FXORO Review 2024

|

|

FXORO is #97 in our rankings of CFD brokers. |

| FXORO Facts & Figures |

|---|

FXORO is an international brokerage firm founded in 2010 and based in Cyprus. The firm is regulated by the Cyprus Securities and Exchange Commission (CySEC) and provides consistent trading conditions with negative balance protection and free membership to the investor's compensation fund. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Shares, Indices, Commodities, ETFs, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $200 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | My tests found that FXORO provides offers an average range of CFD products, covering forex, cryptos, commodities and equities. All these assets can be charted and analyzed manually or automatically with ease through the MetaTrader 4 platform. |

| Leverage | 1:30 |

| FTSE Spread | 2 (Fixed Account) |

| GBPUSD Spread | 3 (Fixed Account) |

| Oil Spread | 4 (Fixed Account) |

| Stocks Spread | From 7 (Fixed Account) |

| Forex | FXORO has a decent range of forex products on offer, although I would have preferred to see greater opportunities within the exotic currency markets. However, the 60 pairs that clients can trade are supplemented by MT4 access and leverage rates of up to 1:30. |

| GBPUSD Spread | 3 (Fixed Account) |

| EURUSD Spread | 2 (Fixed Account) |

| GBPEUR Spread | 3 (Fixed Account) |

| Assets | 60+ |

| Stocks | I wasn't overly impressed with the broker's range of 70+ shares from markets and exchanges across Europe and the US. There are also 16 indices and 14 ETFs that allow for much greater global diversity and more hedging opportunities, but I would have liked to see more global stocks on offer. |

| Cryptocurrency | FXORO clients can access a mediocre range of 9 cryptocurrencies, consisting of key players like Bitcoin, Ethereum and Litecoin. Whilst this is more substantial than many brokers, I feel a much greater range would be required to compete with the top crypto brokers. |

| Coins |

|

| Spreads | Bitcoin: $80 over market price (Fixed Account) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FXORO is an online trading broker offering leveraged investing in forex, shares, commodities, ETFs, indices and cryptocurrency via the MetaTrader 4 platform. The broker has a global presence and is regulated by the CySEC. This review will assess FXORO’s account types and login process, spreads, funding methods, and more. Our experts also share their verdict on using FXORO.

Our Take

- FXORO will suit active traders looking for tight ECN spreads and a reliable platform

- The fixed spread account may also suit traders looking for price certainty

- A range of free deposit methods are available but withdrawal fees apply

- Educational resources could be improved to better support new traders

- Customer support is disappointing with an unresponsive live chat service

Market Access

FXORO offers leveraged CFD trading across a modest range of assets spanning forex, shares, commodities, indices and cryptos. The selection of currencies is particularly strong.

Yet while we liked the diversity of instruments, a longer list of assets is needed to compete with the top brands like CMC Markets and IG Index.

Tradable assets include:

- Forex: More than 60 currency pairs covering majors, minors and exotics

- Cryptocurrency: 9 crypto-assets such as Bitcoin, Ethereum and Litecoin

- Commodities: 7 precious metal and energy commodities such as gold, silver and natural gas

- Indices: 16 of the most popular global indices including the FTSE 100, Dow Jones 30 and S&P 500

- ETFs: 14 exchange-traded funds such as the iShares Russell 2000 and the Invesco QQQ Trust

- Shares: Over 70 company shares across US and European markets, including Apple and Deutsche Bank

Accounts

Our experts were pleased to see that FXORO offers several account types, determined by spreads: Fix, Floating and ECN.

All retail users have access to the same trading features such as maximum leverage, platforms and tools in all accounts. Commissions are only charged in the ECN account.

We were also pleased to see that GBP is accepted as a base currency, in addition to USD and EUR, making the broker a good fit for UK traders. However, the minimum deposit of £200 is higher than some competitors such as XTB (£0) and AvaTrade (£100).

For Muslim investors, all accounts offer an Islamic option. Instead of interest charged on overnight positions, flat fees are charged depending on the market, ranging from $5 to $40. You can request an Islamic ECN, Fix or Floating account from the FXORO customer support team.

How To Open An FXORO Account

I was able to open an account with FXORO within minutes, only needing my personal details for the initial set-up.

- Click the ‘Register’ button on the broker’s website

- Input your basic details such as name and contact information

- Select the account type from the drop-down menu and click ‘Join’

- FXORO will allocate you the login details for the platform and website

After registration, you will need to complete a ‘Know Your Customer’ style questionnaire within 15 days. This involves providing details such as National Insurance number and home address. You will also be asked to submit documents showing proof of residence and identity.

FXORO Fees

ECN Account Fees

Clients with the ECN Account have access to the tightest spreads possible with FXORO, which come directly from liquidity providers. As a result, the minimum possible spread is 0 pips. This is the best fit for high-volume, intraday traders.

When I tested the platform, I was offered a spread of 0.6 pips for the EUR/USD pair, and 1.5 pips for the FTSE 100. These are competitive when compared to top ECN brokers, including Pepperstone and XM.

With that said, to compensate for the low spreads, FXORO ECN clients must pay a commission at a rate of £4 per lot.

Fix Account Fees

I found that the Fix account charges no commission, however, there is a constant difference between buy and sell orders. This means that regardless of what the raw spreads are, clients with this account type always have a 2-pip gap between the bid and ask prices.

The main benefit here is that the spread never varies, even during times of high volatility or low liquidity. This may prove popular with beginners looking for price certainty.

Floating Account Fees

The variable spread account with FXORO provides access to floating spreads from 1.2 pips. This means that the difference in bid and ask prices will vary according to market conditions.

As a result, the spreads can sometimes be tighter than for the Fix account but during times of high volatility, they may be wider than 2 pips.

Similar to the Fixed spread account, we were pleased to see that there is no commission charged.

Other Fees

For FXORO users with non-Islamic accounts, there are swap fees charged on overnight positions. The exact amount you are charged changes and will vary according to the position you take (long vs short) and the asset you are trading.

On the downside, I was disappointed to see that FXORO charges a penalty of £25 every 3 months on accounts that have been left inactive for the said period. After the fourth inactivity period, the charge is £100, after which the inactivity period is reset.

Funding Methods

Deposits

I had a positive experience when depositing with FXORO. There is a range of supported methods and I was especially pleased to see that there are no deposit fees or minimum deposit limits.

The available methods and supported deposit currencies for UK-based clients are detailed below. Typically, debit/credit cards and e-wallets are processed within the same day, whilst bank transfers can take a few working days to process.

- Debit and Credit Cards – GBP, USD, EUR, CHF

- Bank Wire – GBP, EUR, USD, CHF

- Neteller – GBP, EUR, USD

- Skrill – GBP, EUR, USD

- Wire2Pay – USD only

How To Deposit Funds To FXORO

To deposit funds, you must first complete the ‘Know Your Customer’ questionnaire and submit the accompanying documents.

This step-by-step guide for deposing funds is valid for clients that have completed their application and it has been accepted by the broker’s customer team.

- Navigate to Fxoro.com and sign in using your login details

- Click on the ‘Deposit’ button under the ‘Funds’ tab

- Select the deposit method and specify the amount to be transferred

- Click ‘Submit’ to confirm

Withdrawals

You must use the same method for both deposits and withdrawals.

We liked that FXORO offers clients 3 free withdrawals each month, which is a reasonable amount. Additionally, the subsequent charge of £10 per withdrawal is relatively low.

The only drawback is that all withdrawals take between 2 and 5 business days, though this is fairly common amongst forex and CFD brokers.

Trading Platforms

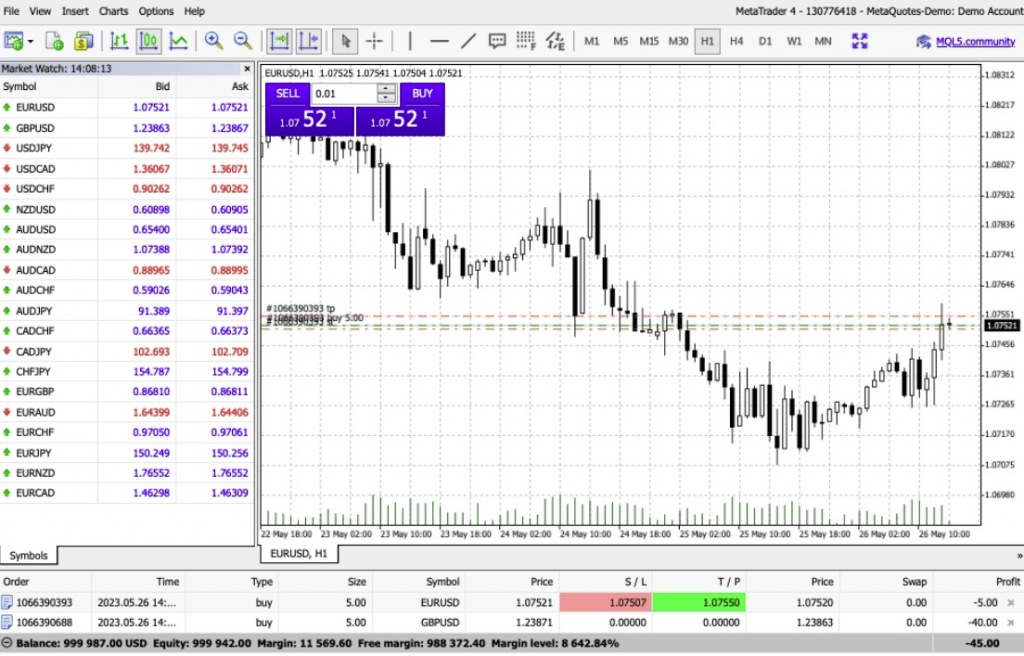

FXORO offers only the MetaTrader 4 (MT4) platform for all accounts and assets. Whilst a wider choice of platforms would match the standard of leading brokers, MT4 is sufficient for most experience levels and strategies.

The MT4 platform is powerful and reputable, offering an impressive suite of technical analysis tools and trading resources. The interface is unadorned but straightforward. I find the chart tools easy to navigate and I’m always impressed by the platform’s customisability.

Some of the best features in my opinion include:

- 50+ technical indicators and analytical objects you can overlay onto price charts

- An MT4 marketplace with thousands more indicators that you can download

- Customisable time frames, in addition to the 9 that are built-in

- Buy limit, sell limit, buy stop and sell stop pending orders

- One-click market execution trades

- Expert advisor support

The MT4 app is available to download onto Windows PCs, or directly via a web browser for Mac and Linux OS users.

MetaTrader 4

How To Place A Trade

I also rate how straightforward it is to make a trade on MT4. To do so:

- Open the ‘New Order’ pop-up

- Select the asset that you want to trade

- Choose the order type from either market execution or pending order

- Specify the trade information such as trading volume and strike prices for the take profit and stop loss orders

- For a market execution trade, click either buy or sell to confirm the order

- For a pending order, choose the order type, strike price and expiration time if necessary

- Submit the order request

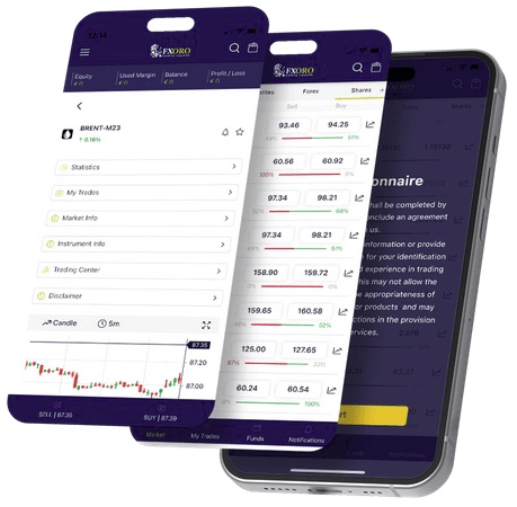

FXORO App

Our experts were happy to find that FXORO offers a proprietary mobile app that clients can use to manage their portfolios.

When testing the app, I found decent technical analysis functionality with market sentiment indicators and a simple trade execution process. The app also comes with portfolio information such as profit, loss and margin levels to help review your performance.

On the FXORO website, you can find QR codes and download links for the app on Android mobiles and iPhones. Alternatively, you can search for the app on the Apple App Store and Google Play, however, ensure it has the correct logo and name before you download.

FXORO Mobile App

Leverage

As FXORO is licensed by the CySEC, we are satisfied that leverage limits are in line with ESMA guidelines to protect retail traders against heavy losses:

- 1:30 – Major forex pairs

- 1:20 – Non-major forex pairs, major indices and gold

- 1:10 – Non-major indices, silver, platinum and all other commodities

- 1:5 – Shares and ETFs

- 1:2 – Cryptocurrencies

Demo Account

I liked that you can sign up for a free demo account, providing a trading experience that closely mirrors that of the variable spread live account.

A paper trading account is a good way to build your understanding of how the MT4 platform works, and how to conduct your analysis and execute trades. I also find paper trading accounts a useful way to gauge the reliability of a broker’s tools.

How To Open An FXORO Demo Account

- Register for a live account as per the instructions above

- Open the MT4 platform via the web terminal or desktop app

- Click on the ‘Demo’ button on the login page

- Input your name and email address

- Choose the base currency (e.g. GBP), starting balance and maximum leverage

- After confirming, FXORO will provide you with the demo account sign-in details

FXORO Regulation

We are pleased to see that FXORO is authorised by the Cyprus Securities and Exchange Commission (CySEC) and therefore can be trusted. This license is held under the name MCA Intelifunds Limited with registration number 126/10.

Although FXORO does not hold a license with the UK’s Financial Conduct Authority (FCA), clients can still expect to receive top-tier protective measures from CySEC. This includes:

- Negative balance protection – Clients cannot make losses exceeding their initial deposit. If there is an error and the client does make a loss greater than their current funds, FXORO will cover the difference to bring the balance back to zero.

- Investor Compensation Fund (ICF) – Clients are compensated up to €20,000 in case the broker defaults and cannot return deposited funds. This is similar to the Financial Services Compensation Scheme (FSCS) in the UK.

Promotional Schemes

As expected from a CySEC-regulated broker, we found no promotional schemes such as a ‘no deposit’ bonus or ‘welcome’ bonus at FXORO. This is common practice with brokers operating under the jurisdiction of the European Securities and Markets Authority (ESMA), to protect you from unrealistic trading incentives.

Additional Tools

Our experts found a decent range of trading tools on offer with FXORO. These altogether provide ample support to clients for their trading strategies and market analysis.

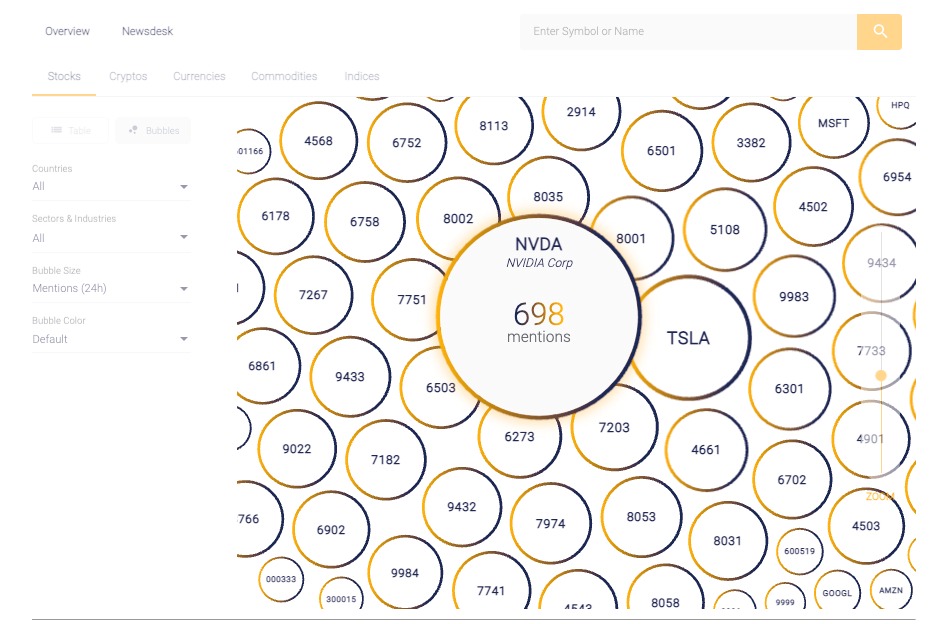

Trading Central

Trading Central is an advanced analytics platform that all FXORO clients can access for free. The tool offers comprehensive market insights and news, with fundamental and technical analysis features. We like that the platform can be tailored to all experience levels.

I was pleased with the range of tools included in Trading Central, including a strategy builder, the Alpha Generation investment decision-maker, bullish and bearish asset picks and an economic calendar.

We also found a streamlined service called Trading Central Market Buzz. This service analyses market sentiment, generating a visual of the most talked-about assets in the world. The example below indicates that the NVIDIA stock was the most popular over the last 24-hour period.

Market Buzz

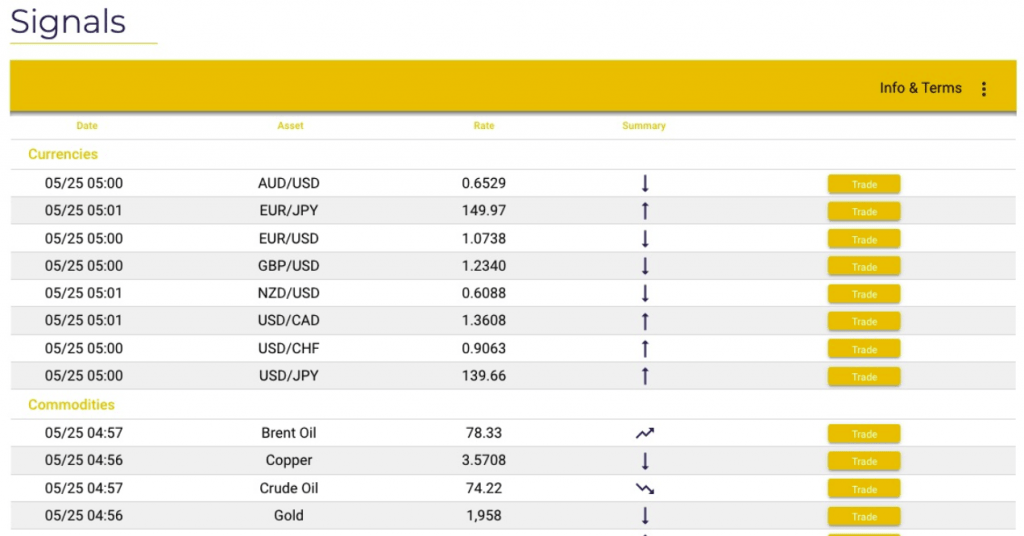

Signals

FXORO also offers a useful alerts service with signals covering all assets, pre-determined by FXORO. This is unlike several other signals providers where you can customise the signals criteria to only see specific markets or assets.

When you click on the signals page, you are shown the assets that are predicted to increase or decrease in value with research derived from technical analysis. I liked that clicking on the alert opens the MetaTrader 4 platform, allowing me to make a trade instantly.

FXORO Signals

Overall, I found the selection is comprehensive and competes with leading brands such as City Index. To stand out further, it would be nice to see full copy-trading tools on offer.

Education

FXORO’s education section is also competitive but could be improved with a wider variety of resources.

I did find numerous training courses with detailed video lessons for beginners and experienced traders. A good range of topics are covered, including how social trading works, how to make the most of the MT4 platform, and how to reduce risk exposure.

Alongside these videos, there is also a free downloadable e-book and free webinars that cover the introduction to fundamental and technical analysis.

Customer Support

FXORO aim to respond to any contact within 24 hours. However, when we tested the live chat service, it was unresponsive. This is a big drawback for us since many active traders rely on quick, convenient and reliable broker support.

To speak to the team:

- Telephone: +357 25 20 5555

- Email address: cs@fxoro.com

- Live chat: Forum located at the bottom of the website

- Contact form: Located in the ‘Contact Us’ section on the website

- Social media: Information about FXORO.com is available on Facebook, Instagram, Twitter, LinkedIn, YouTube and Telegram

FXORO Company Details

Launched in 2010, FXORO is a forex and CFD broker that aims to provide a cutting-edge trading experience with the slogan ‘Anything Is Possible’. The broker offers the award-winning MetaTrader 4 platform alongside a range of charting and analysis tools.

The FXORO headquarters location is in Limassol, Cyprus and the broker is authorised by the Cyprus Securities and Exchange Commission (CySEC), with license number 126/10.

FXORO is also a regular attendee of trading fairs around the world, having participated in the recent National Conference on Cryptocurrency in Milan, Italy.

Trading Hours

The FXORO trading hours depend on the asset and market that you are trading. Forex, for instance, can be traded from Sunday at 9:05 pm until the following Friday at 6:00 pm GMT. ETFs, however, are available from 1:30 pm on Monday to 8:00 pm on Friday.

You can find the full details on trading hours for all assets and markets under the Trading Conditions page on the broker’s website.

Should You Invest With FXORO?

FXORO is a good broker offering a range of markets and a robust trading platform. The broker has a high trust score, with a CySEC license and negative balance protection. Additionally, we liked that clients can choose from flexible pricing models to suit their requirements, including raw ECN spreads with low commissions.

However, the lack of reliable customer support is a considerable flaw. In addition, the number of assets, trading tools and educational resources is limited compared to those of the top brokers. As such, beginners may find a more well-rounded service elsewhere.

FAQ

Is FXORO.com Regulated?

Yes, FXORO holds a license with the Cyprus Securities and Exchange Commission under the name MCA Intelifunds Limited. Therefore, we are confident that FXORO abides by rules imposed via the European Securities and Markets Authority, and offers the required client protection measures.

Does FXORO Offer A Demo Account?

Yes, all FXORO clients can register for a free demo account to practise trading on the MetaTrader 4 platform using simulated funds. A paper trading account is a great way to build up your experience so you can form an opinion on the broker before you begin live trading.

What Deposit Methods Does FXORO Support?

For UK-based traders, you can fund your FXORO account using bank wire, debit/credit cards, and popular e-wallets, Neteller and Skrill. UK clients can also use Wire2Pay, though GBP deposits are not supported so you will have to pay a conversion charge.

What Are The FXORO Trading Fees?

ECN accounts offer raw spreads from 0.0 pips and commissions from £4 per lot. In the Floating account, spreads are wider from 1.2 pips, though there are no commissions. For the Fix account, there are also no commissions and the spreads are kept constant at 2 pips, regardless of the market conditions.

Is FXORO Legit Or A Scam?

FXORO is a legitimate broker that holds a CySEC license, with registration number 126/10. As such, FXORO is trustworthy, with no recent reports of scams.

Article Sources

Compare FXORO with Other Brokers

These brokers are the most similar to FXORO:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, alongside a comprehensive education center and multilingual customer support.

FXORO Feature Comparison

| FXORO | Pepperstone | IG Index | AvaTrade | |

|---|---|---|---|---|

| Rating | 2.8 | 4.8 | 4.4 | 4.9 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities |

| Minimum Deposit | $200 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4 | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail) 1:400 (Pro) |

| Visit | ||||

| Review | FXORO Review |

Pepperstone Review |

IG Index Review |

AvaTrade Review |

Trading Instruments Comparison

| FXORO | Pepperstone | IG Index | AvaTrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | Yes | Yes | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

FXORO vs Other Brokers

Compare FXORO with any other broker by selecting the other broker below.

Popular FXORO comparisons: