Capital Index Review 2024

|

|

Capital Index is #97 in our rankings of CFD brokers. |

| Capital Index Facts & Figures |

|---|

Capital Index is a spread betting, FX & CFD provider offering reasonable trading fees. |

| Instruments | Forex, CFDs, spread betting |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, SCB |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on the markets with high leverage |

| Leverage | 1:30 (UK), 1:200 (Forex CFDs), 1:500 (Global) |

| FTSE Spread | Floating |

| GBPUSD Spread | 0.7 |

| Oil Spread | 3 |

| Stocks Spread | N/A |

| Forex | Buy and sell over 50 forex pairs |

| GBPUSD Spread | 0.7 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.6 |

| Assets | 55 |

| Stocks | Trade on 10+ large stock indices, including the FTSE. |

| Spreadbetting | Trade with leveraged spread betting products at Capital Index. |

Capital Index is a London-based broker offering forex, CFDs and spread betting to UK clients. The brand offers fast execution speeds on the renowned MT4 platform, as well as proprietary software. In this review, we delve into the key aspects of Capital Index, evaluating its offerings, trading platforms, minimum deposit, regulatory compliance, and overall suitability for traders.

Our Take

- Capital Index is best for active traders that qualify for the pro account with tight spreads on the MT4 platform

- The broker is regulated by the Financial Conduct Authority (FCA), giving it a high trust and safety score

- Fees on the entry account are higher than competitors and the range of markets is limited with no UK shares

- The education centre and market research are lacklustre and do not compete with alternatives

Market Access

Capital Index has a limited range of markets and tradable instruments vs competitors, not offering UK stocks, ETFs or some popular commodities.

In terms of forex, the range is better. Capital Index offers 55 different currency pairs including majors, minors and exotics which is in line with leading brands. Traders can also turn to financial spread betting for tax-free profits in the UK.

For CFDs, you can trade:

- Commodities: 5 precious metals and oils, including gold, silver, platinum, WTI crude oil and Brent crude oil

- Indices: 11 of the most traded indices including the FTSE 100 and S&P 500

- Stocks: 55 US shares including Apple and Microsoft

Overall, traders may be disappointed with the lack of diversity in this selection and will find a more competitive offering at CMC Markets or IG Index.

Account Types

Capital Index offers two accounts on the MetaTrader 4 platform: Advanced and Pro.

Our experts were pleased to see that hedging strategies are allowed, as well as automated trading with expert advisors (EAs).

However, the £10,000 minimum deposit requirement for the Pro account means that most traders will be limited to the Advanced profile.

Other than pricing, we didn’t find a great deal of difference between the two accounts, and it’s unclear whether professional traders will receive any added benefits with the Pro account.

We have summarised the key features below:

Advanced Account

- Spreads from: 1.4

- Minimum trade size FX: 0.01 lot

- Minimum trade size non-FX: 0.1 lot

- Minimum deposit: 100 GBP

- Commission (equity CFDs): $0.02/unit/trade (minimum $15/trade)

Pro Account

- Spreads from: 1.0

- Minimum trade size FX: 0.01 lot

- Minimum trade size non-FX: 0.1 lot

- Minimum deposit: 10,000 GBP

- Commission (equity CFDs): $0.02/unit/trade (minimum $15/trade)

How To Open an Account

We found that the account opening process for Capital Index was straightforward and quick while maintaining decent levels of security and fraud prevention.

- Fill out your basic information in the application form and submit

- Complete the KYC process by submitting a form of ID and proof of residence

- Complete an assessment of your suitability for trading high-risk products

- Await confirmation from the customer support team (typically within 24 hours)

Capital Index Fees

Our experts weren’t impressed with the broker’s trading fees, which are higher than leading UK brokers.

Capital Index’s commissions are rolled into the spreads for all markets except equity CFDs. Spreads in both available accounts are wider-than-average, with a minimum of 1.4 pips in the Advanced (standard) account and 1.0 pip in the Pro account. In addition, it was disappointing to see that you would have to deposit £10,000 to access the lower spreads.

In the Advanced account, we were offered 1.5 pips for the EUR/USD, and 2 points for FTSE 100, which doesn’t compete with top brands such as CMC Markets, offering 0.8 pips and 1 pip for the same assets, respectively.

Commissions on equity CFDs are charged at $0.02 per unit per trade, with a minimum of $15 per trade. Again, this minimum is higher than some competitors.

It is also worth being aware that there is a fee of £15 per month after 6 months of account inactivity.

Payment Methods

We were disappointed to see that Capital Index’s deposits and withdrawals can only be made via bank transfer, debit card or credit card, with no e-wallets available.

There is also a £15 charge for same-day bank transfers which is high in comparison to alternatives. With that said, deposits and withdrawals via the other methods are free for UK clients.

The minimum deposit for the entry account is £100, which is high compared to XM, for example, which offers a low starting deposit of £5.

Trading Platforms

MetaTrader 4

We rated the broker’s choice of third-party platform, MetaTrader 4 (MT4), which in our experience is one of the best trading systems available to retail investors. We particularly appreciate the flexibility and convenience, with access via a downloadable desktop app, a web browser or a mobile app.

The best features for us are the charting capabilities, comprehensive range of technical indicators, and automated trading features. We also like that both beginners and experienced traders are catered to, with MT4’s user-friendly design and online marketplace.

Our team has pulled out some of their favourite functionality on MT4:

- Over 50 indicators and analytical objects for technical trading strategies

- Algorithmic trading supported with Expert Advisors (EAs)

- Intuitive one-click trading directly from the charts

- Signals and copy trading features

- 9 time frames, including tick charts

MarketBook

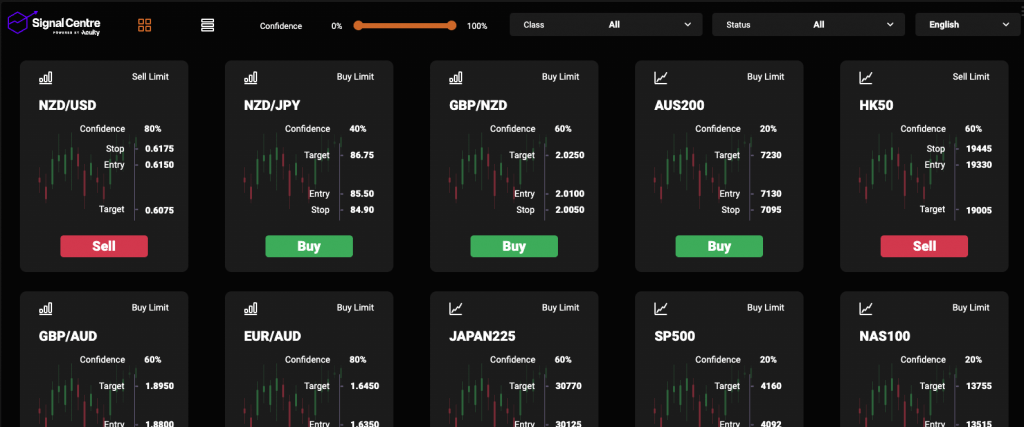

Capital Index also offers a proprietary trading platform, MarketBook, which specialises in market signals. Suitable for both novices and pros, the MarketBook platform offers over 40 trading signals across all markets and over 20 additional tools including forex heatmaps and price action news.

Our team were impressed to see some competitive analysis tools available, including historic news sentiment, live news feeds and trading calculators. We also liked that you can customise the layout and workspace, as well as the technical indicators, which is comparable to MT4.

MarketBook is also compatible with multiple devices, making for a seamless trading experience.

Signal Centre

How To Place A Trade

When we used Capital Index, we found it straightforward to open a trade. However, the process does vary depending on the type of order you are placing:

- Market Order: To place an order that will be executed at the current market price, go to the Market Watch and open the ‘New Trade’ window. Select your chosen instrument and the volume, then select ‘Market Execution’. Choose whether you want to buy or sell and your order will be placed.

- Stop/Limit Order: Set a stop or limit order on your trade by creating a new order and adjusting the stop loss and take profit limits on the pop-up menu.

- Pending Order: To set an order for when a specific target price is reached, use a limit order or a stop order. The former will have a buy or sell limit, while the latter will have a buy or sell stop. This will dictate when the order is executed. These options will appear under your order type on MT4 and can be easily adjusted.

Mobile App

We were glad to see that Capital Index offers the MT4 mobile app – a trusted option among iOS and Android users globally, with excellent reviews on the App Store and Google Play. The application enables investors to stay connected to the markets and manage their trades conveniently from anywhere with an internet connection.

We typically find that the MT4 app functions better than proprietary applications produced by other brokers. And when we tested the app, we could access real-time quotes in line with the desktop software, plus a full set of trade orders and all types of trading execution.

Our team particularly likes that charts are fully customisable, with multiple colour schemes and seamless ‘zoom and scroll’ functionality. We could also easily configure the technical indicators and overlays with the three available chart types.

Leverage

Capital Index offers up to 1:30 leverage on forex and 1:20 on CFDs per the requirements set by the Financial Conduct Authority (FCA). This amount has been deemed suitable by the FCA, but we recommend staying aware that leveraged trading carries risk. You can still lose significant capital if appropriate risk management protocols are not implemented.

Capital Index Demo Account

You can sign up for an MT4 demo account with Capital Index to try forex and CFD trading without risking your real capital. This lets you gain hands-on experience and build confidence in your trading skills before committing funds to live trading. It also makes for a great way to test Capital Index before switching to a real account.

We particularly like that the demo account replicates real-time market conditions, so we could view live price data across a range of trading instruments.

Regulation & Security

We were reassured to find that Capital Index is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK under the registration number FRN 709693.

The FCA is known for its strict regulatory standards, providing investor protection and fostering market integrity. As such, we are confident that Capital Index operates under the highest standards of regulatory oversight.

Key protective measures include negative balance protection, so your account can never fall below zero, as well as compensation of up to £85,000 under the Financial Services Compensation Scheme. In addition, all retail client funds are fully segregated from company funds and kept in separate client money bank accounts.

We are also pleased to see that forex transactions with Capital Index occur within the UK’s data centre in LD4, which allows for more secure monitoring and faster transactions.

Education & Analysis

While using Capital Index, we found that the education and analysis sections were a little underwhelming, though there is some valuable information for beginners.

For those who are not looking for a comprehensive trading programme but still want to improve their general knowledge, Capital Index provides a range of trading guides. We liked that the guides are easy to navigate, with three clear sections: forex, CFD and general trading. These cover broad topics, as well as risk management and strategy building, though it would be nice to see some more diverse and engaging content for advanced traders.

Our team also noted that the broker has a sister company, Learn To Trade, which offers a 3-day trading workshop covering trading basics and 5 key strategies. With that said, many leading brokers offer better education at no charge.

There is a market news section which offers insights into current market trends, economic developments and factors influencing various financial instruments. However, the feed is not updated daily, which is a major drawback for me.

Overall, the broker’s market news and analysis are good but not sufficient enough to compete with the likes of IG Index or XM.

Extra Tools

Aside from market signals within the broker’s platforms, additional trading tools are lacking compared to other brokers.

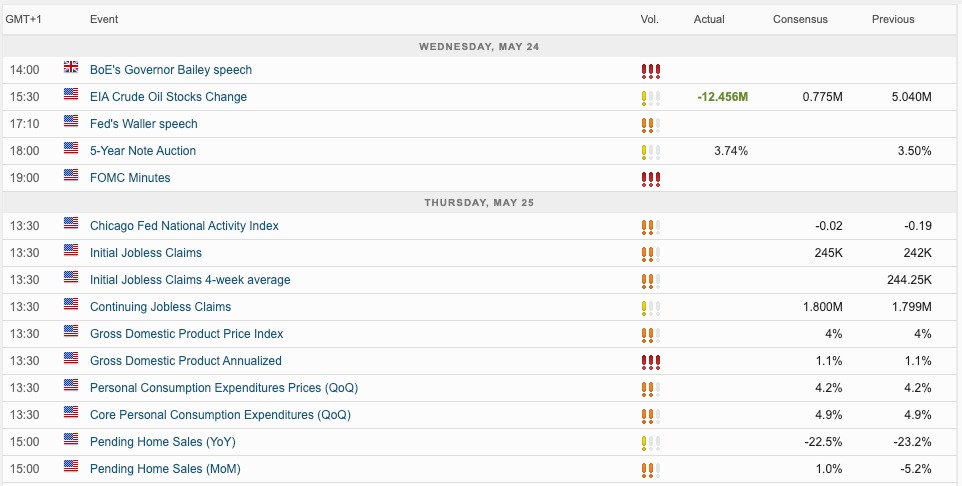

Capital Index does provide an economic calendar, which I was able to use to track and monitor upcoming economic events. However, it’s a shame that other useful tools found at many other brokers are not available, including third-party copy trading platforms and advanced analysis tools such as Autochartist.

Economic calendar

Bonuses & Promotions

As per strict FCA restrictions on trading incentives, UK clients can not access any welcome bonuses or volume-based promotions with Capital Index.

However, we don’t consider this a downside of trading with the broker, as bonuses often come with tough or unreasonable conditions, especially surrounding withdrawals.

Customer Service

Our experts found that the customer support offered by Capital Index is lacking in some areas. There is a live chat option, although disappointingly, we found this to be unavailable at several times of the day.

There is, however, a fairly useful FAQ section on the website which covers the practical aspects of trading including how to open an account, depositing and withdrawing, account management and using the MT4 platform.

Alternative contact information is as follows:

- Telephone number: +44 (0) 207 060 5120

- Existing clients: support@capitalindex.com

- General enquiries: info@capitalindex.com

Company Details

Capital Index is an online forex and CFD broker that provides trading services to retail and institutional clients. Established in 2014, the brokerage is headquartered in London, United Kingdom.

The company aims to offer a transparent and reliable trading environment while catering to the diverse needs of traders. The brokerage operates on a Straight-Through Processing (STP) model, giving traders direct access to the interbank market.

Whilst Capital Index Limited is regulated by the Financial Conduct Authority, the brand also operates in Australia, licensed by the Australian Securities and Investments Commission (ASIC), as well as under a global entity, registered in the Bahamas.

Trading Hours

Trading hours with Capital Index depend on the product you are trading. All forex pairs can be traded 24 hours a day from Monday 12:00 am to Friday 11:45 pm (GMT+2).

Commodities can be traded round the clock from Monday at 1:00 am to Friday at 11:45 pm (GMT+2). Shares can be traded Monday to Friday from 4:30 pm to 11:00 pm (GMT+2). For indices, the trading hours depend on the index/exchange which can be found on the website.

Trading holidays are also listed on the official website.

Should You Trade With Capital Index?

Capital Index is an online forex and CFD broker with an adequate suite of services to meet the needs of retail traders. With its FCA regulation, feature-rich MT4 platform, and access to trading courses, Capital Index is an interesting choice for traders seeking a reliable broker.

However, the entry requirements, average spreads, account types and customer service response time could be improved. The education offering and market research also fall short vs alternatives. As a result, Capital Index isn’t the best broker for UK traders, especially beginners.

FAQ

Is Capital Index A Trustworthy Broker?

Yes, Capital Index is a reliable broker due to its authorisation and regulation by the Financial Conduct Authority (FCA) in the UK. The FCA is known for its stringent regulatory standards, which provide a certain level of investor protection and help ensure fair market practices.

Does Capital Index Offer Low Fees?

We found that spreads are only competitive in the Pro account, which is likely to be inaccessible for most retail traders. In the broker’s standard account offering, spreads start from 1.4 pips, which is higher than the market average.

Is The Customer Support At Capital Index Reliable?

Capital Index provides a good range of support channels and FAQs, however, the live chat was not responsive when we tested the platform. We would recommend using other contact methods, such as telephone or email.

Is Capital Index Suitable For Beginners?

Capital Index offers a modest range of educational resources for beginners, covering the basics of trading. Additionally, the user-friendly platform, MetaTrader 4, provides an intuitive trading environment for newcomers. However, the minimum deposits are relatively high for new traders and the market analysis and research sections could be improved. Overall, Capital Index is not the best option for novice traders.

Is Capital Index Safe?

Capital Index keeps client funds segregated from the company’s own funds. The broker also adheres to strict regulatory requirements, including maintaining proper capital management and using advanced security measures to safeguard client data and transactions. These measures, alongside FCA oversight, are good indicators that the firm is relatively secure.

Article Sources

Compare Capital Index with Other Brokers

These brokers are the most similar to Capital Index:

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Capital Index Feature Comparison

| Capital Index | Admiral Markets | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | - | 3.5 | 4.4 | 4.8 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $100 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, SCB | FCA, CySEC, ASIC, JSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 (UK), 1:200 (Forex CFDs), 1:500 (Global) | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | ||||

| Review | Capital Index Review |

Admiral Markets Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| Capital Index | Admiral Markets | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | Yes | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Capital Index vs Other Brokers

Compare Capital Index with any other broker by selecting the other broker below.

Popular Capital Index comparisons: