Best Halal Brokers with Islamic Trading Accounts UK 2026

Looking to grow your wealth without compromising your values? For UK-based Muslim investors—or anyone seeking ethical, interest-free trading—finding a halal-compliant broker is essential.

We reveal the best halal brokers in the UK that truly deliver on compliance—so you can invest confidently, ethically, and effectively.

Top Halal Brokers & Trading Accounts

-

In our tests, Pepperstone's Halal trading accounts provided consistent swap-free conditions with tight spreads averaging 0.7 pips per lot and no extra commissions. Their clear fee structure and strict avoidance of Haram investments demonstrate a dedication to ethical, Sharia-compliant trading, making them a prime choice for Islamic traders seeking fairness and transparency.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our analysis of XTB's Halal trading arrangement, swap-free accounts offered spreads averaging 1.1 pips per lot, devoid of extra commissions. The firm promotes a clear fee structure and excludes Haram investments, facilitating ethical, Sharia-compliant trading for Muslim investors focused on integrity and adherence to genuine economic principles.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Using Trade Nation's Halal accounts offers swap-free trading with clear, commission-free pricing and spreads averaging 1.2 pips per lot. Prioritising ethical investments and avoiding prohibited sectors, they ensure a compliant and straightforward experience for traders seeking Sharia-compliant options.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Upon reviewing Eightcap’s Halal accounts, we found they provided swap-free trading with average spreads of 1.0 pip per lot and zero commission. Their transparent pricing and exclusion of Haram assets ensure alignment with Islamic principles, fostering a reliable and ethical trading environment for investors prioritising genuine economic activity.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

FOREX.com's Islamic account eliminates overnight interest on trades. During our assessment of halal brokers, it excelled in safety due to its stock exchange listing and robust regulatory credentials. Its superior market research tools were valuable for identifying and studying trades in halal industries and sectors.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

In our evaluation for Muslim investors, eToro's swap-free account incurred no overnight forex interest, charging fees only after seven days for leveraged or CFD positions. Spreads ranged from 1.0 to 1.3 pips per lot, while stock and ETF trades were commission-free. Despite not all assets being wholly Sharia-compliant, eToro's transparent fees and swap-free options provide a largely ethical, cost-effective trading environment for Muslim traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Halal Brokers with Islamic Trading Accounts UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Halal Brokers with Islamic Trading Accounts UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Halal Brokers with Islamic Trading Accounts UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ |

Beginners Comparison

Are the Best Halal Brokers with Islamic Trading Accounts UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Halal Brokers with Islamic Trading Accounts UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Halal Brokers with Islamic Trading Accounts UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Forex.com | |||||||||

| eToro | |||||||||

| Vantage FX |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Global traders can use accounts in various currencies.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- In 2025, eToro enhanced its trading experience by incorporating insights from over 10 million Stocktwits users, enabling better assessment of market sentiment.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- In 2025, eToro altered its fee structure by separating crypto trading fees from the spread. A distinct commission is now listed separately, providing traders with increased transparency while maintaining consistent overall costs.

Cons

- The only significant contact option, besides the in-platform live chat, is limited.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- The broker recently expanded its range of CFDs, offering more trading opportunities.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

How Investing.co.uk Chose The Top Halal Trading Brokers

To find the best halal brokers for UK traders, we carried out a detailed review focused specifically on their Shariah-compliant offerings.

We tested each platform, recording how they performed across key factors — from the availability and authenticity of swap-free Islamic accounts to trading costs, platform quality, FCA regulation, asset range, and customer support (including responses to Islamic account queries).

Our rankings are based on over 200 data points, ensuring our top picks reflect both trust and a genuine halal trading experience.

How To Pick A Halal Trading Account

- Verifying Shariah compliance isn’t just a box-ticking exercise—it ensures your investments truly align with Islamic finance principles. Some brokers label accounts as ‘Islamic’ but then we see they still apply hidden interest-based fees or offer access to haram assets, which defeats the purpose. Look for brokers that provide swap-free accounts certified by reputable Shariah boards (like AAOIFI or independent scholars). Regulated brokers clearly outline their compliance terms and provide documentation, while others may offer only vague assurances. Without verified transparency, you risk unknowingly earning riba or supporting non-compliant companies—undermining both your ethics and financial goals.

- The range of Shariah-compliant asset classes directly impacts how well you can diversify your portfolio while staying within Islamic guidelines. For example, some brokers offer access to Shariah-compliant ETFs and screened stock lists. In contrast, others may only provide basic forex trading without filters for haram currency pairs (like those involving interest-heavy economies). Access to products like Sukuk, halal mutual funds, or even gold (traded per Islamic rules) gives you more flexibility and helps reduce risk through diversification. Filtering tools that flag halal-compliant assets also save you time and reduce the chance of accidentally investing in prohibited sectors.

- Understanding account types and fees is crucial because not all swap-free or Islamic accounts are created equal. Some brokers charge hidden administration fees or impose strict time limits on how long you can hold positions to compensate for the lack of overnight interest, which can increase trading costs unexpectedly. For example, brokers may apply fees or wider spreads on halal accounts compared to their standard ones, affecting profitability—especially for short-term trades. Knowing these details helps you choose a broker that genuinely supports your ethical investing goals without hidden costs eating into your returns.

- Using a broker with intuitive trading platforms like MetaTrader 5, cTrader, TradingView, or custom web interfaces makes trading easier and reduces costly mistakes. Good halal brokers often offer halal asset screeners or filters that help identify Shariah-compliant stocks and ETFs, saving time and ensuring ethical choices. Additionally, access to educational resources focused on halal or ethical investing can build your confidence and deepen your understanding of Islamic finance principles, empowering smarter, values-aligned decisions from the start.

- How you fund and withdraw from your trading account can impact your halal compliance just as much as the trades themselves. Using interest-bearing credit cards or conventional financing methods may indirectly involve riba, which contradicts Islamic principles. Brokers that support Shariah-friendly options—such as debit cards, bank transfers with Islamic banks, or halal-compliant e-wallets—help ensure your entire trading process remains ethical. Some brokers offer a range of funding methods, but it’s important to check for hidden fees or interest-related terms in the fine print before choosing.

- Reliable customer support with Islamic finance knowledge can make a big difference—especially when navigating swap-free accounts, Shariah-compliant assets, or unclear contract terms. Brokers that offer multilingual support and staff trained in Islamic finance can provide clear answers on halal-specific concerns, reducing the risk of unintentional non-compliance. Support availability during Islamic trading hours, including key global markets like the Middle East or Southeast Asia, also ensures you get timely help when it matters most.

- An FCA-regulated broker ensures your funds are protected under strict UK financial laws, which is especially important when dealing with specialised accounts like halal trading. Regulation means the broker must keep client funds segregated from their own money, reducing the risk of loss if the company faces financial trouble. Additionally, compensation schemes like the FSCS protect you up to £85,000 in case of broker insolvency—offering peace of mind alongside ethical investing.

After testing multiple platforms firsthand, I found that the real challenge isn’t just finding a broker that offers a halal account—it’s finding one that understands why it matters.True Shariah compliance goes beyond labels; it shows up in the small details, from how fees are structured to how transparently assets are screened.

What Is Halal Trading?

Halal trading refers to investment practices that comply with Islamic principles, which prohibit earning income through interest (riba), excessive uncertainty (gharar), or unethical industries like alcohol, gambling, or arms.

In halal trading, investors use swap-free or Islamic accounts—offered by brokers like XTB, FXCC, and Pepperstone—that avoid overnight interest charges on leveraged positions.

Instead of profiting from debt or speculation, halal trading emphasises absolute asset ownership, risk-sharing, and transparency. It’s not just about avoiding the forbidden—it’s about ensuring your investments contribute to a fair, ethical financial system.

