US Dollar Lower As FMOC Delivers No Surprises

The US Dollar traded lower on Wednesday following the FMOC Minutes, which failed to surprise with any new information or developments. With traders on holidays for what is essentially a 4 day weekend for US Thanksgiving, flat and choppy markets are expected.

Fed Minutes: One Hike Expected.

As suspected, the Fed all but confirmed a December rate hike in its latest meeting minutes. While some members were opposed to another hike due to apparent softness in recent inflation numbers, it would be out of character for the Fed not to follow through. The Fed has raised every December since 2015 when it began it’s latest tightening cycle, and there’s no real reason why they wouldn’t do the same this year. While data has been somewhat soft, Yellen has made it clear that they will raise rates again this year.

Price action following the minutes added some confirmation to that assumption. What price action you ask? Well…nothing really happened at all. The EURUSD rallied a little on the minutes, but it really it just followed through to the upside. Gold was steady and bonds were relatively quiet. It probably most traders would have left the office as soon as they saw the minutes, trying to beat the traffic to visit family and friends for the weekend.

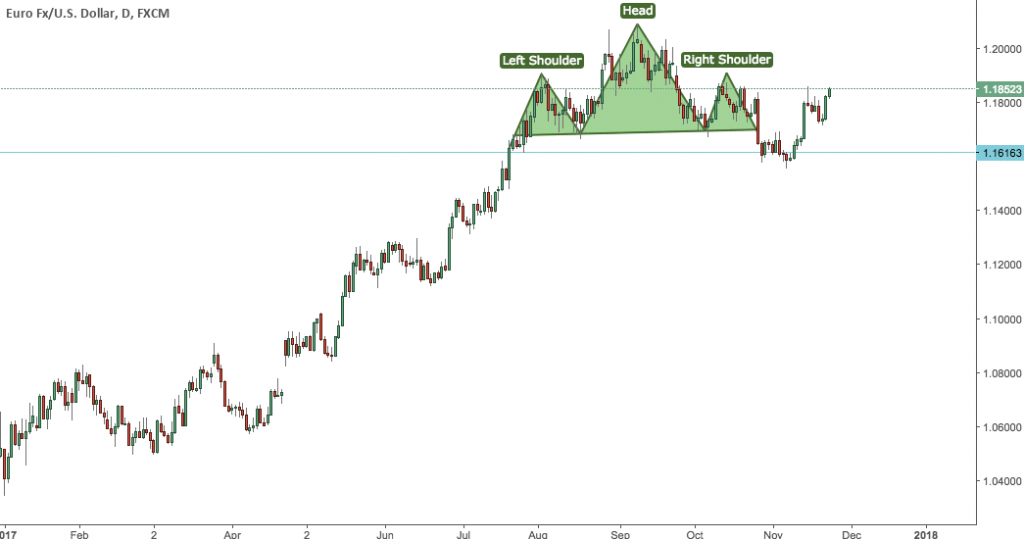

EURUSD Head and Shoulders Failure?

The huge Head and Shoulders pattern that formed on the EURUSD between July and October seems as though it has failed, for the time being. Lower prices looked likely following a dovish ECB and relatively hawkish Fed, however we’ve seen the dollar weaken a little of the last couple of weeks. I still favour the EURUSD lower, however it’s very difficult to pick the timing on a trade like that. Selling rallies remains a viable strategy, at least until we see a break of the top of the pattern.