources for beginners.

Deposits & Withdrawals

Fusion Markets offers a range of deposit methods for UK traders with varying processing times:

- E-wallets including Skrill, FasaPay and Perfect Money (instant)

- Credit & debit cards including Visa and Mastercard (instant)

- Bank wire transfer (2-5 business days)

There are no fees on deposits made with credit and debit cards but you may be charged using other payment methods.

Withdrawals are available via bank wire, credit/debit card, Skrill and Neteller. If you make a withdrawal with a debit or credit card, your payment must equal your deposit amount. Withdrawals are usually processed on the same day. Withdrawal times vary between payment providers, but funds should be credited to accounts within 5 business days.

UK traders can open an account in GBP so you won’t be charged currency conversion fees.

Regulation Review

Fusion Markets is not regulated in the UK. Instead, the broker holds an Australian Financial Services License (ASFL) under Gleneagle Asset Management Pty Ltd (GAML). GAML is regulated by the Australian Securities and Investment Commission (ASIC) under registration number 385620. Licensing conditions include keeping client funds in segregated accounts with Westpac, one of Australia’s top banks.

It’s worth pointing out that the lack of UK regulatory oversight is a drawback as traders may struggle to get official help should they encounter problems. Still, the fact Fusion Markets is regulated by a trusted body does provide some level of security.

Client Safety

Fusion Markets’ privacy policy is in line with European and UK legislation, so personal data is kept secure. The MetaTrader platforms also use encryption technology and dual-factor authentication at the login stage. The broker does not offer negative balance protection, however. Traders hold all responsibility for managing margin calls and account funds. Whilst the broker has only been operating since 2017, there is no history of the broker running a scam.

Customer Support

You can contact Fusion Markets’ customer service via live chat on their website or through email and telephone:

- Email – help@fusionmarkets.com

- Phone number – +61 3 8376 2706

Given the broker is based in Australia, we’d recommend using the live chat service for free and instant support.

Trading Hours

Fusion Markets clients can trade 24/7, though session times do vary depending on the market. For specific trading hours, refer to the company’s website under ‘Session Times’, which provides a comprehensive table of GMT times.

Should You Trade With Fusion Markets?

Fusion Markets is a secure broker offering serious leverage with tight spreads and low commissions. The broker also offers automated copy trading and leading tools via the MT4 and MT5 platforms. The only downsides for UK traders are the lack of FCA regulation and the limited educational tools and absence of negative balance protection. Overall, we are comfortable recommending Fusion Markets to our traders.

FAQ

Is Fusion markets Safe?

Fusion Markets is a legitimate broker regulated by the ASIC and VFSC. And whilst based in Australia, we are confident that Fusion Markets is a safe and secure broker for UK traders. The company is not operating an online scam.

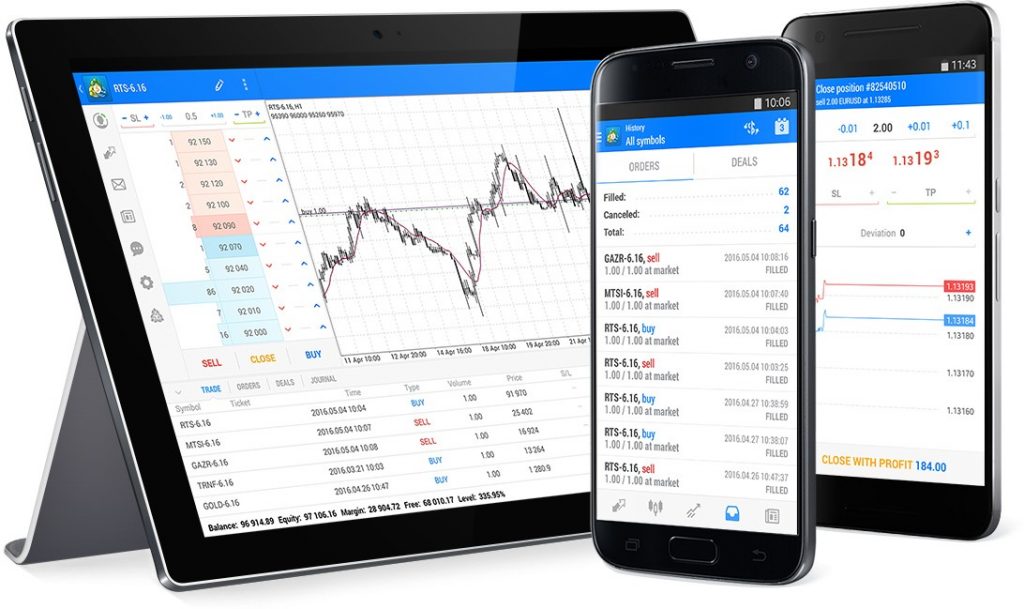

Does Fusion Markets Have A Mobile App?

Fusion Markets does not have its own mobile app. However, clients can trade using the MetaTrader 4 and MetaTrader 5 apps, which are compatible with iOS and Android devices. Head to the Google Play Store or the App Store to start the free download.

How Do I Open An Account With Fusion Markets?

Opening an account with Fusion Markets is easy. Select the ‘Create an Account’ link on the broker’s website where you will need to provide ID documentation and proof of a recent address. The accounts team will review your application with most UK traders getting up and running within a few days.

Does Fusion Markets Offer Welcome Bonuses?

Fusion Markets does not offer any sign-up deals or rebates for UK traders. This is like most forex brokers offering online trading in Europe or the UK. Regulators do not want brokerage’s tempting clients to open trading accounts via promos with unfair terms and conditions.

How Does Fusion Markets Compare Vs Pepperstone & IC Markets?

Fusion Markets is a good option for beginners looking for no minimum deposit requirement and ECN trading with tight spreads. On the other hand, Pepperstone wins on security and regulation, with a license from the UK’s FCA. Pepperstone also has a wider range of 180+ assets. IC Markets is a good broker for experienced traders with a strong track record and a wider selection of payment methods vs competitors.

Top 3 Fusion Markets Alternatives

These brokers are the most similar to Fusion Markets:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

- FP Markets - Founded in 2005 in Australia, FP Markets is a broker regulated by both ASIC and CySEC. It offers a wide range of tradable assets and provides Standard and Raw accounts suitable for traders of all levels. The platform excels in tools, featuring the MetaTrader suite, user-friendly TradingView, and practical insights from Trading Central and AutoChartist.

Fusion Markets Feature Comparison

| Fusion Markets | Pepperstone | IC Markets | FP Markets | |

|---|---|---|---|---|

| Rating | 4.5 | 4.8 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $0 | $0 | $200 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, VFSC, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Fusion Markets Review |

Pepperstone Review |

IC Markets Review |

FP Markets Review |

Trading Instruments Comparison

| Fusion Markets | Pepperstone | IC Markets | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Fusion Markets vs Other Brokers

Compare Fusion Markets with any other broker by selecting the other broker below.

Popular Fusion Markets comparisons:

|

|

Fusion Markets is #11 in our rankings of CFD brokers. |

| Top 3 alternatives to Fusion Markets |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | ASIC, VFSC, FSA |

| Trading Platforms | MT4, MT5, cTrader |

| Leverage | 1:500 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | AstroPay, Credit Cards, Debit Card, FasaPay, Mastercard, Neteller, PayPal, Perfect Money, Skrill, STICPAY, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader |

| Islamic Account | Yes |

| Commodities | Aluminium, Cocoa, Coffee, Copper, Corn, Cotton, Gold, Lead, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Platinum, Silver, Soybeans, Sugar, Wheat, Zinc |

| CFD FTSE Spread | 1.0 |

| CFD GBPUSD Spread | 0.13 |

| CFD Oil Spread | 2.0 |

| CFD Stocks Spread | 0.01 |

| GBPUSD Spread | 0.13 |

| EURUSD Spread | 0.05 |

| GBPEUR Spread | 0.09 |

| Assets | 90+ |

| Crypto Coins | ADA, AVAX, BCH, BNB, BTC, DOGE, DOT, EOS, ETH, LNK, LTC, MATIC, SOL, XLM |

| Crypto Spreads | From 0.04% |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |