Best Commodity Brokers In The UK 2026

Looking to trade gold, oil, wheat or other commodities from the comfort of your screen? In the UK’s crowded market, not all brokers are created equal—fees, platforms, and regulation can vary wildly.

We zero in on what matters most to help you find the best commodity broker that fits your investment goals, whether you’re hedging risk or speculating on global trends.

Top UK Brokers For Trading Commodities

-

In our evaluation of Pepperstone's commodity services, we observed extremely tight spreads (down to 0.05 points on gold), prompt execution, and consistent fills during volatility. Leverage reached up to 1:200, without slippage on oil trades. Multi-platform access and excellent market insights complete a strong commodities arrangement.

Commodities: Aluminium, Cocoa, Coffee, Copper, Corn, Cotton, Gasoline, Gold, Livestock, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Platinum, Precious Metals, Silver, Soybeans, Sugar, Wheat, Zinc

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

During our XTB trial, the vast selection of commodities impressed us, featuring tight spreads from 0.3 on gold and oil, alongside rapid execution and minimal slippage. XTB ranks as one of the most reliable commodities brokers we’ve encountered, thanks to its numerous regulations and stock exchange listing.

Commodities: Aluminium, Cattle, Cocoa, Coffee, Copper, Corn, Cotton, Gasoline, Gold, Lean Hogs, Livestock, Natural Gas, Nickel, Oil, Palladium, Platinum, Precious Metals, Silver, Soybeans, Sugar, Wheat, Zinc

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Analysing Interactive Brokers' commodities services reveals impressive market access and premier execution quality. Gold and energy futures feature minimal spreads and commissions starting at $0.85 per contract. Slippage is minimal, while the Trader Workstation platform offers exceptional control, analytics, and real-time data insights.

Commodities: Aluminium, Gold, Lead, Lean Hogs, Natural Gas, Precious Metals, Soybeans, Zinc

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation offered fixed spreads from 0.20 on gold and 0.024 on silver, ensuring swift and dependable execution. The TN Trader platform, integrated with TradingView, delivered seamless desktop and mobile access. With leverage up to 1:30, trades were reliably executed, simplifying access for beginners, though the commodity range was narrower than others.

Commodities: Aluminium, Copper, Gold, Oil, Silver, Zinc

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Upon testing Eightcap, we noticed fewer commodity options compared to competitors. However, it provided tight raw spreads starting at 0.0 on gold and oil, coupled with ultra-fast execution and minimal slippage. Both TradingView and MetaTrader platforms operated seamlessly on desktop and mobile devices.

Commodities: Gold, Nickel, Oil, Palladium, Platinum, Silver, Zinc

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Commodities: Aluminium, Cannabis, Cattle, Coffee, Copper, Gold, Iron, Lean Hogs, Lithium, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Precious Metals, Silver, Soybeans, Steel, Sugar, Wheat

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

In our commodity testing, FOREX.com provided a broad selection of commodities, delivering rapid execution and tight spreads starting at 0.04 on gold. Leverage is limited to 1:200, yet we were impressed by the reliable fills and minimal slippage during volatile U.S. session hours. The web and mobile platforms appeared robust, complemented by integrated research tools for energy and metal markets, enhancing value for traders.

Commodities: Cattle, Coffee, Cotton, Gold, Lean Hogs, Livestock, Natural Gas, Oil, Orange Juice, Silver, Soybeans, Sugar, Wheat

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Commodity Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Commodity Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Commodity Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Commodity Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Commodity Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Commodity Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

Cons

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

How Investing.co.uk Chose The Best Brokers For Trading Commodities

To identify the best brokers for commodity trading in the UK, we carried out in-depth testing across a range of platforms offering access to energy, metals, and agricultural markets.

Our evaluation focused on key factors including the range of tradable commodities, availability of spot and futures contracts, spreads and commissions, leverage options, and platform tools for technical analysis and risk management.

Only brokers offering competitive pricing, broad commodity market access, and a strong trading experience made our final list.

How To Pick A Commodity Broker

- The range of commodities offered determines the breadth of your trading opportunities and how well you can diversify across sectors with different risk profiles. A broker that provides access to metals, energy, and agricultural markets allows you to hedge or speculate based on global economic cycles—for example, trading oil during geopolitical tensions or gold during inflationary periods. It’s also important to understand whether you’re trading physical assets, futures contracts, or derivatives like CFDs, as each has different implications for leverage, pricing, rollover costs, and settlement. Beginners often start with CFDs due to lower capital requirements, but knowing the structure behind each instrument helps you manage exposure and strategy more effectively.

- Understanding a broker’s fees and costs directly impacts your net returns, especially in high-frequency or leveraged trading. Some brokers charge a commission per trade, while others build their profit into the bid-ask spread—tight spreads may seem cheaper but can widen during volatility. If you’re holding positions overnight, swap or rollover fees can quietly erode profits, particularly in markets like oil or gold where financing costs can be significant. Also watch for deposit, withdrawal, or inactivity fees, which may not be obvious upfront but can add up over time—especially with brokers that operate on low-margin business models.

- A reliable trading platform and tools directly affect your ability to analyse markets and execute trades efficiently. Platforms like MT4, MT5, and cTrader offer advanced charting, automated trading, and customisable indicators that help identify entry and exit points with precision. Access to both technical and fundamental analysis tools enables you to interpret market trends and economic data in real time. Additionally, a robust mobile app ensures you can monitor and manage positions on the go without sacrificing speed or functionality—critical in fast-moving commodity markets where prices can change within seconds.

- Leverage allows you to control larger commodity positions with a smaller amount of capital. Still, under FCA rules, retail clients face stricter limits compared to professional traders to protect against excessive risk. Understanding a broker’s margin requirements is crucial because falling below these thresholds can trigger margin calls or forced liquidations. UK-regulated brokers offer risk management tools like stop-loss orders and negative balance protection, which help limit potential losses and prevent your account from going into debt, especially in volatile commodity markets where prices can fluctuate.

- Fast and reliable order execution plays a key role in commodity trading because prices can shift quickly due to market news or events, and delays can result in slippage—where your trade is filled at a worse price than expected. Brokers offering market execution process orders at the current market price, while instant execution confirms the price before filling, each has different risks and benefits. A wide range of order types, including market, limit, stop, and trailing stops, provides flexibility to enter or exit trades strategically, helping manage risk and lock in profits even in volatile markets.

- Choosing the right account type is essential because different accounts offer varying levels of leverage, fees, and regulatory protections. The minimum deposit affects how much capital you need to start trading— brokers with lower minimums allow easier market access but might limit features. Additionally, having an account in GBP base currency reduces currency conversion costs and protects you from exchange rate fluctuations (I know I’ve got GBP trading accounts).

- Strong customer support and education are not to be overlooked because commodity trading can involve complex instruments and fast-moving markets where timely assistance can prevent costly mistakes. Quality brokers provide multi-channel support (phone, chat, email) with knowledgeable teams who understand technical issues and market nuances. Additionally, access to educational resources like webinars, tutorials, and market analysis empowers beginners to build skills and make informed decisions, reducing reliance on guesswork and improving trading outcomes over time.

- Choosing an FCA-regulated broker enforces strict rules on transparency, capital adequacy, and fair treatment of clients, reducing the risk of fraud or malpractice. Brokers must keep client funds in segregated accounts, ensuring your money is protected even if the broker faces financial trouble. Additionally, the Financial Services Compensation Scheme (FSCS) offers a safety net by compensating you up to £85,000 if a broker fails, providing peace of mind in an otherwise high-risk market.

In my experience, no broker is perfect, but choosing one that combines solid regulation, transparent costs, and user-friendly tools can significantly improve your commodity trading journey.

What Is A Commodity Broker?

A commodity broker is a financial intermediary that facilitates the buying and selling of commodity-based financial instruments—such as oil, gold, or agricultural products—often through derivatives like CFDs or futures.

They provide access to global commodity markets via trading platforms like MetaTrader 5, cTrader, TradingView, or proprietary systems, enabling you to speculate on price movements without owning the physical goods.

In the UK, trusted FCA-regulated brokers like IG, FXPro, and XTB offer robust commodity trading options, combining low-latency execution with risk management tools suited for beginners.

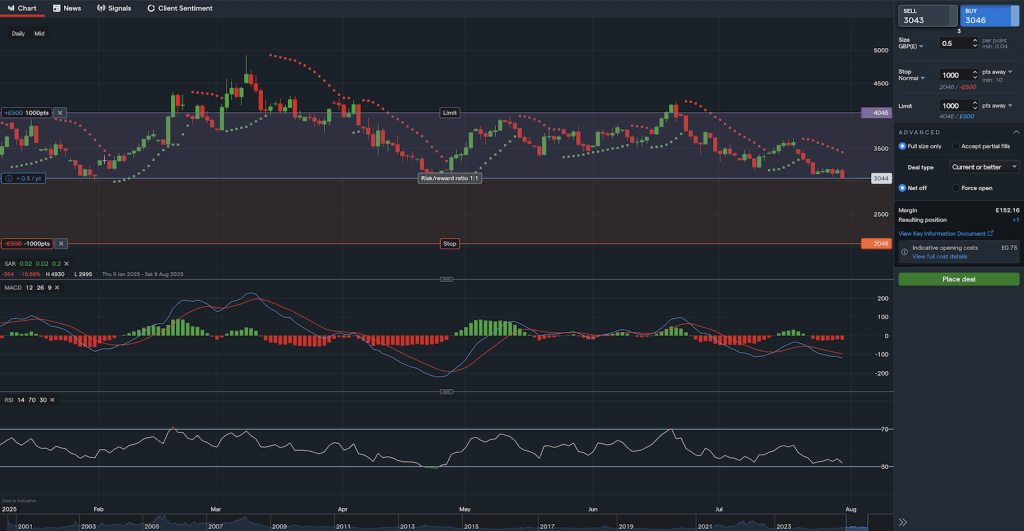

Spreadbetting natural gas with IG offers competitive spreads and commission-free trading

Pros Of Trading Commodities

- Diversification against systemic risk: Commodities often move independently of traditional asset classes like stocks and bonds. For instance, precious metals like gold typically act as a haven during market downturns or currency devaluation, while entirely different supply-demand dynamics can influence agricultural or energy commodities. Adding commodities to a portfolio can reduce overall volatility (beta) and provide a hedge against inflation or geopolitical shocks.

- Efficient use of capital through leverage: Most commodity brokers, especially those offering CFDs or futures contracts, allow margin trading. This means you can open a £10,000 position in crude oil with as little as £500, depending on margin requirements. While this amplifies potential returns, it also increases exposure to downside risk, so it’s crucial to use tools like stop-loss orders and understand margin call thresholds.

- High liquidity & global market access: Major commodities like crude oil, gold, and wheat benefit from deep global liquidity and high trading volumes, which contribute to tight bid-ask spreads and rapid order execution. This makes it easier to enter and exit positions efficiently, even during periods of market volatility. Pricing is generally transparent and reflects real-time supply and demand dynamics, helping you make informed decisions.

Cons Of Trading Commodities

- High volatility & price sensitivity: Commodity prices are often subject to rapid and unpredictable swings driven by factors like weather events, geopolitical tensions, or changes in supply chain dynamics. For example, crude oil and agricultural products can experience sharp intraday moves based on inventory data or export restrictions. This volatility increases both opportunity and risk, requiring active monitoring and disciplined trade management.

- Leverage amplifies losses as well as gains: While leverage can boost returns, it also magnifies losses. A small price move in the underlying commodity can result in a significant percentage loss relative to the margin used. Without strict risk controls, such as stop-loss orders or predefined position limits, you may face margin calls or account liquidation, especially during fast-moving markets.

- Complex fundamentals & external influences: Unlike stocks, commodities are heavily influenced by macroeconomic data, geopolitical developments, and seasonal patterns, which can be difficult for beginners to analyse. Factors like crop yields, news announcements, or central bank decisions can affect prices in ways that may not align with standard technical indicators. This adds a layer of complexity that requires broader market awareness and continuous learning.

I’ve seen firsthand how rewarding yet challenging the commodity market can be. It requires more than just luck—success comes from careful research, disciplined risk management, and the patience to weather ups and downs.Treating commodity trading as a long-term strategy rather than a quick gamble makes all the difference.

Bottom Line

Choosing the right commodity broker in the UK means balancing factors like regulation, fees, platform quality, and the range of available commodities.

A reliable brokerage should offer transparent pricing, strong risk management tools, and responsive customer support to help you navigate volatile markets confidently.

By carefully considering these aspects, you can find a broker that aligns with your trading goals and protects your capital.