Admiral Markets Review 2025

Admiral Markets is a global forex, CFD, futures, spread betting and investments broker. The firm boasts access to MT4 and MT5, two of the most popular online trading platforms. Check out this 2025 Admiral Markets UK review to find out why so many other traders have signed up with the company.

Admiral Markets Headlines

Admiral Markets was established in 2001. Operating around the world with several hundred thousand active traders, this award-winning broker is a well-recognised outfit. Its headquarters are in Tallinn, Estonia, although it also has several offices elsewhere, including in London. Admiral Markets UK Ltd is regulated by the Financial Conduct Authority (FCA) and is just one entity of a many-brokerage group.

Trading Platforms

Admiral Markets uses the industry-recognised MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which investors can download free to a wide range of operating systems. Alternatively, both platforms have WebTrader support and can be accessed online through major browsers like Google Chrome or Safari.

These software packages come with a range of advanced features, listed below:

MT4

- Nine timeframes

- 23 analytical objects

- Four order types

- Financial news alerts

- Expert advisors (EAs)

- 30 built-in technical indicators

- Trading signals and copy trading

- VPS automated investing through an API

- Available on Mac, Windows, iOS and Android

MetaTrader 4

MT5

- VPS available

- 21 timeframes

- Six order types

- Economic calendar

- Trading signals and copy trading

- Available on Mac, Windows, iOS and Android

- News reports from international news agencies

- Automated trading through expert advisors (EAs)

- More than 80 technical indicators and analytical tools

Please note that there is also free access to MetaTrader 4 and MetaTrader 5 Supreme Editions, which come with advanced features. Clients can also use Parallel to get MetaTrader 4 and 5 on their Mac.

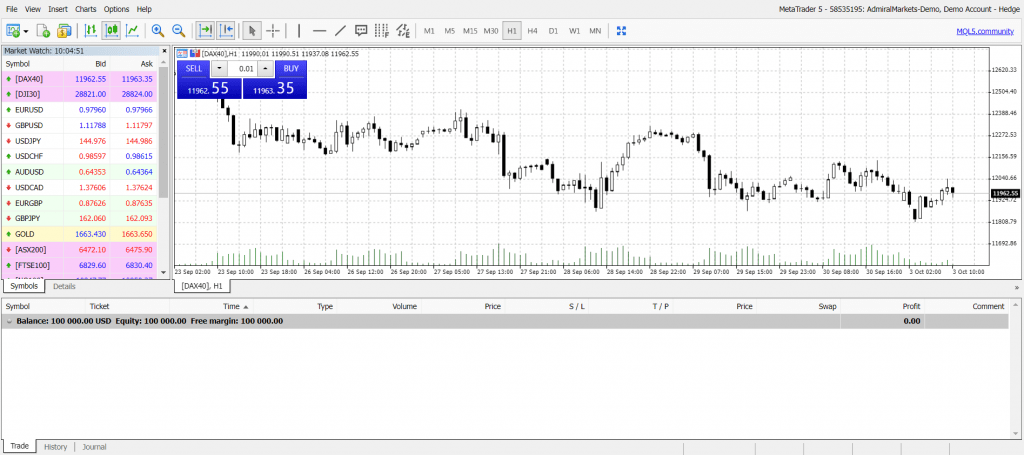

MetaTrader 5 Demo Platform

Markets

There are over 8,000 products to choose from with an Admiral Markets account. Clients can open CFD, futures and spread betting positions or invest in equity stocks and ETFs. The list of assets is as follows:

- 200+ ETFs

- 4,350+ stocks

- 50 forex CFDs

- Two bond CFDs

- 300+ ETF CFDs

- 3,350+ stock CFDs

- 11 commodity futures

- Five metal CFDs (including gold)

- Seven commodity CFDs (including oil)

- 3 cryptocurrency coins (BTC, ETH, XRP)

- 43 index CFDs (including the FTSE 100, S&P 500 and the TecDAX30)

Note that binary options are not available at this broker.

Fees

Spreads and commissions depend on the account type chosen. The firm offers low-spread accounts with higher commission rates or accounts with slightly higher spreads and low or zero commission. Investors can get very competitive spreads on EUR/USD from 0.1 pips with a low spread account (Zero.MT5 & Zero.MT4 accounts). However, spreads can be higher with the Trade.MT5 account, the typical spread for EUR/USD sitting at 0.6 pips and GBP/USD at 1.0 pips.

With the low-spread Admiral Markets (Zero) account, forex and metals have commissions from $1.80 to $3.00 per lot. Investors that want to purchase actual shares and ETFs (rather than derivatives) will incur a commission of $0.02 per share, although spreads are zero. The typical spread for the Dow Jones is $0.90. The typical spread on the FTSE 100 is £0.80 on the Trade.MT5 account. Brent Crude Oil has a typical spread of $0.01 and gold is $0.17 (both Zero.MT5). Full details of spreads and commissions for each account type can be found below. See the website for live spreads.

Other Admiral Markets charges include overnight swap rates for leveraged positions held overnight. These fees can be positive or negative depending on the interbank rate between two currencies in a forex pair. There is also a currency conversion fee of 0.3% for positions quoted in currencies different from your account base currency.

An inactivity fee of £10 per month is charged if no transactions have been executed in the last 24 months and the account balance is greater than zero.

Leverage

The maximum leverage ratios at Admiral Markets are standard for an FCA-regulated broker. Traders get up to 1:30 leverage on major forex pairs, up to 1:20 on indices such as the FTSE100 and 1:5 leverage on stock, ETF and bond CFDs. Remember that if the market moves against you and you lack sufficient margin in your account, you may be subject to a margin call and have your positions closed automatically (at the stop-out level).

Mobile Trading

Admiral Markets has its own in-house mobile trading app (Admirals) available on iOS and Android. The app can be used to open, close and monitor trades as well as manage your account. It is intuitive and simple to use where trades can be opened in a few taps. New traders can register for an account directly from the app. Alternatively, clients can utilise the dedicated MT4 and MT5 applications, both of which are available on both iOS and APK devices.

Admirals Mobile Platform

Payment Methods

Deposits

The minimum deposit at Admiral Markets is £1 with the Invest.MT5 account, although minimum deposits on other accounts are either £100 or £250. All deposit methods are free, including e-wallets, and the processing time at the broker’s end is usually one working day. A full list of deposit methods can be found below:

- Poli

- Skrill

- iDEAL

- Klarna

- PayPal

- Neteller

- Bank transfer

- iBank&BankLink

- Visa/MasterCard

Withdrawals

Withdrawals are processed the same business day if the request is received before 17:00 GMT. Note that Klarna, iDEAL and Poli are not available for withdrawals. Each other method has one free withdrawal request each month, with a fee incurred thereafter.

Demo Account

Admiral Markets has a popular demo account, which beginners can use to get familiar with the markets without risking their own money. Demo accounts are also useful for more experienced traders to practice a new investing approach, such as 1-minute scalping, hedging or a pivot point strategy. Investors must login at least once every 30 days to maintain their demo account. Note that there is a 15-minute delay in market data on the demo account.

Regulation

Admiral Markets UK Ltd is authorised and regulated by the FCA. The FCA is a robust and well-regarded regulatory body that provides a decent level of consumer protection and ensures adequate monitoring of the financial services firms that it governs. We would recommend choosing a broker regulated by the FCA or a body with similar authority, such as the CySEC.

Account Types

There are six account types on Admiral Markets: four that use the MT5 platform and two that use MT4. All MT5 accounts have Level 2 pricing. Our experts have listed the main features of each below.

Trade.MT5

- MT5 platform

- All CFD instruments

- Spreads from 0.5 pips

- Islamic account option

- £250 minimum deposit

- Forex leverage of 1:20-1:30

- Negative balance protection

- Minimum forex order size of 0.01 lots

- Share & ETF CFD commission of £0.02

Invest.MT5

- No leverage

- MT5 platform

- £1 minimum deposit

- Only stocks and ETFs

- Spreads from zero pips

- Commission from £0.02 per share

Zero.MT5

- MT5 platform

- No stock or ETF CFDs

- Spreads from zero pips

- £250 minimum deposit

- 1:20-1:30 forex leverage

- Negative balance protection

- Energies commission of £1 per lot

- Minimum forex order size of 0.01 lots

- Cash indices commission of £0.05-£3.00 per lot

- Forex & metals commission of £1.80-£3.00 per lot

- Forex, metal CFDs, cash index CFDs and energy CFDs

Bets.MT5

- MT5 platform

- No commissions

- Spreads from 0.5 pips

- No stock or ETF CFDs

- £100 minimum deposit

- 1:20-1:30 forex leverage

- Negative balance protection

- Forex, metals, energies, cash indices and index futures

Trade.MT4

- MT4 platform

- All CFD instruments

- Spreads from 0.5 pips

- £250 minimum deposit

- 1:20-1:30 forex leverage

- Negative balance protection

- 0.01 lot minimum order size

- Share & ETF CFD commission of £0.02

Zero.MT4

- MT4 platform

- No stock or ETF CFDs

- Spreads from zero pips

- £250 minimum deposit

- 1:20-1:30 forex leverage

- Negative balance protection

- Energies commission of £1 per lot

- 0.01 lots minimum forex order size

- Cash indices commission of £0.05-£3.00 per lot

- Forex & metals commission of £1.80-£3.00 per lot

- Forex, metal CFDs, cash index CFDs and energy CFDs

How To Get Started With Admiral Markets

1) Open An Account

The first step is to create a login for the Admiral Markets Trader’s Room. If you have already signed up for a demo account, the login details will be the same. Once in the Trader’s Room, you will need to complete several more steps before you can begin. These include entering your UK Unique Taxpayer Reference Number and verifying your identity.

When selecting your account type, you will need to think about whether you have a preference for a particular trading platform and whether you want to invest in stocks and ETFs or simply trade derivatives. Investors can also register for a professional account if they meet the required criteria.

2) Deposit Funds

Now, you need to deposit some capital. The minimum deposit limit depends on your account type and can range from £1 to £250. All deposit methods at Admiral Markets are free. Deposits can be made from the Trader’s Room or the Admirals mobile app.

3) Choose A Market

Whether it is forex or commodities, always choose a market you thoroughly understand. Various factors influence currency pairs, including interest rates and political uncertainty. Being able to anticipate these events is key. Also, be aware that different markets will often have different spreads and/or commission rates. Forex majors usually attract some of the lowest spreads because of their liquidity.

4) Open & Monitor Your Position

Making an order requires care, precision and good timing. If using technical analysis, make use of the many indicators available on MT4 or MT5. For example, Bollinger Bands can be useful for investors implementing a range trading strategy who want to know when the market is in overbought or oversold territory. Once a position has been opened, make sure to check the firm’s economic calendar to see upcoming financial events and announcements that could have an impact on asset prices.

Benefits Of Admiral Markets

- FCA-regulated

- MT4 and MT5 access

- Dedicated UK branch

- Spreads from 0.0 pips

- Range of account types

- Excellent analytical tools

- Lots of additional features

- Bitcoin and altcoin trading

- Guaranteed stop loss orders

Drawbacks Of Admiral Markets

- No promotions or deposit bonus schemes

- One free withdrawal each month

- High minimum deposits

- Market maker

Additional Features

StereoTrader is available to all clients. This is a MetaTrader investing panel that provides more advanced tools, such as historical backtesting using past data and the ability to place multiple orders in one click.

In addition, investors can access a Virtual Private Server (VPS) if they have at least £5,000 in their accounts. A VPS can be useful by reducing latency and enabling EAs to run 24/7, even whilst you are offline. Volatility protection settings can also be enabled to protect against price slippage in highly volatile markets.

Our experts recommend the economic comparison tool, particularly when investing within the forex market. This analytical tool enables the comparison of key performance indicators across different economies such as inflation and GDP. It is often not the absolute performance of different economies but the relative performance that is important.

Investors with limited funds that want to buy expensive shares can purchase fractional shares down to 1/100th. Not only does this make shares like Amazon and Apple more accessible to low-equity speculators but it also allows for greater portfolio diversification.

There is a forex and CFD trading pip and margin calculator on the Admiral Markets website that can calculate the required margin, pip value and profit from given position levels, leverage and lot size.

There is a wealth of free education material available on the broker’s website, including live webinars. These are run by professional traders and cover topics such as identifying a trend and implementing automated strategies. There are also forex and CFD articles, which helpfully state their difficulty level (such as beginner or advanced). In addition, this broker offers Zero to Hero and the Forex 101 courses. The firm’s YouTube channel also has video lessons and there are several trading podcasts on the Admiral Markets website.

Trading Hours

Trading hours with Admiral Markets depend on the market involved. The forex market opens on Sunday at 22:00 GMT and closes on Friday at 22:00 GMT. The different trading sessions in various time zones mean that forex investing can take place 24/5. Stocks opening hours depend on the exchange being traded on. The UK stock market opens at 08:30 GMT and closes at 16:30 GMT (Monday-Friday).

Customer Support

The opening hours to contact customer support are 07:00-16:00 GMT (Monday-Friday). Although many questions can be answered through the FAQs pages on the Admiral Markets website, the broker’s dedicated team can be contacted via live chat or the following:

- Phone Number: +44 20 8157 7344

- Email Address: global@admiralmarkets.com

Safety & Security

The Financial Services Compensation Scheme (FSCS) offers compensation of up to £85,000 if a member ceases trading and is unable to meet its financial obligations. This compensation also extends to a firm that behaves fraudulently or unfairly.

Admiral Markets also holds its money in Tier 1 banks and segregated bank accounts, meaning there is no mix of company and client funds. Under UK law, client money is protected from general creditors should the firm become insolvent.

Admiral Markets Verdict

Admiral Markets offers tight spreads, access to the MT4 and MT5 trading platforms and a wealth of free educational material. Although Admiral Markets has high minimum deposits for its derivatives accounts, many traders will see this as a price worth paying for the features available.

FAQ

Is Admiral Markets A Market Maker?

Yes. Admiral Markets is a market maker firm and the sole liquidity provider. ECN accounts are not available.

Does Admiral Markets Have Free Withdrawals?

Traders get one free withdrawal each month with supported methods. However, withdrawals thereafter are charged a fee.

Can I Close And Delete My Admiral Markets Account?

Yes. Admiral accounts can be closed within the Trader’s Room. Ensure you withdraw all remaining funds from your account before proceeding with this.

Can I Earn Dividends On Shares With Admiral Markets?

Investors can earn dividends on shares. It is also possible with share CFDs to earn dividends without owning the underlying asset (with a long position).

How Should I Try To Identify Market Sentiment On Admiral Markets?

This broker has a dedicated section to assist in identifying which way the market is moving. This includes vast data for a range of assets, showing the proportion of long positions to short positions.

Top 3 Admiral Markets Alternatives

These brokers are the most similar to Admiral Markets:

- IG Index - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

Admiral Markets Feature Comparison

| Admiral Markets | IG Index | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 3.6 | 4.7 | 4.8 | 4.8 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $100 | $0 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | Admiral Markets Review |

IG Index Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| Admiral Markets | IG Index | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | Yes | Yes | Yes | Yes |

Admiral Markets vs Other Brokers

Compare Admiral Markets with any other broker by selecting the other broker below.

Popular Admiral Markets comparisons:

|

|

Admiral Markets is #65 in our rankings of CFD brokers. |

| Top 3 alternatives to Admiral Markets |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting |

| Demo Account | Yes |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global) |

| Mobile Apps | Yes |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Cards, Klarna, Mastercard, Neteller, PayPal, Skrill, Sofort, Swift, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes (MetaQuotes) |

| Islamic Account | Yes |

| Commodities | Cocoa, Copper, Cotton, Gold, Lithium, Natural Gas, Nickel, Orange Juice, Platinum, Silver, Sugar |

| CFD FTSE Spread | 0.8 |

| CFD GBPUSD Spread | 1.3 |

| CFD Oil Spread | 0.03 |

| CFD Stocks Spread | 0.5 |

| GBPUSD Spread | 1 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 1 |

| Assets | 50 |

| Currency Indices | USD |

| Crypto Coins | BCH, BTC, DSH, EOS, ETC, ETH, LTC, XLM, XMR, XRP, ZEC |

| Crypto Spreads | 1% |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |