The Bigger the Risk, the Bigger the Reward

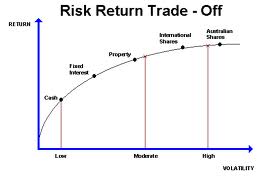

Without risk there can be no reward, and the higher the risk you take as an investor, the higher the potential reward (though the higher the potential loss, too). Before we look at your individual capacity for risk, sometimes called your attitude to risk, let’s look at the types of risk involved when making an investment.

Capital Risk

The first thing to realise when investing is that there is no such thing as a no-risk investment. Even cash savings accounts carry some risk (what if the institution you are saving with goes into bankruptcy?). National Savings products and government bonds are considered no-risk because they are backed by the government, but in this day and age of huge sovereign debt and Eurozone bailouts investors are beginning to realise that even these types of investment carry some risk, however minimal.

Shortfall Risk

This is the risk that your investment does not meet your expectations, and your investment goal is missed. This is typical of requirements for investment where money is placed in a cash savings account. To reduce this shortfall risk, you should consider investing some money in a higher risk asset.

Inflation Risk

If inflation is high, and interest rates or investment returns low, then the spending power of your money will decrease over time. Again the risk here is highest when placing money in cash savings accounts.

Specific Risk

If the company you have invested in performs badly, then your return will be adversely affected. This is specific risk. This risk can be reduced by diversifying across several stocks or investing in a pooled investment scheme such as a unit trust or investment trust.

Market Risk

If the stock market or asset class in which you are invested falls over a short period, then your investments may be pulled down also, irrespective of how well the companies in which you are invested are performing. This is called market risk, and can be reduced by drip feeding investment money into the market, therefore spreading risk over a period of time. This is sometimes called ‘pound cost averaging’.

Currency Risk

When you have invested in securities in a foreign market, your money will have first been converted to the currency of that market. When you want to sell your investment, and then receive the money, the currency will have to be exchanged back into sterling. If the currency has performed poorly, then this could result in a sterling loss, even if the investment has performed well in its base currency.

Your Capacity for Risk

Before committing money to an investment, you need to understand not only the risks involved in the underlying investment, but also how you feel about that risk. One of the key questions to ask yourself when assessing your attitude to risk is ‘How much of my money could I afford to lose before it starts to hurt?’

Generally, it is accepted that there are five levels of risk.

Cautious

You may have little or no investment knowledge or experience, and don’t keep up with investment news. You don’t like the idea that you could lose some of your money by investing it, and are far happier with cash savings accounts and National Savings

Moderately Cautious

You have a little knowledge of investments, and take some interest in investment market news. You may have invested in the past, and you’re willing to accept a little risk for the chance of a better return than available at the building society. Corporate Bonds and government bonds are often investments that appeal to the moderately cautious.

Balanced Risk

You are bang in the middle when it comes to your risk tolerance. You have probably invested before and have a reasonable level of investment understanding. You may have invested in equities and bonds before, and realise some risk gives greater potential for profit. While you will invest in bonds and cash, you will also be drawn by the better returns made possible by pooled investments into equity markets, and property investments will also tempt your investment juices.

Moderately Adventurous

You are investment savvy, and likely to be able to converse on up-to-date investment issues. You will be experienced in investments, and have invested in several different products in the past. You will be able to accept risk for what it is, and will be prepared to put a larger proportion of your portfolio in riskier investments like specialised investment trust and single shares. You accept that losses are part and parcel of making longer term gains. Pooled investment products will appeal, but you may want the option of making switching decisions yourself.

Adventurous

You will be well versed in investment matters, perhaps even having worked in the investment markets themselves. You will be an active investor, with your finger on the pulse of the markets and able to take quick decisions. Losses may niggle at you, but you fully accept these and move on with your long term investment goals. You are likely to look at single share investing in a speculative way, as well as investment vehicles that allow active switching. International markets and small companies will also draw your attention.

In conclusion

Knowing your capacity for risk, and understanding your tolerance to risk, will help you to identify the best investment choices for you. Once you have achieved this, then you will be able to make better informed decisions as to asset mix within your portfolio to achieve your long term goals for your investment cash.