Japan Exchange Group

Brokers with access to the Japan Exchange Group (JPX) facilitate trading on some of the largest stocks in Asia. This review ranks the best Japan Exchange Group brokers for UK traders, taking into account platforms and apps, fees and prices, charts, tools and trading hours. This guide to trading at JPX brokers also unpacks the largest indices and companies by market cap.

Best Japan Exchange Group Brokers In The UK

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

FXCC, a well-established brokerage since 2010, offers cost-effective online trading. Registered in Nevis and regulated by CySEC, it is distinguished by its ECN conditions and absence of a minimum deposit requirement. The account opening process is efficient, taking under five minutes.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500

Safety Comparison

Compare how safe the Japan Exchange Group are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Japan Exchange Group support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Japan Exchange Group at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Japan Exchange Group good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Japan Exchange Group offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Japan Exchange Group.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| FXCC | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Fusion Markets |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- The complimentary education section, featuring the 'Traders Corner' blog, provides a wide array of resources suitable for traders of all experience levels.

- FXCC is a trusted and licensed broker under the regulation of CySEC, a leading European authority ensuring excellent safeguarding standards.

- FXCC has introduced MT5, which in our evaluations, mirrored the trading conditions of MT4 by offering swift execution, improved charting, and market depth tools.

Cons

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

- While the MetaTrader suite excels in technical analysis, its outdated design detracts from the overall trading experience, particularly when contrasted with contemporary platforms such as TradingView.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- Fusion Markets consistently impresses traders with its competitive pricing, featuring tight spreads and lower-than-average commissions. These cost-effective options are particularly attractive to those engaging in frequent trading.

- Fusion Markets provides exceptional support, characterised by rapid, friendly, and efficient responses. Unlike other platforms, it doesn't utilise automated chatbots, ensuring traders experience a seamless interaction.

- The market analysis tools, Market Buzz and Analyst Views, are excellent for identifying opportunities and are seamlessly incorporated into the client dashboard.

Cons

- Fusion Market falls short compared to competitors like IG in education, offering few guides and live video sessions for enhancing trader skills.

- Unlike AvaTrade, there is no specialised trading platform or app tailored for beginners, which is a significant disadvantage.

- The demo account, lasting only 30 days, is limited in its effectiveness as a trading tool when used with a live account.

Choosing Japan Exchange Group Brokers

The Japan Exchange Group owns some of the largest exchanges in Asia and the world, including the Tokyo Stock Exchange. As such, JPX brokers are plentiful. However, this can make choosing a firm difficult. Below we outline the key areas to compare when choosing brokers with access to the Japan Exchange Group.

Instruments & Markets

The Japan Exchange Group is made up of multiple exchanges. Therefore, you will need to find a broker that gives you access to the exchange and listed securities that you want to trade.

For example, if you are looking to spot trade, you will want to find a Japan Exchange Group broker that provides access to the Tokyo Stock Exchange. Derivatives trading, however, predominantly takes place on the Osaka Exchange. Commodities are tradable on the Tokyo Commodity Exchange.

Note that JPX brokers outside of Japan, including the UK, are most likely to provide traders with access to the Tokyo Stock Exchange.

Trading Platforms

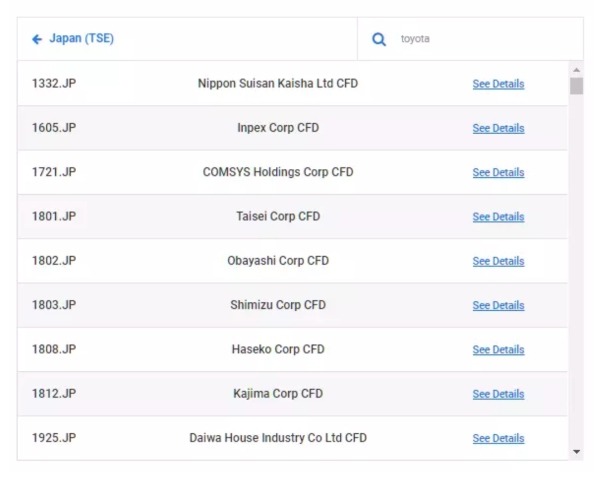

JPX brokers may offer different trading platforms. These can range from popular platforms like MetaTrader 4, MetaTrader 5 or TradingView, to beginner-friendly bespoke solutions.

You will want to choose a Japan Exchange Group broker that offers a platform that suits your trading style and investment strategy. Are you looking for a feature-rich platform that allows programmable trading bots? Do you want a platform with an intuitive, easy-to-use web design?

The top Japan Exchange Group brokers will also offer demo accounts. These allow you to try a broker’s platform with a virtual bankroll. You can trial live charts and graphs, indicators and drawing tools, plus get familiar with navigation and key functionality.

Costs & Fees

How Japan Exchange Group brokers charge traders can differ. Some charge a commission per trade, while others have variable spreads. Subscription models also exist, offering traders more features or fewer restrictions for a monthly fee. Swap fees and deposit and withdrawal charges are other ways brokers make money from traders.

It is important to find a fee structure that suits your JPX strategy to minimise costs. Admiral Markets, for example, charges a 0.15% commission on popular Japanese stocks.

Japanese Stocks at Admiral Markets

Customer Service

Active traders will want reliable customer support during the times they are speculating on Japanese Exchange-listed securities, which open at 9am JST (GMT+9). Look for 24/5 support via live chat, telephone, email and social media.

The best JPX brokers can help with order queries, market data, plus technical issues with platforms and apps.

Regulation

The best UK brokers with access to the Japan Exchange Group are regulated by the Financial Conduct Authority (FCA).

Licensing conditions ensure that firms offer suitable safety measures, including negative balance protection, a cap on retail leverage, plus access to compensation schemes in the event the broker becomes insolvent.

Research & Education

The Japan stock exchange covers a range of companies, assets and commodities in Japan. Therefore, reliable market data will be required to effectively trade. The top Japan Exchange Group brokers offer multiple forms of research and analysis to help traders make informed investment decisions.

Education is another thing to think about, especially if you are new to trading. Top Japan Exchange Group brokers, such as IG, offer training guides, video tutorials and webinars to teach beginner investors how to trade. Content may cover a range of topics, such as general information like glossaries and platform guidance. More complex guides on JPX strategies or specific asset classes may also be provided.

IG Index Insights

Japan Exchange Group Basics

The Japan Exchange Group, also known as Nippon Torihikijo and abbreviated to JPX, is a Tokyo-based Japanese exchange holding company.

It is regulated by the local Financial Services Agency (FSA) and owns three licensed exchanges. These are the Tokyo Stock Exchange (TYO/TSE), Osaka Exchange (OSE), and Tokyo Commodity Exchange (TOCOM).

History

The Japan Exchange Group was established on 1 January 2013, when the TYO and OSE merged. The TYO became the sole securities exchange of the JPX and the OSE became the largest derivatives exchange of the JPX.

In 2019, the Japan Exchange Group acquired TOCOM to grow into the commodity market. The group also has a central clearing counterparty, the Japan Securities Clearing Corporation, an IT services and research arm, JPX Market Innovation & Research, and a self-regulatory body, Japan Exchange Regulation.

While the JPX is still relatively young, its subsidiaries have been around for longer. Both the TYO and OSE were formed in 1878, with the former opening for trading on 1 June and the latter established in the same month. However, the TYO and OSE as we know them today were founded on 1 April 1949.

The TOCOM was founded in 1951 as the Tokyo Textile Exchange. It later merged with the Tokyo Gold Exchange and Tokyo Rubber Exchange in 1984 to form the TOCOM we know today.

Subsidiaries

The Japan Exchange Group is formed of three main exchanges: TYO, OSE and TOCOM.

Tokyo Stock Exchange

The TYO is a stock exchange located in Tokyo, Japan. By market capitalisation, it is the largest exchange in Asia and the third largest in the world. The exchange has over 2,290 listed companies with a combined market share of over £4.7 trillion.

The three main indices tracking the stock market are the Nikkei 225, J30 and TOPIX. 94 domestic and 10 foreign securities companies trade on the TYO, including Daiwa Securities Group, Tokai Tokyo Securities, and Interactive Brokers Securities Japan.

The Tokyo Stock Exchange is the most popular exchange to trade on, and the exchange most JPX brokers provide access to. It predominantly deals in spot trading, allowing traders to buy and sell shares. However, it also supports some derivative like futures.

The exchange is broken up into three major sections: Prime, Standard and Growth.

- The Prime section lists companies that are centred on constructive dialogue with global investors.

- The Standard section lists companies with sufficient liquidity and governance levels to be investment instruments.

- The Growth section lists companies with high growth potential.

Osaka Exchange

The OSE is a derivatives exchange based in Osaka, Japan. However, contrary to its name, trading on the Osaka Stock Exchange takes place in Tokyo. In terms of the amount of business handled, it is the largest in the country.

The OSE focuses on derivatives trading like options and futures contracts. In recent years, the OSE handled almost 100% of options market trading in Japan and almost 60% of the stock price index futures market.

Tokyo Commodity Exchange

The TOCOM is one of Asia’s most popular commodity futures exchanges and the largest in Japan. With 88 listings, the exchange trades precious metals, rubber, aluminium, oil, agricultural products, and sugar.

Indices

TOPIX

The Tokyo Stock Price Index, TOPIX, is the main index of the Japan Exchange Group and the Tokyo Stock Exchange. This is a free-floating index tracking all domestic companies in the TYO’s Prime section. The largest sector weightings are held by the transportation equipment market (12%), the electric appliances market (12%), and banks (10%).

JPX brokers typically offer trading on this live index through futures contracts on the Osaka Exchange.

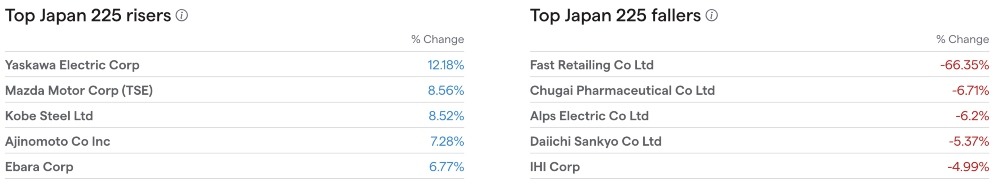

Nikkei 225

The Nikkei Stock Average, Nikkei 225, is a stock market index for the TYO. It is a price-weighted index measuring the performance of 225 large companies in Japan. The index is updated every 15 seconds during sessions, with futures tradable on the Osaka Exchange.

Many major Japanese companies are represented, including Panasonic, Fujitsu, Nissan, Asahi and Yamaha.

Regulation

The Japan Exchange Group is regulated under the Financial Instruments and Exchange Act enforced by the Financial Services Agency of Japan. This is a Japanese government agency designed to regulate the financial services sector, and thus ensure the exchange is efficient and safe.

Furthermore, the self-regulatory body, Japan Exchange Regulation, works to investigate compliance with the laws and regulations of listed companies, investors, and companies seeking listing, etc.

Japan Exchange Group brokers will not necessarily be regulated by the same financial bodies. As outlined above, UK traders are best off choosing a brokerage regulated by the FCA.

JPX Trading Hours

The trading hours for the various exchanges and instruments differ:

- The Tokyo Stock Exchange is open for 5 hours Monday to Friday. Opening hours are between 00:00 am to 02:30 am, and 03:30 am to 06:00 am GMT.

- Equity Index Futures are available between 23:45 pm to 06:15 am, and 07:30 am to 21:00 pm GMT, Sunday night to Friday.

- Equity Index Options are available between 23:45 pm to 06:15 am, and 07:30 am to 21:00 pm GMT, Sunday night to Friday.

- Commodity Futures (Excluding Rubber and Electricity) are available between 23:45 pm to 06:15 am, and 07:30 am to 21:00 pm GMT, Sunday night to Friday.

- Commodity Options are available between 23:45 pm to 06:15 am, and 07:30 am to 21:00 pm GMT, Sunday Night to Friday.

Other specific trading hours are detailed on the JPX website.

JPX Trading Calendar

The Japan Exchange Group follows a total of 14 market holidays. In 2023, observed holidays are:

- New Year’s Day – January 2nd

- Market Holiday – January 3rd

- Old Age Day – January 9th

- Emperor’s Birthday – February 23rd

- Vernal Equinox – March 21st

- Constitution Day – May 3rd

- Greenery Day – May 4th

- Children’s Day – May 5th

- Marine Day – July 17th

- Mountain Day – August 11th

- Old Age Day – September 18th

- Sports Day – October 9th

- Culture Day – November 3rd

- Workers’ Day – November 23rd

Bottom Line On Japan Exchange Group Brokers

Japan Exchange Group brokers give traders access to major Asian exchanges, creating opportunities for UK traders looking to speculate further afield. The best brokers with access to the JPX offer low fees, reliable platforms, FCA oversight, and customer support during standard market operating hours.

Sign up with one of the best Japan Exchange Group brokers to get started.

FAQs

Can UK Traders Invest In The Japan Stock Market?

Yes, UK investors can trade JPX-listed companies from the UK. You will need to find a Japan Exchange Group broker that offers the instruments you want to trade. For example, Pepperstone is an FCA-regulated CFD broker that offers trading on the Nikkei 225 index.

What Time Can UK Investors Trade On The Japan Exchange Group?

Times for different assets vary. However, the Tokyo Stock Exchange is only open for 5 hours a day. These are between 00:00 am to 02:30 am, and 03:30 am to 06:00 am GMT, Monday to Friday.

Are Japan Exchange Group Brokers Regulated?

While the JPX itself is regulated by Japan’s financial regulatory body, there is no guarantee that every Japan Exchange Group broker is overseen by a reputable agency. Online brokers will have different licenses depending on where they are based and the traders they market services to. Importantly, UK traders should favour FCA-regulated brokers with access to the Japan Exchange Group.

Which Is The Best UK Broker With Access To The Japan Exchange Group?

The best JPX broker will depend on your investment objectives, trading style and personal preference. With that said, XTB offers competitive conditions on stocks listed by the Japanese Exchange Group. Alternatively, see our full list of brokers with access to JPX equities.