IQ Option Announce Innovative Introducing Broker Scheme

Introducing Brokers schemes is a growing sector of online marketing and investing. An Introducing Broker (aka IB), refers new clients to a broker delivering online trading or similar and is then paid for delivering that client or business.

In simple terms, the introducing broker “introduces” the client to the trading platform or broker.

IQ Option has launched its own Introducing Broker program, and any suitable website or marketing firm has the opportunity to join.

How Does It Work?

An Introducing Broker can find and refer new customers to a broker in a number of ways:

- managing a fund for a group;

- offering education or tutoring;

- online seminars and webinars;

- trading signals or investment ideas;

- online marketing (websites);

- social media campaigns;

The customer should register an account in the trading system via the supplied programme link in order to be identified correctly. Once the referred client funds their account and starts trading, the IB will start earning a commission based on the trader’s performance.

An IB is interested in keeping their clients trading for as long as possible because the more they trade, the higher IB’s income will be.

Can I Be An Introducing Broker?

There are no restrictions on who can become an introducing broker. You do not need a specific license or qualification.

Experience in the financial markets is not necessary. The role is more about marketing than trading specifically.

Those managing funds or educating others on how to trade should, of course, be active traders.

Finding The Right IB Scheme

We recommend the IQ Option scheme for a few reasons. There are certain potential pitfalls with IB programmes and avoiding these is very important in realising any profit.

The remuneration scheme is key. Flat fees for new clients look attractive, but the IB may not see the full value for a client if they are an active trader long term – that single payment is all you get.

Trading requirements must also be met before a commission is due. These are often hidden and can be difficult to hit all, meaning you earn no revenue at all.

Conversion is crucial too. Sending new clients to a broker that then makes no effort to help those clients trade or deposit means no revenue for the IB

The IQ programme resolves these issues. By working with IQ Option IB Program, you can receive a commission of up to 45%. That is payable from every trade, every time. They also work hard to convert clients into traders and make trading accessible for as many people as possible.

How Does It Work?

The revenue share model starts at 40%. If the IB can bring in 20 clients over 30 days, the figure rises to 45% and will stay there for as long as those volumes are maintained.

There is no negative balance impact at IQ either. A big trader making a sizeable profit will not damage the IB. Each trade commission is paid separately.

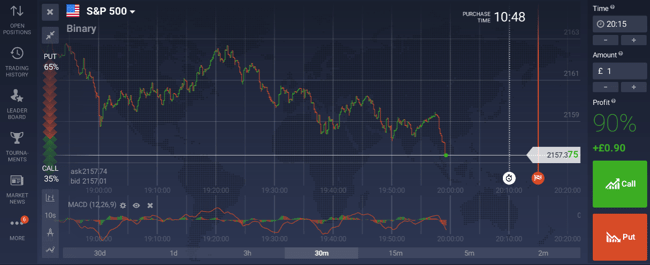

Trading Platform

The IQ Option platform has been designed and refined over many years to the point that it now offers an accessible entry point for traders at all levels.

This makes conversion and long-term profit for introducing brokers much more likely.

Sign up for a demo account and try the platform yourself first.