Best Brokers With Sustainable Stocks 2026

The best brokers offering sustainable stocks allow clients to make investments in environmentally friendly companies. There are many trading products that investors can use, such as individual stocks, ETFs and indices, which track a range of sustainable companies.

Dig into our list of the best brokers for sustainable stock trading – tested by our UK traders.

Top UK Brokers With Sustainable Stocks

-

IBKR offers access to a vast range of equity products from 24 countries. You can invest directly in stocks for capital growth, dividends, or voting rights. Alternatively, engage in trading price movements with CFDs, futures, and over 13,000 ETFs. In 2024, IBKR expanded its European derivatives by including trading on CBOE Europe Derivatives (CEDX).

Stock Exchanges Fractional Shares Leverage Shenzhen Stock Exchange, Toronto Stock Exchange, Euronext, New York Stock Exchange, Korean Stock Exchange, Chicago Mercantile Exchange, London Stock Exchange, IBEX 35, Borsa Italiana, CAC 40 Index France, Nasdaq, Japan Exchange Group, Russell 2000, Nasdaq Nordic & Baltics, Tadawul, Abu Dhabi Securities Exchange, Nairobi Securities Exchange, London Metal Exchange Yes 1:50 Stocks Spread Share Baskets Platforms 0.003 Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

eToro provides access to countless stocks from Europe, the US, and globally. In 2024, Dubai’s leading stocks will be included, and more than 180 Nordic stocks will be available in 2025. Traders can invest independently or participate in the vibrant social trading community. Long-term investors can explore Smart Portfolios, featuring thematic collections such as Big Tech.

Stock Exchanges Fractional Shares Leverage SIX Swiss Exchange, Euronext, Deutsche Boerse, Japan Exchange Group, Shanghai Stock Exchange, New York Stock Exchange, Hong Kong Stock Exchange, Australian Securities Exchange (ASX), Korean Stock Exchange, London Stock Exchange, FTSE UK Index, S&P 500, DAX GER 40 Index, Dow Jones, CAC 40 Index France, National Stock Exchange Of India, Tokyo Commodity Exchange, IBEX 35, Hang Seng, Russell 2000, Borsa Italiana, Taiwan Stock Exchange, Nasdaq, Nasdaq Nordic & Baltics, Dubai Financial Market, Abu Dhabi Securities Exchange Yes 1:30 Stocks Spread Share Baskets Platforms 0.57 (Apple) Yes eToro Web, CopyTrader, TradingCentral -

IG provides access to over 13,000 shares for trading and investment, surpassing most rivals in the number of listed firms. The broker stands out with its zero commission policy on US shares. Additionally, out-of-hours trading unlocks more than 70 shares, alongside popular ETFs and trusts, even when markets are shut. They have also introduced an AI Index, highlighting opportunities in leading US firms specialising in artificial intelligence and machine learning, like Nvidia.

Stock Exchanges Fractional Shares Leverage SIX Swiss Exchange, Taiwan Stock Exchange, Toronto Stock Exchange, Tadawul, Deutsche Boerse, Japan Exchange Group, Shanghai Stock Exchange, Euronext, Hong Kong Stock Exchange, National Stock Exchange Of India, Australian Securities Exchange (ASX), Bombay Stock Exchange, London Stock Exchange, Dow Jones, S&P 500, IBEX 35, Borsa Italiana, Russell 2000, Korean Stock Exchange, Shenzhen Stock Exchange, Nasdaq Dubai No 1:30 (Retail), 1:222 (Pro) Stocks Spread Share Baskets Platforms 0.02 Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

Plus500 provides a comprehensive selection of shares through CFDs across UK, US, and European markets. In 2025, this includes new offerings in quantum computing and AI sectors, featuring companies like IonQ, Rigetti, Duolingo, and Carvana. Unique prospects in the ESG and cannabis sectors set Plus500 apart from other platforms. Traders also have access to over 30 indices, with leverage options reaching up to 1:20.

Stock Exchanges Fractional Shares Leverage SIX Swiss Exchange, Euronext, Deutsche Boerse, Australian Securities Exchange (ASX), London Stock Exchange, Borsa Italiana, FTSE UK Index, CAC 40 Index France, DAX GER 40 Index, IBEX 35, Dow Jones, S&P 500, Nasdaq, Hang Seng No Yes Stocks Spread Share Baskets Platforms Dynamic No WebTrader, App -

City Index provides access to over 4,700 shares from major stock exchanges through CFDs and spread betting, featuring prominent companies such as Tesla and Apple. Traders can also engage in pre-market and after-hours trading on more than 70 US stocks. Additionally, the platform excels in offering indices aligned with emerging consumer interests, like AI, NFTs, and ESG criteria.

Stock Exchanges Fractional Shares Leverage London Stock Exchange, New York Stock Exchange, Nasdaq, Hong Kong Stock Exchange, Euronext, Australian Securities Exchange (ASX), Borsa Italiana, SIX Swiss Exchange, FTSE UK Index, DAX GER 40 Index, Dow Jones, CAC 40 Index France, Hang Seng, IBEX 35, Russell 2000, S&P 500 No 1:30 Stocks Spread Share Baskets Platforms Variable Yes Web Trader, MT4, TradingView, TradingCentral -

XTB provides access to 3,548 real shares and 2,042 stock CFDs, featuring well-known companies like Amazon, Barclays, and BMW, all commission-free. The xStation platform enhances the trading experience with robust analytical tools, such as stock scanners, heatmaps, and a range of fundamental data like market capitalisation and P/E ratios.

Stock Exchanges Fractional Shares Leverage SIX Swiss Exchange, Deutsche Boerse, Japan Exchange Group, Hong Kong Stock Exchange, Bombay Stock Exchange, Australian Securities Exchange (ASX), S&P 500, CAC 40 Index France, DAX GER 40 Index, FTSE UK Index, Hang Seng, Nasdaq, New York Stock Exchange, Dow Jones, Euronext, Russell 2000, IBEX 35 Yes 1:30 Stocks Spread Share Baskets Platforms 0.2% No xStation -

Swissquote provides an extensive range of stocks from key regions such as Europe, Asia, the US, and the UK. The introduction of fractional shares lowers the barrier to entry for high-value equities. Its standout feature, however, is its exceptional stock market research. This includes a daily podcast offering insights into major indices and stocks.

Stock Exchanges Fractional Shares Leverage London Stock Exchange, Deutsche Boerse, Euronext, SIX Swiss Exchange, Borsa Italiana, Nasdaq Nordic & Baltics, New York Stock Exchange, Nasdaq, Australian Securities Exchange (ASX), Hong Kong Stock Exchange, Japan Exchange Group, Dubai Financial Market, DAX GER 40 Index, CAC 40 Index France, Dow Jones, S&P 500, FTSE UK Index, IBEX 35 Yes 1:30 Stocks Spread Share Baskets Platforms N/A Yes CFXD, MT4, MT5, AutoChartist, TradingCentral

Safety Comparison

Compare how safe the Best Brokers With Sustainable Stocks 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ | |

| City Index | ✔ | ✔ | ✔ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Swissquote | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Sustainable Stocks 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| City Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Swissquote | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Sustainable Stocks 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Plus500 | iOS, Android & Windows | ✘ | ||

| City Index | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Swissquote | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Sustainable Stocks 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro | ✔ | $50 | $10 | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Plus500 | ✔ | $100 | Variable | ||

| City Index | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Swissquote | ✔ | $1,000 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With Sustainable Stocks 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| City Index | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 | ✘ | ✔ | ✔ | ✔ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Swissquote | Expert Advisors (EAs) on MetaTrader and FIX API solutions | ✘ | 1:30 | ✘ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Sustainable Stocks 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| eToro | |||||||||

| IG | |||||||||

| Plus500 | |||||||||

| City Index | |||||||||

| XTB | |||||||||

| Swissquote |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

- The trading app provides a top-tier social environment featuring an engaging feed and community chat, which we enjoy using.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

Cons

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The only significant contact option, besides the in-platform live chat, is limited.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- In 2025, Plus500 expanded its range of share CFDs to include emerging sectors such as quantum computing and AI. This update opened up trading opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- The broker provides low-commission trading across varied markets, reducing extra fees and attracting seasoned traders.

- Plus500 has expanded its range of short-term trading instruments by adding VIX options, which feature increased volatility. Additionally, it has extended trading hours for seven stock CFDs.

Cons

- Educational resources are not as extensive as leading brokers such as eToro, which affects beginners' ability to learn quickly.

- Plus500's omission of MetaTrader and cTrader charting tools may deter seasoned traders seeking familiar platforms.

- Compared to competitors like IG, Plus500 offers limited research and analysis tools.

Our Take On City Index

"City Index suits active traders perfectly, offering rapid execution speeds averaging 20ms and a customisable web platform with over 90 technical indicators. Its educational resources are exceptional. For UK traders interested in spread betting on 8,500+ instruments tax-free, City Index is an excellent option."

Pros

- City Index has significantly improved the trading experience. In 2024, they introduced Performance Analytics, providing insights into trades and discipline. The revamped mobile app now includes integrated market research and swipe-access news.

- City Index offers adaptable trading platforms suited to every expertise level. For newcomers, the Web Trader platform is straightforward and user-friendly. For more in-depth analysis and automated features, MetaTrader 4 (MT4) and TradingView are supported, providing a comprehensive trading experience for all traders.

- City Index offers access to over 13,500 markets, including forex, indices, shares, commodities, bonds, ETFs, and interest rates. The platform's inclusion of niche markets such as interest rates provides traders with unique opportunities not commonly available on other platforms.

Cons

- Although many brokers, such as eToro, have broadened their crypto offerings, City Index restricts its clients to crypto CFDs. This limited selection may not meet the needs of traders seeking a wider variety of altcoins.

- Unlike brokers like AvaTrade and BlackBull, City Index lacks options for passive trading, such as social copy trading or real ownership of stocks and ETFs. This limitation may reduce its appeal to traders seeking a more hands-off approach.

- City Index does not offer an Islamic account with swap-free conditions, making it less attractive to Muslim traders than brokers such as Eightcap and Pepperstone.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On Swissquote

"Swissquote is ideal for traders seeking a tailor-made platform, like its CXFD, which incorporates Autochartist for automated chart analysis to support trading decisions. Yet, its moderate fees and high $1,000 minimum deposit could deter novice traders."

Pros

- Swissquote is highly reputable due to its status as a bank, its presence on the Swiss stock exchange, and its authorisations from credible regulators such as FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote offers sophisticated research tools such as Autochartist for technical analysis and real-time news from Dow Jones. The firm's exclusive Market Talk videos and Morning News provide daily expert insights, catering to active traders.

- Swissquote is designed for rapid trading strategies, including scalping and high-frequency approaches. With an average execution speed of 9ms and a 98% fill ratio, it also supports FIX API.

Cons

- Analysis indicates that Swissquote's charges are relatively high. Forex spreads on Standard accounts begin at 1.3 pips, whereas brokers such as Pepperstone or IC Markets offer starting spreads of 0.0 pips. Additionally, transaction fees for non-Swiss stocks and ETFs could accumulate significantly for active traders.

- Swissquote focuses on serving professional and high-net-worth clients, requiring substantial initial deposits, such as $1,000 for Standard accounts. This approach is less favourable for smaller traders who prefer brokers offering higher leverage and no deposit requirements.

- Unlike brokers like eToro that offer social trading capabilities, Swissquote does not provide tools for community interaction or replicating successful traders. This absence can reduce its attractiveness to those who prioritise peer-to-peer learning.

How Investing.co.uk Chose The Best Brokers Offering Sustainable Stocks

We reviewed brokers that provide access to sustainable and green-focused equities and funds. Our team tested each platform to evaluate ease of use, research tools, and the depth of sustainable investment options.

We then ranked the brokers by overall ratings, combining our hands-on experience with verified data points such as stock coverage, fees, and account features, to highlight the best choices for trading sustainable stocks.

What To Look For In A Sustainable Stock Broker

Just being able to access sustainable stocks isn’t enough – a top ethical broker needs to provide its clients with a well-rounded and feature-rich trading experience. Firms should score well in these criteria:

Trust

The most important aspect of any broker is its reliability – put simply, you should never risk handing your hard-earned cash over to a broker unless it has proven credentials as a trusted firm.

Regulation by a top body like the UK’s Financial Conduct Authority (FCA) is the best sign of a reliable firm, as brokers need to meet stringent requirements and to regularly submit financial reports to obtain and maintain a license.

Besides this, the FCA’s rules ensure that UK clients of licensed brokers are covered by safeguards including:

- Negative balance protection, which prevents traders from becoming indebted to their brokers due to losing trades.

- Segregated client funds, meaning that customers’ money is held in separate accounts to business funds.

- Insurance up to a total of £85,000 per customer against business insolvency under the Financial Services Compensation Scheme.

- IG remains one of our experts’ most trusted sustainable stock brokers because it has remained a reputable broker for decades with licenses from some of the world’s most respected regulators, including the FCA.

Platforms & Apps

The platform and trading app is the program or software on which you will spend most of your time completing any analysis, researching potential assets to find entry positions, and monitoring and executing trades.

For this, you will want to choose a broker that offers high-quality platforms such as MetaTrader 4, MetaTrader 5, and newer options like TradingView. These platforms come with a range of in-built indicators, tools and chart customisation options, useful for conducting analysis.

Alternatively, some brokers offer proprietary platforms with excellent tools for traders to pick and trade sustainable instruments.

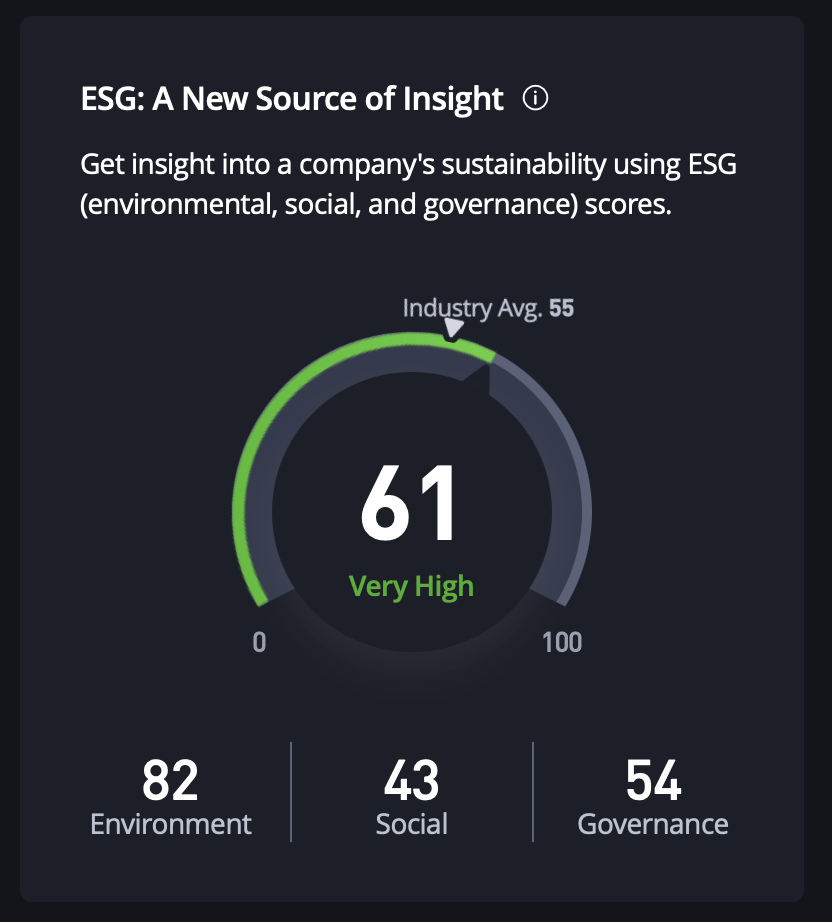

eToro prominently displays ESG scores of companies such as Apple, displayed

- eToro offers its own in-house trading platform with a huge range of useful in-built features, including a display showing ESG scores for a long list of assets.

Fees

When comparing brokers with sustainable stocks, you should look at how their fee structure will work alongside your trading strategy.

Brokers typically charge their clients in one of two ways: either through commission-free trading (whereby the bid-ask spreads are likely to be wider) or via a percentage charge on each trade.

So, for example, if you are looking to capitalise on small changes in an asset’s value using scalping techniques, you may need to find a broker offering tight spreads.

Other potential fees include deposit and withdrawal charges, inactivity fees, swap rates on overnight positions and any premiums for accessing certain features or services.

- City Index is still one of the most affordable brokers for UK traders who want to sustainable stocks, with no commission on spread betting and a low 0.08% commission on UK and European stocks.

Payment Methods

Compare the payment methods they offer. For this, consider the time taken for funds to clear, any fees that are charged and the minimum or maximum limits.

Often, many brokers support bank transfers and credit/debit cards. Certain brokerages such as CMC Markets and Pepperstone also support e-wallet transfers including PayPal, which are usually processed instantly.

- Plus500‘s wide range of accepted payment options continues to impress, with a wide range of digital payment methods such as Apple Pay and PayPal as well as the standard wire transfer and credit card options.

What Are Sustainable Stocks?

Sustainable stock trading involves investing in shares of environmentally friendly and socially conscious companies. Examples include SSE, First Solar and ITM Power, which are active in the renewables energy sector and generate power from solar, wind and hydrogen.

Another option is to invest in companies that manufacture vehicles that run on alternative fuels. One example is BYD, which manufactures electric buses used in UK cities such as London and Coventry in partnership with Alexander Dennis Limited.

Another even more popular example is the electric carmaker Tesla which, at the time of writing, has the greatest market cap of all manufacturers.

These are all companies that aim to make a positive impact through their services and products while also successfully generating revenue.

Why Trade Sustainable Stocks?

Brokers with sustainable stocks allow clients to invest in companies whose ethics are aligned with their own.

Additionally, it provides an avenue for investors to speculate on companies that could see growth in the future as the UK introduces initiatives to become more environmentally friendly.

For instance, the UK government has laid out objectives that say the country must become greener in the future. Examples include the commitment to being carbon neutral by 2050 and the prohibition of the sale of petrol and diesel-fuelled cars from 2030 onwards.

Tips

Diversification

One way to approach it is through diversified trading with products such as ETFs and mutual funds. The iShares Green Bond ETF, for example, only has holdings that meet certain standards relating to sustainability.

These diversified products allow clients to spread their investments out amongst several sustainable stocks, thus reducing risk exposure. Consider, for instance, that you were to only invest in two stocks, and both see a large downward swing in price. Your portfolio will suffer greatly as a result.

However, if instead you invest in 20 stocks and two of them drop in value, your overall portfolio will not be as greatly impacted. It is also possible that the decline in value is offset by growth from some of the other holdings.

Start Small

One of the key reasons for investing in sustainable stocks is so traders can capitalise on the potential increase in their value in the future. As countries develop more sustainably to meet objectives set out in global initiatives, many companies could grow as a result.

However, a downside to investing in smaller-cap companies is that there may be less liquidity, widening the bid-ask spreads and making them less suitable for short-term trading. Therefore, these smaller stocks may be better suited to investors with a long-term view.

Run Analysis

To identify which stocks to trade at online brokers and when you should enter and exit your position, you can use technical analysis. While it may be important to invest in companies that are aligned with your values, you still want to choose stocks that have growth or dividend potential.

So, if you are spot trading, you will want to find stocks that are likely to increase in value over time. If you are trading derivatives, you can capitalise on both bullish and bearish trends. In both instances, you need to be able to identify these trends over given time frames by completing analysis using tools like technical indicators.

Follow The News

Stay up to date on news and announcements surrounding sustainable stocks. For example, if a company announces a new product or project, then its valuation can change.

Also, look to see which companies are given government contracts where they are tasked with a new project. For example, developing a new wind farm or manufacturing sustainable trains and buses for public transport routes.

To help stay informed, you can also subscribe to news publications such as ESG News and Green Stock News, which offer real-time updates and global market data. You can also follow experts and analysts on social media.

Risk Management

All trading carries a degree of risk, even when investing in diversified products such as ETFs. For this reason, adopt risk management techniques to help reduce your risk exposure.

Examples of measures include using take profit and stop loss orders. These two triggers will automatically close your position once the asset reaches a certain price, to either secure profit from a winning position or limit your total losses.

UK Tax Considerations

When trading sustainable stocks, you will need to consider your tax obligations. In the UK, revenue from online investing is often classified as capital gains, which is treated separately from normal income tax. It is important to note that you are only taxed on the profits you make from trading, not the overall returns.

Helpfully, some of the best brokers provide a document reviewing your trades over the tax year. These reports will detail the profits from each trade and the exit date and time, making it easier to submit your tax return.

Bottom Line

The top brokers for sustainable stocks offer trading and investment opportunities in companies with green credentials. This can be through direct share dealing, ETFs, or indices.

Importantly, compare the fees charged, UK regulatory oversight, the reliability of the platform and app, plus additional tools and insights into specific companies and sectors, such as renewable energy.

To get started, head to our ranking of the best brokers with sustainable stocks.

FAQ

How Can I Find Sustainable Stocks To Invest In?

To find sustainable stocks, you can use trackers such as the Dow Jones STOXX Sustainability Index. This index focuses on European-based companies that meet certain criteria regarding their environmental and social impact, as well as how they are governed.

Alternatively, many top-rated brokers for sustainable stock trading offer stock screeners and list companies by various ESG metrics.

How Do I Determine How Sustainable A Company Is?

One of the main methods to determine the sustainability of a company is through its ESG (environment, social and governance) rating. This rating evaluates a company’s operations according to a set of criteria by reviewing publicly available information.

This typically includes annual reports and data such as carbon emissions. The rating providers then collect all the information together to categorise each company they review.

For example, Sustainalytics, one of the main providers of ESG ratings, uses a 0 to 40+ scale to rate each company.