BlackBull Markets Review 2025

BlackBull Markets is a good ECN and STP broker that offers access to over 26,000 tradeable instruments via the MT4, MT5 and TradingView platforms. With no minimum deposit and tight spreads, there are plenty of opportunities for investors of varying abilities and goals. This 2025 broker review will delve into BlackBull Markets’ assets, deposit and withdrawal methods, leverage rates, customer support and more.

BlackBull Markets is a competitive broker for UK investors, offering thousands of CFD and equity products with low spreads, advanced trading platforms and sophisticated educational resources. Copy trading is also available.

Company History & Overview

BlackBull Markets is a New Zealand (NZ)-based broker with a head office in Auckland, although it does have staff and tech bases elsewhere around the world. Founded in 2014, the brokerage has grown to serve tens of thousands of traders from over 180 countries, including the UK. Its goal is to become the leading online financial technology and foreign exchange broker.

Our experts found that BBG Limited is the official company name, which is registered in Seychelles under company number 857010-1. The share trading side of its business is registered in New Zealand.

On the downside, the trading firm is not regulated by the FCA.

Markets & Instruments

Traders at BlackBull Markets have access to a wide range of markets, including cryptocurrencies. That said, DeFi enthusiasts may be disappointed by the depth of that market, with just a dozen crypto assets on offer.

Available assets:

- 9 Metals – including gold and silver

- 10 Indices – including the UK 100 (FTSE) and US 30

- 72 Forex Pairs – including majors, minors and exotics

- 26,000+ Equities – including Tesla, Amazon and Apple

- 9 Cryptocurrencies – including Bitcoin, Ethereum and Ripple

- 5 Energy Commodities – including Brent crude oil and natural gas

- 8 Agricultural Commodities – including soybeans, coffee and sugar

Platforms

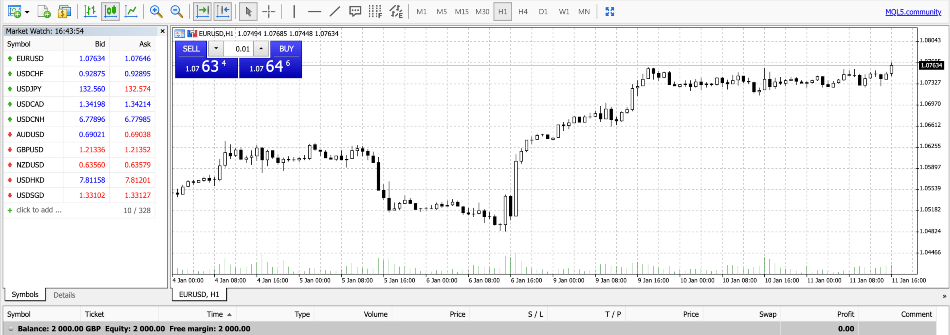

The main trading platforms at BlackBull Markets to download (or use webtrader versions of) are MetaTrader 4, MetaTrader 5 and TradingView, a strong offering.

To maximise trade execution speeds, the broker’s servers are located as close as possible to the most important global exchanges like London, New York and Tokyo. In addition, as an ECN broker, liquidity providers compete against one another to lower average spreads.

We recommend beginners start with one of the MetaTrader platforms as these are intuitive but still allow for development towards more advanced trading once you feel more comfortable. Clients can also benefit from a demo account on MT4 and MT5.

While using TradingView, we found it to be another reliable platform with plenty of technical analysis features. It is particularly suitable for traders interested in the social side of trading and those who look closely at what others in the market are doing.

MetaTrader 4

- VPS support

- Nine timeframes

- 23 analytical objects

- Autochartist integration

- Financial news and alerts

- Trading signals and copy trading

- Algorithmic trading using expert advisors (EAs)

- 30 technical indicators (more available on the MetaTrader Market)

- Windows, Mac, iOS (not currently available on the App Store), Android, MT4 WebTrader and MT4 MultiTerminal

MetaTrader 4

MetaTrader 5

- VPS support

- 21 timeframes

- Autochartist integration

- Trading signals and copy trading

- 80+ indicators and analytical tools

- News reports and economic calendar

- Algorithmic trading using expert advisors (EAs)

- Additional indicators available on the MetaTrader Market

- Create your own indicators with the MQL5 programming language

- Windows, Mac, iOS (not currently available on the App Store), Android and WebTerminal

MetaTrader 5

How To Place A Market Order On MT5

- Use the client login area to access the MetaTrader 5 platform using your Blackbull Markets account details

- Find the asset you want to trade in the list of instruments on the left

- Right-click on the asset

- Click New Order

- A pop-up box will appear in which to enter the details of the trade, set any parameters like stop loss or take profit and confirm the order

- Alternatively, you can use one-click trading by utilising the Buy and Sell buttons on the asset price chart itself

TradingView

- 30m+ users

- 12 chart types

- Custom time intervals

- Up to eight charts per tab

- Replay historic price movements

- 100+ fundamental fields and ratios

- Charting platform and social network

- 100+ pre-built indicators and 100,000+ community-built indicators

- Web, desktop and mobile/tablet versions available (from the App Store and Google Play)

How To Connect To TradingView

Investors will first need to sign-up for a TradingView account if they do not already have one. Next, they can use their BlackBull Markets account number and password to connect directly within the trading platform’s interface.

Account Types

BlackBull Markets has a refreshingly simple account structure with three profiles available. Islamic/swap-free accounts are also offered as halal alternatives to each standard type. There are eight base currencies to choose from, including GBP, which will help UK investors avoid currency conversion charges when transferring funds from UK bank accounts.

We recommend the ECN Standard account for beginners as there is no commission and no minimum deposit. More experienced traders will likely benefit from the tight spreads on the ECN Prime account.

ECN Standard

- No commission

- £0 minimum deposit

- Spreads from 0.8 pips

- Minimum lot size of 0.01

ECN Prime

- Spreads from 0.1 pips

- Minimum lot size of 0.01

- £2,000 minimum deposit

- Commission from £6 per lot

ECN Institutional

- Spreads from 0.0 pips

- Minimum lot size of 0.01

- Complimentary VPS access

- £20,000 minimum deposit

- Commission from £3 per lot

- 24/7 dedicated customer support

How To Register For A Real Account On BlackBull Markets

- Complete the application form after clicking the Visit button at the top or bottom of this BlackBull Markets review. This consists of personal details, questions about employment and the source of your funds, as well as other information

- The application form also requires you to verify your identity using a photo ID and a supporting document like a bank statement or telephone bill

- Verify your email address by clicking on the link in the email you receive from BlackBull Markets

- Wait for approval (usually within 24 hours)

- Deposit funds into your account and begin trading

Fees & Charges

Even with the zero commission ECN Standard account spreads start quite low at BlackBull Markets from just 0.8 pips. More experienced traders can access even tighter spreads starting from just 0.1 pips with the ECN Prime account, with a commission of £6 per lot.

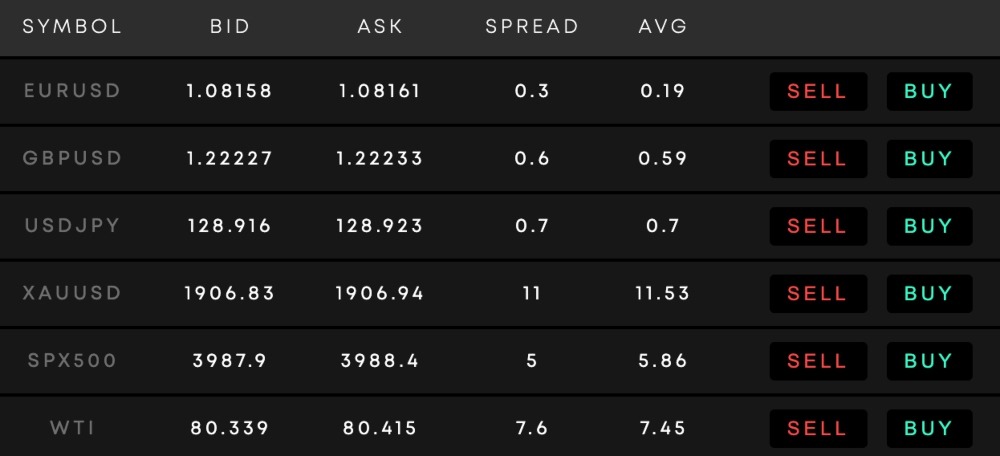

Spreads On Popular Assets

Swap rates may apply for positions held overnight. When using the broker, we did not find any account opening or inactivity charges.

Overall, the fees on BlackBull Markets are reasonable and certainly make trading at this broker accessible to beginners.

BlackBull Markets App

The BlackBull Shares Trading app is available on iOS and Android, providing client access to the equities markets while on the go. There are 23,000 shares offered from over 80 international markets.

MT4, MT5 and TradingView also have apps for mobile and tablet devices, although the first two are currently not available on iOS – only Android. TradingView is available both from the Apple App Store and Google Play Store.

Payment Methods

Deposits

There are no minimum deposit limits or deposit fees with BlackBull Markets. This is not always the case with other brokers, so it is a clear benefit of using this company.

Traders should note that some deposit methods do have minimum limits. For credit and debit cards, this is £50. Share trading accounts also have a £1,000 minimum deposit requirement.

The following deposit methods are available to UK clients:

- Skrill

- Neteller

- Wire transfer

- Credit/debit card

- SEPA bank transfer

- Crypto (including Bitcoin, Ethereum and Litecoin)

SEPA bank transfers, Neteller and Skrill are instant methods. Bank wire transfers take 3-5 business days. Processing times for other deposit methods can vary.

How To Deposit On BlackBull Markets

- Click on Wallet Deposit in the Secure Client Area (the main portal)

- Choose a wallet from the available options

- Select a funding method

- Enter the desired amount

- Confirm the payment

Withdrawals

Withdrawals are usually processed within 24 hours on BlackBull Markets. Clients must withdraw using the same method used to deposit funds.

There is a £5 charge in the base currency of your account for withdrawals using credit/debit cards, Neteller, Skrill and international wire transfers. Traders should therefore plan withdrawals carefully to avoid paying this fee too regularly.

Demo Account

BlackBull Markets has a £100,000 30-day demo account where traders can use virtual money to practise trading and test new strategies, although these accounts are fairly common in the online investing industry.

The broker lets customers choose between the MT4 and MT5 platforms. Note that the demo account is not available on TradingView.

How To Open A Demo Account On BlackBull Markets

- Click on Try A Free Demo under the Trading tab

- Complete the application form

- Download the trading platform (MT4 or MT5)

- Login to the trading platform using the details received by email

Bonuses & Promotions

We were disappointed by the lack of promotions and bonuses for BlackBull Markets’ traders, particularly as BBG Limited is regulated offshore, which usually means the broker is not as restricted in providing a bonus or discount to traders as some licensed firms are. With that said, our experts found a one-month free trial for the BlackBull Research tool subscription.

UK Regulation

BBG Limited, which trades as BlackBull Markets, is regulated by the Financial Services Authority (FSA) in Seychelles under license number SD045.

BlackBull Markets is also registered under the company name Black Bull Group Limited, which is incorporated in New Zealand. The share trading side of the business is Black Bull Trade Limited and is a registered Financial Services Provider in New Zealand.

In 2020, the broker announced it had received a derivatives issuer license from the Financial Markets Authority (FMA) in New Zealand.

Importantly, the trading company is not regulated by the UK Financial Conduct Authority (FCA), which is a key drawback for British traders.

Leverage

Leverage rates are available up to 1:500 on BlackBull Markets. This is high, particularly compared to European-regulated brokers, which must limit leverage to 1:30 for retail traders.

Remember that margin trading increases risk as well as potential returns and that some markets may have lower maximum leverage ratios.

Extra Tools & Features

When we used BlackBull Markets, we found an excellent range of market analysis resources, some of which are free and others subscription-based.

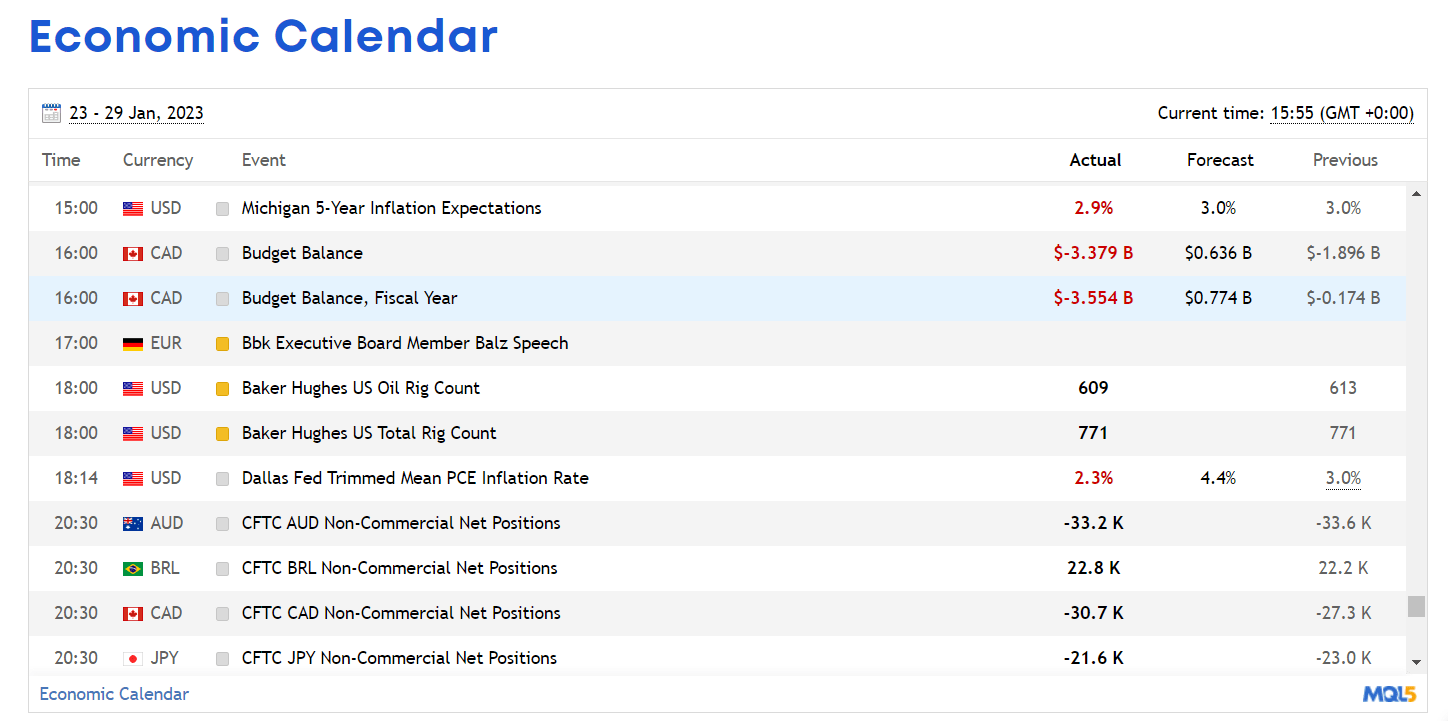

Market analysis is crucial for traders at all levels. Alongside educational articles and videos, there is BlackBull Research, which features expert analysis, recommendations and model portfolios for a fee.

Fundamental analysis is supplemented by the provision of an economic calendar.

Another of this broker’s products is BlackBull Social, where investors can copy the positions of experts around the world. The broker is also linked to ZuluTrade and Myfxbook where traders can access similar features.

Other products available on BlackBull Markets include:

- Autochartist integration with MetaTrader 4 & 5

- FIX API for experienced and institutional traders

- Educational trading guides at beginner, intermediate and advanced levels

- Free VPS to reduce latency (must be on Prime account, £2,000 minimum deposit and 20 lots traded across forex pairs or metals per month)

How To Install Autochartist On MT4 & MT5

- Download and log in to the MetaTrader 4 or 5 platform

- Separately access the Autochartist MetaTrader installer

- Choose your desired primary language, e.g. English

- Check the box against each MetaTrader platform that you wish to install this plugin on

- Click Install and then Finish

BlackBull Markets Opening Hours

Trading hours on BlackBull Markets vary depending on the market. The hours for stocks usually depend on the exchange they trade on. Forex can be traded 24 hours a day on weekdays.

Always check the market first before trading. Also, note that some hours are better for investors as there is more liquidity in the market. This is usually the case when major forex trading sessions overlap.

Customer Service

There is 24/7 customer support on BlackBull Markets, which is more extensive than that provided by many other online brokers. The following support options are available:

- Live Chat – logo on website

- Phone – +44 207 097 8222

- Email – support@blackbullmarkets.com

While using BlackBull Markets, the support team were responsive and helped with various account and platform queries.

Client Safety

This broker uses segregated bank accounts, meaning client funds are kept separate from those belonging to the firm. This is standard policy for reputable brokers. Negative balance protection is also provided.

BlackBull Markets will only contact its customers on numbers from New Zealand (country code is +64). This helps protect against scammers over the phone. ANZ Bank is a New Zealand financial institution that manages the broker’s operational liquidity.

MetaTrader and TradingView have adopted their own security measures and encryptions on their respective platforms.

Should You Trade With BlackBull Markets?

BlackBull Markets has low spreads and provides access to a huge range of investment products from markets around the world. MT4, MT5 and TradingView give investors the tools needed to undertake advanced technical and fundamental analysis. This is supplemented by the broker’s own market analysis and educational resources.

The main drawback for the firm is the offshore license in Seychelles but, with its main operations in New Zealand, UK traders should still consider registering with BlackBull Markets.

FAQ

Is BlackBull Markets A Scam?

We are not aware of any evidence to indicate that BlackBull Markets is a scam. The broker was founded in 2014, has a large customer base across the world and has a strong operational presence in New Zealand and the UK, despite part of the business being registered in Seychelles.

When Do Margin Calls Take Effect On BlackBull Markets?

Margin calls are received when your account capital margin drops below 70%. The trade will automatically be closed out when your margin drops below 50%.

Is BlackBull Markets A Good Broker?

BlackBull Markets has low spreads, good customer support, high-quality trading platforms and a strong range of markets. Although some of its business is registered offshore in the Seychelles, many of the broker’s resources are based in New Zealand. Copy trading is also available, which will appeal to many beginners.

When Is Customer Support Available On BlackBull Markets?

Customer support is available 24/7 on BlackBull Markets, which means traders can get support outside normal market hours. This is a stronger offering than many other brokers.

Do I Have To Download A Trading Platform For BlackBull Markets?

No. MT4, MT5 and TradingView all come with web versions so you can trade through online browsers without needing to download software. That said, they do also come with desktop solutions so it is possible to download the platforms if you wish.

Top 3 BlackBull Markets Alternatives

These brokers are the most similar to BlackBull Markets:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- FP Markets - Founded in 2005 in Australia, FP Markets is a broker regulated by both ASIC and CySEC. It offers a wide range of tradable assets and provides Standard and Raw accounts suitable for traders of all levels. The platform excels in tools, featuring the MetaTrader suite, user-friendly TradingView, and practical insights from Trading Central and AutoChartist.

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

BlackBull Markets Feature Comparison

| BlackBull Markets | Pepperstone | FP Markets | IC Markets | |

|---|---|---|---|---|

| Rating | 3.7 | 4.8 | 4 | 4.8 |

| Markets | CFDs, Stocks, Indices, Commodities, Futures, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $0 | $0 | $40 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FMA, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | BlackBull Markets Review |

Pepperstone Review |

FP Markets Review |

IC Markets Review |

Trading Instruments Comparison

| BlackBull Markets | Pepperstone | FP Markets | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | Yes |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

BlackBull Markets vs Other Brokers

Compare BlackBull Markets with any other broker by selecting the other broker below.

Popular BlackBull Markets comparisons:

|

|

BlackBull Markets is #14 in our rankings of CFD brokers. |

| Top 3 alternatives to BlackBull Markets |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Stocks, Indices, Commodities, Futures, Crypto |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FMA, FSA |

| Trading Platforms | MT4, MT5, cTrader |

| Leverage | 1:500 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Cards, Debit Card, FasaPay, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, cTrader Automate |

| Signals Service | BlackBull Research stock recommendation service |

| Islamic Account | Yes |

| Commodities | Aluminium, Cocoa, Coffee, Copper, Corn, Gasoline, Gold, Lead, Natural Gas, Oil, Palladium, Platinum, Silver, Sugar, Wheat, Zinc |

| CFD FTSE Spread | 1.5 |

| CFD GBPUSD Spread | 0.5 |

| CFD Oil Spread | 1.5 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.8 |

| Assets | 64 |

| Crypto Coins | ADA, BTC, ETH, LTC, POLY, XAX, XCOTI, XFET, XINJ, XNAKA, XRP |

| Crypto Spreads | 245 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |