Swissquote Review 2025

Swissquote is an online trading company that offers its UK investors the opportunity to trade on a variety of forex pairs and CFDs, such as stocks, indices, commodities and bonds. The broker offers a competitive range of trading platforms that includes the well-renowned MetaTrader 4 and 5 apps, alongside its in-house Advanced Trader platform.

This 2025 review will cover everything a UK trader should know about Swissquote, including its regulation status, supported markets, spreads, leverage and customer service reputation.

Swissquote is an advanced CFD and forex broker that offers low-cost trading and equity investing in more than 400 assets. While it is great for beginners to see the firm regulated by the FCA, the minimum deposit of £1,000 may put some less serious traders off.

Company History & Overview

Swissquote’s business forerunner, Marvel Communications SA, was set up in 1990 by Marc Burki and Paolo Buzzi as an online-focused financial software company. Marvel Communications SA eventually transformed into Swissquote in 1996, which gave users of the platform access to all the securities on the Swiss Stock Exchange at no cost.

The broker’s shares were first floated on the SIX Swiss Exchange in 2000. The site is now visited by over 2 million users each month, making it the largest Switzerland-based financial portal. With an ethos of “democratising banking”, the site holds, in its own words, “transparency, integrity, and unbiased information” as its core values.

Markets & Instruments

Swissquote clients gain access to over 400 different forex and CFD instruments, each of which can be accessed from a single trading platform of their choosing. This is not as large a range as some major competitors, though it still gives traders plenty of opportunity to explore different markets, currencies and diversification strategies.

- Forex: 72 major, minor and exotic pairs

- Commodities: 5 agricultural, 7 energy and 14 metal/forex pairs

- Indices: 26 index CFDs, from the FTSE 100 to global ESG rankings

- Stocks: 337 equities from the UK, Europe and the US

- Bonds: 3 bonds

On the downside, cryptocurrency is not available.

Platforms

Swissquote offers a strong range of trading platforms, with its members having the option of using the well-regarded MetaTrader 4 and 5 platforms, as well as the site’s own award-winning Advanced Trader platform.

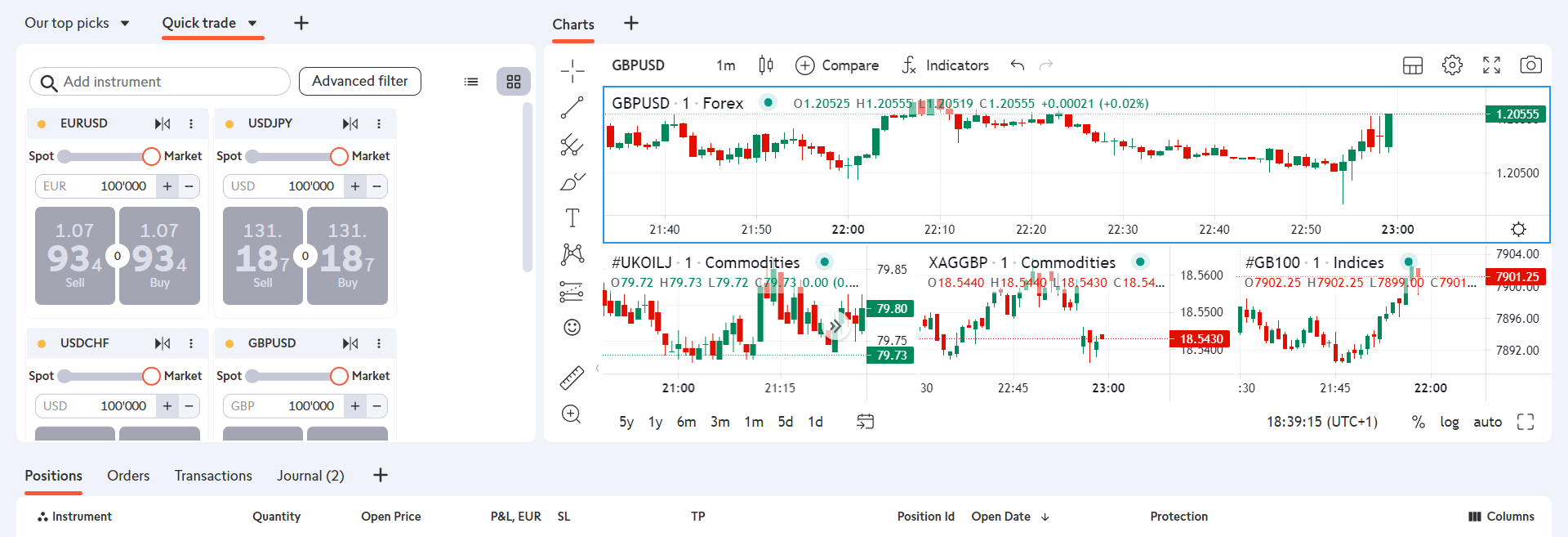

Advanced Trader

Advanced Trader is accessible via a desktop program, web browser and mobile app, which can be downloaded from both the Apple App and Google Play stores.

The simple interface of Swissquote’s in-house platform offers users an accessible investing experience while maintaining technical functionality for more experienced traders to complete sophisticated multiple-order-type’ strategies. Key features include:

- 15 timeframes

- Chart overlays

- Built-in journal

- Nine order types

- One-click trading

- Automatic pattern detection

- Over 50 smart charting tools

- Synchronised multi-chart layout

- Widely customisable user interface

- Over 80 technical indicators for in-depth market analysis

Advanced Trader Platform

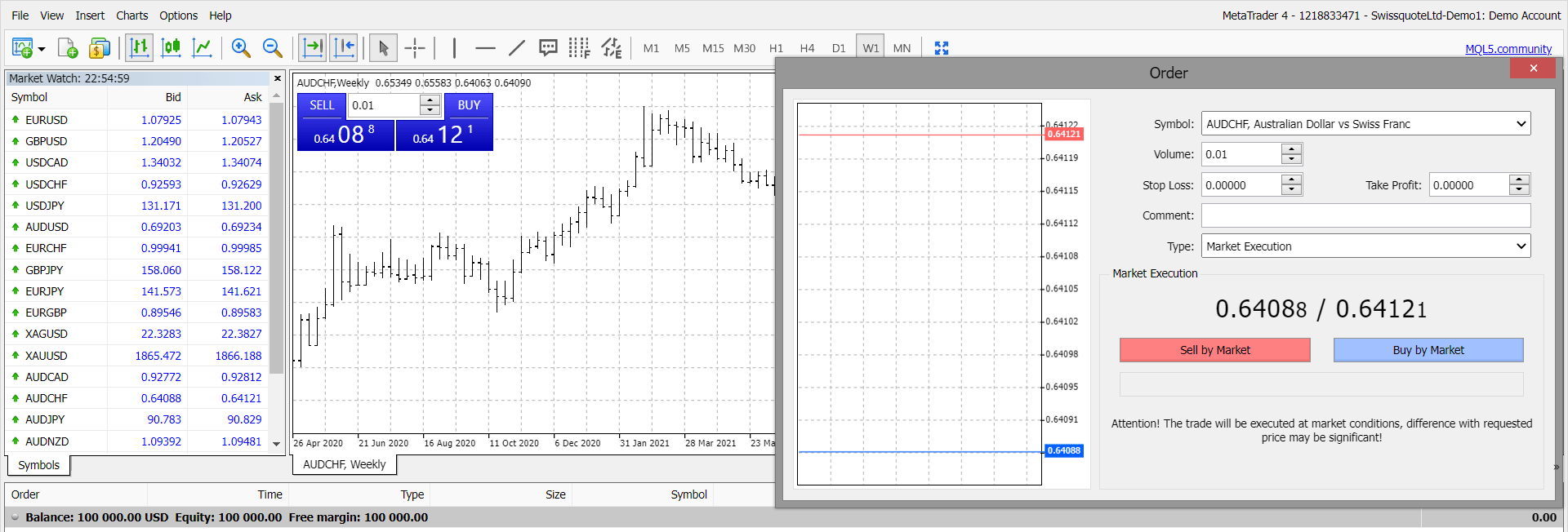

MetaTrader 4

One of the most widely used platforms, the streamlined and fairly intuitive MetaTrader 4 (MT4) will likely be known to any trader with prior online investing experience. Much like Advanced Trader, MT4 is available on desktop, online and via a mobile app, which can be downloaded for free on iOS and Android.

