Vantage FX Review 2025

Vantage FX is an online broker that specialises in forex and offers over 300+ instruments across three STP and ECN accounts. This review covers the broker’s UK regulation, spreads, leverage and the MT4 and MT5 trading platforms. Find out whether you should open an account with Vantage FX today.

About Vantage FX

Vantage FX is an award-winning broker headquartered in Australia under the Vantage International Group. They offer forex and CFD trading to retail and institutional clients. Among other global locations, the broker has an office in London which is regulated by the Financial Conduct Authority (FCA).

Established in 2009, the company founders consist of a team of finance, forex and technology experts. Its brand is recognised by its black, white and red logo. Vantage FX UK is currently led by CEO, David Shayer.

Trading Platforms

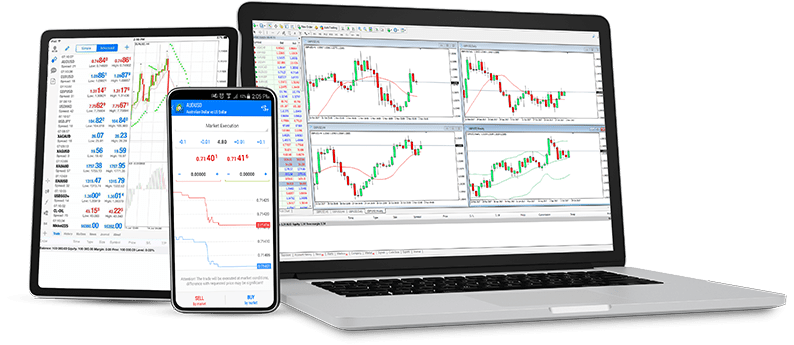

MetaTrader 4

Vantage FX’s MT4 platform is connected to a set of custom liquidity pools named oneZero™ MT4 Bridge. The broker promises fast executions, having worked alongside MetaQuotes to fine-tune their fibre optic network and MT4 server. Clients have access to:

- One-click trading

- 3,200+ professional trading signals

- 9 viewable timeframes and 3 chart types

- 30 indicators and 24 technical analysis tools

- Automated forex trading via Expert Advisors (EAs)

MetaTrader 4

Access the MT4 platform via webtrader, desktop download or mobile app.

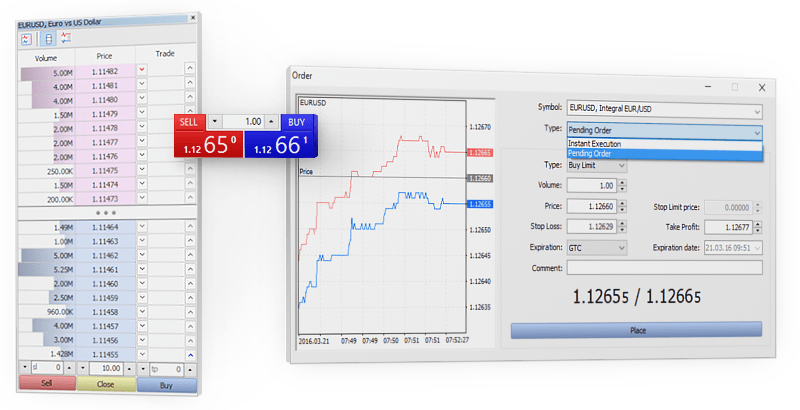

MetaTrader 5

MT5 is a more advanced platform suited to professional forex traders. MT5 comes with EAs, forex signals and the ability to hedge positions. It also promises ultra-fast executions via their NY4, MT5 Equinix server located in New York. Additional features include:

- Built-in alert system

- Customisable interface

- Instant & pending orders

- 80 existing trading indicators

- 21 timeframes and 3 chart types

- Thousands of algorithmic trading solutions

MetaTrader 5

The MT5 platform is available via webtrader, desktop download or mobile app.

Copy Trading

Vantage FX provides social copy trading through ZuluTrade, MyFXBook Autotrade and DupliTrade. These platforms let your trading account mirror the performance of top forex traders. Online traders are ranked and users can analyse past performance before choosing a provider to copy. The broker’s selection of social and copy trading services is extensive vs other providers.

Assets

Vantage FX offers an impressive choice of over 300 tradable instruments:

- Shares – Stocks from 50 US companies, 50 HK companies, 50 UK and EU companies and 50 Australian companies, including GameStop (GME)

- Forex – 40+ major, minor and exotic currency pairs, including GBP/USD, NZD/SGD and EUR/AUD

- Indices – 15 major stock markets, including FTSE100, US30 and Nikkei225

- Metals – Trade precious metals, including gold, silver and copper

- Energy – Trade natural gas and oil including Brent Crude Oil

- Softs – Trade cocoa, coffee, cotton, orange juice and raw sugar

The FCA does not permit UK retail traders to invest in crypto CFDs. The broker also removed binary options in 2017 to focus on ECN forex trading.

Trading Fees

Spreads and commission rates on Vantage FX are low and variable. Cost structures differ across account types:

- Standard STP – Spreads from 1.4 pips with £0 commission. Typical spreads on GBP/USD are 1.6

- Raw ECN – Spreads from 0.0 pips with £3 commission per lot per side. Typical spreads on GBP/USD are 0.5

- Pro ECN – Spreads from 0.0 pips with £2 commission per lot per side. Typical spreads on GBP/USD are 0.5

Clients can refer to the ‘Market Watch’ panel on the MT4 platform to get the most up-to-date swap rates and live spreads.

VantageFX Leverage

Professional UK clients can access up to 1:500 leverage on forex. However, due to FCA regulation, leverage is restricted for retail clients:

- Major currency pairs up to 1:30

- Non-major currency pairs, gold and major indices up to 1:20

- Other commodities and non-major equity indices up to 1:10

Note if your account has insufficient equity you may receive a margin call.

Mobile Apps

Trade anywhere and anytime with the MT4 and MT5 mobile apps. Both are available to install on iOS and Android devices. The mobile platforms have the same functionality as the desktop platform, such as viewing prices in real-time, placing trades and managing pending orders. The MetaTrader mobile apps can be installed from both Google Play and the Apple App Store.

Vantage FX mobile app

Vantagefx.com also has a proprietary mobile app, which provides access to 250+ tradable instruments. You can open a demo account, chat with customer support, make deposits and withdrawals and more. The Vantage FX app can be downloaded from Google Play and the Apple App Store, where it has many positive customer reviews.

Deposits

Vantage FX offers a range of deposit methods for UK traders with varying processing times:

- Domestic EFT – 1 – 2 business days

- International EFT– 2 – 5 business days

- Broker-to-broker transfer – 2 – 5 business days

- Credit/debit card (Visa and MasterCard) – Instant

- Domestic fast transfer – Up to a few hours during GMT Business hours

- BTC and ETH – Quick processing times that depend on network confirmation speeds

Opening and funding an account can be done in GBP, meaning you won’t be charged currency conversion fees. BTC and ETH base currencies are also supported.

There are zero deposit fees, though your financial institution may have its own charges. The maximum daily deposit is £10,000.

Withdrawals

To request profits, login to the Vantage FX client portal and navigate to the withdraw tab. There is no minimum withdrawal requirement. All withdrawal requests are processed via the same method used to deposit funds, eg bank transfer. Withdrawal times are typically 3 – 5 business days. Requests are processed Monday to Friday 9am – 5pm GMT.

Demo Account

Vantage FX offers an unlimited demo account, as it can take time to learn how to become a profitable forex trader. Users can practice trading with the broker’s full range of 300+ instruments. Clients can access the MT4 platform and the Standard STP or Raw ECN accounts.

To open a demo account, select the ‘Demo Account’ button on the broker’s website, fill in your details and submit the form. Users can then download MT4 and sign in to the practice account.

Vantage FX Welcome Bonus

New UK clients can claim a 50% deposit bonus. A 10% forex rebate bonus is also available if you deposit a minimum of £1,000 with the STP account. Vantage FX also runs referral programs and active trader rewards which can help reduce costs and maximise profits. Always read bonus terms and conditions before claiming.

Regulation Review

Vantage FX is a trading name of Vantage Global Prime LLP, which is regulated by the Financial Conduct Authority (FCA) under reference number 590299. The broker must adhere to licensing conditions, including risk management, regular staff training, financial compliance and strict auditing procedures.

Vantage FX is also regulated by the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA).

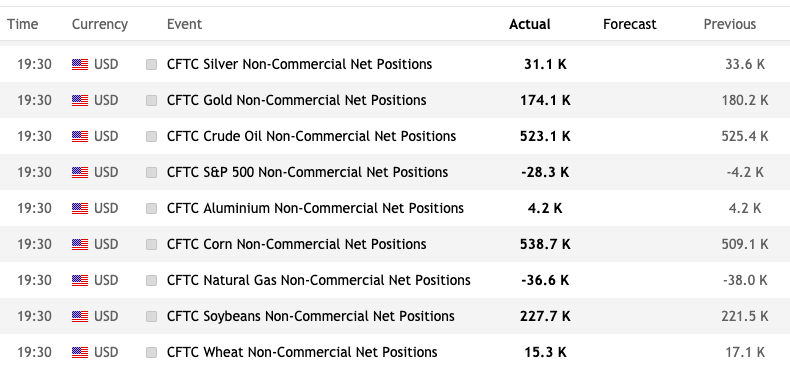

Additional Features

Novice traders can learn to trade forex using the educational tools on Vantage FX. The broker also offers other free features including an economic calendar. For further trading ideas, news of promos or tutorials, Vantage FX has a social media presence across YouTube, LinkedIn, Twitter and Facebook. Additionally, UK clients can claim a free forex VPS by emailing info@vantageprime.co.uk.

Economic calendar

Note: Vantage FX does not offer an API solution.

Trading Accounts

Vantage FX offers three different account types to suit traders of all levels:

- Standard STP – This account is suited to novice traders looking for direct access to the markets with no commissions. The minimum deposit is £200.

- Raw ECN – This account is designed for more experienced traders who require deep liquidity and tight spreads. The minimum deposit is £500.

- Professional ECN – Designed for professional clients, users have to be elected by Vantage FX UK and demonstrate trading experience and expertise. Negative balance protection is not available with this account. The minimum balance is £500.

Vantage FX also offers a halal swap-free Islamic Standard STP account and an Islamic Raw ECN account. Additionally, Vantage FX offers a Multi-Account Manager (MAM/PAMM) for professional clients to manage executions on an unlimited number of trading accounts.

Another bonus for us was the BTC/ETH account. A great solution for crypto investors, clients can open an STP/ECN account with Bitcoin or Ethereum as the base currency. This makes it easy to speculate on traditional financial markets using existing digital assets, without having to convert cryptos into fiat currencies like GBP.

To register for an account, click the red ‘Live Account’ button on the broker’s website. You will be asked to complete some forms and provide ID documents for verification. Once approved, your account details will be sent via email. Traders can then login to the Vantage FX client portal.

Note, the minimum lot size is 0.01 while the maximum lot size is at 100.0.

Benefits

If you take Vantage FX vs competitors, such as IC Markets, the broker scores well in the following:

- 300+ tradable instruments

- ECN/STP execution model

- Segregated client funds

- MAM/PAMM accounts

- Forex Islamic account

- Educational tools

- FCA Regulation

- Copy trading

Drawbacks

However, compared to alternatives like eToro, IG, and XTB, Vantage FX has some drawbacks:

- No cTrader

- No PayPal funding

- £200 minimum deposit

- No proprietary platform

- Zero no deposit bonuses (NDB)

Trading Hours

Vantage FX platforms are open for trading 24/7, so weekend access is available. With that said, session times vary across each market – refer to the ‘Trading Hours’ section on the broker’s website for a breakdown of opening hours.

Customer Support

You might encounter withdrawal problems, have forgotten your password, want to delete your account, find the platform is down, or want general information. In that case, you can reach out to Vantage FX’s customer support team via:

- Email – support@vantagefx.co.uk

- Live chat – bot in the right of the website

- UK telephone contact number – +44(0)20 7043 5050

- UK headquarters address – 7 Bell Yard, Holborn, London, WC2A 2JR, UK

The customer support team endeavours to respond to all queries within 24 hours.

Client Safety

Client funds are kept in a segregated custodial account held with NatWest bank. The broker also protects personal information, as detailed in their privacy policy. Platforms are password-protected and encryptions are used to protect sensitive data and payment information. Overall, we are comfortable with Vantage FX’s level of security.

Vantage FX Verdict

Vantage FX is a legitimate, secure and FCA-regulated broker with tight spreads and low commissions. The broker offers automated copy trading services and the industry-leading MT4 and MT5 platforms. Its account options are also suited to traders of all levels. We are comfortable recommending Vantage FX to our traders.

FAQ

Is Vantage FX A Market Maker?

No. Vantage FX is not a market maker and is an ECN forex broker. ECN brokers pass your orders to a pool of liquidity providers who compete for the best bid/ask spreads. A market maker, on the other hand, does not match your trade and takes the opposing position, which does not generally align with traders’ interests.

Is Vantage FX Regulated?

Yes. Vantage FX is a trading name of Vantage Global Prime LLP, which is authorised and regulated by the Financial Conduct Authority (FCA). The company license number is 590299. The UK’s FCA is a leading regulatory agency and a good indication that the broker is trustworthy.

Is Vantage FX Safe?

As a regulated brokerage, Vantage FX is subject to strict standards set by the FCA. It keeps client funds segregated with the National Westminster Bank. The broker also has a robust privacy policy and abides by AML and CTF policies. As a result, we believe Vantage FX is a legit broker.

How Much Capital Do I Need To Trade With Vantage FX?

The minimum capital required to open an account is £200 on the Standard STP account, which is a higher entry than most competitors. The Raw ECN and Professional ECN accounts require a £500 minimum deposit.

Does Vantage FX Offer A Demo Account?

Yes. Vantage FX offers an initial free 30-day demo account. Traders can also apply for a non-expiring demo solution by contacting customer support via email. The practice account is a great way to try before you buy.

Top 3 Vantage FX Alternatives

These brokers are the most similar to Vantage FX:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

Vantage FX Feature Comparison

| Vantage FX | Pepperstone | IG Index | IC Markets | |

|---|---|---|---|---|

| Rating | 4.7 | 4.8 | 4.7 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $50 | $0 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, FSCA, VFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | Vantage FX Review |

Pepperstone Review |

IG Index Review |

IC Markets Review |

Trading Instruments Comparison

| Vantage FX | Pepperstone | IG Index | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | No | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | Yes | Yes | Yes | No |

| Volatility Index | Yes | Yes | Yes | Yes |

Vantage FX vs Other Brokers

Compare Vantage FX with any other broker by selecting the other broker below.

Popular Vantage FX comparisons:

|

|

Vantage FX is #16 in our rankings of CFD brokers. |

| Top 3 alternatives to Vantage FX |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting |

| Demo Account | Yes |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, FSCA, VFSC |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:30 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ADVcash, AstroPay, Credit Cards, Debit Card, FasaPay, Neteller, Skrill, STICPAY, Swift, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Copper, Cotton, Gasoline, Gold, Natural Gas, Oil, Orange Juice, Palladium, Platinum, Silver, Sugar, Wheat |

| CFD FTSE Spread | 1.0 |

| CFD GBPUSD Spread | 0.5 |

| CFD Oil Spread | 0.01 |

| CFD Stocks Spread | 0.01 |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.0 |

| GBPEUR Spread | 0.5 |

| Assets | 55+ |

| Currency Indices | USD |