AdroFX Review 2025

AdroFX is a global broker specialising in the forex, stock, indices, metal and crypto markets. The offshore firm has customers from hundreds of countries and is financially regulated. This 2025 online review will explore the broker’s trading platforms, fees, customer support and more to help investors decide whether to sign up for an AdroFX account.

Company History & Overview

Established in 2018, AdroFX now operates in over 200 countries with more than 100 employees globally. It is an offshore broker comprising several entities. Adro Markets Ltd is based in St. Lucia, Adro M Group LLC is based in St. Vincent and the Grenadines and ADROMKT is registered in Vanuatu.

Although the broker claims to be a team of professionals with experience in the financial sector, no details are given as to its founder or CEO.

Trading Platforms

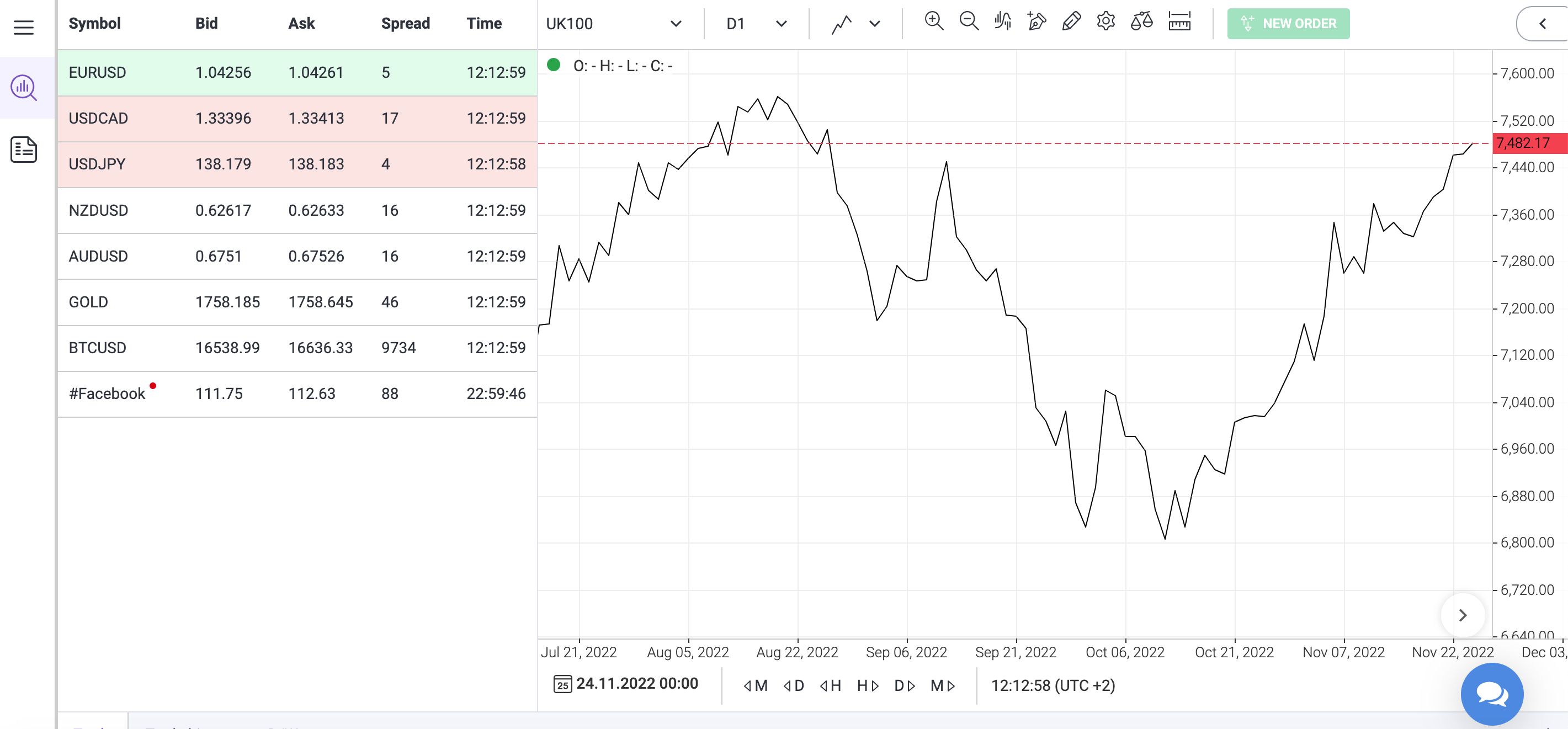

Investors with AdroFX have a choice of two trading platforms: Allpips or MetaTrader 4 (MT4). MetaTrader is respected by many brokers and traders across the world for the capability of the tools it provides and its reliability. It is also suitable for investors of various abilities.

Although not as well-known in the investing world, Allpips is a good choice for beginners as it has access to copy trading and basic indicators. More advanced speculators though will find a greater offering of indicators and technical analysis tools on MT4. The average trade execution time for both platforms is 11.07ms. Our experts also found the following key details related to each platform:

Allpips

- Web-based

- Copy trading

- One-click trading

- Three chart types

- Trading dashboard

- Six technical indicators

- Nine timeframes, from one minute to one month

Allpips Trading Platform

MT4

- One-click trading

- Three chart types

- Algorithmic trading

- 23 analytical objects

- 30 built-in technical indicators

- Desktop, web and mobile versions

- Nine timeframes, from one minute to one month

- Find more indicators and EAs on the MetaTrader Market

- MultiTerminal to assist in trading on multiple accounts from one single terminal

Markets

With over 115 trading instruments, AdroFX provides its customers with multiple assets and markets. Our review found these to be broken down as follows:

- 60+ forex CFDs

- Nine indices CFDs

- Spot metal CFDs (gold and silver)

- Stock CFDs (including Microsoft, Apple and Amazon)

- Four crypto CFDs (Bitcoin, Ethereum, Ripple and Litecoin)

Fees

No commission is charged by AdroFX. Most costs are incurred through spreads, although some account types provide access to tight spreads from around 0.4 pips. The typical EUR/USD spread is 0.8 pips on the FIAT, Crypto, MT4 Pro and MT4 Premium accounts. The typical FTSE 100 spread is 12.0 pips on the FIAT account.

Swap rates may apply on positions held overnight. The quantity depends on whether it is a long or short position and the asset. Islamic accounts charge a flat administration fee instead of swap fees when a position is held for more than three days. Accounts that have been inactive for six months or more are charged an inactivity fee of £5.

Leverage

As an offshore broker, account types at AdroFX offer leverage up to 1:500. Investors do not have to use the full rate; we would recommend that beginners start without leverage until they become comfortable with their trading strategy.

Mobile Trading

AdroFX does not have its own mobile application but MT4 has an app available to download on Android from the Google Play Store (where it has a 4.6 rating), although the app has been removed from the App Store. The app contains many of the same trading features that you would find on the web or desktop platforms, including multiple timeframes and indicators. When we used AdroFX’s MT4 app, we found it to be intuitive and easy to navigate.

Payment Methods

Deposits

No deposit fees are charged by AdroFX, although banks may charge a commission for bank wire transfers. Deposits are processed 24 hours a day, Monday-Friday, and processing times are generally one hour, except for bank transfers, which are 1-5 working days. There is a 25-unit minimum deposit (in the relevant base currency) for all methods apart from PayRedeem, which has a 50-unit minimum deposit and bank transfers, which have a 100-unit minimum deposit. Lower amounts than the minimum can be deposited but these will be subject to fees. We found the following deposit methods available:

- Skrill

- Tether

- Bitcoin

- PAYEER

- STICPAY

- Neteller

- Ethereum

- PayRedeem

- Bank transfer

- Perfect Money

- Visa/Mastercard

Withdrawals

Withdrawals can be made using any of the deposit methods, except Neteller. AdroFX charges withdrawal fees, which depend on the method used. For Visa and Mastercard, it is 1.99%. Withdrawals are processed during business hours (07:00-16:00 GMT Monday-Friday). The processing time for withdrawals is 24 hours. Withdrawal fees may also be applied if investors withdraw money before any speculative activity has occurred.

Demo Account

AdroFX does provide a demo account that gives users a live market experience and leverage rates of up to 1:500. This practice account, which protects customers’ real money, is ideal for beginners or those wishing to test a new trading strategy.

Allpips Demo

Bonuses & Promotions

As an offshore-regulated broker, AdroFX has the freedom to offer multiple enticing promotions. The current promotions and bonuses are:

- 100% Deposit Bonus – bonus is paid out over one year

- 30% Deposit Bonus – receive up to 30% of your deposit as an initial bonus

- Insurance Promo – receive up to 30% of your initial deposit back as a tradeable bonus to reduce risk

Always check the terms and conditions before using a promotion.

Regulation

AdroFX is made up of several entities, each of which is registered in different offshore locations and with various regulators. Adro Markets Ltd is regulated by the Business Services of Saint Lucia Act. Adro M Group LLC and ADROMKT are regulated by the Financial Services Authority (FSA) and Vanuatu Financial Services Commission (VFSC) respectively.

Although being officially regulated is a good sign of a broker’s legitimacy, these are all offshore regulators and will therefore likely undertake less stringent monitoring than more robust bodies like the FCA and CySEC that people generally put more trust in. This could mean client deposits are less safe than in an FCA-regulated broker.

Account Types

Each account type is linked to one of the trading platforms offered by AdroFX (Allpips or MT4). We list the details of each account below.

Allpips Accounts

Fiat Account

- 0.01 minimum lots

- Spreads from 0.4 pips

- 1:500 maximum leverage

- Currency pairs, metals, crypto, stocks and indices

- $100 initial deposit (USD, EUR and GBP base currencies)

Crypto Account

- 0.01 minimum lots

- $100 initial deposit

- Spreads from 0.4 pips

- 1:500 maximum leverage

- Earn on uninvested crypto

- BTC and ETH base currencies

- Currency pairs, metals, stocks and indices

Cent Account

- $25 initial deposit

- USD base currency

- 0.0001 minimum lots

- Spreads from 2.0 pips

- 1:500 maximum leverage

- Currency pairs and metals

MetaTrader 4 Accounts

Standard Account

- 0.01 minimum lots

- Spreads from 1.2 pips

- Islamic account option

- 1:500 maximum leverage

- Forex, metals, indices and crypto

- 100 initial deposit (USD, EUR and GBP base currencies)

Micro Account (Cent Account)

- $25 initial deposit

- USD base currency

- 0.0001 minimum lots

- Only forex and metals

- Spreads from 2.0 pips

- 1:500 maximum leverage

Premium Account

- 0.01 minimum lots

- Spreads from 0.4 pips

- Islamic account option

- All instruments available

- 1:500 maximum leverage

- 2,000 initial deposit (USD, EUR and GBP base currencies)

Pro Account

- Free VPS

- 0.01 minimum lots

- Spreads from 0.3 pips

- Islamic account option

- All instruments available

- 1:500 maximum leverage

- 10,000 initial deposit (USD, EUR and GBP base currencies)

How To Trade On AdroFX

1) Register For An Account

While using the AdroFX, we found the sign-up process to be very quick and take less than a minute. Investors will only need to enter a few personal details and verify their email addresses. Once complete, clients will have access to their AdroFX account.

2) Deposit Funds

The next step is to deposit funds, which can be done by clicking on Funding on the left panel. Traders can then choose their deposit method. Processing times are clearly displayed.

3) Start Investing

Once funds have been deposited, you can begin investing. Whatever platform you choose, make use of the technical analysis tools and economic calendar available. Beginners or those struggling to find the time to carry out in-depth analysis may want to use copy trading or the signals service. Although some brokers specifically ban certain strategies like scalping, AdroFX supports all strategy types.

Benefits Of AdroFX

- Tight spreads

- No deposit fees

- Zero commission

- MetaTrader 4 platform

- Forex trading calculator

- Negative balance protection

Drawbacks Of AdroFX

- Withdrawal fees

- Typos on the website

- No MetaTrader 5 platform

- Offshore-regulated broker

Additional Features

While using AdroFX, we found a decent education section with videos and ebooks. Some of the videos are freely available to watch without an account but others require registration. A large forex glossary is also on the website to aid investors’ understanding of trading jargon.

The daily market analysis section provides useful insight into the markets and includes articles that look at the week ahead to allow users to prepare effectively. The news and blogs section is helpful to those that want a more in-depth understanding of particular topics relevant to current market events. Investors using fundamental analysis will likely benefit from AdroFX’s economic calendar.

Trading Hours

Trading hours at AdroFX are restricted to 24/5 (Monday-Friday). Whilst some markets like forex and crypto are open overnight between Monday and Friday, the stock market hours are 14:30 to 21:00 GMT on weekdays.