Whilst it is primarily known for its use in forex trading, most CFDs can be traded on MT4, though stocks and synthetic CFDs are excluded. Key features include:

- Market news

- Six order types

- Nine timeframes

- Algorithmic trading

- 24 analytical objects

- Hedging capabilities

- Multi-account manager

- Over 30 technical indicators

- MQL4 indicator marketplace

MetaTrader 4

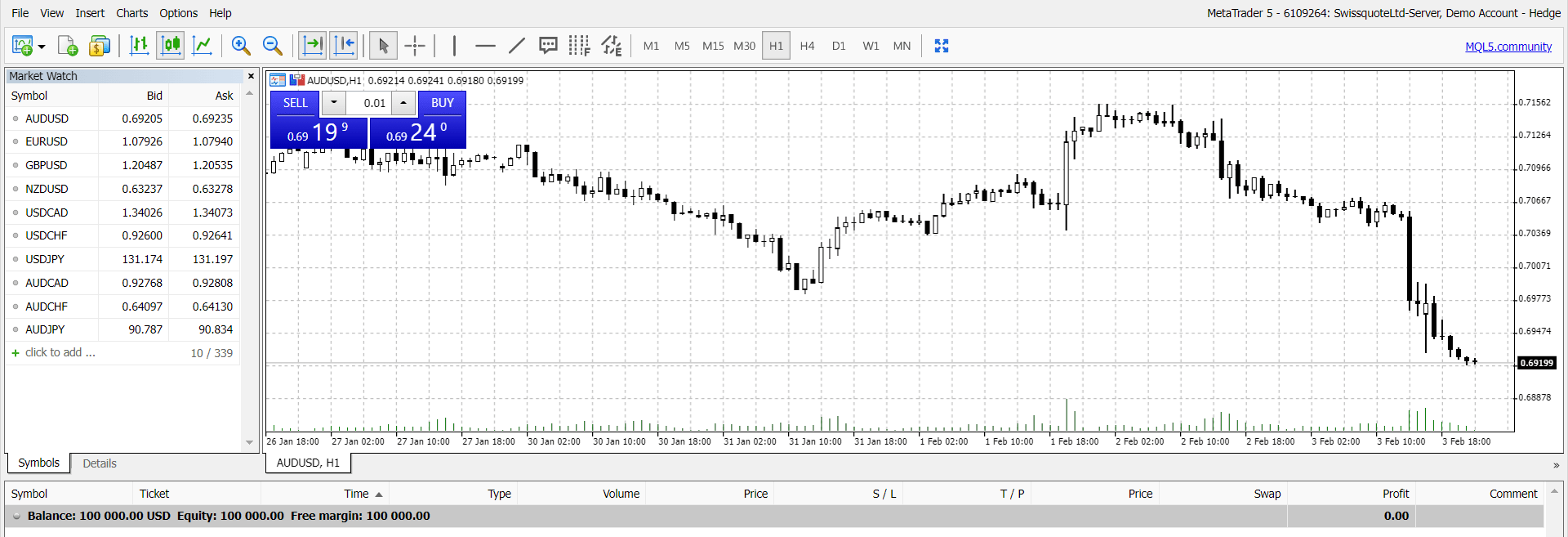

MetaTrader 5

The most recent platform produced by MetaQuotes, the designers of MT4, MT5 boasts a much larger range of advanced analytical trading tools and indicators. However, some prefer the simpler, more accessible interface of MT4. Key features include:

- Copy trading

- 21 timeframes

- Nine order types

- One-click trading

- Algorithmic trading

- Strategy backtesting

- Multi-account manager

- Hedging & netting support

- MQL5 indicator marketplace

- Integrated economic calendar

- 80+ advanced technical indicators

MetaTrader 5

Pricing & Charges

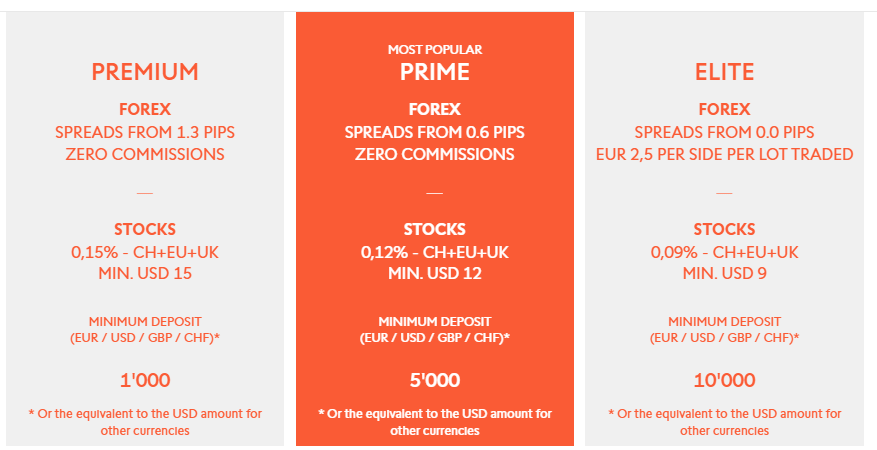

Swissquote charges a combination of spreads and commissions for users to speculate on its investment products. Premium and Prime account holders benefit from no commissions on forex, index, bond and commodity instruments, with spreads from 1.3 pips for Premium accounts and 0.6 pips for Prime accounts. Elite accounts, on the other hand, combine raw spreads (from 0.0 pips) with commission charges of £2.50 per lot per side.

Those looking to invest in stocks and equities will incur commission fees on all positions, with rates depending on their account type. Premium account holders are charged 0.15% of each position, for a minimum of £10 per position. Prime accounts incur 0.12% for a minimum of £12 and Elite accounts must pay 0.09% for a minimum of £9.

Overall, our experts found that Swissquote is competitive in terms of trading fees.

Mobile Apps

When we used the broker, we discovered that all the analysis and trading platforms offered by Swissquote can be accessed by a corresponding mobile app for investing and account management on the go. These can be useful to keep updated on open positions while not being able to access a desktop or laptop computer, enabling users to manage their accounts, just on a smaller screen with a more streamlined user interface.

However, MetaTrader mobile apps have less functionality than their desktop versions, so should not be relied upon for advanced technical analysis over the web or desktop platforms.

Payment Methods

UK clients have two deposit and withdrawal options. Supported payment methods are wire transfers and credit/debit card deposits. Both Visa and Mastercard payment cards are accepted with no transaction fees and the same goes for wire transfers. However, some banks may charge third-party transaction fees, so be careful.

The minimum initial deposit is £1,000, which is high for a broker that supports retail traders. Once an account has been opened and initially funded, there is no minimum deposit limit.

Account Types

Our experts found three account types available to UK users of Swissquote: Premium, Prime and Elite. The key differences between these accounts are given below:

Swissquote Account Types

How To Sign Up For A Live Account

- Visit the Swissquote website using the Visit button in this review and click Open Your Account

- Enter your personal details (name, address, email & phone number)

- Enter additional client information (occupation, reason for application & tax residency details)

- Enter financial information (base currency used, initial deposit, and declaration of the requisite knowledge and/or experience in trading

- Pick the trading platform you would like to use (Advanced Trader, MT4 or MT5)

- Review and submit your application

- Verify your identity and address details

- Deposit funds and get investing

Demo Account

Swissquote, like many other trading sites, offers prospective users a chance to try out its services without any initial deposit in the form of a demo account. This account type simulates the Swissquote experience, using virtual funds to provide a training scenario in which you can learn the ropes, develop strategies and trial new markets over 30 days.

Once the account has expired, you can apply for another, which is a bit of a pain.

How To Open A Demo Account

- Visit the Swissquote website

- Click the Try a Demo button on the header

- Fill out the form with personal details or sign in with either Facebook or Google

- Select the trading platform upon which you would like to practice

UK Regulation

Swissquote has been registered in the UK by the FCA since 2012 under the firm reference number 562170. Its company number is 07710095, and it is registered under the office address Boston House, 63-64 New Broad Street, London, EC2M 1JJ, UK.

Regulation by the FCA is a good sign that a business is trustworthy and legitimate, as it is a well-regarded financial authority that imposes rigid compliance protocols on the companies registered under it. It guarantees negative balance protection for all retail clients, limits leverage rates and ensures no predatory bonus promotions are offered. Moreover, UK residents receive the added protection of FCS compensation of up to £85k in case of business failure.

Leverage Rates

Due to its regulation by the FCA, Swissquote is only able to offer leverage rates of up to 1:30, so capped to protect unknowing investors from being encouraged to make overly risky trades. This is significantly less than competitors not regulated by the FCA or within the EU. For example, IC Markets offers leverage of up to 1:500 and FXTM boasts rates of up to 1:200.

The leverage limits on Swissquotes are 1:30 for forex CFDs and up to 1:20 for others, depending on the underlying asset.

Extra Tools & Features

While using Swissquote, our experts found it to offer a range of educational content for investors looking to learn new skills for trading on the stock market. These include online courses, such as the Master Forex course, eBooks and many PDFs on subjects from managing risk and reading charts, all available to be downloaded at no cost.

Clients can also join webinars on topics like a discussion on the national debt of western economies.

Trading Hours

The trading hours for Swissquote vary across its hundreds of instruments, so cannot be fully listed here. However, the earliest opening for the forex markets is 00:00 GMT, and the latest close is 22:58 GMT. For commodities, this is 00:02 GMT and 22:58 GMT and, for stock indices, this is 08:02 GMT and 22:55 GMT.

Customer Service

To contact customer support, Swissquote clients can call a helpline or use the live chat feature available on the broker’s website. With over 23 years of experience in the industry, the firm holds itself to a high standard of customer service, with 24/5 multilingual phone lines winning awards for customer satisfaction.

- Phone Number: +44 20 7186 2600

Client Security

Client security is important and the broker has taken several steps to make logging into its accounts as secure as possible. This is done via two-factor authentication (2FA) upon login, meaning that clients need a Level 3 Code, which can be sent either in the post or by text.

Swissquote also offers an extensive list of security tips to its clients, making sure they are as clued up as they can be on matters of digital security.

Should You Trade With Swissquote?

With its long history in banking, Swissquote is a solid candidate for any UK-based investor looking for a legit CFD and equity broker. The firm’s services are well organised and spreads are highly competitive, with Elite accounts accessing raw values. All offered trading platforms are well-regarded and provide accessibility, customisability and advanced functionality, suitable for investors of all experience levels.

While the minimum deposit is relatively high and its selection of instruments somewhat limited (no crypto), there are many advantages that prop up Swissquote as a good broker.

FAQ

Is Swissquote A Good Broker?

Our up-to-date 2025 review has found Swissquote to be a highly satisfactory broker for UK-based investors. The market and instrument selection may be limited in comparison to some competitors but it includes all the most popular index, forex, commodity and stock products. Moreover, the firm’s FCA regulation is reassuring and the trading platform selection is of a good standard. However, the minimum deposit of £1,000 is a lot higher than most.

Does Swissquote Offer A Demo Account?

Yes, Swissquote offers a free demo account to any trader wishing to try out its services before investing any real money. Each account lasts for 30 days and can be used with any of the trading platforms. Details on how to sign up for this can be found in our full Swissquote review.

What Is The Minimum Deposit On Swissquote?

The minimum deposit on Swissquote varies with each account type but the lowest limit for UK users is £1,000 on the Premium account. This is notably higher than most alternatives.

Is Swissquote A Trustworthy Broker?

Swissquote is regulated by the FCA in the UK, so users will benefit from negative balance protection and tight regulations. Additionally, its customer service is highly rated, which gives a positive indication as to the trustworthiness of the firm.

What Trading Platforms Are Available On Swissquote?

Three trading platforms are available on Swissquote: MetaTrader 4, MetaTrader 5 and Advanced Trader, the site’s proprietary platform. This is a good selection that caters to both beginners and experienced traders.

Top 3 Swissquote Alternatives

These brokers are the most similar to Swissquote:

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Swissquote Feature Comparison

| Swissquote | IG Index | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| Rating | 4 | 4.7 | 4.3 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $1,000 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | - | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | Swissquote Review |

IG Index Review |

Interactive Brokers Review |

Pepperstone Review |

Trading Instruments Comparison

| Swissquote | IG Index | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | No |

| Warrants | Yes | Yes | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | No | Yes |

Swissquote vs Other Brokers

Compare Swissquote with any other broker by selecting the other broker below.

Popular Swissquote comparisons:

|

|

Swissquote is #57 in our rankings of CFD brokers. |

| Top 3 alternatives to Swissquote |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Demo Account | Yes |

| Minimum Deposit | $1,000 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:30 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Cards, Debit Card, Mastercard, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader and FIX API solutions |

| Signals Service | Integrated in CFXD |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Copper, Gasoline, Gold, Natural Gas, Oil, Palladium, Platinum, Precious Metals, Silver, Soybeans, Sugar |

| CFD FTSE Spread | 0.9 |

| CFD GBPUSD Spread | 1.7 |

| CFD Oil Spread | 0.03 |

| CFD Stocks Spread | N/A |

| GBPUSD Spread | 1.7 |

| EURUSD Spread | 1.3 |

| GBPEUR Spread | 1.5 |

| Assets | 80+ |