24-Hour Trading

Trading was once the domain of professionals and institutions operating on set hours in specific geographic locations, but today, the worldwide web, internet-based brokers and cryptocurrencies allow individual investors to make trades 24/7, 365 days a year.

24-hour trading is a godsend for many private traders, as it allows them to trade in their own time, regardless of their duties during normal working hours (though not all assets and markets will be available around the clock). Forex, cryptos and other assets that are available will likely require specific strategies tailored to the time of day.

This guide will provide examples and strategies to help beginners understand the meaning of 24-hour trading markets. We have also reviewed and listed the top brokers and trading apps in the UK with 24 hour trading below.

24 Hour Trading Platforms & Brokers

-

IG provides more than 55 crypto CFDs and digital assets for trade and storage. It uniquely features a crypto index tracking the top 10 digital currencies by market cap, allowing broad speculation on the crypto market’s value. In the UK, its crypto services strengthened post-acquisition of an FCA digital asset licence, enabling regulated trading and investment in leading cryptocurrencies.

IG provides an extensive selection of over 80 currency pairs through its own web platform, mobile app, or MetaTrader 4. For advanced charting and forex analysis, the ProRealTime software is available. Testing shows forex spreads are competitive, beginning at 0.1 pips on major pairs such as EUR/USD.

Crypto Coins- BTC

- ETH

- SOL

- XRP

- BCH

- ADA

- TIA

- LINK

- EOS

- HBAR

- ICP

- LTC

- NEAR

- NEO

- ONDO

- PEPE

- DOT

- POL

- SHIB

- XLM

- SUI

- TRX

- TON

- UNI

- DOGE

- AAVE

- APT

- ARB

- AVAX

- CRYPTO10

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.9 0.8 0.9 Total Assets FCA Regulated Platforms 80+ Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

XTB provides a robust array of over 50 cryptocurrencies, featuring competitive spreads beginning at 0.22% on Bitcoin and leverage up to 1:5. The xStation platform facilitates trading with pairs like ETH/BTC and DSH/BTC. Traders can operate round-the-clock in a secure and transparent cryptocurrency trading environment.

XTB offers over 60 currency pairs with competitive spreads, averaging 1 pip on major pairs. The xStation platform is user-friendly, featuring over 30 indicators in its charting package and a variety of order types, supporting diverse trading strategies and risk management.

Crypto Coins- ADA

- BTC

- BCH

- DSH

- EOS

- ETH

- IOTA

- LTC

- NEO

- XRP

- XLM

- TRX

- XEM

- XLM

- XMR

- DOGE

- BNB

- LINK

- UNI

- DOT

- XTZ

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

IBKR offers access to Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at attractive commission rates without the need for a crypto wallet. Furthermore, traders can explore a variety of assets, including crypto indices like the NYSE Bitcoin Index, and futures contracts such as BAKKT Bitcoin Futures.

IBKR offers a vast range of over 100 forex pairs, including major, minor, and exotic currencies, outstripping most competitors except CMC Markets. Trading is available across multiple platforms with institutional-grade spreads beginning at 0.1 pips. There are also 20 sophisticated order types, such as brackets, scale, and one-cancels-all (OCA) orders, enhancing trading strategies.

Crypto Coins- BTC

- LTC

- ETH

- XRP

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value Total Assets FCA Regulated Platforms 100+ Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

The broker’s Bahamas entity facilitates access to cryptocurrencies. Traders can utilise a vast array of indicators to customise their strategies, with transparent pricing and no hidden fees.

Trade Nation provides more than 30 popular forex pairs with variable spreads. Traders can choose between a user-friendly proprietary platform and MetaTrader 4. Real-time forex market updates and insights are available through 'Smart News'.

Crypto Coins- BTC

- ETH

- LTC

GBPUSD Spread EURUSD Spread GBPEUR Spread Variable Variable Variable Total Assets FCA Regulated Platforms 33 Yes TN Trader, MT4 -

Trade over 15 popular cryptocurrencies such as Bitcoin and Ethereum. Engage in trading these digital assets 24/7, with transparent fees. Access up to 1:10 leverage on leading tokens like BTC.

ActivTrades provides competitive fees in forex, offering excellent spreads on major pairs like EUR/USD starting from 0.5 pips, with no commission charges. The enhanced ActivTrades platform, along with the renowned MetaTrader 4, equips traders with essential tools to navigate the FX market with confidence.

Crypto Coins- BTC

- ETH

- LTC

- BCH

- DOT

- EOS

- LINK

- XLM

- NEO

- ADA

- SOL

- XRP

- BNB

- XMR

- AVAX

- DOGE

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.8 0.5 0.8 Total Assets FCA Regulated Platforms 50+ Yes ActivTrades, MT4, MT5, TradingView -

FXOpen provides more than 40 cryptocurrency CFDs, featuring both crypto-only pairs and those paired with traditional currencies like GBP, USD, and JPY. Traders can leverage their crypto CFD trades at a ratio of 1:2. There are three types of orders available: market, limit, and stop, and scripts are on hand for automated trading.

Crypto Coins- BTC

- BCH

- ETH

- LTC

- ETC

- EOS

- DSH

- XRP

- IOT

- XMR

- NEO

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.2 0.5 Total Assets FCA Regulated Platforms 50+ Yes TickTrader, MT4, MT5, TradingView -

Trade crypto CFDs with high leverage via the renowned MetaTrader platform. Engage in trading across major cryptocurrencies, such as Bitcoin, in both upward and downward price movements.

Trade over 60 currency pairs, such as GBP/USD, EUR/GBP, and ZAR/USD. Enjoy minimal spreads starting at 0 pips and rapid execution.

Crypto Coins- BTC

- ETH

- LTC

- ADA

- XRP

- LINK

- SOL

- BCH

- DOGE

- DOT

- MATIC

- TRUMP

- SUI

- XLM

- AVAX

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.3 0.1 0.4 Total Assets FCA Regulated Platforms 62 Yes Tickmill Webtrader, MT4, MT5, TradingView

Safety Comparison

Compare how safe the 24-Hour Trading are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| ActivTrades | ✔ | ✔ | ✘ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the 24-Hour Trading support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| ActivTrades | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the 24-Hour Trading at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IG | iOS & Android | ✔ | ||

| XTB | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| ActivTrades | iOS & Android | ✘ | ||

| FXOpen | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ |

Beginners Comparison

Are the 24-Hour Trading good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IG | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| ActivTrades | ✔ | $0 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the 24-Hour Trading offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| ActivTrades | Yes (APIs), Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (UK and EU), 1:400 (Global & Pro) | ✘ | ✘ | ✔ | ✘ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the 24-Hour Trading.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IG | |||||||||

| XTB | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| ActivTrades | |||||||||

| FXOpen | |||||||||

| Tickmill |

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- Global traders can use accounts in various currencies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On ActivTrades

"ActivTrades stands out for traders at every level, offering nearly unparalleled execution speeds of 4ms. Choose from top-tier trading software like MT4, MT5, TradingView, or the user-friendly ActivTrader, perfect for budding traders."

Pros

- While cTrader isn't supported, MT4, MT5, TradingView, and the broker's ActivTrader platform accommodate various trading requirements. The firm's web-based platform has proven user-friendly and visually appealing for novices during testing.

- ActivTrades provides competitive spreads, especially for forex trading, starting at 0.5 pips on major currency pairs without extra commissions. Additionally, the €/£10 inactivity fee is only applied after 52 weeks, benefiting active traders.

- Based on our tests, ActivTrades offers swift and reliable support via live chat, email, and phone in multiple languages. This makes it an excellent choice for both traders and newcomers seeking quality assistance.

Cons

- The platform lacks features for copy or social trading, which is a disadvantage for traders interested in passive investing or replicating the trades of seasoned traders. This is particularly evident when compared to eToro and Vantage.

- Its research tools are decent, although somewhat lacking. The expanding 'Analysis' hub is useful, but the absence of Trading Central or Autochartist means advanced technical insights are missing. This limitation may hinder traders seeking to spot opportunities in volatile markets.

- ActivTrades needs improvement in educational resources to compete with firms like XTB and CMC Markets. While it offers well-presented and informative webinars, the selection of courses and quizzes remains limited, hindering a more comprehensive and engaging learning experience for traders.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

Cons

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

Cons

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

24-Hour Trading Markets

A wide range of popular trading brokers and websites has made it possible to trade a diverse list of assets 24 hours a day. These include:

- Foreign Exchange – Forex markets are open 24 hours a day, 5 days a week. Many popular brokers such as Pepperstone, Vantage FX, and IC Markets are available to UK traders.

- Crypto – Cryptocurrency markets never close, so you can make trades at any time of day, any day of the year. This includes crypto-based financial products, such as IQCent‘s digital contracts, as well as standard cryptocurrency markets.

- Synthetic Markets – Some trading brokers offer 24/7 trading on synthetic markets – proprietary, simulated markets based on real-world assets.

- OTC Trading – Another popular 24-hour product offered by companies such as binary options broker Pocket Option is OTC markets, which allow trades on a variety of securities, commodity and other assets during times when the ordinary market is closed. OTC trading takes place with a counterparty, rather than on an exchange, allowing brokers to offer it outside ordinary trading hours.

- Standard Markets – With 24/7 trading becoming more commonplace, some of the traditional markets have extended their hours to allow trading nearly round the clock. The CBOE’s options exchange, for example, allows trades on S&P 500 Index and other indices nearly 24 hours a day, 5 days a week.

Each of these methods of 24-hour trading has its own characteristics which traders should familiarise themselves with, and which we will explore in the next section.

24-Hour Forex Trading

Forex is the classic 24-hour trading instrument for a simple reason: no matter what time of day it is, there will be a currency market open somewhere in the world, whether that is in Japan or New York.

The forex trading day begins in the morning in Asia and Australasia, with the Sydney session closing at 6 am and the Tokyo market running between midnight and 9 am, UK time. The focus then switches to London, with the UK forex session open between 8 am and 4 pm BST. Finally, the New York session kicks off at British noon until 9 pm, at which point the Sydney session opens once more.

The Forex Trading Day (BST):

- Sydney: 9 pm – 6 am

- Tokyo: 12 am – 9 am

- London: 8 am – 4 pm

- New York: 12 pm – 9 pm

As a result, you will find there are three main sessions for forex trading over the course of a UK day:

- The overnight Asia-Pacific session coinciding with Sydney and Tokyo markets

- The European session that runs from British morning to afternoon

- The US session from 12 pm – 9 pm BST

This is important because certain currency pairs will trade more actively during different sessions. The GBP/USD pair will have a far higher volume during the European through US sessions, while you can expect the USD/JPY pair to be more active during the Asia-Pacific session.

Moreover, trading volume and volatility are not distributed evenly over the course of a trading day, and you can expect a much more active environment at certain times of the day. Generally, the first hours after London opens tend to have a high trading volume, which then slows during late morning until the New York market opens at midday. The overlapping hours between the British, European and US markets tend to be busy for forex trades, particularly for the GBP/USD and EUR/USD pairs.

Similar dynamics will exist for different currency pairs depending on their geographical location and the opening hours of their local forex market. It is a good idea to learn the most active markets and pairs during the 24-hour trading period you intend to be executing orders.

24-Hour Cryptocurrency Trading

Crypto markets remain open for trading 24/7 because they work on decentralised blockchain ledgers – anyone can execute a transaction on the blockchain any time they like.

Nevertheless, cryptos are still likely to mirror some of the dynamics of traditional assets, and particularly the 24-hour aspect of forex markets.

This is because individuals and institutions involved in cryptocurrency trading in different geographical regions are still likely to do their trading at roughly the same times during a standard working day. When the European and US markets wind down for the day, the Asian market gets started.

Each session will have its own pattern regarding 24-hour trading volumes and volatility, and the best play on a given market may well depend on gauging how that asset will react to the price movements of the previous session.

As a result, crypto traders should familiarise themselves with the market dynamics during the hours they trade and use that knowledge when analysing price movements and setting up trades.

Bear in mind that while many prefer to trade during periods with high trading volume driving price movements, this can cause be expensive on crypto markets where certain trades require “gas fees” – the network fee paid per transaction, which can quickly climb to hundreds of dollars during periods with high volume.

Synthetic Products

Popular brokers have developed proprietary synthetic markets, which are designed to simulate the price movements experienced in a real market.

There are no real, underlying assets at play on a synthetic market – instead, the price movements are generated algorithmically by the synthetic index brokers, meaning they can be traded at any time, 24/7.

While many traders feel synthetic markets are too random to trade on, since they are completely divorced from real-world events, some traders do say it is possible to consistently profit from them using standard technical analysis methods.

Traders who are only available to place trades at a specific time might enjoy synthetic markets since they can choose to trade with different volatility levels than those available to them on the real markets. Besides that, synthetic markets can be attractive as they give traders a chance to use instruments like CFDs at any time of day.

OTC Products

Some of the best binary options brokers, like Pocket Option, let traders speculate on the price of forex, securities and indices during standard trading hours, but also provide an over-the-counter (OTC) version of many assets that can be traded around the clock.

It is not always clear what influences price movements of the OTC assets, which differ from the actual market price, and some traders complain that the price movements are too random to consistently make profitable trades. However, Pocket Option says OTC quotes are provided directly by international banks, liquidity providers and market makers, and the payout is generally considerably higher than exchange-traded assets. Algorithmic strategies can also be used.

Standard Markets

Standard financial markets are becoming more flexible about trading times as online investing becomes ever more popular. Some exchanges now allow after-market or pre-market trading, in some cases allowing customers to trade certain securities and indices 24 hours per day.

- The CBOE launched a 24/5 global trading service in November 2021, allowing the trade of S&P 500 Index (SPX) and Volatility Index (VIX) options nearly 24 hours per day.

- Some trading brokers offer an ever-growing list of securities that can be traded 24 hours a day, 5 days a week.

- Popular brokers such as IG, City Index and CMC Markets support 24-hour trades on indices 5 or more days per week.

24-Hour Trading Strategies

With such a wide range of products, assets and markets available to trade day and night, the scope of strategies that could be used in 24-hour trading is nearly endless.

One of the most important things to consider is the time you make your trade and the phase the market is in. Since traders often seek out 24-hour trading because of time constraints preventing them from trading during their local market’s normal opening hours, this can be an especially important point.

The following list provides traders with a “24-hour trading clock”, showing major exchanges’ trading hours in the British time zone:

Exchange Trading Hours (GMT)

- London Stock Exchange (LSE): 08:00–16:30

- Euronext: 08:00–16:30

- Nasdaq: 14:30–21:00

- New York Stock Exchange (NYSE): 14:30–21:00

- Australian Securities Exchange (ASX): 00:00–06:00

- Tokyo Stock Exchange (TSE): 00:00–06:00

- Shanghai Stock Exchange (SSX): 01:30–07:00

- Shenzhen Stock Exchange (SZSE): 01:30–07:00

Here are some features to note about different market phases for 24-hour trading:

Market Open

The first period after the market opens tends to be busy as a flurry of buy and sell orders come in at once. This is a good time for strategies that aim to take advantage of price moving out of a range, such as breakout or straddle strategies.

End-Of-Day Trading

Some traders prefer the final period before the market closes as they feel that as the market winds down there is less random noise and, with lower trading volumes, there could be gaps in the market or other opportunities to exploit. Prices of market data and other tools also tend to be cheaper during this period.

After-Hours & Pre-Market Trading

When you trade securities, indices and commodities outside normal trading hours, you will face completely different market conditions due to the lower volume and liquidity as far fewer people are making trades. This heightens risk, and it can also lead to a much wider spread than during normal hours.

Finally, watch out for after-hours news events that may cause a sudden spike in volume and thus an extreme price movement.

Trading Orders & Automated Trading

While the specific hours you are able to devote to trading may be limited, that doesn’t necessarily mean you can only make trades during those hours.

Many traders use after-hours to study assets’ fundamentals and plan their trades for the following day. These trades may be scheduled by placing an order that will automatically be filled when the asset reaches a specified price level.

Alternatively, automated trading bots can be programmed to trade according to user-defined parameters throughout the day without the trader being present at all.

Comparing 24-Hour Trading Brokers

As there is such a diverse variety of products, markets and styles for trading 24 hours, the broker you choose will depend on your specific needs.

Forex Brokers

Since the forex markets have traditionally worked 24/5, there is a wide selection of forex brokers available to UK traders.

For most traders, the most important things to look out for when selecting a forex broker are the spread, pricing structure for additional fees, and regulation.

Brokers like CMC Markets are FCA-regulated brokers and trusted by large customer bases, and they are also known for their competitive spreads and pricing structures. Some other reputable brokers such as Pepperstone offer a range of assets to trade, including forex but also indices, commodities and shares.

Binary Options Brokers

Many binary options brokers offer trading on 24-hour markets such as forex and crypto, and some like Pocket Option allow traders to speculate both on stock or commodities markets during opening hours and to make 24/7 trades on OTC or synthetic markets.

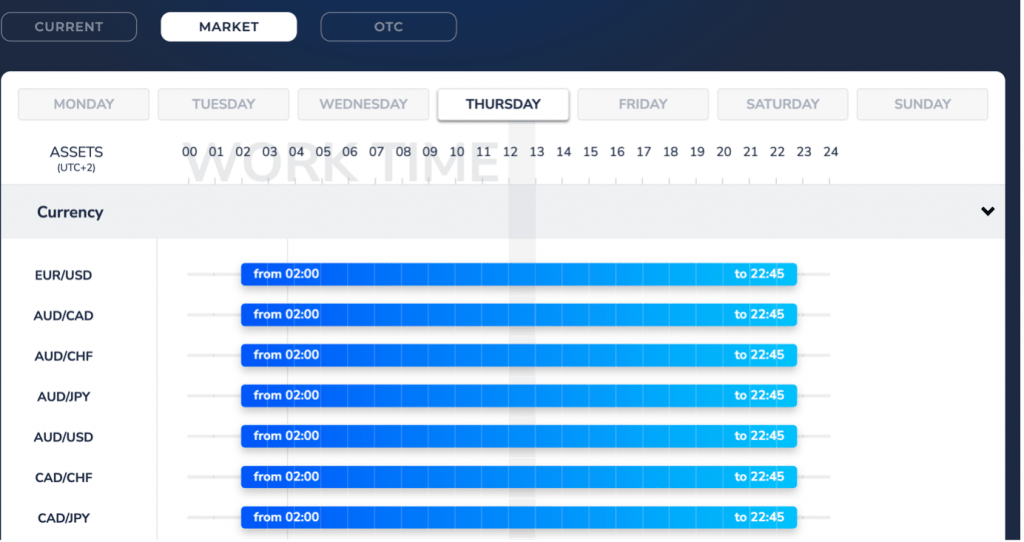

It should be easy to find the trading schedule for different assets offered by the broker, as can be seen from the screenshot from Pocket Option below.

Pocket Option Trading Schedule

Another thing to keep in mind when trading binary options is that the payout levels are likely to change depending on the time of day it is.

Trading Platforms

Another consideration when choosing your 24-hour trading broker is its support for different trading platforms. This can be especially important for traders with time constraints, as it will be easier to research, set up and execute scheduled trades using a more powerful platform, not to mention support for automated trading bots and algorithms.

While many 24/7 brokers get traders on board their proprietary platforms when they sign up, you may wish to look for one that supports third-party software, such as MetaTrader’s MT4 or MT5, if you are familiar with these platforms.

Bottom Line On 24-Hour Trading

It is not easy fitting a trading side-hustle into your daily routine if you already work full-time, but fortunately there are many ways to access lucrative markets, 24/7. Traders can either choose a stock exchange that is open and busy during the period they can trade, or go for a 24-hour asset class like forex and crypto or a product such as binary options that is available round the clock. Trading orders and automated robots provide other options for traders who want to deal with a specific asset during hours they would otherwise be unavailable.

Use our list of the best brokers with 24-hour trading to get started.

FAQs

What Can I Trade 24 Hours A Day?

No matter what time you are awake and free to log into your trading account, you can be sure profitable markets are available. Forex markets are open 24/5 and cryptocurrencies can be traded 24/7, though you will still need to take into account the prevailing market conditions at the specific times you trade.

Trading volumes for cryptocurrency will tend to rise and fall to the same schedule as other major markets, but you can check Coinbase or your chosen exchange for the 24-hour data on bitcoin, ether, dogecoin or whichever crypto asset you prefer.

Otherwise, traders can access certain stocks and indices 24 hours a day from some brokers, or they could try trading a synthetic market.

Are Any Stock Exchanges Open 24/7?

Stock exchanges usually operate on a schedule according to the standard working day in their geographic location, but there are still some ways to trade stocks round the clock. Some brokers, including Interactive Brokers and Charles Schwab allow traders to access a selection of assets including SPX-listed stocks during extended pre-market and after-market hours, in some cases allowing 24-hour trading.

Where Can I Trade 24 Hours?

Thanks to the internet, traders around the world should be able to access some form of 24-hour trading as long as they have a connection. With the right broker, you will be able to trade cryptocurrencies 24/7, forex 24/5, and you will be able to access after-hours trading on selected indices such as VIX and other assets including SPY and other ETFs, stocks and commodities.

Can I Trade Stocks 24 Hours A Day?

It is possible to trade some stocks effectively 24 hours a day with certain brokers. However, bear in mind that the market dynamics will be very different during after- and pre-market hours, as volumes will be much lower.

Is Forex Open 24-Hour?

Forex markets are generally open 24 hours per day throughout the 5 days of the working week. With a good trading platform or trading app, anyone can trade the currency pairs of their choice, at any time of the day.

What Is The Best Time For A 24-Hour Trader To Execute Trades?

If you are available and able to trade 24 hours a day, whether that is because you have a free schedule and are willing to lose sleep to execute a trade or because you have mastered automated trading, you will have the advantage of being able to pick and choose the asset and market time you wish to trade.

The best time to trade depends on the context, with certain assets and markets tending to be busier during specific times in the day. In forex, the busiest periods tend to be when two exchanges from a particular currency pair are both working at the same time. So, the GBP/USD pair will have a higher trading volume at around midday UK time, when exchanges in London and New York are both active.

Volumes of other assets such as cryptocurrencies will also tend to ebb and flow as different time zones join the market or finish trading for the day. However, keep in mind that a major news event – and in particular, an unexpected one – will often drive up the trading volume during irregular hours.