Degiro Review 2024

|

|

Degiro is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Degiro |

| Degiro Facts & Figures |

|---|

DEGIRO is a Netherlands-headquartered broker with millions of users and authorization from leading regulators, including the BaFin and FCA. Clients can access global exchanges anytime, anywhere, and on any device. DEGIRO offers stock trading with exceptionally low fees and a huge range of markets. DEGIRO are not CFD brokers and do not offer CFDs. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Stocks, ETFs, Bonds, Futures, Options, Warrants |

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | iOS, Android & Windows |

| Payments | |

| Min. Trade | Variable |

| Regulated By | BaFin, FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| Stocks | DEGIRO offers access to over 50 exchanges from more than 30 countries. Fees are low with a €1 commission on US shares plus a €1 processing fee. ETFs have no commission, just a €1 processing fee. The free cost calculator available to all users is also a bonus. |

Degiro is an online stock broker offering low fees and a user-friendly mobile app. The company also provides trading opportunities in ETFs, bonds, index funds and more. See our review for details of the Netherland-based broker’s costs, live accounts, minimum deposit requirements, login security and more. Find out whether UK traders should sign up for a Degiro trading account.

About Degiro

Degiro was established in 2008 and operates from a head office in the Netherlands. Today, the company has a presence in 18 countries with 180+ employees and is one of the biggest online brokers in Europe. Degiro is focussed on providing clients with straightforward access to global stock exchanges, including the FTSE. The broker’s UK operations are authorised by the Financial Conduct Authority (FCA).

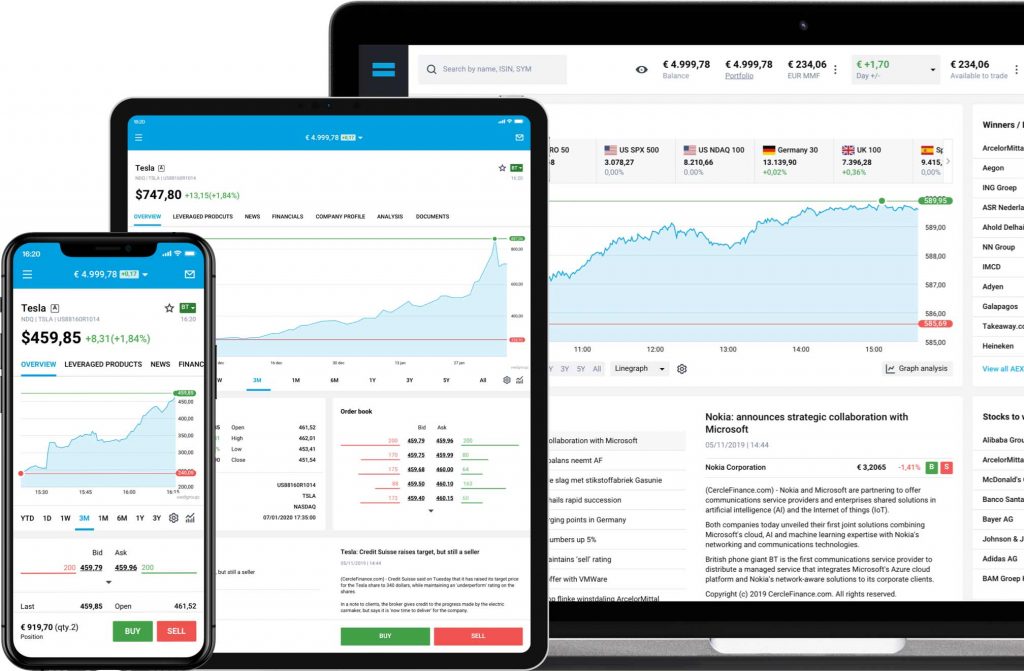

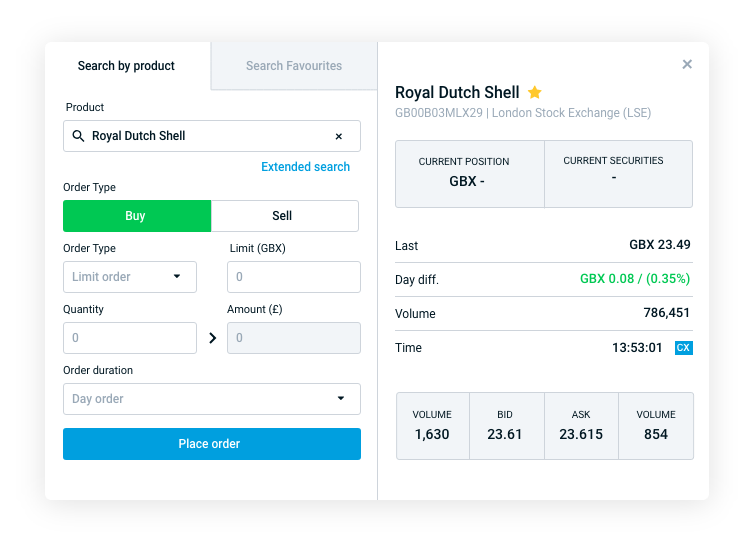

Trading Platform

Degiro offers its proprietary WebTrader solution to all clients. No software download is required, with platform access available via major internet browsers. The bespoke trading terminal offers sophisticated features through an intuitive interface. Clients get real-time market news, live streaming prices, a favourites list, plus customisable graphs and charts. A modest selection of technical indicators is also available, along with multiple order types and short selling capabilities.

WebTrader

Some users may be disappointed by the lack of MT4 and MT5 access, but the broker’s proprietary application does the job for straightforward stock trading. User reviews are mostly positive of the easy-access platform with secure logins. With that said, alternative brokers may be a better fit for those looking for advanced analysis tools.

Markets

Degiro offers UK clients a selection of ETFs, bonds, tracker funds, shares, futures and options. Traders can access 50+ exchanges across 30 countries, including the London Stock Exchange, the Toronto Stock Exchange, the Australian Securities Exchange, plus the S&P 500. The ETF list is vast with direct market or smart order routing (SOR).

Degiro does not offer forex and CFD trading or ISA investments. Crypto trading on the likes of Bitcoin is also not available owing to FCA regulatory conditions.

Fees & Commissions

Despite some free ETFs, the broker does charge varying trading fees, most of which are competitive vs alternatives like Hargreaves Lansdown. Custody (non-lending) fees vary between the four other account types. A full breakdown by account is available on the broker’s website. A cost calculator is also provided on the website so users can understand the impact on investment returns.

Examples of fees with the Basic, Active, Day Trader, and Trader accounts are as follows:

- Bonds – €35.00 + 0.03%

- ETF worldwide list – €2.00 + 0.03%

- Futures – Eurex indicies – €0.75 per contract

- Options – Eurex (Germany) – €0.75 per contract

- Stocks – London Stock Exchange – £1.75 + 0.014%

- Investment funds – free

Connectivity Costs

There are fees for trading opportunities outside of home markets. Connection charges are 0.25% of the total account value (maximum charge of €2.50) per calendar year, per exchange. The LSE is exempt from this fee. The connectivity fee for US options is charged at €5.00 per calendar month, per exchange.

Additional Services

Extra fees to consider when trading with Degiro include:

- Portfolio transfer – £10.00 per position

- Price feeds – maximum £10.50 per month

- Email and telephone orders via Degiro dealing desk – £8.50 surcharge

Leverage Review

Degiro leverage varies by account type and asset class. Stocks can be bought on margin through; Euronext Access Paris, Xetra, and Borse Frankfurt via direct-to-market routing. Trading with leverage is inherently risky so make sure you have appropriate alerts and limits in place. The broker also offers non-leveraged stock trading products.

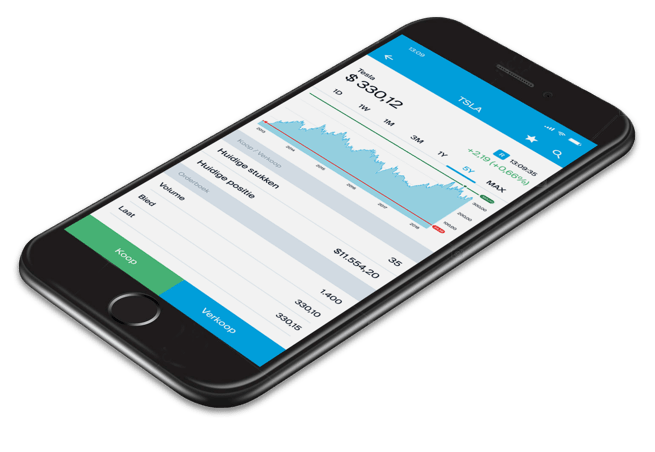

Mobile Apps

Degiro offers an award-winning mobile app based on its bespoke browser platform. This is available for free download and is compatible with iOS and Android devices. Clients can access full trading features, respond to market movements, and complete transactions while on the go. Features include:

- Real-time quotes

- Interactive graphs

- Access all order types

- Stock market live news

- Market sentiment index

- View & add to favourites list

Degiro app

Deposits

There is no minimum deposit requirement to open a Degiro live account. However, the broker only accepts deposits via bank account transfer. E-wallet payments such as PayPal or Revolut are not accepted.

Login to the WebTrader and click the deposit/withdrawal logo to add or withdraw funds from your trading account. Processing times of 2-3 working days apply.

Withdrawals

Degiro does not charge any processing fees but all funds must be withdrawn to a nominated bank account. Clearing times can vary depending on any KYC or security checks that need to be conducted. Priority processing of deposits or withdrawals is not supported.

Demo Account

Degiro does not offer a demo account. This is a significant disadvantage vs competitors such as eToro, Plus500, and XTB. Demo accounts are a good way for new traders to become familiar with platform features and to test strategies in a simulated environment.

Regulation Review

The broker is a registered investment firm with the Netherlands Authority for the Financial Markets (AFM). Prudential supervision is provided by the Dutch Central Bank (DNB). The broker also has authorisation from the Financial Conduct Authority in the UK. Traders can be assured of segregated funds and investor protection schemes.

Additional Features

Degiro offers several support features. This includes an Investors Academy; an educational hub with learning content and day trading strategy information, ideal for new starters. Topics include order types, stock prices, market orders and margin requirements.

In addition, there are WebTrader tutorial videos on the broker’s website. These cover new platform features, exchange connection fees, how to set strategies, plus how to use stop losses, limit orders, and trailing stops. A blog-style forum with market insights is also available.

Stock finder

Trading Accounts

Degiro offers five account types. Trading services and costs differ between accounts:

- Basic – The default account, this profile does not support debit money, debit securities, or derivatives. Fees are low and margin trading is not offered.

- Custody – An entry-level account, suitable for taking long positions in securities. This profile does not support debit money, debit securities, or derivatives. This is a secure account with no lending or third-party asset segregation.

- Active – This profile supports limited debit money, debit securities and derivatives.

- Trader – This profile supports debit money and the full suite of securities and derivatives.

- Day Trader – This account offers all investment services, suitable for active day traders.

Note, margin trading, otherwise known as trading with debit money, is only offered on the Active, Trader and Day Trader accounts.

To open a live account, clients must complete an online registration form with proof of residency. Degiro uses bank identification, requiring a £0.01 transfer and the IBAN of the funding bank account. Clients are free to open several different trading accounts with Degiro.

Benefits

- Stock shorting

- FCA regulation

- No inactivity fees

- Multiple account types

- Competitive share dealing

- Award-winning mobile app

- No minimum deposit requirement

- Investor academy and other educational resources

Drawbacks

- No forex trading

- No demo account

- Taxes on profits may apply

- No debit/credit card deposits

- MetaTrader 4 & MetaTrader 5 not offered

Trading Hours

The broker follows standard office hours with 24-hour weekday trading. Note, trading hours may differ by instrument. Degiro offers a list of opening hours by global stock exchange on their website, with respective public holiday dates published.

Contact Details

Degiro offers help via several support channels:

- Email – clients@degiro.co.uk

- Order desk email – orders@degiro.co.uk (24/7)

- Phone number – +31 20 261 3072 (Monday to Friday 7 am to 9 pm)

- Address – Degiro BV, Rembrandt Tower, 9th Floor, 1096 HA Amsterdam, The Netherlands

Our review was pleased with the speed and quality of responses when interacting with the customer support team.

Client Safety

Account access is password protected. Personal information is secured with SSL encryption on both PC and mobile applications. Two-step authentication is also available and high-quality data privacy protocols are in place. For the safest trading environment, Degiro encourages clients to ensure the latest system updates have been installed.

Degiro Verdict

Degiro is a safe and reliable broker. UK traders benefit from FCA regulation, five account types, plus a host of educational content. It is disappointing to see no demo account, however, entry requirements for beginners are still low with no minimum deposit stipulation or inactivity fees. Overall, we’re comfortable recommending Degiro to our readers, though the broker is more suited to ‘buy and hold’ investors versus active day traders.

FAQ

Does Degiro Offer Trading On Penny Stocks?

Yes, Degiro offers trading on penny stocks, suitable for new or inexperienced users. Penny stocks are offered on several popular exchanges with a breakdown on the broker’s website.

How Can I Change The Language Of My Degiro Account?

Degiro does not offer the functionality to change the language of the trading platform interface. For English and Irish accounts, traders must open an account on the relevant platform (Degiro.co.uk) or Ireland (Degiro.ie).

What Are The Differences Between The Degiro Custody Vs Basic Accounts?

A basic account offers access to all products and investment services except debit money, debit securities, and derivatives. A Custody account is subject to different conditions as securities are held separately from the lending pool.

What Is The Minimum Deposit To Open A Degiro Account?

There are no minimum deposit requirements to open a live trading account at Degiro. With that said, a £0.01 transfer is required at the registration stage for verification purposes.

Does Degiro Offer Fractional Shares Trading?

Currently, Degiro does not offer fractional shares trading. Keep an eye on the broker’s platform for new features and investment opportunities.

Top 3 Degiro Alternatives

These brokers are the most similar to Degiro:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Degiro Feature Comparison

| Degiro | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 1.8 | 4.9 | 4.8 | 4.7 |

| Markets | Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $0 | $100 | $0 | $0 |

| Minimum Trade | Variable | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | BaFin, FCA | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 69% of retail CFD accounts lose money. |

|||

| Review | Degiro Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Degiro | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | Yes | No | No |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | Yes | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Degiro vs Other Brokers

Compare Degiro with any other broker by selecting the other broker below.

Popular Degiro comparisons: