Best Futures Brokers In The UK 2026

Looking to trade futures in the UK? With tighter regulations, evolving platforms, and global market access, you need a broker that combines competitive pricing with powerful tools and trusted regulation.

We cut through the noise to reveal the top futures brokers in the UK—helping you choose the one that aligns with your strategy, risk appetite, and investment goals.

Best Brokers For Trading Futures

-

Interactive Brokers provides direct futures trading on over 30 global exchanges with exceptionally low commissions, starting at just $0.25 per mini-contract. In our evaluation, its sophisticated Trader Workstation platform stood out with extensive order types and algorithmic features. IBKR’s worldwide access and minimal fees render it an excellent option for active futures traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation provides futures trading mainly via CFDs on indices and commodities. In our tests, fixed spreads began at 0.3 points for key indices such as the S&P 500. This approach ensures price certainty, unlike most futures brokers, and it doesn't charge commission fees.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

IG Markets provides futures trading on more than 90 international contracts, featuring an intuitive platform and robust charting tools. In our tests, low commissions, beginning at approximately $2.50 per contract, and tight spreads were notable. With regulatory oversight and low minimum deposits, IG accommodates both novice and seasoned traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

FOREX.com provides futures trading via its partner, StoneX, granting entry to key U.S. and international futures markets. In our evaluations, they offered competitive fees beginning at $7 per $100,000 traded on RAW Pricing accounts. The platform features sophisticated charting tools, integrates with TradingView's extensive trading community, and supports trading on the dependable MetaTrader 5.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

eToro provides futures exposure via CFDs on indices, commodities, and cryptocurrencies instead of direct exchange-traded futures. In our evaluation, the platform excelled due to its simplicity, fixed spreads, and commission-free model, appealing to beginners. Social trading enhances its value by allowing users to replicate the strategies of seasoned futures traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000

Safety Comparison

Compare how safe the Best Futures Brokers In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Futures Brokers In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Futures Brokers In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ |

Beginners Comparison

Are the Best Futures Brokers In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Futures Brokers In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Futures Brokers In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| IG | |||||||||

| Forex.com | |||||||||

| eToro | |||||||||

| Vantage FX | |||||||||

| Tickmill |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Global traders can use accounts in various currencies.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- The in-house Web Trader remains a standout platform, excellently crafted for budding traders. It features a sleek design and offers more than 80 technical indicators for thorough market analysis.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- Funding choices are restricted when compared to top options such as IC Markets. Many popular e-wallets, including UnionPay and POLi, are noticeably absent.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- eToro is a globally recognised brand, operating under top-tier international regulations. It boasts a community of over 25 million users.

- There is an extensive online training academy offering a range of accessible resources, from concise articles to detailed courses.

- In 2025, eToro enhanced its trading experience by incorporating insights from over 10 million Stocktwits users, enabling better assessment of market sentiment.

Cons

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The only significant contact option, besides the in-platform live chat, is limited.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Opening a live account is both straightforward and swift, requiring under 5 minutes to complete.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- The broker recently expanded its range of CFDs, offering more trading opportunities.

Cons

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

Cons

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

How Investing.co.uk Chose The Top Futures Brokers

To identify the best futures brokers for UK traders, we conducted hands-on evaluations of each platform’s futures offering. Our testing focused on key factors including the range and number of futures contracts available.

In addition, we reviewed FCA regulatory standing, ease of use, and advanced order types, all critical for UK-based futures traders. Brokers were then rated and ranked.

How To Pick A Futures Broker

- Account types and minimum deposits determine your access to different markets, leverage levels, and trading tools. Some brokers offer tiered accounts—such as standard, professional, or institutional—each with varying margin requirements, fees, and regulatory protections. Understanding these distinctions helps avoid unexpected costs or restrictions, while ensuring the account suits your trading style and capital. Additionally, minimum deposits can impact how much risk you’re exposed to initially, so choosing a broker with flexible requirements can make starting more manageable and less financially stressful.

- The range of markets offered by a futures broker shapes your trading opportunities and diversification potential. Access to commodities, indices and currencies enables you to diversify risk across different asset classes, thereby reducing your reliance on a single market’s performance. Other markets have unique volatility profiles, margin requirements, and trading hours, so having a broad selection enables you to tailor your strategy and manage risk more effectively.

- Leverage and margin requirements determine how much capital you need to control a futures position and the level of risk you take on. Leverage allows you to open larger trades with a smaller deposit, amplifying both potential gains and losses. However, brokers set margin requirements to ensure you maintain enough funds to cover market fluctuations—falling below these can trigger margin calls and forced position closures. Understanding this balance is vital for managing risk effectively and avoiding unexpected losses, especially in volatile futures markets.

- A trading platform and available tools directly impact your ability to analyse markets, execute trades quickly, and manage risk. Advanced technical analysis features—such as customisable charts and indicators on MT5 and cTrader—help identify trading opportunities and trends, while fast execution speeds minimise slippage in fast-moving futures markets. Risk management tools, such as stop-loss orders and real-time margin monitoring, are crucial for safeguarding your capital and mitigating losses. For beginners, a user-friendly yet powerful platform can accelerate learning and improve trading discipline.

- Trading costs—including commissions and spreads—directly impact your profitability and trading strategy. Unlike CFDs, futures contracts typically do incur overnight financing fees, making them more cost-effective for holding positions in the long term. However, brokers may charge commissions per contract, and even small spreads can add up for frequent traders.

- Quick, knowledgeable customer support can prevent costly mistakes, especially in fast-moving futures markets. Responsive UK-based support teams understand local regulations and market conditions, offering tailored guidance and faster issue resolution. In contrast, global brokers with limited local presence may experience slower response times or language barriers, which can be particularly critical when managing margin calls or technical issues.

In my experience, choosing the best futures broker comes down to a balance of clear pricing, dependable trade execution, and responsive support—because in volatile markets, these practical factors often make the most significant difference between success and frustration.

What Is A Futures Broker?

A futures trading broker is a platform that allows you to trade standardised contracts, speculating on the future price of assets such as commodities, forex, or indices.

Unlike stock trading, futures involve derivatives—agreements to buy or sell an asset at a set price on a future date—often using leverage, which can amplify both profits and losses.

Futures brokers may offer access to global futures exchanges or provide futures-like exposure through CFDs. While CFDs are often easier to access for beginners, they differ from true futures in terms of structure, pricing, and tax treatment.

A good broker does more than route trades—it provides fast execution, market data, risk management tools, and educational resources. Picking the right futures trading broker is a crucial step in trading with confidence and managing risk effectively.

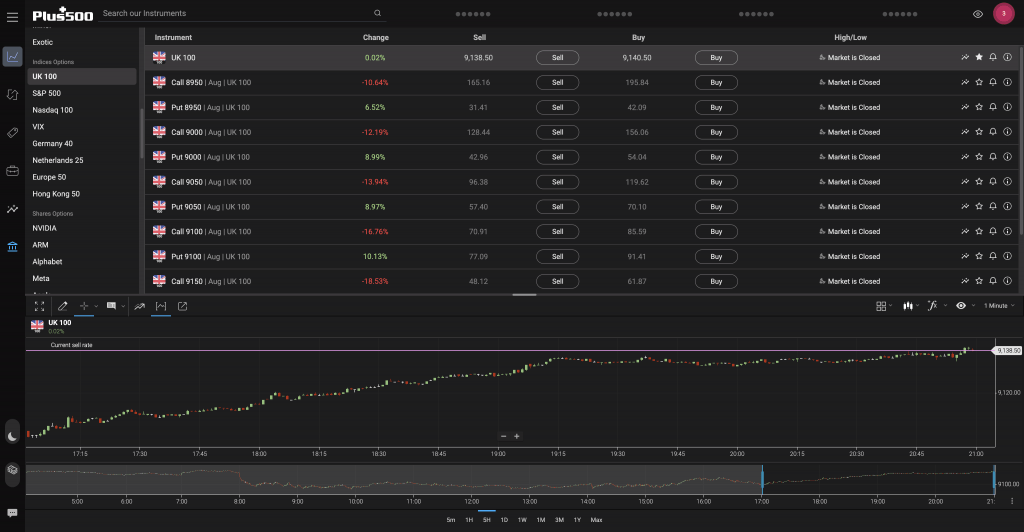

Trading FTSE 100 futures on Plus500 with a clean interface and real time pricing

Pros Of Futures Trading

- High liquidity & market depth: Futures contracts—especially those tied to major indices, commodities, and currencies—are among the most liquid instruments in global markets. This high liquidity translates into tight bid-ask spreads, efficient price discovery, and minimal slippage, even during periods of volatility. For active traders, this means more precise order execution and lower implicit trading costs. Liquidity also allows for faster entry and exit from large positions without significantly impacting the market price.

- Transparent & competitive cost structure: Futures trading generally involves lower and more transparent costs than many over-the-counter products. Trades are executed on centralised exchanges where fees (commissions, clearing, and exchange fees) are itemised. Unlike CFDs, futures do not incur overnight financing or swap charges, making them more cost-efficient for multi-day or long-term positions. Additionally, the absence of broker-set pricing reduces the risk of spread manipulation, which can occur in OTC markets.

- Leverage with institutional-grade risk controls: Futures allow you to control large contract values with relatively small initial margin requirements, offering significant leverage. However, unlike retail leverage products, futures are subject to strict daily mark-to-market settlements and variation margin calls, which help manage counterparty risk and keep accounts in check. This system fosters discipline, requiring you to maintain sufficient capital and mitigating the risk of excessive, unchecked losses.

Cons Of Futures Trading

- Complex contract specifications & expiry dates: Futures contracts come with standardised terms, including fixed contract sizes, expiration dates, and settlement procedures. For beginners, managing contract rollovers—switching from an expiring contract to a new one—can be complicated and costly if not timed correctly. Misunderstanding these details can lead to unintended positions or additional fees, which may erode profits or increase losses.

- Market volatility & price gaps: Futures markets can be highly volatile, especially around economic announcements or geopolitical events. Price gaps—where the price jumps significantly between trading sessions—can occur because many futures markets close overnight. These gaps can bypass stop-loss orders, exposing you to unexpected and potentially substantial losses.

- High leverage increases risk of rapid losses: While leverage magnifies gains, it equally amplifies losses. Futures often require relatively small margins, but adverse market moves can trigger margin calls quickly, demanding additional funds to maintain positions. Failure to meet margin calls may result in forced liquidation of positions at unfavourable prices, potentially leading to losses that exceed the initial investment.

In fast-moving futures markets, having access to reliable technology isn’t just a convenience—it’s essential.I’ve seen firsthand how delays or platform glitches can turn a promising trade into a missed opportunity, so choosing a broker with robust execution tools is key to staying competitive.

Bottom Line

Choosing the right broker for trading futures in the UK involves balancing key factors such as regulation, trading costs, platform features, and market access.

Understanding the difference between actual futures contracts and CFDs is crucial, as is knowing the risks and leverage involved.

Our choice of the best brokers for trading futures will help you find the right fit to trade futures with confidence and effectiveness.