Customer Support

Customer support at AdroFX is available 24/5 and can be accessed using:

- Live chat

- Online contact form

- Phone: +44 203 504 2223

- Email: support@adrofx.com

Security

Like most brokers, AdroFX uses segregated accounts to separate client and company funds. This means that, in the event of insolvency, your funds should be protected, although there may be other factors in play. SSL encryption technology is also used to protect certain client information.

The firm offers negative balance protection to help protect account capital should losses exceed the available equity. This is particularly important with brokers that have high maximum leverage.

AdroFX Verdict

AdroFX provides access to a range of markets, including forex and stocks, although its crypto and commodities sections are fairly limited. While the integrity and security of AdroFX may be questioned as an offshore broker, this does bring benefits, particularly concerning higher leverage and a wider selection of promotions. Moreover, the firm offers negative balance protection, segregates client funds and implements SSL encryption technology.

FAQ

What Is A CFD On AdroFX?

A CFD is a contract for difference. It allows traders to speculate on the price of a product without owning the underlying asset.

What Are The Benefits Of Using A VPS On AdroFX?

In addition to greater speed and safety, a virtual private server (VPS) allows investors to run algorithmic trading bots and expert advisors (EAs) 24/7, even when offline.

Can I Earn Money Through Copy Trading On AdroFX?

The Allpips copy trading service allows you to copy others’ strategies, or provide your own for copying. Both methods can net you money, provided the strategies are successful. Higher profitability will generally mean more subscribers.

Can I Choose Which Trading Platform To Use On AdroFX?

Yes. Traders can choose to use either the Allpips platform or MetaTrader 4. Note that your choice of trading platform impacts which account type you can opt for.

Do I Have To Download Software To Use The Trading Platforms On AdroFX?

No. Both Allpips and MT4 can be used through your web browser without needing to download software that takes up storage space on your computer. That said, MT4 does also have an alternative desktop version available that needs to be downloaded.

Top 3 AdroFX Alternatives

These brokers are the most similar to AdroFX:

- FP Markets - Founded in 2005 in Australia, FP Markets is a broker regulated by both ASIC and CySEC. It offers a wide range of tradable assets and provides Standard and Raw accounts suitable for traders of all levels. The platform excels in tools, featuring the MetaTrader suite, user-friendly TradingView, and practical insights from Trading Central and AutoChartist.

- Vantage FX - Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

AdroFX Feature Comparison

| AdroFX | FP Markets | Vantage FX | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.9 | 4 | 4.7 | 4.8 |

| Markets | Forex, CFDs, Indices, Shares, Metals, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $25 | $40 | $50 | $0 |

| Minimum Trade | 0.0001 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | VFSC, FSA, BSSLA | ASIC, CySEC, FSA, CMA | FCA, ASIC, FSCA, VFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | 100% Deposit Bonus up to $10,000 | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | AdroFX Review |

FP Markets Review |

Vantage FX Review |

Pepperstone Review |

Trading Instruments Comparison

| AdroFX | FP Markets | Vantage FX | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

AdroFX vs Other Brokers

Compare AdroFX with any other broker by selecting the other broker below.

Popular AdroFX comparisons:

|

|

AdroFX is #54 in our rankings of CFD brokers. |

| Top 3 alternatives to AdroFX |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Indices, Shares, Metals, Cryptos |

| Demo Account | Yes |

| Minimum Deposit | $25 |

| Minimum Trade | 0.0001 Lots |

| Regulated By | VFSC, FSA, BSSLA |

| Trading Platforms | MT4 |

| Leverage | 1:500 |

| Bonus | 100% Deposit Bonus up to $10,000 |

| Mobile Apps | iOS &; Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Cards, Debit Card, Mastercard, Neteller, PayRedeem, Perfect Money, Skrill, STICPAY, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Smart Signals |

| Islamic Account | Yes |

| Commodities | Gold, Silver |

| CFD FTSE Spread | From 9.0 |

| CFD GBPUSD Spread | From 0.5 |

| CFD Oil Spread | N/A |

| CFD Stocks Spread | From 3.0 |

| GBPUSD Spread | From 0.5 |

| EURUSD Spread | From 0.4 |

| GBPEUR Spread | From 1.5 |

| Assets | 60+ |

| Crypto Coins | BTC, ETH, LTC, XRP |

| Crypto Spreads | From 3.0 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |