Euro Currency Index

Euro Currency Index brokers give UK traders access to a speculative derivative on one of the world’s most important currencies. The index tracks the performance of the Euro compared to several other major currencies, including the USD and GBP. This guide will explain how the Euro Currency Index works, its constitution, background and price drivers. We also explain how to trade the Euro Currency Index.

Euro Currency Index Brokers

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 2006, IFC Markets is an STP/ECN brokerage distinguished by innovative synthetic indices, a variety of fixed and variable spread account options, and a streamlined registration process completed in minutes during trials.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs, Synthetics BVI FSC NetTradeX, MT4, MT5 Min. Deposit Min. Trade Leverage $1 0.01 Lots 1:400 -

FXTM, founded in 2011, is a forex and CFD broker operating worldwide. Regulated by top authorities such as the FCA, it provides a secure trading environment. With over 1,000 markets and three account types, FXTM accommodates traders of all experience levels.

Instruments Regulator Platforms CFDs, Forex, Commodities, Indices, Stocks, Crypto FCA, FSC, CMA FXTM Trader, MT4, MT5 Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30

Safety Comparison

Compare how safe the Euro Currency Index are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ | |

| IFC Markets | ✘ | ✔ | ✘ | ✔ | |

| FXTM | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Euro Currency Index support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| IFC Markets | ✘ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXTM | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Euro Currency Index at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ | ||

| IFC Markets | iOS & Android | ✘ | ||

| FXTM | iOS & Android | ✘ |

Beginners Comparison

Are the Euro Currency Index good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots | ||

| IFC Markets | ✔ | $1 | 0.01 Lots | ||

| FXTM | ✔ | $200 | 0.01 Lots |

Advanced Trading Comparison

Do the Euro Currency Index offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

| IFC Markets | Expert Advisors (EAs) on MetaTrader, API Access | ✘ | 1:400 | ✔ | ✘ | ✘ | ✘ |

| FXTM | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Euro Currency Index.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| CMC Markets | |||||||||

| IFC Markets | |||||||||

| FXTM |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets has introduced an AI News feature. This leverages AI to highlight and summarise market stories instead of executing trades, suggesting the future direction of broker research tools.

- We've upgraded the 'Assets & Markets' rating due to frequent product enhancements in early 2025. These include extended trading hours for US stocks and the introduction of new share CFDs.

- The CMC web platform offers an exceptional user experience with sophisticated charting tools for trading and customisable options, suitable for both novice and seasoned traders. It supports MT4 but not MT5, and TradingView will be available from 2025.

Cons

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

Our Take On IFC Markets

"IFC Markets is ideal for traders seeking flexibility. It offers both micro and standard accounts, with minimum deposits starting at just $1. Traders can combine multiple assets into one synthetic instrument on the user-friendly NetTradeX platform, a unique feature."

Pros

- Over time, we've observed significant progress, such as the new Standard ECN account on MT5 and the expansion of synthetic instruments on NetTradeX, indicating IFC Markets is evolving to better serve traders.

- MT4, MT5, and NetTradeX can be used on desktop, web, or mobile with live and demo access. They offer full functionality and no platform restrictions, even for micro accounts.

- The NetTradeX platform's PCI feature allows you to create custom synthetic instruments. This unique tool enables you to trade intricate macro perspectives or hedged positions as a single chartable asset.

Cons

- The service lacks third-party technical analysis tools and news feeds, like those from Trading Central, Autochartist, Reuters, or Dow Jones. It relies solely on in-house research, which does not provide the same depth or automation as external services.

- In our tests, ECN spreads on MT5 were tight, while fixed spreads on MT4 were wide at 1.8 pips for EUR/USD. Crypto spreads are extremely high, exceeding 500 pips on ETH/USD.

- The NetTradeX app feels outdated and cumbersome, even with its advanced features. It misses the user-friendliness of top trading apps like AvaTrade.

Our Take On FXTM

"FXTM caters to seasoned traders, offering accounts tailored for short-term strategies. It won DayTrading.com's 'Best ECN Account' award. Experience tight, reduced spreads and benefit from VPS support for algorithmic trading."

Pros

- FXTM offers an impressive selection of payment options, with a focus on local solutions in Africa and Asia such as M-Pesa and TC Pay Wallet. E-wallet withdrawals are processed rapidly, often within 30 minutes, accommodating traders needing swift fund access.

- FXTM’s UK division provides exceptional client safeguards, including top-tier coverage of up to $1 million per client and segregated accounts, reinforcing security for traders with substantial balances.

- FXTM’s Advantage and Advantage Plus accounts provide tight spreads starting at 0.0 pips and charge low or zero commissions, tailored for traders aiming to reduce expenses.

Cons

- FXTM's educational resources, including its insightful e-books, have significantly improved. However, these materials are predominantly aimed at novices, which may not attract seasoned traders.

- FXTM imposes a $10 inactivity fee following just three months without trading. This is shorter than the period many brokers offer and might frustrate those who do not trade regularly.

- FXTM provides only MetaTrader 4/5 for desktop trading, lacking a bespoke platform such as eToro's for a tailored experience. MetaTrader 4/5 is becoming outdated for active traders.

Euro Currency Index Explained

The relative performance of the Euro (EUR) against other major currencies is tracked by the Euro Currency Index. Currencies from major economies, including the USA (USD), Japan (JPY) and the UK (GBP), constitute the makeup of this index.

Five main ticker symbols are used to represent this index, EXY, EURX, ECX, EUR_I. EXY, and EURX are the most common. With that said, brokers may have their own symbols for the index on their platforms.

UK investors looking to trade the Euro Currency Index can do so through multiple vehicles, including CFDs, options and ETFs.

How Does The Euro Currency Index Work?

The Euro Currency Index tracks the Euro’s performance against a basket of other major currencies, typically GBP, USD, JPY, CHF and SEK.

Most brokers offer the standard set of currencies, but some may offer their own custom Euro Currency Index, making some changes to the constituent currencies’ weightings and calculation.

For example, IFC Markets offers its own index that is based on USD, JPY, AUD, CHF and CAD.

Typical weightings:

| Currency | Weighting |

|---|---|

| US Dollar (USD) | 31.55% |

| Sterling (GBP) | 30.56% |

| Yen (JPY) | 18.91% |

| Swiss Franc (CHF) | 11.13% |

| Swedish Krona (SEK) | 7.85% |

Live Chart

Background

The first Euro Currency Index was launched by Stooq.com in 2004. This index, EUR_I, had equal weighting for its four constituent currencies, USD, GBP, JPY and CHF.

Dow Jones later released two of its own Euro Currency Indices in 2004, the DJEURO and DJEURO5. While no longer tracked, these were indices with baskets of 10 and 5 currencies respectively.

The EXY was released by the New York Board of Trade (NYBOT) in 2006, made up of the standard set of weightings given above. The Intercontinental Exchange (ICE) offered options and futures contracts on this index before discontinuing it in 2011.

What Moves The Price Of The Euro Currency Index?

The Euro Currency Index is an indicator of the Euro’s relative performance compared to other major international currencies. As such, investors can use the economics behind the index and each constituent country to predict performance and capitalise on fluctuations.

Some of the most significant factors that affect the index’s performance include:

Eurozone

The Euro is the primary currency of the Eurozone. Therefore, the economic health of the area will have a direct impact on the movement of the Euro Currency Index.

This covers a large area, spanning multiple countries, and thus can be a complicated matter to understand. Looking at the major countries’ economic performances (Germany, France, Italy etc) can be a useful indicator of how the Euro Currency Index will move as they tend to have the biggest impact.

You will want to take into account the economic growth, inflation, stock market performance and politics of these regions. All can influence the value of the Euro on the world stage.

USA & UK

The USA and UK currencies both take a large percentage of influence on the Euro Currency Index’s weighting, accounting for around 30% each. As such, the performance of these economies will be a good determinant of price movement when speculating at Euro Currency Index brokers.

If these currencies are getting stronger compared to the Euro, the index will likely fall in price. Having a good handle on the strength of these and other constituent currencies will help you predict the movement of the Euro Currency Index.

Global Events

With the world’s economies so intermingled due to the increase of globalisation, local changes in economic situations can be felt the world over. For example, the effects of the Russia-Ukraine war were strong on the Euro, causing a major crash in the EXY, with a dip down to 96.93 points in September 2022.

Keeping up to date with global events becomes ever more important as the world integrates further.

Comparing Euro Currency Index Brokers

To profit from Euro Currency Index performance speculation, you will need to choose an online broker. There are many firms available to UK traders looking to trade the Euro Currency Index. Below, we cover the key factors that should be taken into consideration.

Products

The Euro Currency Index can be represented by several different financial products, whether contracts for difference (CFDs), options, futures or ETFs.

The type of product you want to trade will be a major determinant for the brokers you consider. Pepperstone, for example, offers leveraged CFDs, allowing traders to increase their profit-making potential.

ETFs offer a more diversified way of investing, allowing you to spread your risk.

Constituents

Unlike in the past, there is no single dominant or main Euro Currency Index that all brokers use. The standard set of constituent and weightings developed by the NYBOT is still widely used.

However, many companies offer custom Euro Currency Index products with different constituents or weightings. For example, CMC Markets has its own index that includes alternative components like the EUR/SGD pair.

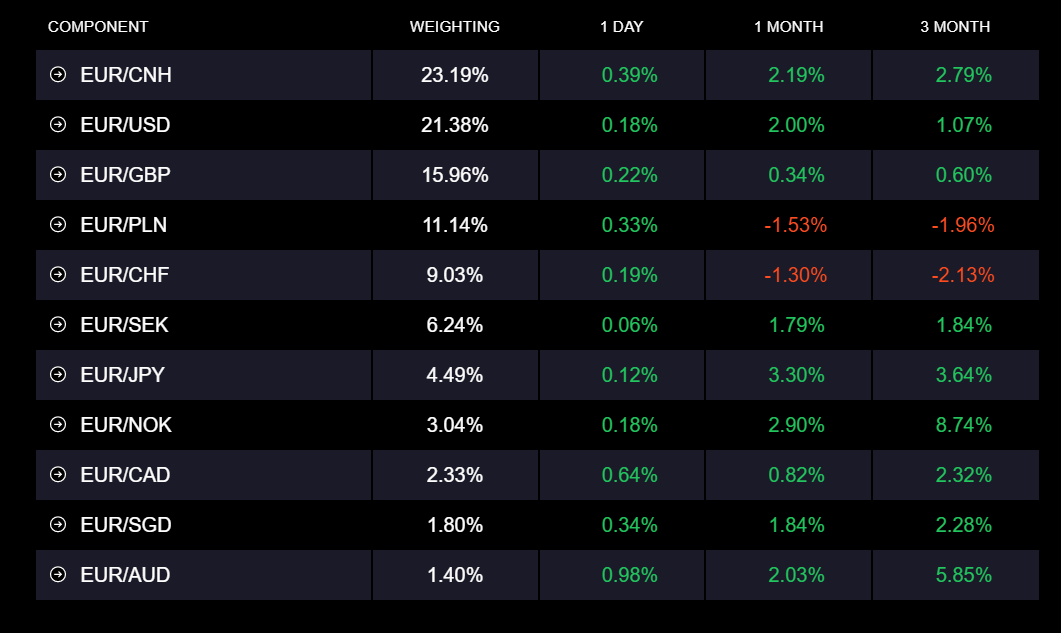

CMC Markes Euro Currency Index Constitution

Platform

More generally, choosing a Euro Currency Index broker that offers a platform that suits you is important. The platform is where you will spend your time opening and closing positions, performing analysis, and researching currencies. As such, the features that the platform provides will be key to ensuring you have a productive and effective investing experience.

Some Euro Currency Index brokers will provide technically focused, popular platforms like MetaTrader 4, MetaTrader 5 or TradingView, while others may have their own bespoke platforms designed for user-friendliness or social trading.

Top Euro Currency Index brokers will offer multiple platform choices and demo accounts. Demo accounts allow you to practise using a trading platform with virtual currency before investing personal capital.

Fees

Fees can quickly eat away at profits, so finding a Euro Currency Index broker that gives you the features to maximise profits while minimising fees is important.

Fees come in many different forms, including deposit/withdrawal fees, commissions, spreads, holding fees, subscription services/freemium models and more. Each brokerage may have a different fee structure that should be carefully weighed against your intended use of the firm.

Pepperstone, for example, offers the Euro Currency Index CFD with a minimum spread of 0.6 pips and 1:5 leverage for UK traders.

Base Currency

UK traders will want to find a broker that allows GBP as an account base currency. This will mean there will be no foreign exchange fees when depositing or withdrawing from the account.

Advantages Of Trading The Euro Currency Index

- Varied Instruments – The Euro Currency Index’s performance can be speculated through several products, including CFDs, futures, options and ETFs.

- Diversity – Brokers may offer different index makeups and weightings, giving traders options for the constitution of the Euro Currency Index. Some will have more diversified indices, while others may be simpler and easier to predict.

- Information – There is a lot of information available about the Euro and the constituent currencies as they are all highly popular currencies.

Disadvantages Of Trading The Euro Currency Index Brokers

- Unpopular – Despite the Euro being one of the world’s leading currencies, the Euro Currency Index is not as popular an instrument. This means there are not as many trustworthy brokers offering the index as a legitimate financial product.

- Composition – While Euro Currency Index brokers can offer differently constituted alternatives, the standard currencies making up the index are limited. This may lead to the index not accurately representing the Euro’s overall global performance.

- Weighting – Similar to the composition, the weighting is fairly heavily skewed to the GBP and USD. The standard weightings were developed before the major events of the 2010s and early 2020s. These include the likes of Brexit and the potential Eastern shift away from the USD. As such, the weighting may misrepresent the actual impact these currencies have on the Euro.

Opening Hours

Euro Currency Index brokers offer different open trading hours as there isn’t necessarily a single centralised exchange from which the brokers obtain their index data. As such, look out for a firm that provides the opening hours that suit you best.

For example, CMC Markets allow traders to invest in its Euro Currency Index CFD from 00:00 to 22:00 GMT, Monday through Friday.

Bottom Line On The Euro Currency Index

Euro Currency Index brokers allow traders to speculate on the performance of one of the world’s most important currencies through its comparative strength against other major currencies. This can provide a more diversified way to speculate on the Euro itself than a single forex pair. Furthermore, there is a variety of Euro Currency Index constitutions out there, with many online brokers adapting the formula to better capture the currency’s performance, making it an interesting product for UK traders.

FAQ

Can UK Investors Trade The Euro Currency Index?

UK investors can trade the Euro Currency Index via several products, including CFDs, ETFs, options and futures. Several UK brokers offer the asset via leveraged CFDs, including Pepperstone and CMC Markets.

What Is The Euro Currency Index Symbol?

There have been several published Euro indices through the years. The main symbols that have been used are EUR_I, EXY, EURX and ECX. The most commonly used symbols nowadays are EXY and EURX.

What Affects The Euro Currency Index’s Performance?

Multiple factors can affect the index’s performance. Some major factors are the Eurozone’s economic performance, the strength of the UK and USA economies and any major world events.

Is It Safe To Trade The Euro Currency Index?

All online trading is risky. However, the safety of investing in the index can also depend on the brokerage you use. We recommend investors trade with highly rated and regulated brokers, particularly those overseen by reputable bodies like the Financial Conduct Authority. For instance, Pepperstone and CMC Markets are FCA-regulated brokers that offer Euro Currency Index CFDs.