Binary Options Ichimoku Strategy

The binary options Ichimoku strategy makes use of a technical indicator that helps investors to identify and act on upcoming market volatility and trends. This review will provide a summary of the Ichimoku strategy for binary options trading, detailing how the indicator works, its pros and cons, as well as helpful tips to get started.

Binary Options Brokers UK

What Is The Binary Options Ichimoku Strategy?

The binary options Ichimoku strategy involves using technical analysis to determine trend direction, strength and any potential reversals. The full name is Ichimoku Kinko Hyo and it was first developed as a trading strategy and indicator in the 1970s by a Japanese journalist.

The name ‘Ichimoku’ roughly translates to ‘glance’, as all that you should need to map out your next trades is a quick look at the price history chart.

The Ichimoku Indicator

Trading with the binary options Ichimoku strategy uses an indicator of the same name. The Ichimoku indicator is typically made up of five lines overlaid on top of the price history chart. They are called Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B and Chikou Span.

Tenkan-sen

This line is a plot of the average of the greatest and lowest values of security over the past nine time periods (for a five-minute time frame, this would be 45 minutes). It often closely follows the current price and can be used to help indicate any upcoming trends acting as a support/resistance line.

The Tenkan-sen line is also known as the ‘signal line’ and ‘conversion line’.

Kijun-sen

Similar to Tenkan-sen, the Kijun-sen is calculated by finding an average between the highest and lowest prices of a security, however, it is over 26 periods rather than nine (for a 30-minute time frame this is 13 hours). It is also known as the ‘baseline’.

The Kijun-sen is used to aid trend confirmation as it helps to indicate future price action. For instance, if the Kijun-sen is lower than the security’s current price, this is an indication to open a call binary option. Conversely, if the Kijun-sen line is above the asset’s value, then you may place a put as it implies that a potential downtrend is coming.

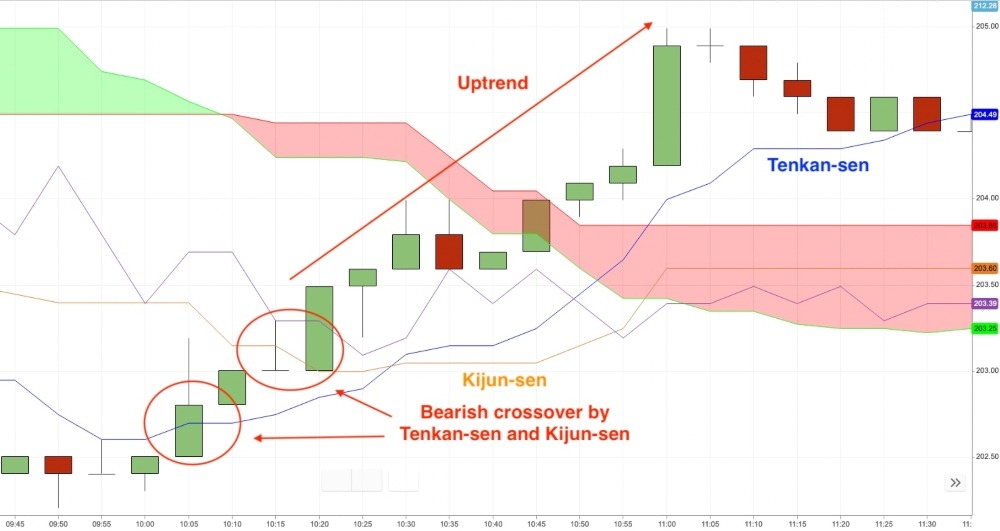

Together, the Tenkan-sen and Kijun-sen lines can be used to help identify trends. An example of this can be seen in the price chart below.

Senkou Span A & Span B

The Senkou Span A and Senkou Span B lines are used to form the cloud, known as the Kumo.

The Senkou Span A takes the average of the Tenkan-sen and Kijun-sen. Senkou Span B finds the average of the highest and lowest security prices from the previous 52 time periods. Both are offset such that they are plotted 26 periods ahead and are therefore also known as the leading spans A and B.

