Deutsche Boerse

The Deutsche Boerse provides access to German-based exchanges and markets, including the Frankfurt Stock Exchange. This guide lists the main factors to consider when comparing Deutsche Boerse brokers, including key indices, notable stocks and popular derivatives. We also cover the trading rules for UK investors looking to access the Deutsche Boerse.

Best UK Brokers With Access To Deutsche Boerse

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Founded in 2008 and based in Israel, Plus500 is a leading brokerage with over 25 million registered traders across more than 50 countries. It focuses on CFD trading, offering a user-friendly proprietary platform and mobile app. The company provides competitive spreads and does not impose commissions or charges for deposits or withdrawals. Plus500 stands out as a highly trusted broker, licensed by respected authorities such as the FCA, ASIC, and CySEC.

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable Yes -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Deutsche Boerse are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Deutsche Boerse support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Deutsche Boerse at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Plus500 | iOS, Android & Windows | ✘ | ||

| CMC Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Deutsche Boerse good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Plus500 | ✔ | $100 | Variable | ||

| CMC Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Deutsche Boerse offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Deutsche Boerse.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| eToro | |||||||||

| Plus500 | |||||||||

| CMC Markets |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Beginners benefit from a modest initial deposit.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- eToro has enhanced its investment portfolio by frequently introducing new crypto assets. It currently offers a selection of over 100 digital currencies.

Cons

- The only significant contact option, besides the in-platform live chat, is limited.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- The customer support team consistently delivers reliable support around the clock through email, live chat, and WhatsApp.

- In 2025, Plus500 expanded its range of share CFDs to include emerging sectors such as quantum computing and AI. This update opened up trading opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- Plus500 offers a dedicated WebTrader platform tailored specifically for CFD trading. It features a user-friendly and streamlined interface.

Cons

- Algorithmic trading and scalping are not available, potentially deterring certain traders.

- Compared to competitors like IG, Plus500 offers limited research and analysis tools.

- Plus500's omission of MetaTrader and cTrader charting tools may deter seasoned traders seeking familiar platforms.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

- CMC Markets has introduced an AI News feature. This leverages AI to highlight and summarise market stories instead of executing trades, suggesting the future direction of broker research tools.

- CMC provides competitive pricing with narrow spreads and low trading fees, except for stock CFDs. The Alpha and Price+ programmes offer additional benefits for active traders, including discounts on spreads of up to 40%.

Cons

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

Comparing Deutsche Boerse Brokers

Regulation

Look out for reputable Deutsche Boerse brokers that are regulated by top-tier agencies, such as the UK’s Financial Conduct Authority (FCA).

Brokers with FCA regulation offer several protective measures including negative balance protection, whereby you cannot lose more money than what has been deposited in your account. They must also apply a maximum cap on leverage for retail traders to prevent heavy losses. For equities, this limit is 1:5.

Among the top Deutsche Boerse brokers that are FCA-regulated is Pepperstone.

Instruments & Assets

Consider the range of Deutsche Boerse markets and assets available at your chosen broker. For instance, Pepperstone is limited to only trading contracts for difference (CFDs) on 100 German stocks. Investing in DAX indices is another popular means of Deutsche Boerse trading, providing access to the largest publicly-traded companies in Germany.

Ultimately, ensure that the broker you choose offers trading in the specific Germany assets and instruments that you are interested in.

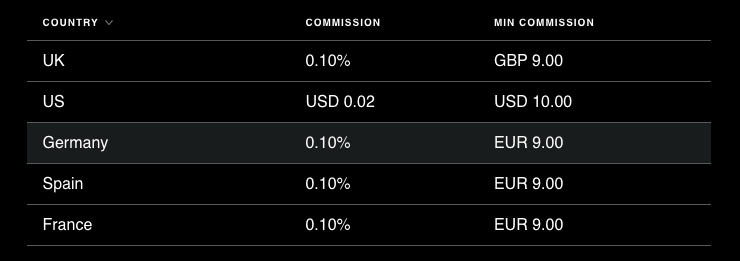

Fees

Using a Deutsche Boerse broker with competitive pricing can help to keep trading costs down. For CFD shares, the most common charge is the trading commission, which is added as a percentage to your trade. For example, CMC Markets charges a competitive 0.10% commission when trading German shares.

CMC Markets Germany Shares Commission

Trading Platform

Leading Deutsche Boerse brokers offer high-quality trading platforms with a range of resources to support analysis. Some of the best third-party systems include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are available through many top brokers. We rate these platforms in particular because they allow for in-depth technical analysis of German stocks.

On the other hand, several popular brokers such as eToro only offer a proprietary platform. The downside of these solutions is that they tend to offer less customisation and analysis tools.

We recommend that you first practice with a demo account if you are using a platform that you are unfamiliar with.

Funding Methods

Popular payment methods include bank transfers and debit/credit cards, as well as some e-wallets. For example, XTB allows clients to fund their accounts using Skrill, which processes deposits immediately.

You should also consider the broker’s minimum deposit and withdrawal limits. For example, CMC Markets sets no minimum deposit limit, making it highly accessible for new traders. In addition, with fast bank card processing, you can begin trading as soon as you register.

Customer Support

The best Deutsche Boerse trading brokers have readily contactable customer support desks that are always open. IG, for example, has dedicated UK hotlines.

Many brokers also have accounts on social media such as Facebook where you can keep up to date on any news and announcements.

What Is The Deutsche Boerse?

In 1992, the Deutsche Boerse Group (also known as Deutsche Börse AG) was formed from a consortium of various regional German stock exchanges, the chief of which was the Frankfurt Stock Exchange. Over time, Deutsche Boerse acquired and formed several other exchanges across a range of markets, including the European Derivatives Exchange and the European Energy Exchange.

Today, Deutsche Boerse is one of the main marketplaces for trading in Europe’s largest economy. Alongside the Frankfurt headquarters, the exchange has offices in approximately 60 countries, including the Czech Republic and Singapore. There are also several Deutsche Boerse branches in London, including Quantitative Brokers, an analytics and technology company.

Alongside exchanges and marketplaces, Deutsche Boerse has several subsidiaries that work to uphold the quality of markets. To do so, it uses advanced trading technology to provide reliable platforms where investors can execute fast trades. One Deutsche Boerse brand of particular note is ISS, which analyses the ESG considerations of different businesses. We see UK retail investors taking an increasing interest in the sustainability credentials of potential investments.

Deutsche Boerse is also heavily involved in both the buy and the sell side of trades, offering services to support brokers. One example is the trade and regulatory reporting hub which helps brokers to ensure they are compliant with rules set out by regulatory bodies across Europe. This hub helps brokerages register trade information with a central data repository, among other duties.

History

- 1988 – The DAX index is launched

- 1991 – The Frankfurt Stock Exchange starts facilitating electronic trading of equities

- 1992 – Deutsche Boerse is founded. At the same time, it acquires Deutscher Kannesverein, a group formed from the mergers of regional stock exchanges, including Berlin, Frankfurt am Main and Munich

- 1993 – Fully-electronic trading is introduced using the BOSS-CUBE system

- 1996 – The MDAX index is launched

- 1998 – Eurex, the first international derivatives exchange is launched in partnership with the Swiss Stock Exchange

- 1999 – The SDAX index is launched

- 2001 – IPO of Deutsche Boerse with a share issue price of €335

- 2006 – Commodities are introduced to the Xetra trading platform

- 2012 – The attempted Deutsche Boerse and NYSE Euronext merger is blocked by the EU

- 2015 – The acquisition of the forex exchange 360T is completed

Markets

The Deutsche Boerse Group runs three main exchanges which each provide access to different markets, offering clients multiple ways to trade.

- Frankfurt Stock Exchange: This is the main stock exchange for German companies and has a history dating as far back as the late 1500s. It operates several platforms, with the most prominent being Xetra, used for electronic trading both online and on the stock exchange trading floor.

- European Energy Exchange: The European Energy Exchange, or EEX, offers market access to instruments such as options, futures and exchange-traded commodity (ETC) contracts. Through this exchange, investors can trade energy-related commodities such as natural gas and LNG.

- European Derivatives Exchange: Eurex is one of the main exchanges for clients interested in trading options and futures contracts on markets ranging from forex and cryptocurrency to stocks and ETFs. The platform also offers numerous resources to support online trading such as economic calendars, margin calculators and education.

Indices

Qontigo, a Deutsche Boerse subsidiary, runs several indices that are used to track Germany ‘s economy and, in partnership with other exchanges, international stocks and share prices. The following are among the main German-specific indices you can trade at Deutsche Boerse brokers:

- DAX40: The DAX40 (Deutscher Aktienindex) is the most well-known Deutsche Borse index. It is made up using 40 of the largest blue-chip German stocks such as Bayer, Volkswagen Group and Allianz. Previously, it was the DAX30 but in 2021 the index was expanded to include an additional 10 listed companies.

- MDAX: This index includes mid-sized companies that are the 50 largest by market cap after those included in the DAX40. Popular constituents include Lufthansa, Hugo Boss and Puma.

- SDAX: This is the small-cap Deutsche Aktienindex with the 70 largest companies that come after those included in the MDAX (in other words, those ranked 91 up to 160 by market cap and order volume). The telecoms company 1&1 and the manufacturing company Krones are popular examples.

- TecDAX: The Technology Deutsche Aktienindex is an index of the 30 biggest companies in the technology industry. This index includes several firms that are present in the DAX40, MDAX and SDAX.

- DAX 50 ESG: This is an index with strict rules on the high standards of ESG for companies to be included. For instance, companies involved in military contracting or unconventional oil and gas are excluded. This provides a way for investors to benchmark companies in the DAX40 and MDAX with high ESG ratings. Popular constituents include Siemens and DT Telekom AG.

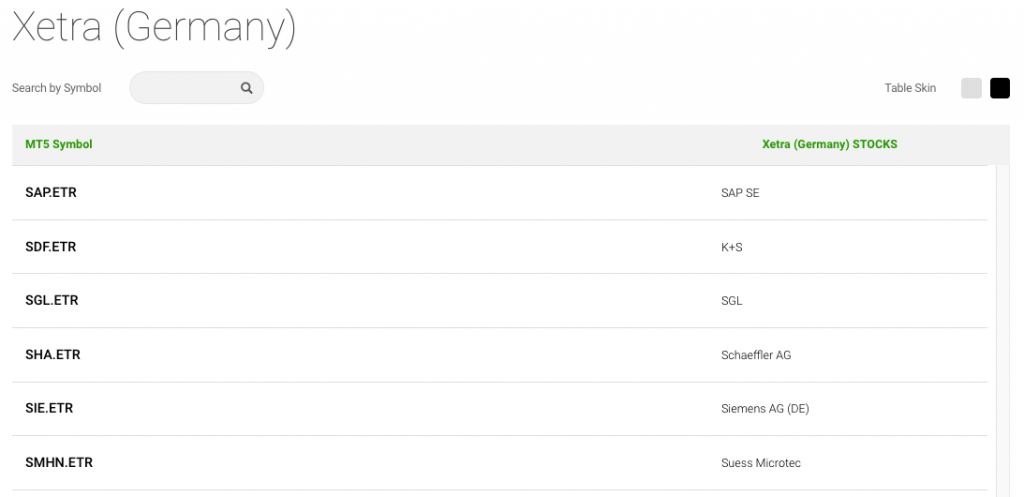

Largest Stocks

In 2023, the largest companies on Deutsche Boerse exchanges included:

- SAP – Ticker symbol SAP, market cap of approximately €156 billion

- Siemens – Ticker symbol SIE, market cap of approximately €132 billion

- Deutsche Telekom – Ticker symbol DTE, market cap of approximately €117 billion

- Airbus – Ticker symbol AIR, market cap of approximately €105 billion

- Allianz – Ticker symbol ALV, market cap of approximately €95 billion

Access to many of these stocks are available at top brokers, including IC Markets:

IC Markets Xetra Stocks

Trading Hours

The trading hours at Deutsche Börse brokers will vary depending on the specific market and the assets you are trading. For example, the core Deutsche Boerse AG opening hours for stocks on the Xetra exchange are from 8:00 am until 4:30 pm GMT, Monday to Friday. Including the pre-trading and post-trading hours, this extends to 6:00 am until 8:00 pm GMT.

Trading derivatives on the EEX are available from 6:00 am until 4:00 pm GMT. The Eurex, however, is open from 5:30 am until 8:00 pm, although this includes both pre- and post-trade hours. To find the days when trading halts, plus holidays and trading calendars, check the Xetra, EEX or Eurex websites.

Bottom Line

Through Deutsche Boerse trading brokers, investors can trade on assets in the Frankfurt Stock Exchange, European Energy Exchange and the European Derivatives Exchange. Altogether, Deutsche Boerse supports numerous strategies with many ways to diversify portfolios.

Importantly, when comparing brokers with access to Deutsche Boerse, consider the pricing structure, available products, trading platforms and UK licensing.

FAQ

Can I Trade On Deutsche Boerse Stocks In The UK?

Yes, many brokers in the UK allow Deutsche Boerse trading via stocks of listed companies on the Frankfurt Stock Exchange, for example. This includes IC Markets and XTB. Alternatively see our full list of brokers with access to Deutsche Boerse.

What Exchanges Does The Deutsche Boerse Run?

The Deutsche Boerse Group operates three of the largest exchanges in Europe. This includes the Frankfurt Stock Exchange, the European Energy Exchange and the European Derivatives Exchange. For stocks, ETFs and bonds, there are two main trading venues with the Frankfurt Stock Exchange. These trading desks are Xetra and Boerse Frankfurt.

Do Deutsche Börse Support Algorithmic Trading?

Yes, there are Deutsche Boerse brokers that permit clients to use expert advisors to execute an algo trading strategy.

Where Is Deutsche Boerse Based?

The address for Deutsche Boerse Group’s head office is Mergenthalerallee 61, 65760 Eschborn, Germany. There are also several offices in locations across the globe, for example, New York, Leipzig and Prague.

Where Can I Find Deutsche Boerse Market Data?

If you are interested in information such as equity prices and a list of constituents of Deutsche Boerse indices, there are several available options. The best choice is to search for the assets on your broker’s trading platform where you can find live charts. Other options include the Boerse Frankfurt website or third-party analysis tools such as TradingView or Yahoo Finance.

Article Sources

Frankfurt Stock Exchange Website

European Energy Exchange Website