Cyclical and Defensive Stocks

Not all companies perform the same way when the economy shifts. Some thrive when optimism is high and spending flows freely, while others do well when caution takes over and consumers tighten their belts.

What drives this difference? It all comes down to how closely a business’s fortunes are tied to economic momentum – and how people change their spending habits as conditions shift.

From high-end holidays and car showrooms to supermarket shelves and utility bills, the economy influences not just what we buy, but which businesses boom or buckle.

This contrast is at the core of understanding cyclical and defensive stocks – and knowing when to lean into each can be a useful tool for long-term investors.

Quick Introduction

- Economies move in cycles, expanding during booms and contracting during recessions, often measured by changes in GDP (Gross Domestic Product).

- Consumer spending shifts with the cycle, generally rising during good times and tightening during downturns.

- Cyclical stocks (think carmakers, airlines, luxury brands) thrive when the economy grows and consumer confidence is high.

- Defensive stocks (think utilities, food retailers, healthcare) remain stable even when the economy slows, as they provide everyday essentials.

- Consumer staple stocks are considered the cornerstone of defensive investing, offering steady cash flows by providing goods people rely on regardless of economic conditions.

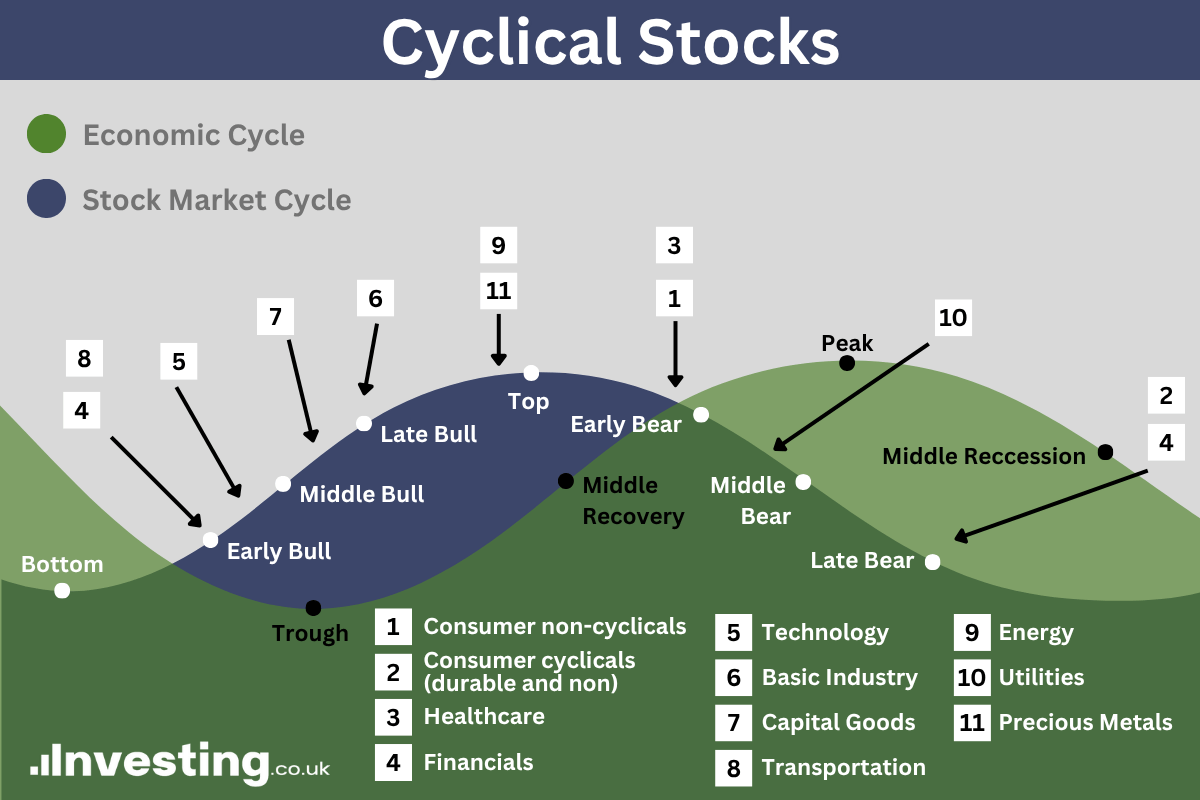

- Investment timing matters, with cyclical stocks tending to outperform in recoveries and expansions, while defensive stocks often excel in downturns and recessions.

- Understanding the difference between cyclical and defensive stocks can help investors navigate economic ups and downs more effectively.

Understanding the Role of GDP

Gross Domestic Product, or GDP, is the value of all goods and services within an economy, and can be measured in a simple form by adding up everyone’s income or spending (logically these two should be equal, but spending on credit distorts these numbers).

GDP is usually measured on an annual basis, and then announced in terms of percentage change from the previous quarter and the previous year.

At the top of the economic cycle, most money is being spent. But spending habits change through an economic cycle. When times are good, consumers will buy more of what they want, and when times are bad this spending becomes restricted to necessary items.

In other words, discretionary spending increases as the economy improves and peaks at the top of the cycle whilst necessary spending is likely to remain fairly constant throughout.

It is the economic cycle and our habits as consumers that define the difference between cyclical and defensive stocks.

Cyclical stocks are likely to outperform defensive stocks as the economy is improving and while it is operating at peak, while defensive stocks are likely to outperform cyclical stocks when the top of the economic cycle has passed and through the recessionary phase.

Cyclical Stock Sectors

When identifying cyclical stocks and sectors, it is easiest to think about the types of goods and services that we will be more likely to use when we have excess cash in our pockets.

Our spending habits change, and we begin to buy the items that we would like to own rather than (or as well as) the items we need.

When times are a little harder, our spending is dictated at least as much by affordability as by desire.

When work is plentiful, wages rising, job offers ten-a-penny, we are more likely to visit a car showroom and buy the cabriolet we always wanted, but when we are living in fear of losing our jobs, then perhaps taking our current model to the service station is more appropriate. Car manufacturers and dealers are most definitely on the list of cyclical stocks.

We all need to eat, of course, but when we have cash in our pocket we are more likely to take the family to a restaurant, maybe even high end, rather than face the drudgery of the washing up after a meal. Restaurant chains are also on the list of cyclical stocks.

Other sectors that prosper most through the good times include house builders, hotels, airlines, and travel companies. Any company that manufactures or sells luxury goods and services also belong on the list of cyclical stocks.

Defensive Stock Sectors

On the other hand, when times are tough, and we are living in fear of losing our jobs, then our spending contracts. We tend to see the future with pessimism and spend accordingly.

That car that would be bought in the good times can wait a year or two. But there are essentials that we all require to live, and live in comfort.

For example, we all need to eat. But it’s cheaper to eat at home rather than eat out. As a treat we might take the children to McDonald’s, or visit a ‘proper’ restaurant once a fortnight. Other than this, we’ll buy more at the supermarket and eat in. Food retailers, particularly no frills chains, and fast food restaurants are defensive stocks.

We need heat and lighting, too. And water, to drink, cook with, and bath in. Utility companies are top of the list of defensive stocks, and often have a captive audience as their customer base.

The same with healthcare companies: health is important to most people, and governments tend to spend more on healthcare when times are tough. Pharmaceutical companies, drugs manufacturers, and medical insurance companies weather an economic downturn well.

Companies that produce non-durable goods, such as household supplies, soaps, detergents, and toothpastes tend to hold sales steady throughout an economic cycle.

It’s for this reason that Dan Buckley, Chief Analyst at DayTrading.com, says: “If you’re getting into a late-cycle economy (unemployment low, inflation rising), then tilting a stock portfolio toward a more defensive mix could be a prudent thing to do.”

Buckley goes further and pinpoints: “Consumer staples as the most defensive flavor of equities.”

There are also specific ways to gain exposure to them. Buckley notes: “There are dedicated ETFs to consumer staples, such as XLP (offered by SPDR) and VDC (offered by Vanguard).”

Additionally, he points out: “There are also futures dedicated to the sector, which can provide access at lower capital requirements, such as IXR (Globex). Utilities, a separate sector that’s staples-like in nature, goes under IXU on Globex.”

This all fits with the broader point: when the economy turns, we tend to pull back on the luxuries, but keep spending on the things we truly need. And it’s the companies behind those essentials that are best placed to weather the storm.

Price Performance of Cyclical and Defensive Stocks

When the economy is roaring, and we are doing well and spending more, companies that produce goods or services that pander to our desires rather than our needs sell more. Revenues increase, companies can raise prices more easily and margins grow.

When the economy falters, so too does our spending. Cyclical companies have to respond to falling demand by cutting prices, and margins retreat. Cyclical stocks tend to rise and fall with the economic cycle.

Dividends, too, paid by cyclical companies will be better when the economy is expanding, and worsen when the economy comes back.

Defensive stocks tend to see sales remain relatively stable throughout a cycle (though some discount manufacturers benefit more due to pricing policy). Revenues, earnings and dividends tend to stay on an even keel, as do dividends.

Theoretically at least, an investor should buy a cyclical stock as the economy is recovering and prepare for the share price rises to come. As the economy hits its peak, and GDP growth starts to ease back and turn neutral or negative, then defensive stocks may outperform cyclical stocks.

Bottom Line

Understanding how cyclical and defensive stocks behave through an economic cycle may help you to make better investment decisions and time fund switches with better accuracy for long term portfolio health.

Of course, defensive stock prices may also fall during a large scale recession, but they are likely to hold better than cyclical stocks, and also more likely to continue to pay dividends.

And a final closing remark from Dan Buckley: “In a world of low yields, owning equities that behave more like bonds – with stable cash flows and resilience to downturns – becomes increasingly attractive. Consumer staples can fill that role.”

This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. The views expressed, including any quoted material, are for general discussion and should not be interpreted as a recommendation to buy or sell any securities or make any specific investment decisions. Always conduct your own research or consult a qualified financial advisor before making investment choices.