Aside from the Kumo, these lines create two support and resistance levels. For instance, when the asset’s value is above the Kumo, the lines offer the first and second support levels. Then, when the asset is below the Kumo, the lines are the first and second resistance levels.

When trading a binary options Ichimoku strategy, the first part you should look at is the Kumo. While all five lines are important, the cloud is the most informative at just a glance.

Firstly, you can use the positions of Span A and Span B to identify trends. Span A being above Span B signals a bullish trend whereas B above A signifies a bearish trend.

When the Kumo is taller (A and B are further apart), it is less likely that the price will touch the cloud and trend momentum is stronger. If the Kumo is thinner, then the trend is not as strong. However, this does not necessarily mean that a reversal is predicted. It is only when the two Senkou span lines crossover that a trend reversal is signalled. Both of these concepts are demonstrated in the images below.

Generally, an asset’s price line entering and staying inside the Kumo is a sign of uncertainty and potential volatility. As it is not clear when and in which direction the price will leave the cloud, this is not the best time to open binary options positions.

Chikou Span

The Chikou Span line is simply the current price but projected backwards 26 time periods and so it is often called the ‘trailing’ or ‘lagging’ span. This line is used as a further aid to help with identifying future trend direction and strength as another support and resistance line.

For instance, if the Chikou Span increases past the price line, the signal for an uptrend is strengthened. The Chikou line decreasing past the price supports the indication of a downtrend.

Below is an example of the Ichimoku indicator overlaid onto a price history chart where all five lines are labelled.

How To Set Up A Binary Options Ichimoku Strategy

Depending on where you plan to conduct your technical analysis for the binary options Ichimoku strategy, you may need to download the Ichimoku Cloud indicator.

If you plan to use brokers such as Pocket Option, the indicator comes with their proprietary platform so this is not a concern. However, if you plan on using third-party trading platforms such as MetaTrader 4 (MT4) or NinjaTrader 8 for your analysis, you will need to find a free download link for the indicator. Other platforms such as TradingView also provide the binary options Ichimoku indicator for free.

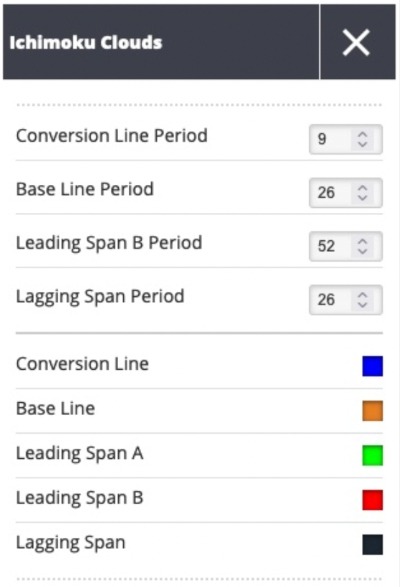

When you first click on the Ichimoku indicator to overlay it onto your chart, you will be asked to input the time periods for the five lines. Traditionally, you can use the 9/26/52 setup however, there are other setups depending on the binary options contract length and asset you are interested in.

Binary Options Ichimoku Indicator Setup

Once you have set up the indicator, look for signs of future price movement. For example, look at how the Kumo changes in size and if the Senkou Span lines crossover to gauge the momentum of a price change. Additionally, keep an eye out for how the Tenkan-sen and Kijun-sen lines move relative to each other.

Interpreting these signals will help tell you whether to place puts or calls or avoid trades altogether.

Pros Of The Binary Options Ichimoku Strategy

- Can be quickly interpreted with a short glance

- The binary options Ichimoku indicator comes built-in to the platforms at top brokers

- The indicator can be applied to multiple underlying markets, from forex to stocks and cryptocurrencies

- The binary options Ichimoku indicator can be used in combination with other tools, such as the RSI, stochastic and zig zag

- It can be used across multiple time frames, from shorter-term binary options of hours to longer-term contracts that span days and weeks

Cons Of The Binary Options Ichimoku Strategy

- A complex indicator that may be difficult to understand for beginners

- Easy to fall into the trap of only using one or two of the five lines

Trading Tips

Use The Information Provided

When trading a binary options Ichimoku strategy, do not just rely on one or two lines. The point of this indicator is that all lines are useful in providing information whether it be momentum strength or future trend direction.

For example, you cannot solely rely on the Tenken-sen as it is a minor support/resistance line that usually closely follows the current price. By itself, it will not tell you much but together with the Kumo and Kijun-sen, you may be able to confirm binary options trends.

Take The Time To Learn The Strategy

The binary options Ichimoku strategy is relatively complex. There is a lot to study with many different parts of the indicator needed to recognise each signal and know the respective meaning.

To help improve your knowledge of the binary options Ichimoku indicator, there are multiple resources you can find online. For example, Yahoo Finance offers a definitive guide on the Ichimoku indicator. Other examples include books, YouTube video tutorials, plus free PDF worksheet downloads and guides.

Practise

It can be hard to put everything that you have learnt into practice when trading the binary options Ichimoku strategy. Even with all the education in the world, you will not automatically start earning quick profits straight away.

The best way to support your development with the binary options Ichimoku strategy is through a demo account. Many online brokers, including Pocket Option, offer free demo accounts where clients can practise their binary options trading risk-free before starting with a live account.

Use Additional Trading Help

If you are struggling with the binary options Ichimoku strategy, you could enlist help from extra tools and services, such as expert advisors, alerts and signals. An expert advisor is essentially a robot working as a trading manager that can help with the optimisation of the strategy by opening and closing positions when suitable conditions are met. Note that these bots will not necessarily improve your success rate, rather they can execute trades quicker and without your constant input. You can find EAs coded in languages such as Javascript and Python via third parties on the web on sites such as GitHub.

Alerts and signals are notifications sent by providers to let you know when you should open a binary options trade. For example, a call alert could be sent if the Kumo is wide and both the Tenkan-sen and Kijun-sen decrease below the current price. The notification will likely also include information on expiration and volume.

Risk Management

Binary options trading is risky. The ‘all or nothing’ nature of binaries means that you can quickly see mounting losses after just a few trades that go wrong. No matter how proficient you are with the binary options Ichimoku strategy, your investments will always carry a degree of risk.

To help mitigate the risk of going into the red on your account, you can adopt binary options money management techniques, such as not risking more than 1% of your total funds on a single trade.

Last Tips On Trading Binary Options Using The Ichimoku Indicator

The binary options Ichimoku strategy can be tough to understand at first but it can prove worthwhile if you invest the time and effort. Whether you are a beginner looking to complement your main job salary or an advanced trader with years of experience, it can be a winning binary options strategy.

FAQs

What Markets Can I Trade On Using The Binary Options Ichimoku Strategy?

For UK-based investors, there is a range of assets and markets available for the binary options Ichimoku strategy. For example, popular brokers, such as Pocket Option, offer trading on major and minor forex pairs like the GBP/USD, EUR/GBP and GBP/CAD. Other online brokers, such as IQCent, also offer trading on cryptocurrencies including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP). In addition, binary options typically facilitate trading on stocks, commodities and certain indices such as the FTSE100. It is worth noting that the Ichimoku strategy can be used across all expiry times, ranging from 60 seconds and 30 minutes up to several days.

Is The Binary Options Ichimoku Strategy The Best Investment Tactic?

It can be a good strategy, however, there is always a risk of winning zero trades. Adopting the binary options Ichimoku strategy is not a guarantee that your trading win rate will improve as price history is not a guaranteed indication of future performance. Use our guide to setting up a binary options Ichimoku strategy to get started.

Where Can I Find More Information On The Binary Options Ichimoku Strategy?

For investors seeking guidance on the binary options Ichimoku strategy, there are many options. One of the best ways to find education is through tutorials and training classes from experts with documentation and examples of how to understand the indicator and execute trades. Another option would be to speak with other investors from trading groups on websites such as Reddit and Discord.

What Should I Do If The Binary Options Ichimoku Strategy Is Not Working?

If you are struggling with the binary options Ichimoku strategy, switch from the live account to a demo profile for risk-free practising. Additionally, you can work on your planning by creating a map for your trades using a journal or Excel document.