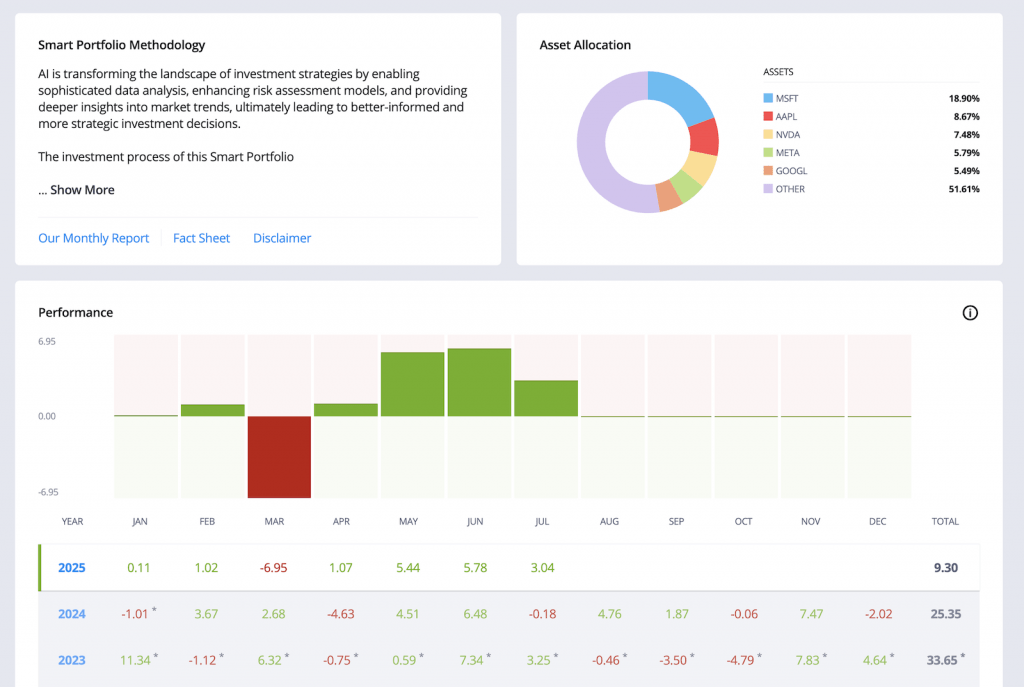

eToro offers a Sharia-compliant portfolio powered by AI

Pros Of Halal Trading

- Ethical compliance with clear boundaries: Halal trading adheres strictly to Islamic finance principles, meaning it excludes stocks and instruments tied to industries like alcohol, gambling, pork, and conventional banking. It also avoids earnings derived from interest (riba), making it fundamentally different from most traditional investing. Some brokers like eToro and IG provide access to Shariah-compliant ETFs and Islamic screening tools to help you identify halal assets. This built-in ethical filter helps beginners avoid morally questionable investments without needing deep financial expertise.

- Lower exposure to risky leverage: Conventional trading often relies on margin and overnight positions, which accrue interest—a clear violation of halal principles. In contrast, halal accounts (usually labelled swap-free) offered by brokers like Pepperstone and Axi eliminate overnight swap fees. This restriction discourages excessive leverage and encourages cash-based or fully collateralised trades. For beginners, this means less exposure to compound losses and a more controlled approach to portfolio growth.

- Transparency & real-asset focus: Halal trading emphasises asset-backed transactions and risk-sharing, which discourages speculative derivatives that don’t represent absolute ownership (e.g., naked short selling or high-frequency trading on margin). Many Shariah-compliant investments—such as Sukuk (Islamic bonds) or equity funds screened by AAOIFI standards—are structured to ensure clarity and fairness.

Cons Of Halal Trading

- Limited asset selection: Halal investing requires screening out companies involved in prohibited (haram) sectors or earning significant income from interest, typically more than 5% of their revenue. As a result, you may miss out on large swathes of the market, including many tech giants and financial institutions. Even Shariah-compliant ETFs, such as those offered on eToro, often hold a narrower selection of stocks, which can reduce diversification and limit sector exposure.

- Higher trading costs: Some brokers charge slightly higher fees or widen spreads on Islamic (swap-free) accounts to offset the loss of overnight interest income. For example, some platforms may impose administrative fees or require a minimum trade duration on swap-free accounts. This can affect short-term trades or high-volume forex pairs, making halal trading less cost-efficient in specific strategies.

- Limited access to derivatives & advanced instruments: Shariah principles prohibit speculative trading and instruments involving excessive uncertainty (gharar), which rules out many popular derivatives like standard options, futures, or CFDs involving leverage. While some brokers like IG offer Shariah-compliant CFD trading with adjusted terms, the range is still narrower. This limitation can restrict more sophisticated strategies like hedging or short-selling, posing a challenge if you seek tactical flexibility.

One thing I learned the hard way is that not all ‘swap-free’ accounts are equal—some quietly add admin fees or time limits that can eat into your profits.It took digging through terms and placing real trades to realise that a truly halal account needs more than just the right label—it requires the proper structure.

Bottom Line

Halal trading offers a way for UK investors to grow their wealth while staying true to Islamic principles. Although it comes with certain limitations—like restricted asset choices and higher costs in some cases—it promotes ethical, transparent, and risk-conscious investing.

With more brokers now offering reliable Islamic accounts, accessing Shariah-compliant trading is easier than ever. Ultimately, the best halal broker in the UK is one that balances faith, functionality, and financial opportunity.

This website does not provide religious rulings on Islamic trading. For personal guidance on whether your trading activities comply with Shariah principles, we advise seeking advice from a qualified religious scholar who can assess your specific situation.